Учитывая, что L1 и L2 соседствуют, на какие еще проекты L3 стоит обратить внимание?

Оригинальный автор: 0X STRUBE

Оригинальный перевод: TechFlow

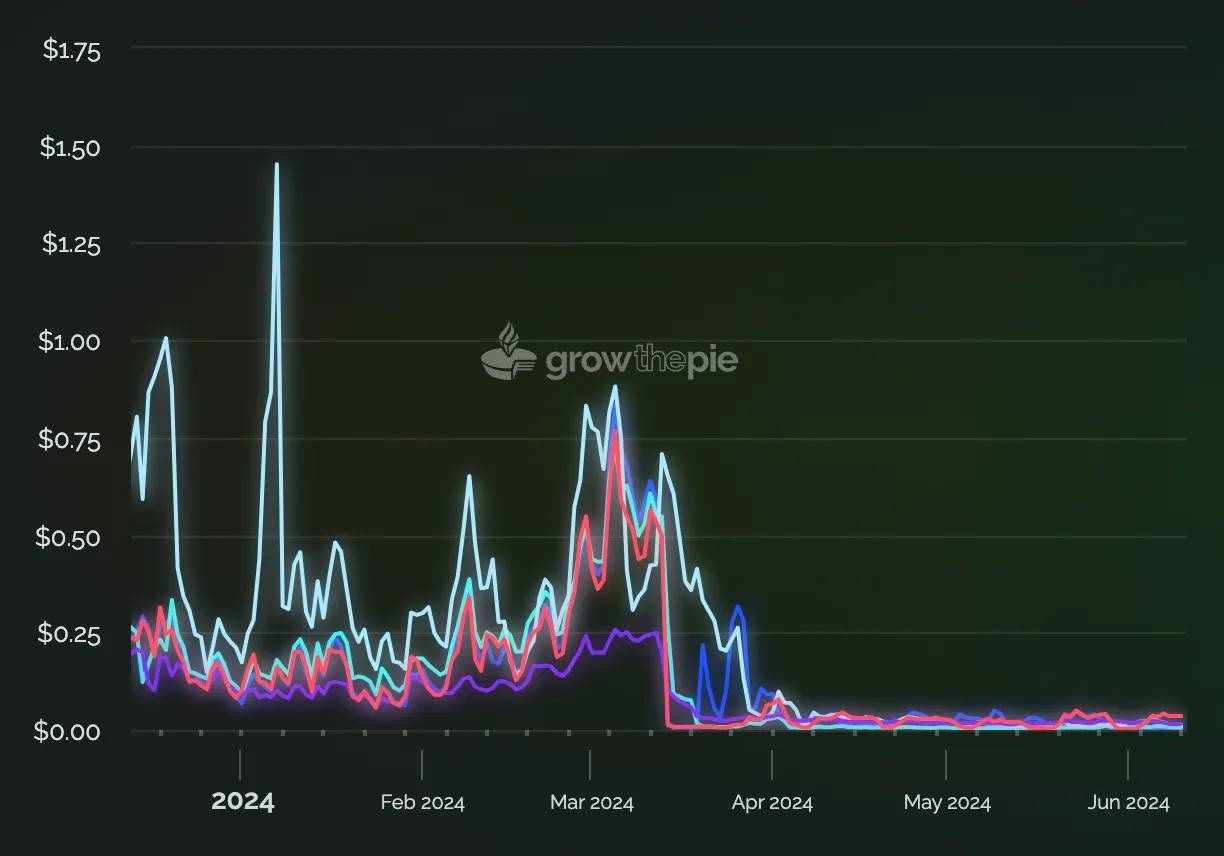

Ethereum has made significant progress on its roadmap over the past few years, completing the transition from Proof of Work (PoW) to Proof of Stake (PoS), known as “The Merge,” and more recently, the “Dencun” upgrade, including proto-danksharding, making Layer 2 transactions cheaper.

(Источник: growthepie )

Before Dencun, the transaction fee for Layer 2 was about $0.50, but now the transaction fee on most Layer 2 chains is only one or two cents. This change has greatly promoted the expansion of new applications on Ethereum.

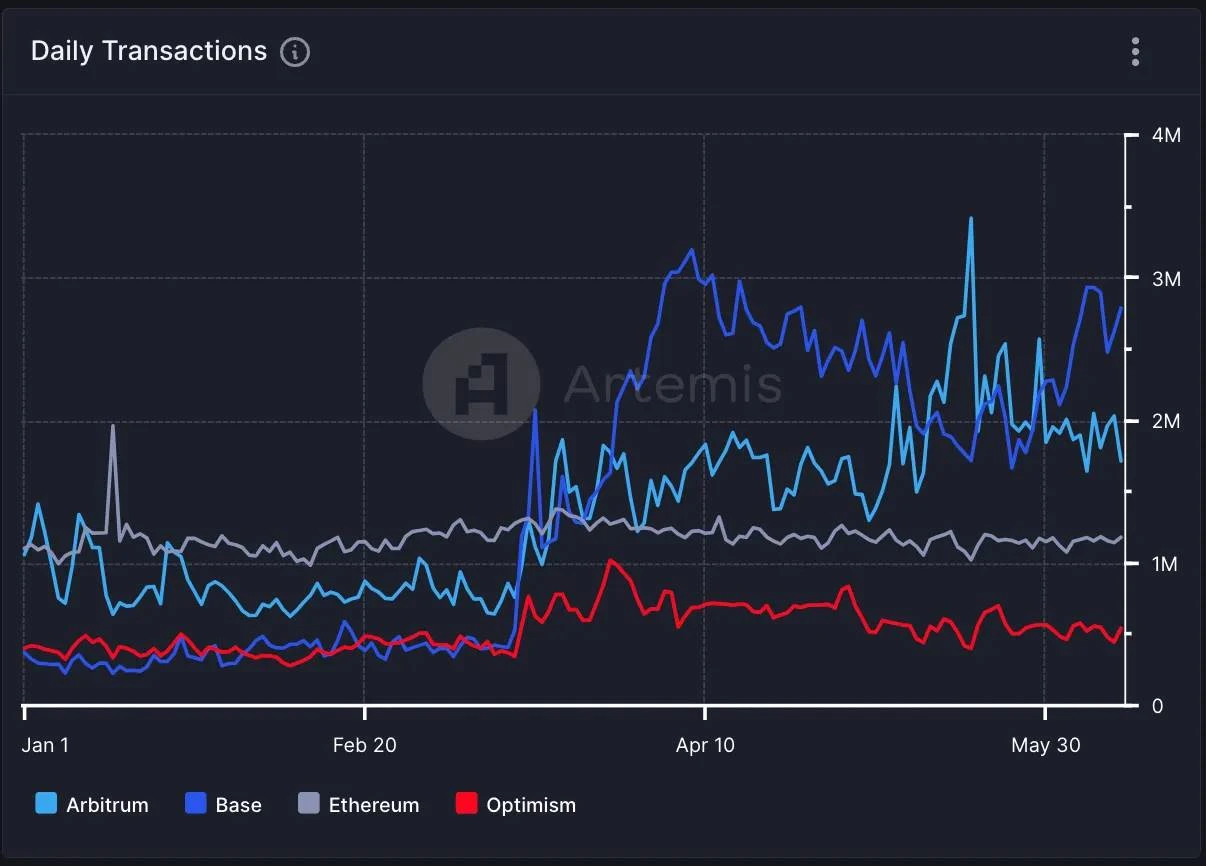

(Источник: Артемида )

Since the Dencun upgrade, Arbitrum and Base have surpassed Ethereum mainnet in daily transaction volume, and this trend continues. While there is still a lot of work to be done on Ethereum scaling, this is a major step in the right direction, and the infrastructure has improved significantly since the last cycle. The increase in activity and transaction volume on the Arbitrum and Base chains in recent months may be just the tip of the iceberg of what is to come in this cycle.

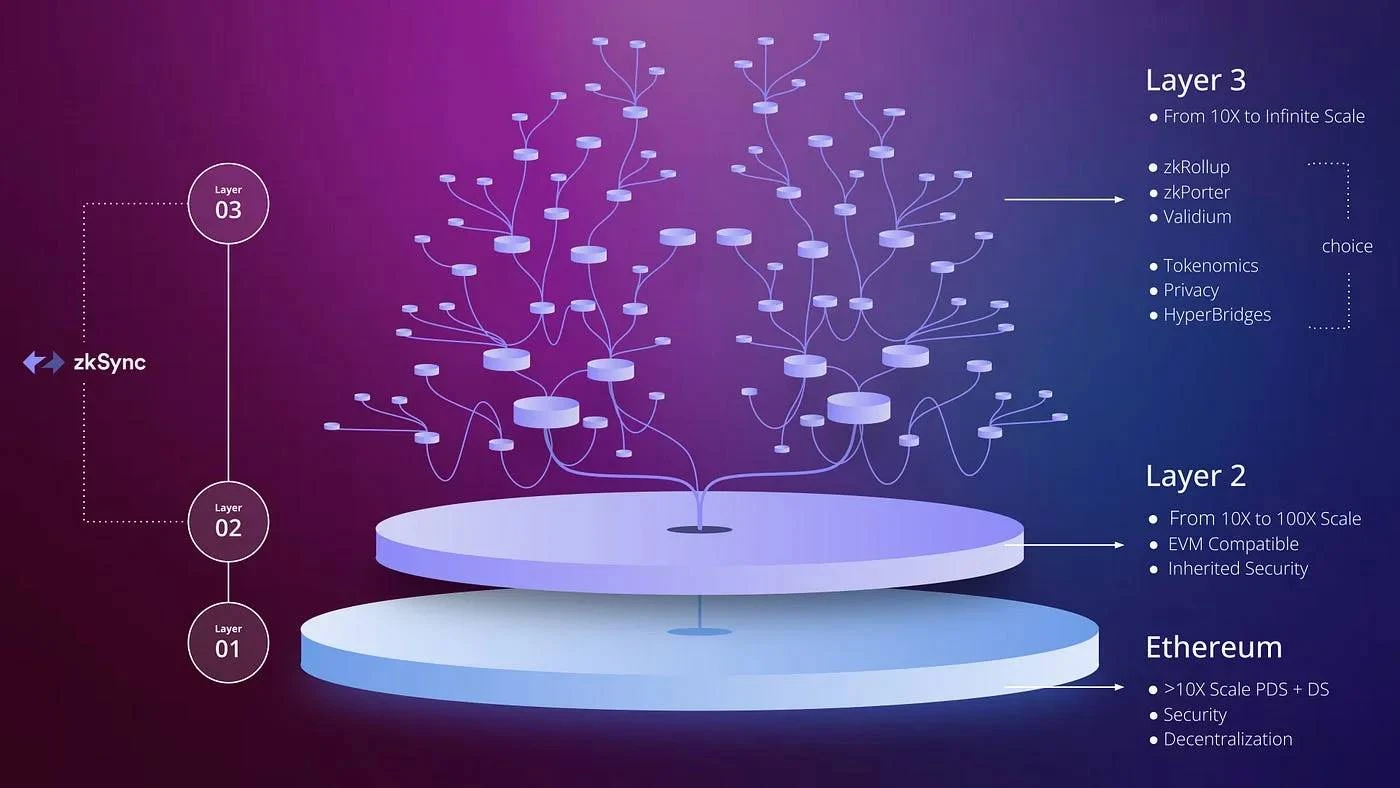

Layer 3 Scaling

The initial versions of Ethereum rollups were Optimism and Arbitrum, both of which were optimistic rollups. Currently, there are more and more Layer 2 optimistic and zero-knowledge rollups, most of which are classified as general-purpose. The choice of which rollup an application chooses to run or build on depends on its required feature set and security requirements. For example, applications such as Uniswap can run on a general-purpose Layer 2 (such as Arbitrum One). However, if you are a crypto game or NFT project, or other application that requires higher throughput or extremely low transaction fees (such as $0.0001), you may need a different solution. This is where Layer 3 comes in.

Examples of Layer 3 frameworks include Arbitrum Orbit and zkSync Hyperchains . Although Layer 3 is still in its early stages, some changes and improvements can be expected in the future. The general idea of Layer 3 is to further expand Ethereum by creating highly customizable, cheap, fast, and interoperable chains with varying degrees of security and decentralization.

Degen Chain (DEGEN)

Degen Chain is an emerging innovative blockchain that was launched in January 2024 and quickly attracted attention, with its fully diluted valuation (FDV) exceeding US$2 billion within three months of its launch.

Degen Chain was initially launched on Farcaster’s Degen channel, a new social app that allows users to “tip” for quality content.

Degen is built using Arbitrum Orbit, settled to Base, and uses AnyTrust for data availability (DA). The initial enthusiasm for the chain caused the total locked value (TVL) to soar, but then stabilized, and the price of DEGEN also adjusted accordingly.

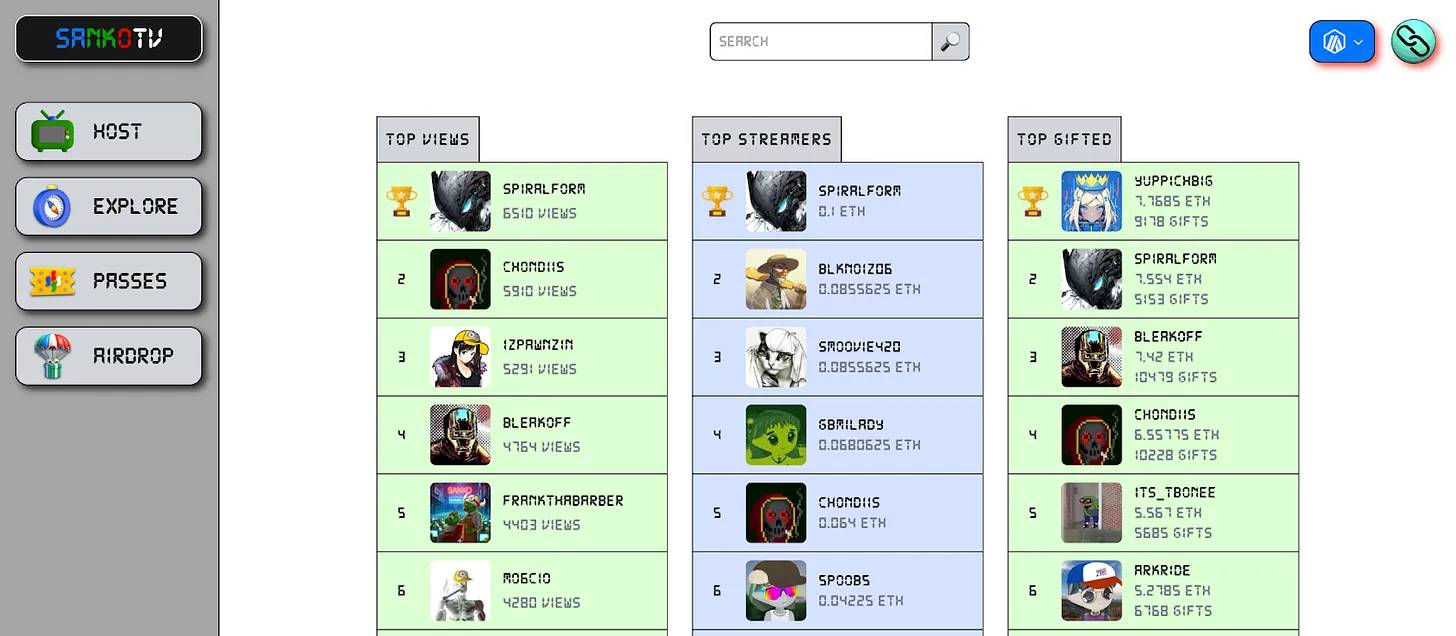

Sanko (DMT)

Another interesting Layer 3 application is Sanko , another chain built with Arbitrum Orbit, settled to Arbitrum L2, and using AnyTrust for data availability. Sanko focuses primarily on NFTs and games, taking advantage of the low cost and high throughput provided by Layer 3. Sankos native token DMT performed well in 2024.

Dream Machine is an interesting application from Sanko L3, which is also a social and gaming platform. Sanko.TV combines gaming and streaming entertainment, where users can buy passes for their favorite streamers and gain access to private chat rooms, similar to how Friend.tech works.

Sanko demonstrates the customizability of Layer 3 chains, showing its potential. The rise in DMT prices shows the continued interest in what Sanko is building, and the innovative nature of combining gaming and social is a compelling value proposition. Social applications are starting to gain momentum, so Sanko is definitely a project to watch.

The Future of Layer 3

Layer 2 mainnet has been online for several years and has made significant progress in scaling Ethereum. While the scaling roadmap continues to advance, Layer 3, which is highly customizable, seems to be the logical next step. There are already many projects experimenting on Layer 3 and have made varying degrees of progress.

However, an interesting use case and a short-lived craze do not necessarily mean a good investment. In both examples we discussed (DEGEN and DMT), the native tokens experienced significant volatility and these chains are far from proven. However, now that Layer 2 has scaled and transaction fees are only a penny or two, the opportunities and use cases have greatly increased. It is important to track the trend of application types due to increased throughput and customizability, and Layer 3 will undoubtedly bring some interesting investment opportunities.

This article is sourced from the internet: With L1 and L2 crowded together, what other L3 projects are worth paying attention to?

Related: How can strategic investment products liberate investors’ productivity and enhance returns?

As AI technology continues to liberate human productivity, can crypto investment save worry and effort and generate excess returns? Passive strategy products can! Not only can they reduce investors’ operating costs and avoid emotional decisions caused by market fluctuations, but they also support multiple usage scenarios such as slow bull market, shock, and medium- and long-term layout. This article will help you understand what passive strategy investment products are and how to use them. What are passive strategy investment products? Passive strategy products are not affected by emotional decisions and have the characteristics of high transparency, low fees, and low risks. They aim to obtain returns that exceed the market average by minimizing transaction steps and transaction fees, and are suitable for users who want to simplify the investment process…