Обязательный курс для основателей посевного раунда: историю рассказываете вы, а не PPT

Оригинальный автор: JOEL JOHN

Оригинальный перевод: TechFlow

This post was inspired by a conversation I had with Joe Eagan of Anagram discussing their EIR program , and is a compilation of notes I share with a startup founder who is seeking funding.

The importance of signals

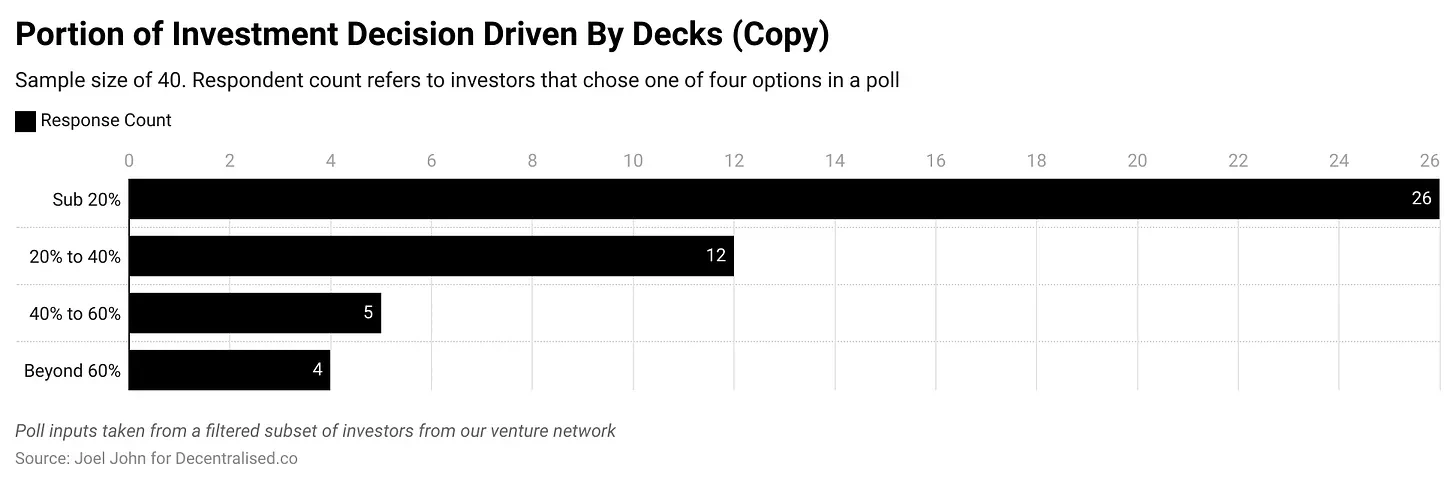

Before writing this post, I asked two groups of investors the same question: “At the seed stage, how much of your investment decision is driven by PowerPoint?” The responses varied. Dovey Wan of Primitive Ventures noted in our venture capital community that seed stage investing is like a first date, mostly based on feelings. Kyle Samani of Multicoin argued that much of fundraising is about communication , and PowerPoint is the primary tool to convey that.

At the seed stage, there is often very little information available about the product, and if it is a new market with no existing competitors, there is also very limited information about the market size.

When investing in Amazon in the late 1990s, were investors thinking about the market for buying books online? Or Jeff Bezos leaving his position as vice president at DE Shaw ? The former, while it looked like there was market potential, was a very weak signal.

However, a hedge fund manager giving up his comfortable job to analyze the Internet frontier to reduce regret is a very strong signal.

Founders can signal in a variety of ways. Y Combinator’s Jessica Livingston recently noted that what interested her about the Airbnb founders was their hustle. To keep raising money, even when they were in credit card debt, they created $40 boxes of cereal. These politically themed cereal boxes helped them make $30,000 in an election year when they tried to give away 6% of the company in exchange for a $20,000 check.

Airbnb is currently valued at $96 billion.

I’m not saying founders should start selling meme circles. What makes the Airbnb story so impressive is that they didn’t shut down their bed rental business to sell politically themed cereal. The cryptocurrency equivalent of 2024 might be a launchpad for founders to launch a politically-inclined meme coin.

I mean, at the early stage, VCs are looking for signal. And that signal can be generated in many forms. At the seed stage, when you have nothing else to show, PowerPoint is just one way to create that signal.

But what do you do when you don’t have PowerPoint? You can spend a hundred hours perfecting your presentation, or you can build that signal in a few ways.

Tell your story well

Many companies have been built on great communication skills. One of my favorite examples is Anand Sanwal, founder of CB Insights, a company that provides market intelligence and data analysis. You may not have heard of him, but most venture capital analysts rely on CB Insights to provide market maps and early insights into emerging companies, such as AI-driven agriculture or robot food delivery .

A great example of his storytelling abilities is how he deals with challenges in his life and how his father’s business compares to CB Insights. Or his take on the lessons he learned while running a SaaS company, or even the anecdote that his startup was originally called “Chubby Brains”!

One of the most rewarding things for seed-stage founders is to spend 8-12 hours writing up everything they know into a GitBook. This book should describe in detail what’s interesting about the emerging industry (like intent or passkeys), the market opportunity, and how their product fits into it. You can go into great depth here, but you probably don’t need to do so in your PowerPoint.

In an emerging industry, a well-written document can become the go-to resource for analyst research. This way, VCs will proactively pay attention to you instead of you cold contacting them. More importantly, potential employees, partners, and the media will also rely on these documents. Well-written documents are the bridge to invite the public to dream with you, and become the foundation for forming a community and leveraging network effects.

Of course, not all founders are willing to spend time writing documentation. So what can you rely on? Another approach is to tell a compelling story. For example, read this excerpt from Peter Thiel’s course notes :

“There were six people on the founding team of Paypal, and four of them built bombs in high school.”

This sentence immediately grabs the readers attention, showing how these people came together and realized the dream of digital currency. The story is a starting point, and the narrative can be different. Too many times, I see founders playing a role, hoping that venture capitalists will not regret missing out on them.

Strong founders understand this. Steve Jobs once purposely hid his Porsche when venture capitalists came to visit because he didn’t want them to think he was rich.

Founders’ stories are often rooted in their childhood experiences, pain points as consumers, or observations made at work. Jeff Bezos famously left his comfortable hedge fund job because he saw the huge potential of the Internet. Vitalik’s experience of losing his assets in World of Warcraft is also often cited as the reason for his interest in decentralized asset ownership.

Your story can be told in any medium you see fit. It doesn’t matter if it’s a podcast, a tweet, a short video, or an article. The key is to share it so people know about it. At the seed stage, the most compelling stories are often the founders’ personal experiences because investors are usually betting on founders. You should share your story because consumers may accept it before venture capitalists. When consumers recognize your story, you have market traction. This also leads to my next point.

Things that are not easy to expand

A better option is to release a product that is not yet perfect and look for early users. If you release a flawed product, you may hear some painful feedback from customers that can help you keep improving the product. These early users will become a powerful reference for venture capitalists when they consider backing you.

Below is a private message I sent to Alex from Nansen in 2020 when I bought their product for $7. He personally does one-on-one customer support. In the early days, their product was just a simple SQL dashboard. Now, they are valued at $750 million. I am proud to be their investor. But before that, I was a happy customer, even though there were still many problems with the product. I stuck with it because Alex personally provided one-on-one support when the product was broken, and he still does so now.

Telling your story and focusing on your customers costs nothing, but it can be the difference between your success and failure.

I even wrote an article about Nansen in December of that year. If you’re a user, you can compare the screenshots in the article to the state of the product today to see how much progress they’ve made. Being a good person and building interesting things is the most cost-effective way to get free publicity.

Many founders raise millions and build something nobody needs because their core customer base is VCs who want to invest in them. They sell equity, not their own product. And because capital allocators are often incentivized to be “nice” for deal flow, they don’t give good feedback. The market is usually the ultimate judge of whether your goal is to create a popular product.

Early adopters are not looking for a fully mature product. Early adopters are willing to use a flawed product if you can take good care of them or provide meaningful value.

Too often, consumers make choices based on which founder pays attention to them. If you don’t have the best product, simply spending time with potential users can make up for the lack of early experience. People want to be listened to before they are served by a product. Paul Graham calls this “ doing things that don’t scale .”

Consensus building

A lot of venture capital operates on consensus. As a VC, you don’t really focus too much on total available market (TAM), revenue, or even founders. Because if the TAM is large, you’re either betting on a mature market with limited upside, or you’re lacking focus.

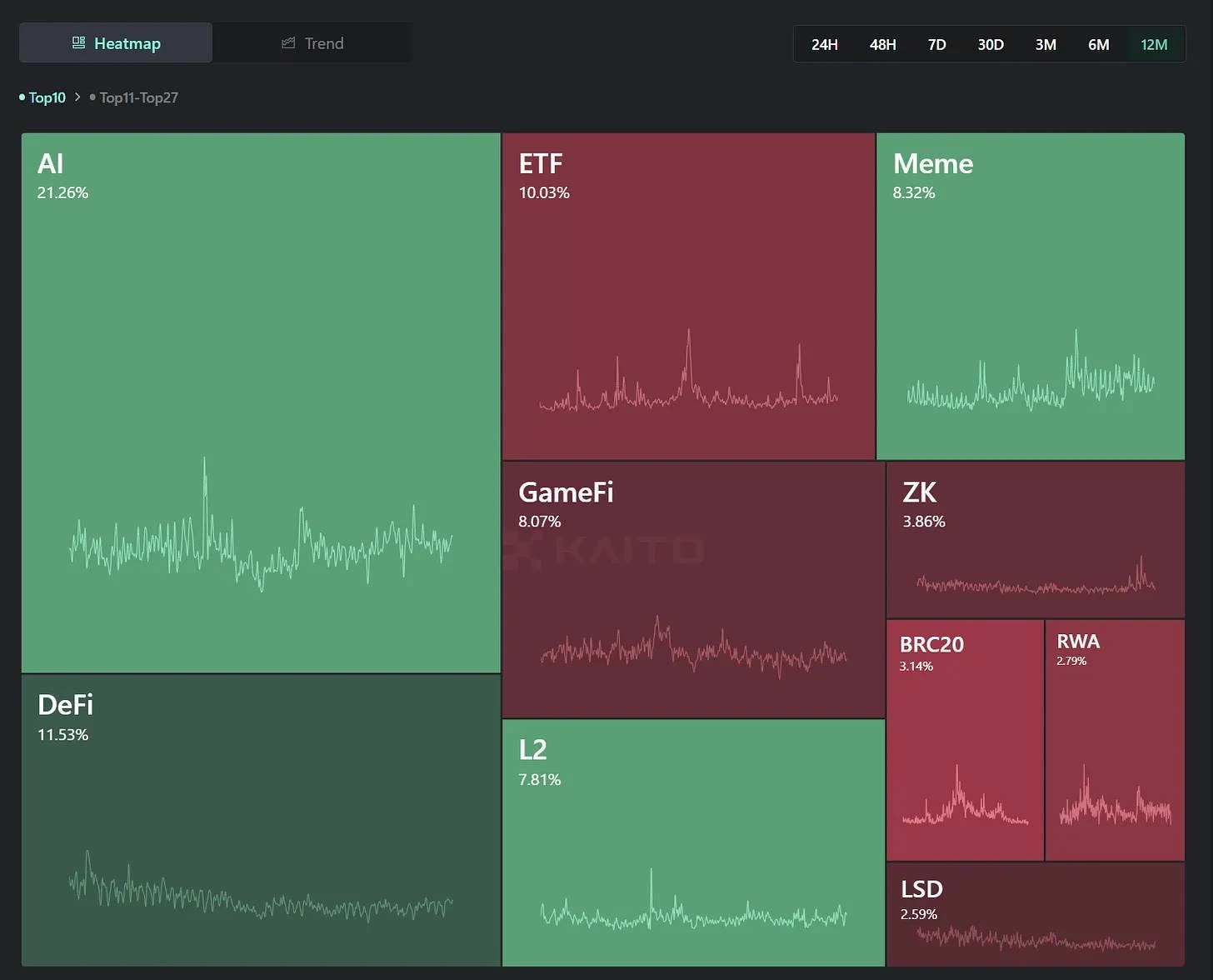

In contrast, early-stage VCs are more focused on what buyers (other VC funds) in subsequent rounds will bet on. The focus is often on narrative or theme.

This is both an advantage and a disadvantage. The advantage is that insightful venture capitalists can guide founders to market opportunities that they might not have noticed. The disadvantage is that only projects that fit the focus areas of subsequent investors can get funding.

Founders who solve hard problems often have difficulty finding backers because their exit strategy may not be clear to VCs. In the crypto space, MA is relatively rare. As a result, most crypto VC funds rely on a token model. When you know the market relies on a preset narrative, you optimize in that direction.

In the traditional venture capital world, it usually takes ten years to achieve an “exit.” If you can hold out that long, the chance of success is about 10% to 15%. The cycle for cryptocurrency tokens is 24 months.

This creates a higher bar for founders who are solving “hard problems” — typically consumer-facing applications that require founders to deeply understand the complexities of the market and use technology to solve the problem.

How do you deal with this as a seed-stage founder? The truth is, it’s hard to deal with it. Some founders are good at telling stories, but most aren’t. Even if you have some market traction, the market may not value you accordingly. Google almost sold itself for $750,000, and this phenomenon is not new.

A company’s valuation is the collective fantasy of its future potential held by its founders and backers. Sometimes, only the founders have this fantasy; sometimes, every fund shares it (as was the case with FTX). How many people with capital share this fantasy determines the valuation at the seed stage.

When there is no consensus in an industry, success often comes down to perseverance and persistence. The startup world is full of stories of founders who persevered until a fund decided to back them. The founder of Canva was rejected 100 times. Only in the hyper-capitalist world of Web3, where exits via tokens are a given, do we see rounds filling up overnight.

As long as venture capital relies on consensus and crypto relies on token liquidity, founders will continue to face difficulty raising money when they solve hard problems. It’s the nature of the game. If you’re a founder working on solving hard problems, don’t view rejection as a measure of the value of what you’ve built. A lot of the time, you’re communicating a vision that only you can see. If it’s a consensus bet, you’re in a competitive market. But there are some subtle nuances here.

Just because you continue to build in a market, doesn’t mean you’ll necessarily succeed. Smart founders are often able to judge when to double down and when to shut down their company. Many founders we work with shut down their companies, take a break, and re-enter the market after learning from past experiences. These types of founders are often rated higher for the lessons they learned from past experiences and the integrity they showed when shutting down unsuccessful projects.

It is just as commendable to close a company as it is to persevere and continue. Many times, the value in the process is being able to have an honest conversation.

Shuffle

( Source reference . This is probably because hes been doing it for over twenty years , by the way.)

I wish I could tell you that PowerPoint doesn’t matter. But I’m not Masayoshi Son running SoftBank, I’m just helping out at Decentralised.co.

Ultimately, the purpose of a PowerPoint is simple. It’s to communicate the information that founders need to share in the process of raising money. Most founders struggle with storytelling, building community, or achieving basic profitability. So, PowerPoint becomes the lowest barrier to entry.

So, assuming you still want to succeed, I suggest you ignore most of the crap advice you get from investment bankers. In 2015, the average time a venture capitalist spent on a project was 3 minutes and 44 seconds. By 2024, your time will be reduced to 2 minutes and 30 seconds. In the cryptocurrency field, your real time may be only one minute , because the analyst or partner may be looking at the price list of a meme while reading your proposal.

Here’s what you should include in your PPT:

-

The nature of opportunity and your unique approach to it.

-

Why the team is the best choice, including experiences, stories, and personal factors.

-

Signs of market traction: You have customers, sign-ups, and pre-orders that support the case for market demand.

-

You need to find ways to improve the unit economics of your product to scale—that is, what distribution factors give your product a competitive advantage.

-

How will this product make money? You don’t need a clear answer, but you do need to have a clear idea of the directional vision of how to make money at what scale.

-

If you already have customers, consider showing proof of their love for you, such as tweets, email replies, and chat logs. Showcase user feedback.

Here’s what I wish a founder friend knew. The perfect PowerPoint is like the perfect cup of coffee I pursue as a writer. You can wait and assume things will fall into place. But like coffee, PowerPoint isn’t the answer to every problem.

PowerPoint can be a great place to procrastinate. Accelerators like Y Combinator are effective in part because they set deadlines for applications. Founders are forced to submit their half-baked ideas. Yet, when we look at it from a 10-year perspective, Y Combinator founders have the most impact on the entire network.

Instead of waiting for the perfect presentation, talk to customers, send cold messages to VCs, launch products. Most of these things will fall on deaf ears, and rejection is the norm for early-stage entrepreneurs. But you can’t rally a team with just a vision in your head. You need something concrete. The best way to achieve those concrete results is through conversations. Instead of spending weeks preparing PowerPoint slides, you’re more likely to succeed if you talk to people, record feedback, and launch products quickly.

Like coffee and writing, PowerPoint is meant to help you, not keep you waiting. If you have a better way to convey credibility, hold off on perfecting your PowerPoint.

Here are some resources for founders on building a PPT.

-

Этот collection of over 1400 PPTs is for inspiration.

-

Y Combinators slides are for people who like a standardized format.

-

Some additional PowerPoint presentation examples .

-

Этот article from NFX about storytelling ( my personal favorite).

-

OpenDeck PPT classified by business model and stage.

-

NYU professor Ashwath Damodarans course on numbers and storytelling .

-

And my article on narrative games from last year.

-

If you want to step away from the entrepreneurial world and simply get inspired, check out this book on creativity .

Seed-stage investing is essentially an investment in people. VCs buy the founders’ connections and experience at a lower valuation. If the founders lack these resources, documentation can help demonstrate their expertise. In general, all early-stage investing is a bet on the founders and their ability to scale the company.

However, this is based on the premise that founders need to start businesses in areas favored by capital. Today, it is much more difficult to build and raise funds for an NFT market than it was 36 months ago because attention and capital have shifted elsewhere.

In a world where attention is scarce, getting it is half the battle. How you do that is up to the founders themselves.

This article is sourced from the internet: A must-learn course for seed round founders: It’s you who tells the story, not the PPT

Original author: Shang2046 The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice. The market continues to fluctuate between $60,000 and $70,000, paying off debts to reach a new all-time high ahead of schedule Market Week BTC continued to adjust downward in the short term, and as of June 24, it once fell below $61,000. Last week, we predicted that the market would enter a short-term clearing phase of weak equilibrium, and the first target of clearing would be Bitcoin miners. As the price of the currency fell, more and more miners sold all their daily output (maximum supply 450 coins/day) and also sold their solid inventory. Unfortunately, liquidation is often accompanied by a certain…