Отчет об исследовании настроений на рынке криптовалют (21-28 июня 2024 г.): SOL вырос на 7%, VanEck подал заявку на создание трастового фонда Solana

SOL rises 7%, VanEck submits Solana Trust fund application

June 28, 2024 Solana cryptocurrency price surged nearly 10% after multiple sources provided verified information about VanEck (VanEck Solana Trust) application for Solana-based spot ETF. VanEck is an asset management company with more than $89 billion in assets under management. This is the first such application filed with the U.S. Securities and Exchange Commission (SEC). Solana immediately rose after the news about the spot ETF application, but soon encountered some resistance and profit-taking. Bitcoin reacted to the news by jumping nearly $1,400 from $60,800 to $62,200, but the price is currently below $62,000 again.

There are about 31 days until the next Federal Reserve interest rate meeting (2024.08.01)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

Технический анализ рынка и аналитика настроений

Компоненты анализа настроений

Технические индикаторы

Ценовой тренд

BTC price fell -4.88% and ETH price fell -1.78% in the past week.

На изображении выше показан график цены BTC за последнюю неделю.

На изображении выше показан график цены ETH за последнюю неделю.

В таблице представлена скорость изменения цен за прошедшую неделю.

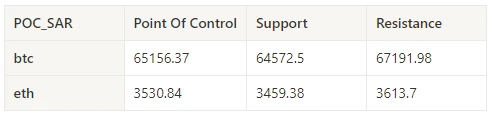

График распределения цены и объема (поддержка и сопротивление)

In the past week, BTC and ETH fell to 6.24 and formed a dense trading area at a low level before fluctuating widely.

На рисунке выше показано распределение зон с плотной торговлей BTC на прошлой неделе.

На рисунке выше показано распределение зон с плотной торговлей ETH за последнюю неделю.

В таблице показан недельный интенсивный торговый диапазон BTC и ETH за прошедшую неделю.

Объем и открытый интерес

BTC and ETH had the largest trading volume this past week when they fell on June 24; open interest for both BTC and ETH rose slightly.

Верхняя часть изображения выше показывает ценовой тренд BTC, середина показывает объем торгов, нижняя часть показывает открытый интерес, голубой цвет — среднее значение за 1 день, а оранжевый — среднее значение за 7 дней. Цвет K-линии представляет текущее состояние, зеленый означает, что рост цены поддерживается объемом торгов, красный означает закрытие позиций, желтый означает медленное накопление позиций, а черный означает состояние переполненности.

Верхняя часть изображения выше показывает ценовой тренд ETH, середина — объем торгов, нижняя часть — открытый интерес, голубой цвет — среднее значение за 1 день, а оранжевый — среднее значение за 7 дней. Цвет К-линии представляет текущее состояние, зеленый означает, что рост цены поддерживается объемом торгов, красный — закрытие позиций, желтый — медленное накопление позиций, черный — переполненность.

Историческая волатильность против подразумеваемой волатильности

In the past week, historical volatility of BTC and ETH was highest at 6.24; implied volatility of BTC rose slightly while ETH fell slightly.

The yellow line is the historical volatility, the blue line is the implied volatility, and the red dot is its 7-day average.

Управляемый событиями

No data was released in the past week.

Индикаторы настроений

Импульс Настроения

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, Nasdaq was the strongest, while Bitcoin performed the worst.

На картинке выше показана динамика различных активов за последнюю неделю.

Кредитная ставка_Настроение по кредитованию

Over the past week, the average annualized return on USD lending was 13.3%, and short-term interest rates remained around 12.4%.

Желтая линия — это самая высокая цена процентной ставки в долларах США, синяя линия — 75% самой высокой цены, а красная линия — 7-дневное среднее значение 75% самой высокой цены.

В таблице показана средняя доходность процентных ставок в долларах США за разные дни владения в прошлом.

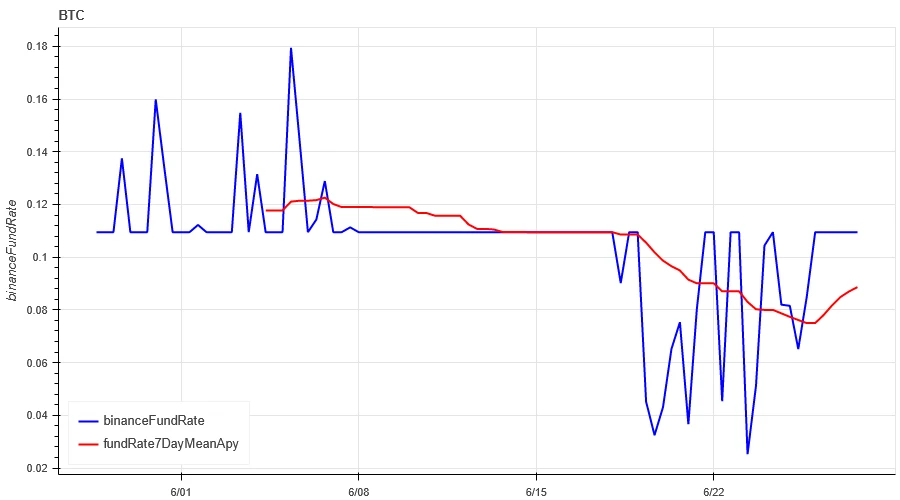

Ставка финансирования_Настроение по кредитному плечу по контракту

The average annualized return on BTC fees in the past week was 8.8%, and contract leverage sentiment remained at a low level.

Синяя линия — это ставка финансирования BTC на Binance, а красная линия — ее среднее значение за 7 дней.

В таблице показана средняя доходность комиссий BTC за разные дни владения в прошлом.

Рыночная корреляция_консенсус-настроение

The correlation among the 129 coins selected in the past week dropped to around 0.45, and the consistency between different varieties dropped significantly.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

Широта рынка_Общее настроение

Among the 129 coins selected in the past week, 5.5% of the coins were priced above the 30-day moving average, 25% of the coins were priced above the 30-day moving average relative to BTC, 4% of the coins were more than 20% away from the lowest price in the past 30 days, and 6.3% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market continued to fall.

На картинке выше показаны [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos и т. д., fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, Idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, ссылка, ткацкий станок, lpt, lqty, lrc, ltc, luna 2, магия, мана, манта, маска, matic, мем, мина, mkr, рядом, нео, nfp, океан, один, ont, op, ordi, pendle, pyth, qnt, qtum, Робин, Роуз, Руна, RVN, песок, Sei, sfp, skl, snx, ssv, stg, storj, stx, sui, суши, sxp, тета, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-дневная пропорция каждого индикатора ширины

Подведем итог

Over the past week, Bitcoin (BTC) and Ethereum (ETH) prices have experienced wide range fluctuations after the decline, while the volatility and trading volume of these two cryptocurrencies reached the highest level during the decline on June 24. The open interest of Bitcoin and Ethereum has increased slightly. In addition, the implied volatility of Bitcoin has increased slightly, while the implied volatility of Ethereum has decreased slightly. The funding rate of Bitcoin has remained at a low level, which may reflect the continued low leverage sentiment of market participants towards Bitcoin. The market breadth indicator shows that most cryptocurrencies continue to fall, indicating that the overall market has maintained a weak trend over the past week.

Твиттер: @ https://x.com/CTA_ChannelCmt

Веб-сайт: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.06.21-06.28): SOL rose 7%, VanEck submitted Solana Trust Fund application

Hong Kong Virtual Asset Spot ETF On April 30, a total of 6 virtual asset spot ETFs under Bosera HashKey, China Asset Management and Harvest Asset Management officially rang the bell and were listed on the Hong Kong Stock Exchange and opened for trading, including Bosera HashKey Bitcoin ETF (3008.HK), Bosera HashKey Ethereum ETF (3009.HK), China Asset Management Bitcoin ETF (3042.HK), China Asset Management Ethereum ETF (3046.HK), Harvest Bitcoin Spot ETF (3439.HK) and Harvest Ethereum Spot ETF (3179.HK). Li Yimei, CEO of China Asset Management, said in an interview with Bloomberg TV that the launch of Hong Kong spot Bitcoin and Ethereum ETFs opens the door for many RMB holders to seek alternative investments. As the opening-up develops, hopefully there will be new opportunities for mainland Chinese investors to participate…