Hack VC: хакер, который инвестирует в хакеров, инфраструктурный маньяк в криптовалютном VC

Автор оригинала: TechFlow

In the crypto market of 2024, there is one crypto VC that you cannot ignore.

Prefers lead investors, with 50% of the projects invested this year being lead investors, including the familiar io.net, Initia, AltLayer, imgnAI, etc.

Prefer infrastructure, with one-third of the projects invested being infrastructure, including Berachain, EigenLayer, Movement, Babylon, SUI, Eclipse, etc.

In addition to funds, they also have technology and developer communities that can empower the projects they invest in for the long term;

The name of this VC is Взломать ВК .

As the name suggests, they are a group of tech geeks invested in hacking.

This article will give you an inside look at the story behind Hack VC and its founding partner Alexander Pack.

Starting from Hong Kong, connecting the East and the West

In 2014, Alexander, who was only 22 years old, came to Hong Kong to work at Arbor Ventures, a VC in the financial technology field, and participated in the Princeton Asia Teaching Scholarship Program. It was also in this year that he invested in cryptocurrency for the first time. At that time, there was no Ethereum, and cryptocurrency was not even considered an industry.

The following year, Alexander joined AngelList, the worlds largest equity crowdfunding platform, and became the first analyst in its investment team. Within a year, he supported the team to complete more than 100 venture capital investments. At the same time, Alexander began to try angel investment. The first project he invested in was Numerai, in which he invested $300,000. It claimed to subvert quantitative trading with artificial intelligence. Later, the project evolved into a decentralized prediction market and hedge fund, issued the token NMR, and obtained investment from Placeholder and Paradigm.

During this period, Alexander also participated in the investment in Polychain Capital, which laid a solid foundation for the long-term cooperation between the two in the future.

After leaving AngelList, Alexander joined Bain Capital as Director of Cyber Investments and helped launch the firm’s crypto investment business, backing 16 funds and 11 startups.

During this period, Alexander met Feng Bo, founding partner of Ceyuan Ventures, and the two jointly invested in Basis and some cryptocurrency exchanges.

In 2018, Alexander decided to start his own business and co-founded the crypto venture capital fund Dragonfly Capital with Feng Bo. In October, they announced that they had raised $100 million.

Thanks to their past accumulation, the two received support from Silicon Valley and Chinese technology companies at the beginning of their founding. Alexanders former boss, Salil Deshpande of Bain Capital, a16z co-founder Marc Andreessen and its crypto fund head Chris Dixon, as well as Founders Funds Cyan Banister and Polychains Olaf Carlson-Wee all participated in the investment.

In Asia, investors include Bitmain, OKX, Sequoia China head Neil Shen, Baidu founder Eric Xu, ZhenFund founding partner Xu Xiaoping, Dianping founder Zhang Tao, and Meitu founder Cai Wensheng.

In October 2019, at the Dragonfly Crypto Summit, Sequoia China founder Shen Nanpeng raised the following question: “Many years ago, when we started investing in the Internet, investors did not call themselves “Internet funds” or venture capital institutions that only focused on a specific “specialized field”; but why is it different in the blockchain and cryptocurrency field today? Investment institutions active in the cryptocurrency market only focus on the cryptocurrency and blockchain fields. What’s going on?”

Alexander Pack replied that the cryptocurrency investment field is so unique because, on the one hand , it is related to technology trends, which involves the understanding and judgment of early technologies . On the other hand, investing in the blockchain field is not only about high-risk early technology projects, but also about investing in an asset , which requires considering the factors that the asset itself should pay attention to, such as liquidity, volatility, market trends, etc. In addition, the crypto market has been a global market since day one, which has put forward high requirements for investors.

Alexander Pack said that Dragonfly Capital hopes to become a bridge connecting the Eastern and Western cryptocurrency industries, helping Asian projects and investors obtain Western-developed technologies, and helping Western blockchain projects access the Asian cryptocurrency market.

To succeed in the crypto space, you must consider global development from day one. As the Dragonfly Capital official website says, “ Globalization from day one .”

In 2020, Alexander left Dragonfly Capital. According to the letter to LPs on April 27 of that year, Alexander left due to different views on the direction of the companys development, but he will continue to manage the first batch of funds as a part-time partner.

In 2021, Alexander co-founded the crypto fund Hack VC with independent GP Ed Roman, the founder of Hack.Summit ().

In the fall of 2021, Hack VC completed the fundraising of a $200 million crypto fund, with investors including Sequoia Capital, Fidelity, Marc Andreessen and Chris Dixon of a16z, etc.

Alexander said the name Hack VC reflects their teams style: a group of hackers investing in hackers.

Hack VC focuses on early-stage investments, specifically investing in the technological infrastructure that will take crypto mainstream, and tends to maintain a smaller and more flexible investment scale than many of its peer firms.

“For me, my favorite thing in the world is to find a great founder with a brand new idea and invest in them from the very beginning, before there’s a product or business plan, usually as an incubation. It’s hard to do that when you’re raising too much money.”

Prefers to lead investment and is keen on infrastructure

In 2024, when talking about Hack VC, the first word that comes to mind is active “lead investors”.

Following the announcement of raising $200 million in 2021, Hack VC announced in February 2024 that it had raised a $150 million fund.

With sufficient financial support, Hack VC frequently appears in project financing news and plays a leading role.

From January 2024 to date, Hack VC has invested in 23 projects in the announced financing news, of which 11 were lead investors, accounting for nearly 50%, including many well-known projects such as io.net, Initia, AltLayer, imgnAI…

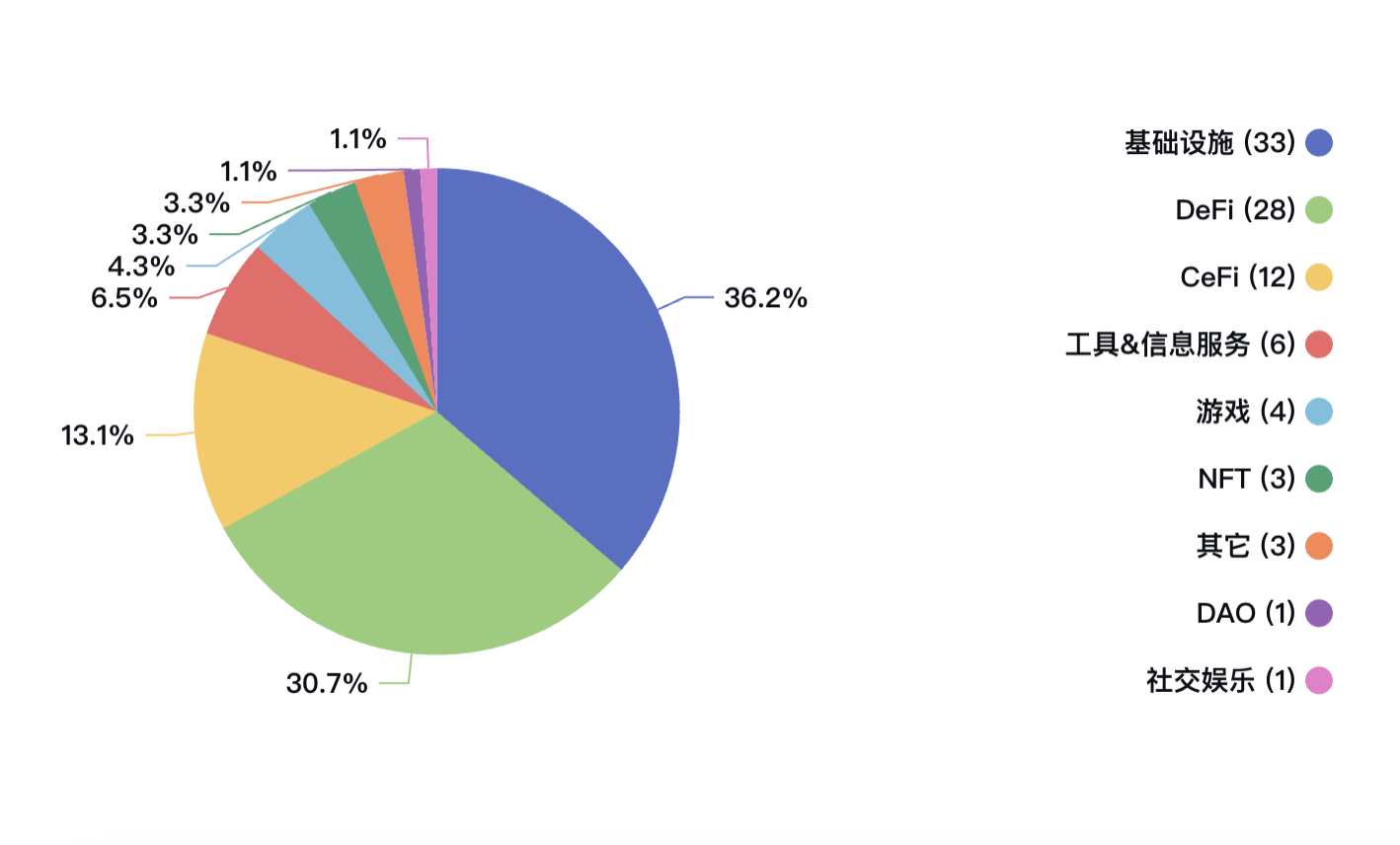

According to statistics, among the 99 investments in history, Hack VC’s investments in infrastructure accounted for 33, accounting for one-third. It can be said to be the “infrastructure maniac” in crypto VC. Typical cases are:

Data source: Rootdata

Затмение : A modular Rollup using SVM as the execution layer.

Инициация : It is a Layer 1 network based on the Cosmos ecosystem. It eliminates the fragmented experience of multi-chain systems through vertical integration of the technology stack and is committed to building a blockchain ecosystem similar to the Apple ecosystem.

Берахейн : An EVM-compatible Layer 1 focused on DeFi, built on top of the Cosmos SDK, and adopts the Proof of Liquidity (PoL) consensus mechanism.

Собственный слой : A re-staking protocol that enhances blockchain networks by reusing the security of base layers such as Ethereum. It allows anyone to leverage the trust and security of Ethereum without having to build their own system from scratch.

Вавилон : A Bitcoin restaking protocol that extracts the security of Bitcoin and empowers all PoS blockchains without any additional energy costs.

СУИ : Developed by Mysten Labs, based on the Move smart contract language, it aims to be the first programmable blockchain platform to reach Internet scale.

Движение : Building the first second-layer blockchain on Ethereum using the Move language in order to improve the security and efficiency of smart contracts.

Betting on infrastructure is also in line with Hack VCs consistent philosophy.

In early 2024, Alexander said in an interview that Hack VCs investment strategy is built on an infrastructure-focused research-driven approach, with core categories including:

Web3 infrastructure : the foundational protocols and networks that build the plumbing for the new internet.

Financial Infrastructure : Companies that use smart contracts and blockchain technology to build the next generation of financial markets, especially in the DeFi space.

Web3 x AI : Companies building at the intersection of web3 and generative AI.

In addition to infrastructure such as L1, Hack VC has made no secret of its optimism about the combination of Crypto and AI. Recently, founding partner Ed Roman published an article elaborating on the four major encrypted AI directions he is optimistic about, including:

1. Decentralized AI training ;

2. Using overly redundant AI reasoning calculations to reach consensus ;

3. Web3-specific AI use cases : such as Web3 protocols that use AI to perform risk scoring on DeFi pools, and Web3 games that use AI to control non-player characters (NPCs);

4. Consumer-grade GPU DePIN .

Currently, Hack VC has invested in several well-known encryption AI projects:

0G : A modular AI public chain designed to alleviate the pain points of on-chain AI applications in the Web3 ecosystem, such as speed and cost efficiency.

Ritual : Combining the best principles and techniques of cryptography and AI to create a system that enables the open and permissionless creation, distribution, and improvement of AI models.

io.net : A distributed computing network that provides GPU computing services that are cheaper, faster, and more flexible than traditional centralized services, providing machine learning engineers with access to unlimited computing power.

Sentient : Polygon co-founder’s new venture, an AI platform that relies on underlying blockchain protocols and incentive mechanisms.

In addition to infrastructure, Hack VC also bet on DeFi and CeFi, investing in 28 DeFi projects, accounting for 28%; in the CeFi field, it invested in 12 projects, accounting for 12%. Well-known investment projects include:

Cryptocurrency exchange Bybit, crypto asset management company Amber, crypto market maker Wintermute, decentralized derivatives platforms dYdX and Vertex, aggregated DEX 1inch, collateral lending platforms MakerDAO and Compound…

A closer look at the projects led by Hack VC reveals that it can also get investments from other top crypto VCs. According to statistics, Hack VCs main co-investors are Polychain, Robot Ventures, etc.

Hack VC has “great co-investor relationships” with other venture capital firms, in part because Alexander has provided seed funding to more than a dozen crypto funds, including Multicoin, Polychain, Paradigm, Standard, and Parafi.

Unique Value: Technology and Community

For all crypto VCs, what really sets them apart is something other than money.

The biggest feature of Hack VC is that in addition to providing the funds needed for project development, it can also provide technical support and liquidity during the development of the protocol.

Hack VC has an internal technology platform Hack.Labs, which goes beyond traditional investment methods and enables its team of blockchain engineers and quantitative researchers to provide liquidity, stake assets, make open source contributions, etc. This also makes Hack VC not only an investor in many projects, but also a core contributor.

For the project parties, besides funds and technology, what else is lacking?

Community, especially the developer community.

Ed Roman, co-founder of Hack VC, is also the founder of the global developer community hack.summit(). Since 2014, its hackathon events have attracted more than 130,000 participants from more than 150 countries. In April 2024, Hack.Summit() came to Asia for the first time and was held in Hong Kong Cyberport.

Funding, technology platform, and developer community correspond to the three sub-segments of Hack VC: VC TEAM, Hack.Labs, and hack.summit(). The trinity constitutes a complete Hack VC.

So, what kind of crypto projects will Hack VC invest in?

Similar to traditional risk methods, crypto investment is essentially an investment in people, so it pays more attention to the background and strength of the founder.

Alexander has said they prioritize references, case studies, and past work records.

In the seed stage of traditional venture capital, founders often lack a track record, which poses a challenge to investment decisions. However, Alexander believes that in the crypto field, the situation is completely different. Due to the open source nature of deep technology and the culture of open construction, almost everyone has a track record, even at the seed stage.

“I like to dive deep into what the founders are building and why, so I’ll look at their code and architecture and seek feedback from other experts. Also, I look for a good track record — whether it’s through GitHub commits or academic research papers.

It’s not just about what they do, I’m also looking for qualities like honesty, integrity, and loyalty in the founders, avoiding bad traits is key.

Finally, I prioritize startups in large markets that align with our thesis-driven approach. This ensures that the founders we invest in not only have the skills, but are also building in the right environment.”

В итоге, Hack VC prefers founders with successful experience, and the entrepreneurial project should have a high enough ceiling.

This article is sourced from the internet: Hack VC: A hacker who invests in hackers, an infrastructure maniac in crypto VC

По теме: Создание будущего биткоина: как протокол RGB расширяет собственную экосистему BTC

Оригинальная статья: Ash, Bitcoin Square; Sawyer, Echo, BiHelix введение Более десяти лет Bitcoin находится на переднем крае криптовалютной революции, являясь пионером концепции децентрализованной цифровой валюты и технологии блокчейна. Несмотря на новаторские инновации Bitcoin, его основная функциональность в первую очередь сосредоточена на том, чтобы быть средством обмена и сохранения стоимости. Однако с введением надписей в протоколе Bitcoin Ordinals в прошлом году и недавним появлением протокола Runes люди начали пересматривать многочисленные возможности Bitcoin, выходящие за рамки сохранения стоимости. Эти новые протоколы выпуска активов вызвали новое внимание к экосистеме Bitcoin, а также подчеркнули ограничения Bitcoin с точки зрения масштабируемости и времени подтверждения транзакций. Именно на этом фоне родился протокол RGB, открывший…