Подробное объяснение плана Jupiter H2 и последних обновлений, я бы хотел назвать это светом нового цикла DeFi

Оригинал | Odaily Planet Daily

Автор | Как

Today, Jupiter co-founder Meow talked about the second half of the year (H2) plan in a video. The team will conduct experiments in many aspects with the aim of promoting the development of Jupiter in key verticals, such as Jupiter Product, LFG Launchpad, Trial WGs, Crucial J 4 J Votes, GUM, etc.

Additionally, Jupiter released 4 updates today to optimize LFG, and Sanctum will take advantage of the following features when it launches its token next week:

-

MinOutput: A new way to swap at startup;

-

Alpha Vault in LFG UI: Allow depositors to be the first to swap in the pool;

-

Динамический Аирдропs: Teams can add custom rewards, such as the longer they wait to claim, the more airdrops they get;

-

Аирдроп Vesting: Teams can customize vesting parameters for airdrop recipients.

As the DeFi core of Solana ecosystem, Jupiter is closely related to the prosperity of Solana ecosystem. How will Jupiter develop? Can it collect the experience and lessons of the older generation of Ethereum DeFi leaders? What kind of future will it present? Odaily Planet Daily will analyze the key points mentioned by Jupiter today.

Jupiters past achievements and product pillars

Jupiter co-founder Meow said in the video that the so-called H2 plan is to conduct in-depth research on the functions that have been developed based on the current Jupiter, thereby promoting the vertical development of Jupiter.

Jupiters current businesses are mainly divided into: liquidity aggregation, limit orders, DCA (fixed investment strategy) and Perps trading and LFG Launchpad.

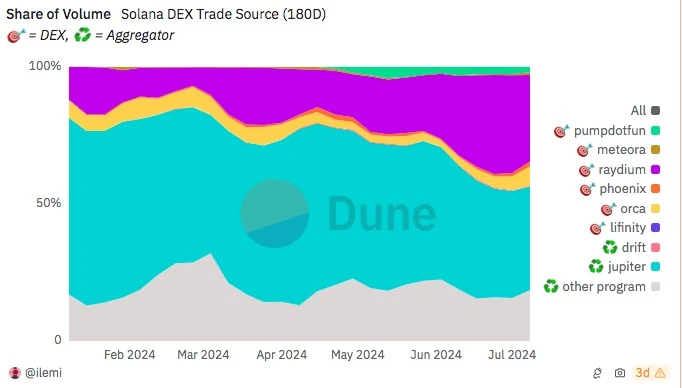

Jupiter鈥檚 popularity is largely due to its liquidity aggregation. As the leading aggregator on Solana, Jupiter accounts for half of Solana鈥檚 on-chain transaction volume, and almost most of the on-chain transactions come from it.

The following figure is a semi-annual Solana transaction share chart:

This chart shows the importance of Jupiter in Solana鈥檚 DeFi. As the meme wave on Solana becomes popular, Solana鈥檚 trading volume ranks first, so Jupiter naturally takes the lead in the field of aggregators.

Why has Jupiter developed so rapidly on Solana, while the aggregation effects of 1inch and Uniswap, which appeared earlier on Ethereum, are mediocre? This is mainly because liquidity aggregation uses the LP depth of different DEXs to satisfy users needs to trade with lower slippage, but the differences in the underlying networks of the two have led to the fact that liquidity aggregation has not developed well on Ethereum.

Secondly, Jupiter鈥檚 limit orders, DCA (fixed investment strategy) and Perps trading are actually inferior to the liquidity aggregation function, but it enriches its ability to meet the different needs of users.

Finally, the emergence of LFG Launchpad and its popularity in the cryptocurrency market have helped Jupiters development. From the beginning of the year to now, Launchpad has held three rounds. The first round was Zeus Network, the second round was Sanctum, and the third round was deBridge.

Key points of Jupiter H 2 plan and recent optimization

The above is a brief introduction to Jupiter鈥檚 current status. Back to the beginning of the article, in which existing sectors is the H2 plan mentioned by Jupiter co-founder Meow conducting experimental research?

-

Jupiter Product: As the name implies, starting from the Jupiter product itself, it should represent Jupiters liquidity aggregation and the expansion and in-depth research of various trading models;

-

LFG Launchpad: As a successful experimental product currently launched by Jupiter, the rules and development of LFG Launchpad will continue to be deepened;

-

Trial WGs: Various trial working groups on Jupiter, such as the working group mentioned in the Jupiter community proposal that promotes Jupiter on Reddit and other action groups that are beneficial to the development of Jupiter. The community votes on the budget required for its development and decides on its subsequent development;

-

Crucial J 4 J Votes: This is a critical proposal, which is actually what any project owner is pursuing on the road to decentralization.

-

GUM: GUM stands for Giant Unified Market, which integrates meme coins, real-world assets, stocks, foreign exchange and other investments into Solanas Jupiter, making it easier for them to trade directly with each other.

Today, Jupiter also released some upgrade plans. Here we will also explain the role of these 4 measures:

MinOutput:

-

Flexible pricing: Users can specify the lowest price they are willing to accept, ensuring that transactions will not be at prices that do not meet expectations due to market fluctuations.

-

Reduce risk: In the case of large market fluctuations, users can preset the minimum acceptance price to ensure that the transaction can be completed within the expected range and reduce the risk of loss.

-

Improve user experience: Users no longer need to worry about quotes changing during the transaction process, which increases the certainty of the transaction process and user confidence.

Alpha Vault:

-

Priority Trading: Provide depositors with the opportunity to be the first Swap in the pool and enjoy the advantages of priority trading.

-

Lock-up period: In return for this advantage, buyers of the Alpha Vault need to accept a lock-up period to prevent short-term speculation.

-

Liquidity management: This approach not only improves transparency and user experience, but also increases the efficiency of liquidity management and helps maintain market stability.

Dynamic Airdrop:

-

Incentivize holding: By increasing the correlation between waiting time and airdrop rewards, users are encouraged to hold tokens longer and reduce short-term selling behavior.

-

Custom rewards: Teams can add custom reward mechanisms to make airdrops more flexible and attractive, increasing user engagement.

-

Promote long-term participation: In order to obtain more airdrop rewards, users will be more inclined to hold tokens for a long time, which will help build a more stable user base and market environment.

Airdrop lock-up:

-

Long-term interest alignment: By customizing lockup parameters, the team can ensure that the interests of airdrop recipients are aligned with the long-term development goals of the project.

-

Reduce short-term speculation: The lock-up mechanism can prevent users from selling tokens immediately after the airdrop.

-

Stabilize the market: Gradually unlocking tokens can avoid sudden large-scale selling pressure in the market and maintain the stability of token prices.

в заключение

As the DeFi leader on Solana, Jupiter itself gathers most of the traffic, but how to make good use of this traffic to ensure high product retention rate and strong user stickiness is the focus of its research (and that of all DeFi projects).

By vigorously developing LFG Launchpad, Jupiter has actually seen how to make DeFi products not just designed as supporting functional networks, but as new coin listing platforms with transactions as the core.

In the new cycle, Jupiter has the potential to use the traffic base of on-chain transaction shares to retain users on its own platform, which is different from the development direction of other DeFi projects. It is not an exaggeration to call it the light of Solana DeFi.

This article is sourced from the internet: Detailed explanation of Jupiter H2 plan and recent updates, I would like to call it the light of the new cycle DeFi

Original author: Route 2 Fi Original translation: Ladyfinger, BlockBeats Editors Note: In this article, we follow the perspective of a senior cryptocurrency market participant and KOL, and gain in-depth insights into his analysis of current market trends, reflections on his personal investment philosophy, and deep insights into the angel investment field. Through his writing, we not only gain insights into the dynamics of the cryptocurrency market, but also appreciate how an investor constantly learns, adapts, and seizes opportunities in a rapidly changing financial environment. In addition, the article also provides basic knowledge of venture capital structure, providing readers with a comprehensive perspective to understand this multidimensional and dynamic industry. Introduction I havent opened a document for a long time, and I always dont know where to start when facing a…