Краткая история токенизации активов: сложная трансформация и светлое будущее

Оригинальный автор: ALEX WESELEY

Оригинальный перевод: TechFlow

Article Introduction

In this article, author ALEX WESELEY delves into the potential and challenges of tokenizing financial assets on public blockchains. Although billions of dollars of real financial assets have been tokenized and deployed on public blockchains, there is still a lot of work to be done at the intersection of law and technology to restructure the infrastructure of the financial system. The article reviews the historical context of traditional financial markets, especially the paperwork crisis of the 1960s, revealing the fragility and inefficiency in the existing system. The author believes that public blockchains are uniquely positioned to solve these problems in a trusted and neutral manner on a global scale.

The main points

-

While billions of dollars of real-world financial assets have been tokenized and deployed on public blockchains to date, there is still a lot of work to be done at the intersection of law and technology to re-architect the infrastructure of the financial system on public blockchains.

-

History tells us that the existing financial system was not designed to support the level of globalization and digitization required today, and it has become a closed system built on outdated technology. Public blockchains are uniquely positioned to solve these problems in a trusted and neutral manner on a global scale.

-

Despite the challenges, we at Artemis still believe that stocks, treasuries, and other financial assets will migrate to public blockchains because they are more efficient. This will allow network effects to be unleashed as applications and users converge on the same underlying platforms that enable programmable and interoperable assets.

Предисловие

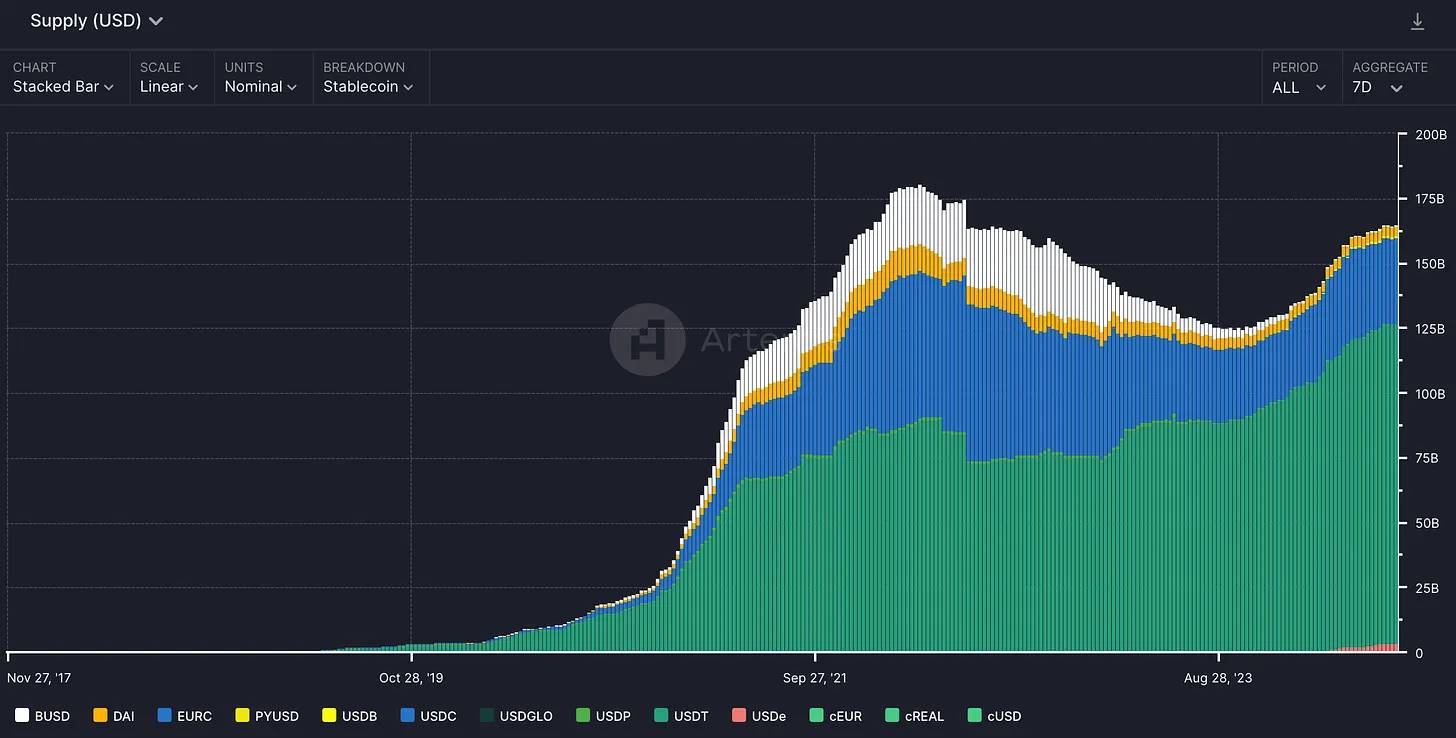

With over $160 billion in fiat currency tokenized and $2 billion in U.S. Treasuries and commodities tokenized, the tokenization of real-world financial assets on public blockchains has begun.

Stablecoin Supply (Artemis)

Tokenized Treasury Supply by Issuer (rwa.xyz)

For years, the financial industry has been intrigued by the potential that blockchain technology could have to disrupt traditional financial market infrastructure. Promised benefits include increased transparency, immutability, faster settlement times, improved capital efficiency, and reduced operating costs. This promise has led to the development of new financial instruments on the blockchain, such as innovative trading mechanisms, lending protocols, and stablecoins. Currently, decentralized finance (DeFi) has over $100 billion in locked assets, indicating significant interest and investment in this space. Proponents of blockchain technology envision its impact beyond the creation of crypto assets such as Bitcoin and Ethereum. They foresee a future in which global, immutable, and distributed ledgers will enhance the existing financial system, which is often constrained by centralized and siloed ledgers. Central to this vision is tokenization , the process of representing traditional assets on a blockchain using smart contract programs known as tokens.

To understand the potential for this transformation, this article will first examine the development and operation of traditional financial market infrastructure through the lens of securities clearing and settlement . This review will include a review of historical developments and an analysis of current practices, providing the necessary context to explore how blockchain-based tokenization can drive the next phase of financial innovation. The Wall Street clerical crisis of the 1960s will provide a key case study , highlighting the vulnerabilities and inefficiencies in the existing system. This historical event will set the stage for a discussion of the key players in clearing and settlement and the challenges inherent in the current delivery-vs-payment (DvP) process. The article concludes with a discussion of how permissionless blockchains may offer unique solutions to these challenges and have the potential to unlock greater value and efficiency in the global financial system.

Wall Streets Paperwork Crisis and the Depository Trust Clearing Corporation (DTCC)

Today’s financial system was formed gradually after decades of systemic stress. An often overlooked event is the paperwork crisis in the late 1960s, which sheds light on why the settlement system has developed into what it is today. George S. Geis describes this event in detail in “ Historical Context of Stock Settlement and Blockchain ”. Reviewing the development of securities clearing and settlement is essential to understanding the current financial system and recognizing the importance of tokenization.

Today, it’s easy for people to buy securities in a matter of minutes through their online broker. Of course, it wasn’t always this way. Historically, stocks were issued to individuals in the form of physical certificates, which represented ownership of the stock. In order to complete a stock trade, the physical certificate had to be transferred from the seller to the buyer. This involved handing the certificate over to a transfer agent, who would cancel the old certificate and issue a new one in the name of the buyer. Once the new certificate was delivered to the buyer and the seller received payment, the trade was settled. In the 19th and 20th centuries, brokerages gradually began to hold stock certificates on behalf of their investors, allowing them to more easily clear and settle trades with other brokerages. The process was still largely manual, with a single brokerage firm typically using 33 different documents to execute and record a single securities transaction (SEC). While manageable at first, the process became increasingly cumbersome as trading volumes increased. In the 1960s, stock trading activity increased dramatically, making it impossible to physically deliver securities between brokerages. Systems designed to handle the 3 million shares traded per day in the early 1960s were no match for the 13 million shares traded per day by the end of the decade (SEC). To allow time for back-office processing of settlements, the New York Stock Exchange (NYSE) shortened trading hours, extending the settlement time to T+5 (fifth day after the trading day), and eventually stopped trading altogether on Wednesday.

A stock certificate (Colorado Artifactual)

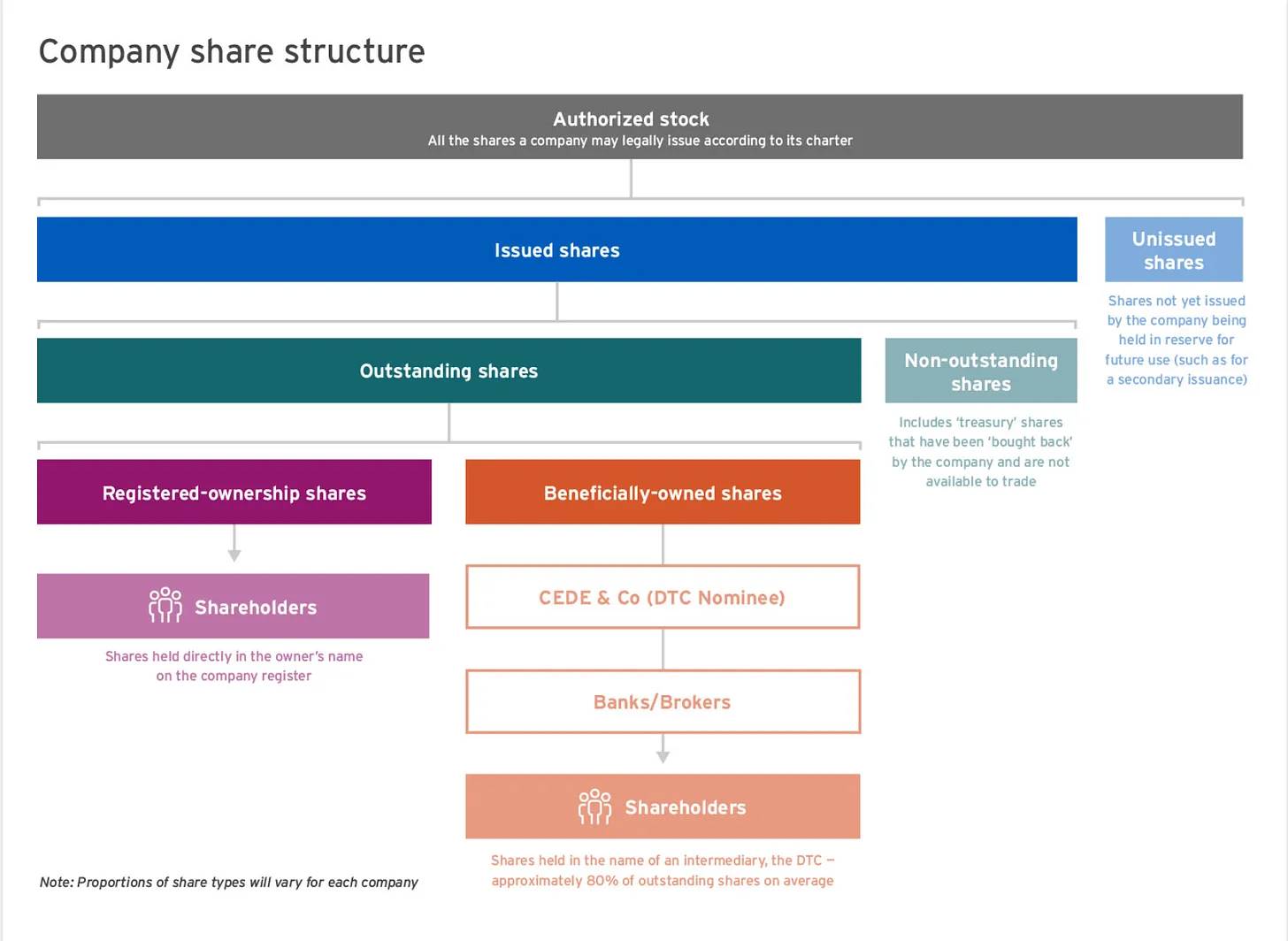

Since 1964, the New York Stock Exchange (NYSE) has been looking for a solution by creating the Central Certificate Service (CCS). CCSs goal was to become a central depository for all stock certificates, meaning that it would hold all stocks on behalf of its members (mainly broker-dealers), while end investors would receive beneficial ownership through book entries by their brokers. CCSs progress was hampered by various regulatory restrictions until 1969 when all fifty states amended their laws to allow CCS to centrally hold certificates and transfer stock ownership. All stocks were transferred to CCS to be stored in immobilized fungible bulk. Since CCS held all stocks in a fixed form, it recorded the balances of its member-broker-dealers in its internal books, and these broker-dealers in turn recorded the balances of the end investors they represented in their internal books. Stock settlement could now be done through book entries rather than physical delivery. In 1973, CCS changed its name to the Depository Trust Company (DTC) and all stock certificates were transferred under the name of its subsidiary Cede Co . Today, DTC, through Cede, is the nominal owner of nearly all of the companys stock. DTC itself is a subsidiary of the Depository Trust Clearing Corporation (DTCC), whose other subsidiaries include the National Securities Clearing Corporation (NSCC). These companies, DTC and NSCC, are one of the most critical components of todays securities system.

The creation of these intermediaries changed the nature of stock ownership. Before, shareholders held physical certificates; now, this ownership was represented through a series of ledger entries. As the financial system evolved, increasing complexity led to the creation of more custodians and intermediaries, each of which had to maintain its own record of ownership through ledger entries. The hierarchy of ownership is simplified in the following diagram:

Source: ComputerShare

Notes on the digitization of securities

Starting in the wake of the paperwork crisis, the DTCC stopped holding physical shares in its vaults, so shares went from being “fixed” to being completely “dematerialized,” with almost all now represented solely as electronic book entries. Today, most securities are issued in dematerialized form. As of 2020, the DTCC estimates that 98% of securities are dematerialized, with the remaining 2% representing nearly $780 billion in securities.

A Primer on Traditional Financial Market Infrastructures (FMIs)

To understand the potential of blockchain, one needs to understand financial market infrastructures (FMIs), which are the very entities that blockchain is poised to disrupt. FMIs are the backbone of our financial system. The Bank for International Settlements (BIS) and the International Organization of Securities Commissions (IOSCO) have detailed the role of FMIs in the Principles for Financial Market Infrastructures (PFMIs). BIS and IOSCO define the following critical financial market infrastructures for the smooth functioning of the global financial system:

-

Payment Systems (PSs) : Systems responsible for transferring funds between participants securely and efficiently.

-

Example: In the United States, Fedwire is the primary interbank wire transfer system, providing Real-Time Gross Settlement (RTGS) services. Globally, the SWIFT system is systemically important because it provides a network for international funds transfers, but it is only a support system – it does not hold accounts or settle payments.

-

Central Securities Depositories (CSDs) : Entities that provide securities accounts, central custody services, asset servicing, and play an important role in ensuring the integrity of securities issuance.

-

Examples: In the US, DTC. In Europe, Euroclear or Clearstream.

-

Securities Settlement Systems (SSSs) : Securities settlement systems enable the transfer and settlement of securities through book entries according to a set of predetermined multilateral rules. These systems allow the transfer of securities either without payment or with payment.

-

Examples: In the US, DTC. In Europe, Euroclear or Clearstream.

-

Central Counterparties (CCPs) : Entities that act as a buyer to every seller and a seller to every buyer to ensure the performance of unbound contracts. CCPs achieve this by innovating the process of splitting one contract between a buyer and a seller into two contracts: one between the buyer and the CCP, and another between the seller and the CCP, thereby absorbing counterparty risk.

-

Example: In the United States, the National Securities Clearing Corporation (NSCC).

-

Transaction Report Repositories (TRs) : Entities that maintain electronic records of transaction data sets.

-

Example: DTCC operates a global transaction reporting repository in North America, Europe, and Asia. It is primarily used for derivatives trading.

Throughout the life cycle of a transaction, the interaction of these systems is roughly shown in the following diagram:

Source: Federal Reserve Bank of New York

Typically, transfers are organized in a spoke model with the FMI as the central hub, where the spokes are other financial institutions such as banks and broker-dealers. These financial institutions may interact with multiple FMIs in different markets and jurisdictions, as shown in the following figure:

Source: Federal Reserve Bank

This isolation of ledgers means that entities must trust each other to maintain the integrity of their ledgers and their communications and reconciliations. There are entities, processes, and regulations that exist purely to facilitate this trust. The more complex and global the financial system becomes, the more external forces are needed to enforce trust and cooperation between financial institutions and financial market intermediaries.

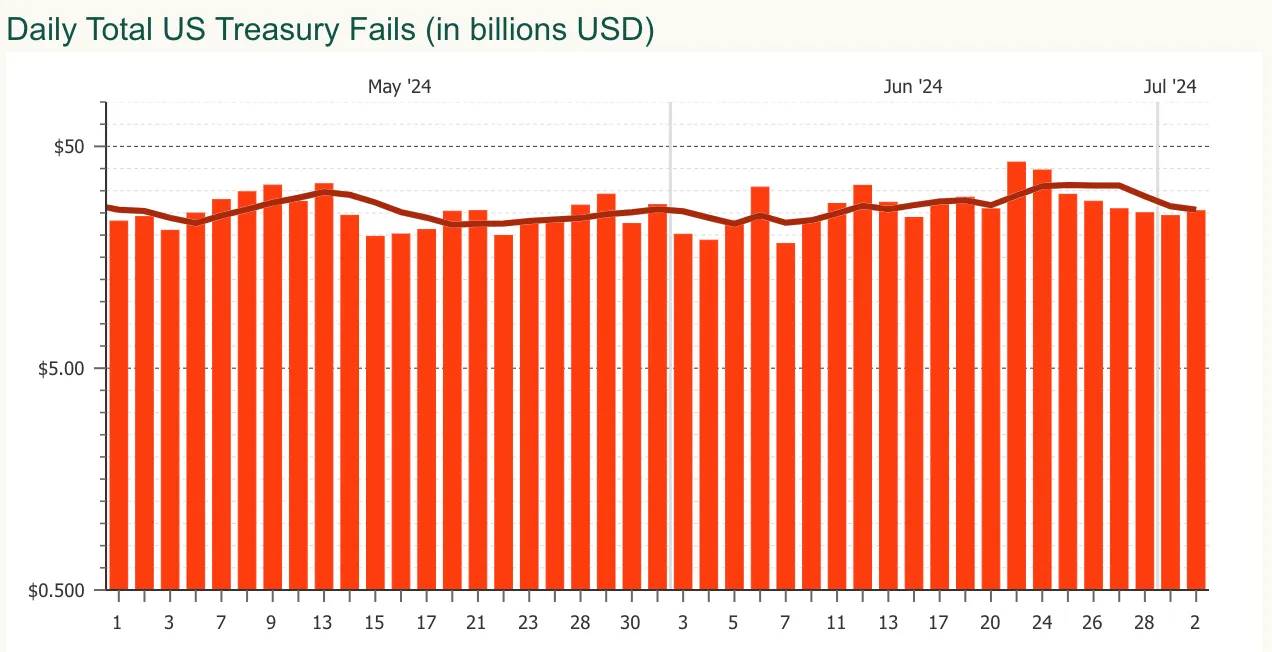

The inefficiencies of current financial markets are demonstrated by the following data on corporate securities settlement failures, which have recently grown to account for more than 5% of total trading volume.

Source: Federal Reserve Bank of New York

According to additional data provided by the DTCC, the amount of daily settlement failures in U.S. Treasury securities is between $20 billion and $50 billion. This represents approximately 1% of the $4 trillion in Treasury securities transactions that the DTCC clears each day.

Source: DTCC

A settlement failure has consequences because the buyer of the security may have already used it as collateral in another trade. That subsequent trade will also face a settlement failure, potentially leading to a cascading failure.

Securities Settlement: Delivery Against Payment

The Committee on Payment and Settlement Systems states that “the greatest financial risk in securities clearing and settlement occurs during the settlement process”. Securities can be transferred without or with payment. Some markets employ a mechanism whereby the transfer of securities occurs only if the corresponding funds transfer is successful – a mechanism known as Delivery versus Payment (DvP). Today, the delivery of securities and the payment of funds occur in two fundamentally different systems. One occurs through the payment system, and the other through the securities settlement system, those mentioned in the previous section. In the United States, payments might be made via FedWire or ACH, while international payments might use SWIFT for communication and settlement through a network of correspondent banks. On the other hand, securities delivery occurs through securities settlement systems and central securities depositories such as DTC. These are different systems and ledgers, requiring increased communication and trust between the different intermediaries.

Source: FIMMDA

Atomic Settlement in Blockchain and DvP

Blockchain can mitigate certain risks in payment delivery systems, such as principal settlement risk, through a unique property called atomicity. A blockchain transaction itself can consist of several different steps. For example, delivering a security and completing its payment. What makes blockchain transactions special is that either all parts of the transaction succeed or none of them do. This property, called atomicity, enables mechanisms such as flash loans, where users can borrow money without collateral in a single transaction, as long as they pay it back in the same transaction. This is possible because if a user fails to repay the loan, the transaction and the loan will not be recorded. In blockchain, payment delivery can be done trustlessly through smart contracts and atomic execution of transactions. This has the potential to reduce principal settlement risk, where part of a transaction does not succeed, exposing the parties to potential losses. Blockchain has key characteristics that enable it to replace the role played by traditional securities settlement systems and payment systems in payment delivery settlement.

Source: Moonpay

Why choose permissionless blockchain?

For a blockchain to be public and permissionless, anyone must be able to participate in validating transactions, generating blocks, and reaching consensus on the canonical state of the ledger. In addition, anyone should be able to download the state of the blockchain and verify the validity of all transactions. Examples of public blockchains include Bitcoin, Ethereum, and Solana, where anyone with an internet connection can access and interact with the ledger. Blockchains that meet this criteria and are sufficiently large and decentralized are essentially trusted neutral global settlement layers. That is, they are unbiased environments for the execution, verification, and settlement of transactions. Through the use of smart contracts, transactions can be conducted between parties that do not know each other, enabling trustless, intermediary-free execution and resulting in immutable changes to the global shared ledger. Although no single entity can restrict an individuals access to the blockchain, applications built on the blockchain may implement permissions such as whitelisting for KYC and compliance-related purposes.

Public blockchains can improve the efficiency and capital efficiency of back-office operations by leveraging the programmability of smart contracts and the atomicity of blockchain transactions. These capabilities can also be achieved with permissioned blockchains. To date, much of the enterprise and government exploration of blockchain has been conducted through private and permissioned blockchains. This means that validators of the network must pass KYC checks before being allowed to join the network and run the ledgers consensus mechanism, transaction validation, and block generation software. Implementing a permissioned blockchain for institutional use will not be more beneficial than using a private shared ledger between institutions. If the underlying technology is completely controlled by entities like JP Morgan, a consortium of banks, or even a government, the financial system will no longer be unbiased and credibly neutral. Enterprises and government agencies have been researching distributed ledger technology since 2016 , but we still havent seen significant implementation of these systems outside of pilot projects and testing environments. According to Chris Dixon of a16z, this is partly because blockchain allows developers to write code that can make strong commitments, while enterprises dont need to make as many commitments to themselves. In addition, blockchains should be like massively multiplayer games, not just multiplayer games like enterprise blockchains.

Tokenization Case Studies

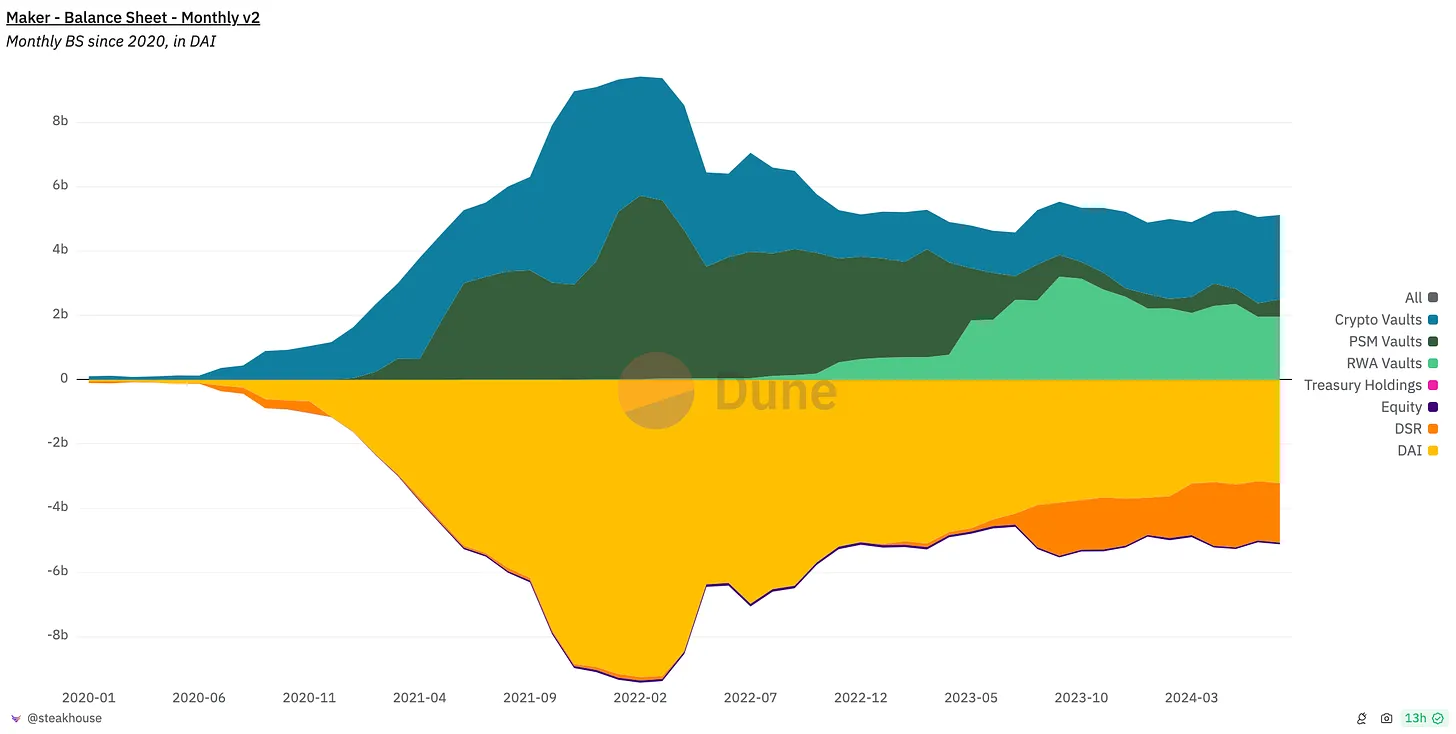

Maker, the protocol that manages the DAI stablecoin, has increased the use of real-world assets (RWAs) to collateralize the issuance of DAI. In the past, DAI was mainly backed by crypto assets and stablecoins. Today, about 40% of Makers balance sheet is held in RWA vaults that invest in US Treasuries, generating significant income for the protocol. These RWA vaults are managed by various entities including BlockTower and Huntingdon Valley Bank.

Source: Dune/steakhouse

БлэкРок ’s USD Institutional Liquidity Fund (BUIDL) was launched on the public Ethereum blockchain in March 2024. The fund invests in U.S. Treasuries, and investors hold fund shares via ERC-20 tokens. In order to invest in the fund and issue additional shares, investors must first undergo KYC through Securitize. Payment for shares can be made via wire transfer or USDC . While the issuance and redemption of shares can be done via stablecoins, actual trade settlement does not occur until the fund successfully sells the underlying securities in traditional financial markets (in the case of a redemption). In addition, the transfer agent Securitize maintains an off-chain transaction and ownership registry that legally takes precedence over the blockchain. This suggests that there are many legal issues that need to be resolved before U.S. Treasuries themselves can be issued on-chain and atomically settled with USDC payments.

Ондо Финанс is a fintech startup that is innovating in the tokenization space. They offer a variety of products including OUSG and USDY, which are issued as tokens on multiple public blockchains. Both products invest in US Treasuries at the bottom and provide yield to holders. OUSG is only available to qualified purchasers in the US, while USDY is open to anyone outside the US (and other restricted regions). An interesting point about USDY minting is that when a user wishes to mint USDY, they can choose to wire USD or send USDC. For USDC deposits, the transfer is considered completed when Ondo converts USDC to USD and remits the funds to its own bank account. This is for legal and accounting purposes, clearly demonstrating that the lack of a clear regulatory framework for digital assets is hindering innovation.

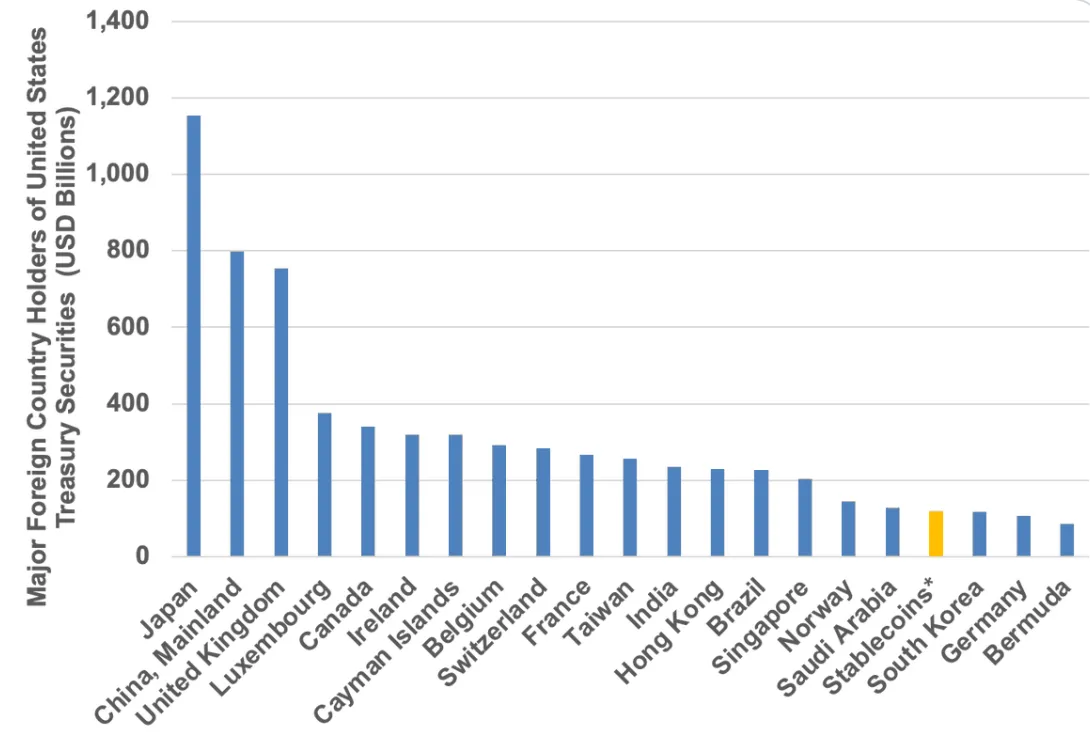

Stablecoins are by far the most successful example of tokenization . Over $165 billion of tokenized fiat currency exists in stablecoins, with trillions of dollars traded monthly. Stablecoins are becoming an increasingly important part of financial markets. Stablecoin issuers are collectively the 18th largest holder of U.S. debt in the world.

Source: Tagus Capital

в заключение

The financial system has gone through many growing pains, including the paperwork crisis, the global financial crisis, and even the GameStop incident. These periods stress-tested the financial system and shaped it into what it is today: a system of large intermediaries and silos that rely on slow processes and regulations to build trust and conduct transactions. Public blockchains offer a better alternative by creating censorship-resistant, trusted neutral, programmable ledgers. However, blockchains are not perfect yet. Due to their distributed nature, they suffer from technology-specific issues such as block reorganizations, forks, and latency-related issues. For a deeper dive into settlement risks associated with public blockchains, see Natasha Vasan’s Settling the Unsettled . Additionally, despite improvements in the security of smart contracts, smart contracts are still frequently hacked or exploited through social engineering. Blockchains also become expensive during periods of high congestion and have yet to prove their ability to handle transactions at the scale required by the global financial system. Finally, there are compliance and regulatory hurdles that need to be overcome in order for widespread tokenization of real-world assets to become a reality.

With the right legal framework and sufficient development of the underlying technology, asset tokenization on public blockchains has the potential to unlock network effects as assets, applications, and users are brought together. As more assets, applications, and users come on-chain, the platform itself and the blockchain will become more valuable and more attractive to builders, issuers, and users, forming a virtuous cycle. The use of globally shared, trusted and neutral underlying technology will enable new applications in the consumer and financial sectors. Today, thousands of entrepreneurs, developers, and policymakers are building this public infrastructure, overcoming numerous obstacles, and working to build a more connected, efficient, and fair financial system.

This article is sourced from the internet: A brief history of asset tokenization: a tortuous transformation and a bright future

Original author: Kaori , BlockBeats Original editor: Jack , BlockBeats Over the weekend, an article from Fortune magazine said that Farcaster would launch a token like most protocols, which helped Farcasters daily active users, which had been declining for nearly half a month, pick up again. On May 22, Farcaster completed a $150 million financing led by Paradigm with a valuation of nearly $1 billion. This news once again attracted attention to Farcaster and its largest front-end application Warpcast, which had attracted market attention at the beginning of the year. Daily active users reached a record high one day after the announcement of financing. Last week, Voodoo, a well-known casual game publisher, spent 500 million euros to acquire BeReal, a social networking app for acquaintances, because it was attracted by…