Исследовательский институт Bitget: курс контракта BTC становится положительным, что указывает на то, что фонды покупают в краткосрочной перспективе, и человек

За последние 24 часа на рынке появилось много новых популярных валют и тем, которые могут стать следующей возможностью заработать деньги, включая:

-

The sectors with relatively strong wealth creation effects are: well-known Meme and ETH ecological projects

-

Hottest tokens and topics searched by users: Raydium, BGB, ETH Spot ETF

-

Potential airdrop opportunities include: Fuel, DeBank

Data statistics time: July 9, 2024 4: 00 (UTC + 0)

1. Рыночная среда

The market continued to fluctuate yesterday, with BTC fluctuating in a narrow range of $55,000 to $57,500, with a certain amount of intraday trading space. The German government continued to transfer BTC to centralized exchanges, which was interpreted by the market as continued selling pressure. However, the US BTC spot ETF showed a net inflow for two consecutive trading days, with a single-day net inflow of up to $296 million yesterday, the third highest single-day net inflow since June. The BTC contract rate turned positive, indicating that funds were buying BTC spot and contracts, and funds were flowing back to the crypto market in the short term.

On the macro level, the market is paying attention to the US CPI data to be released on Thursday, which is expected to grow by 3.1% month-on-month. If it is lower than 3.1%, the probability of the Fed cutting interest rates in September may increase significantly, which is good for the crypto market. In addition, several institutions have submitted revised ETH spot ETF S-1 forms. The ETH ETF may be approved in July, so you can pay attention to the performance of ETH.

2. Богатый сектор

1) Sector changes: Well-known memes (BONK, PEPE, BOME)

основная причина:

-

Blue-chip tokens such as ETH and SOL began to rebound;

-

The markets attention to the Meme coin sector has increased, Bithumb has launched BRETT, and Justin Sun and the founder of IOSG have expressed their attitudes towards Meme coins.

Rising situation: BONK, PEPE, and BOME rose by 21.4%, 12%, and 9.8% respectively within 24 hours;

Факторы, влияющие на перспективы рынка:

-

Price token trend: For BONK, the trend of SOL token will affect the price of BONK, because BONK on DEX is denominated in SOL. Keep an eye on the price trend of ETH and SOL. If ETH and SOL maintain an upward trend, you can continue to hold Meme assets in the relevant ecosystem.

-

Increase or decrease in open interest: Check the contract data on the tv.coinglass website to understand the movement of major funds. In the past 24 hours, the open interest of BONK has surged by 70%, mainly due to the increase in net long positions. The account long-short ratio has fallen below 1, indicating that major funds have opened long positions in BONK through contracts. In the future, you can continue to pay attention to changes in contract data.

2) Sectors that need to be focused on in the future: ETH ecosystem projects (UNI, LDO, PEPE)

основная причина:

Many institutions have submitted S-1 forms for ETH spot ETFs. The S-1 documents for ETH spot ETFs may be approved by the SEC in July. ETH ecological assets may have room for speculation. Recently, the track has experienced a large correction and has fallen out of layout space;

Конкретный список валют:

-

UNI: Первый проект DeFi Swap на блокчейн-приложениях. Средний дневной доход Uniswap в прошлом составлял около $1 миллиона, что является значительным доходом.

-

LDO: The leading LSD project in the ETH ecosystem, with a TVL of 29.6 billion US dollars and a valuation of less than 1.6 billion US dollars, is relatively undervalued;

-

PEPE: Currently, it is the most hyped meme coin in the ETH ecosystem. It has a very strong community foundation and is likely to continue to rise along with the ETH price.

3. Горячие поисковые запросы пользователей

1) Популярные децентрализованные приложения

Raydium:

Yesterday, the Solana ecosystem DEX Raydium protocol fees reached 2.5 million US dollars, surpassing the Ethereum network protocol fees (1.36 million US dollars) and the Solana network protocol fees (1.15 million US dollars) to rank second.

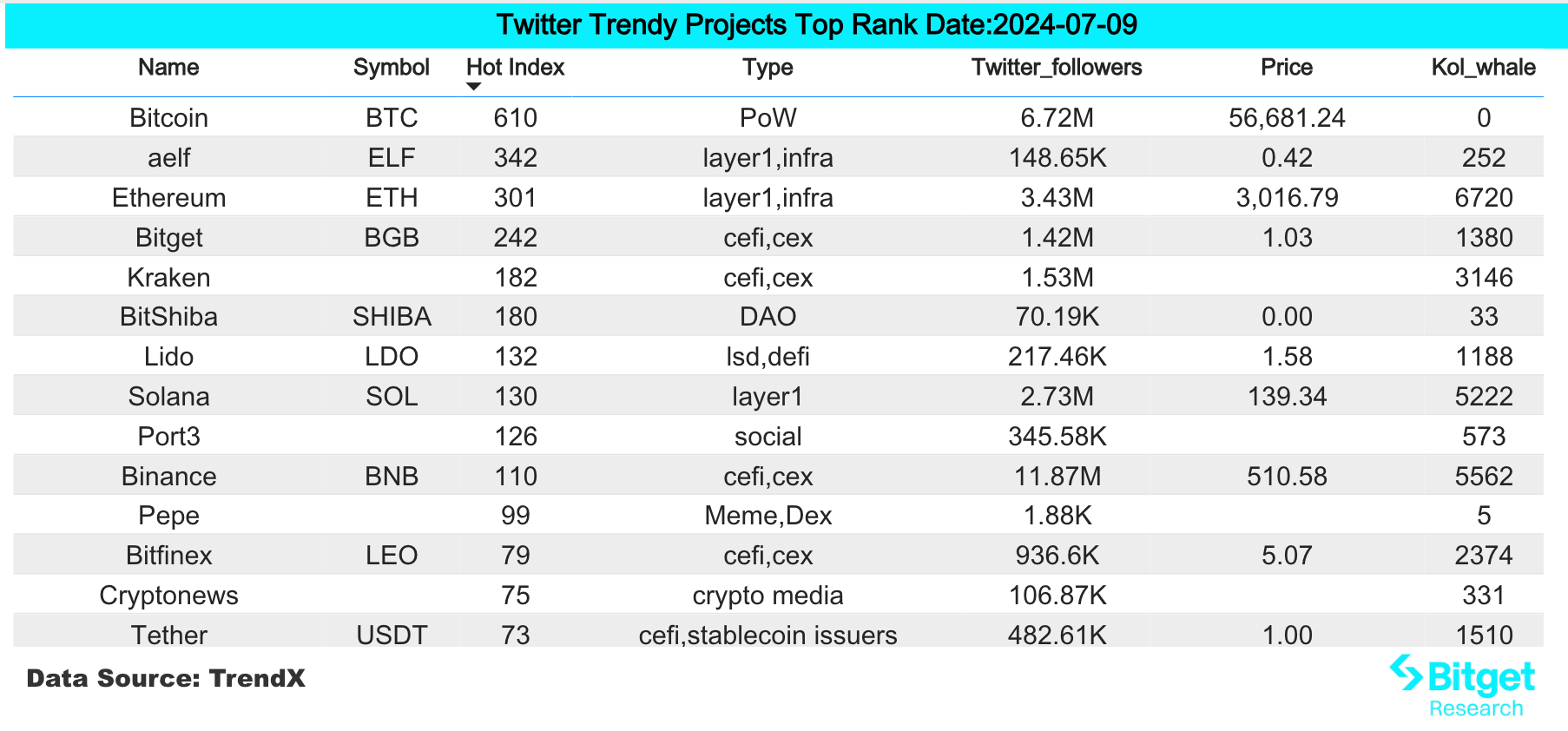

2) Твиттер

BGB:

Yesterday, Bitget launched the BGB/USDT contract trading pair with a maximum leverage of 50 times. A week ago, on July 1, Bitget announced the upgrade of the BGB smart contract address to further enrich the rights and interests of BGB holders, expand its use scenarios in decentralized applications such as DeFi, DEX, and GameFi, and provide more value and opportunities for BGB holders.

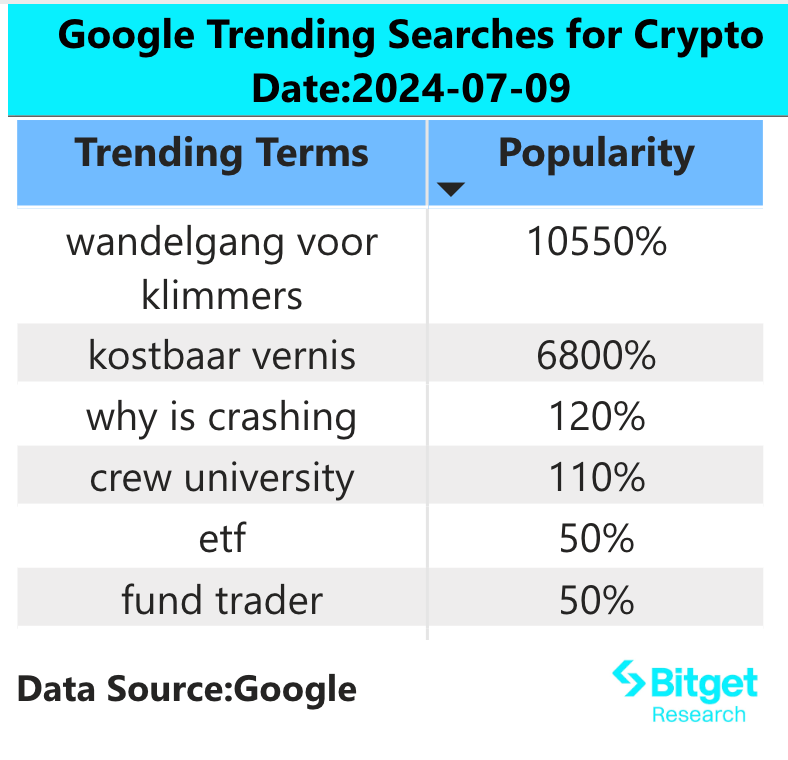

3) Регион поиска Google

С глобальной точки зрения:

ETH Spot ETF:

On July 8, according to the filing documents of the U.S. Securities and Exchange Commission (SEC), VanEck has submitted its Ethereum spot ETF S-1 revised registration statement, intending to rename VanEck Ethereum Trust to VanEck Ethereum ETF. On July 9, according to The Block, after VanEck submitted the revised S-1 registration statement, 21 Shares, BlackRock, Fidelity, Franklin Templeton and Grayscale also submitted revised S-1 registration statements before the deadline.

Из горячих запросов в каждом регионе:

(1) There are no obvious characteristics in the Google Trends hot searches of Asian countries, but it is worth noting that SLP appeared in the hot searches in the Philippines. At the same time, the Philippine stablecoin PHPC was launched on Ronin yesterday. This shows that the game public chain and the entire GameFi sector have very high traffic and recognition in the Philippines.

(2) There are no obvious characteristics in the hot searches of European and American countries. For example, the hot searches of China should be BLAST, VET, and JUP, while those of the United States are MAGA, XAI, etc. Each country is different, which shows that there is a lack of hot spots in the current market.

Потенциал Аирдроп Возможности

Топливо

Fuel is a UTXO-based modular execution layer that brings globally accessible scale to Ethereum. As a modular execution layer, Fuel can achieve global throughput in a way that monolithic chains cannot, while inheriting the security of Ethereum.

In September 2022, Fuel Labs successfully raised $80 million in a round of financing led by Blockchain Capital and Stratos Technologies. Multiple leading investment institutions invested, such as CoinFund, Bain Capital Crypto and TRGC.

Participation method: You can directly deposit the tokens accepted by Fuel into the points you have earned. Participants can earn 1.5 points per day for every $1 they deposit in the following assets:

Points: ETH, WET, eETH, rsETH, rETH, wbETH, USDT, USDC, USDe, sUSDe and stETH; From July 8th to 22nd, depositing ezETH will earn you 3 points per day.

ДеБанк

DeBank is a multi-chain DeFi portfolio tracker that supports DeFi protocols across multiple chains. DeBank also announced last year that it would launch the DeBank Chain based on OP Stack, and the mainnet will be launched in 2024.

Yesterday, DeBank announced that DeBank XP had been snapshotted at 8:00 am Beijing time on July 4. All active addresses have the opportunity to claim the initial XP airdrop. The initial XP of each address will be confirmed by its on-chain assets, credit, and Web3 social ranking on DeBank. The XP claim page is already available on DeBank, and the claim will last for one month.

Исходная ссылка: https://www.bitget.com/zh-CN/research/articles/12560603812485

«Отказ от ответственности» Рынок рискованный, поэтому будьте осторожны при инвестировании. Эта статья не представляет собой инвестиционный совет, и пользователям следует подумать, подходят ли какие-либо мнения, взгляды или выводы в этой статье к их конкретным обстоятельствам. Инвестирование на основе этой информации осуществляется на ваш страх и риск.

This article is sourced from the internet: Bitget Research Institute: BTC contract rate turns positive, indicating that funds are buying in the short term, and many institutions submit ETH spot ETF S-1 forms

Original | Odaily Planet Daily Author | Asher In the past week, the overall crypto market was sluggish, and the GameFi sector experienced a certain degree of correction, but many popular projects continued to update their project dynamics this week. Perhaps now is a good time to lay out the GameFi sector. Therefore, Odaily Planet Daily summarized and sorted out the blockchain game projects that have been popular recently or have popular activities. Secondary market performance of blockchain gaming sector According to Coingecko data, the Gaming (GameFi) sector fell 10.0% in the past week; the current total market value is $18,665,081,150, ranking 27th in the sector ranking, down two places from the total market value sector ranking last week. In the past week, the number of tokens in the GameFi…