On June 27, Matthew Sigel, head of digital asset research at VanEck, said he had applied to the SEC for the Solana ETF.

The new fund, called VanEck Solana Trust, is the first Solana ETF to be applied for in the United States. He said: 鈥淭he native token SOL functions similarly to other digital commodities such as Bitcoin and Ethereum. It is used to pay transaction fees and computing services on the blockchain. Like ETH on the Ethereum network, SOL can be traded on digital asset platforms or used for peer-to-peer transactions.

Связанное чтение: VanEck: Why do we apply for SOL ETF?

James Seyffart, ETF analyst at Bloomberg, posted on social media that the Solana ETF came earlier than expected, but the approval rate is still unknown. Whether it passes or not, it is enough to excite the dormant crypto community. After all, this round of the market can be described as an ETF bull market.

Bitcoin is the only bull

After the spot ETF was approved, BTC, as a representative of digital assets, became the first logically successful target in the cryptocurrency circle.

Bitcoin spot ETFs have given Wall Street a formal channel to allocate crypto assets, bringing a large amount of off-market funds to the crypto market. It can also be seen from the key nodes of Bitcoins rise that the rise from $25,000 to $69,000 was almost entirely driven by ETFs. Whether it is a victory in a lawsuit or fake news, the stimulation of the news has always been a concern for the market.

On August 30, 2023, Grayscale won the lawsuit against the SEC and overturned the SECs decision to block the Grayscale ETF. As fake news about the approval of the Bitcoin spot ETF in October fermented, Bitcoin stabilized at $34,000. On January 11, the SEC approved 11 spot Bitcoin ETFs at the same time, and the price of Bitcoin surged to $48,590 that day.

After the Spring Festival, Bitcoin started to rise wildly. After crossing the 69,000 US dollar mark, the market value of Bitcoin reached 1.35 trillion US dollars, surpassing Meta Platforms and jumping to the 9th place in the worlds mainstream asset market value.

Data shows that from January 21 to 26, the total assets under management of Bitcoin ETFs fell from $29.16 billion to $26.062 billion in 5 days, a loss of more than $3 billion. Since February, the total assets under management of Bitcoin ETFs have steadily increased from $28.3 billion, and exceeded $40 billion in less than a month.

With the massive influx of funds, the price of Bitcoin has seen a big rise. Throughout February, the price of Bitcoin experienced its biggest fluctuation in history, with the price of each Bitcoin rising by $18,615, which is higher than the value of Bitcoin 15 months ago.

Связанное чтение: Bitcoin hits record high 15 years after its birth, and returns to $69,000 per coin in 800 days

In comparison, the copycats are struggling to catch up with the rise of BTC. The major positive impact of the Ethereum ecosystem, the Cancun upgrade, was diluted. Solana made a brilliant debut with the meme coin, but the pre-sale and celebrity coins that emerged continued to disrupt the market trend. In addition, the rise of pumpfun made memes further divide the market attention. Crypto VCs were constantly squeezed to the opposite side of retail investors by highly profitable memes and airdrops.

At the same time, the Bitcoin ecosystem, led by Rune, has been developing strongly. Due to the lack of a clear business model and asset logic, many people believe that this cycle is the sole bull of Bitcoin.

BlackRock Wants, BlackRock Gets

If we have to find a reason to start this round of bull market, it must be BlackRock. In the context of the market being in a deep bear state and the industry facing high-pressure supervision, BlackRocks ETF single-handedly reversed the situation in the crypto market.

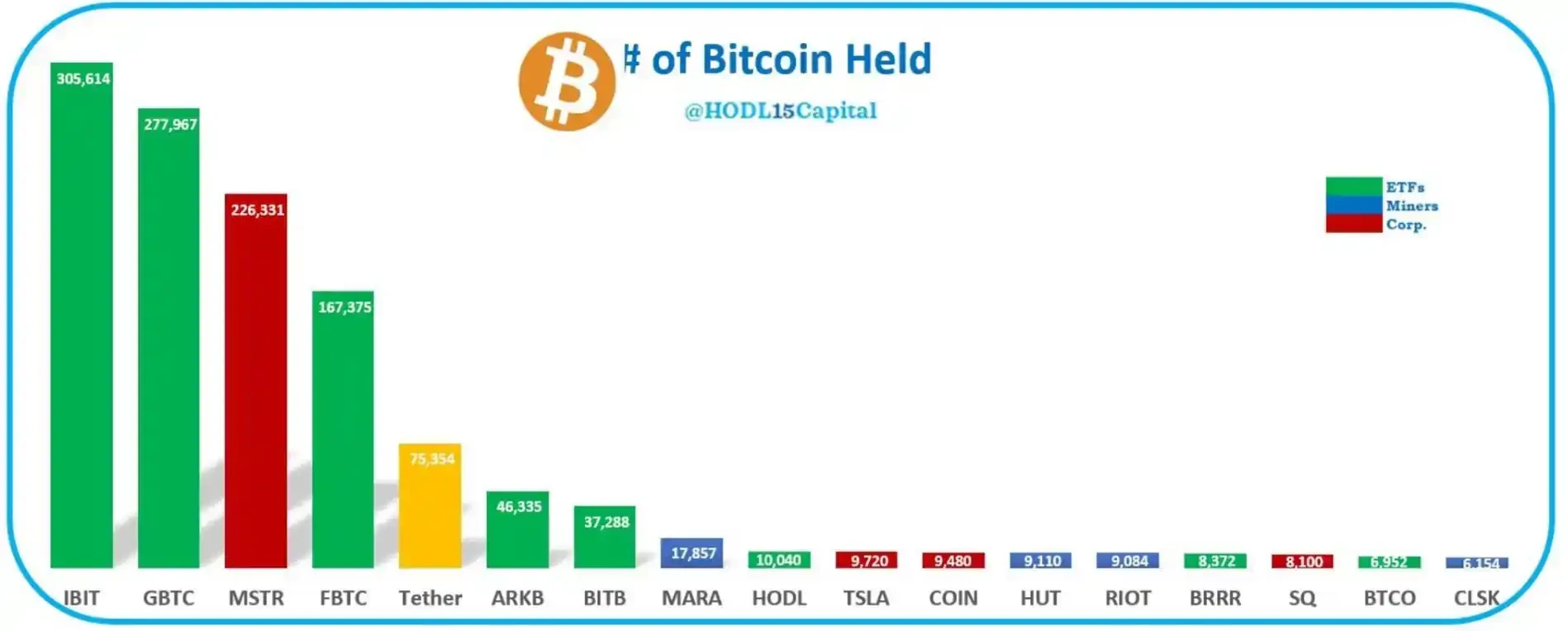

After the launch of the Bitcoin spot ETF, IBIT was also the one with the strongest performance and the best liquidity. Last week, HOD L1 5 Capital listed the top ten companies holding Bitcoin in the world so far, and BlackRocks IBIT ranked first with 305,614 BTC.

There is a saying on Wall Street: BlackRock Wants, BlackRock Gets. As a financial giant in charge of $10 trillion in assets, the SEC seems to have to give way to BlackRock.

What many people fail to see is that the launch of a Bitcoin spot ETF may just be an appetizer for financial giants in their layout in the tokenized world.

At the end of 2022, Larry Fink, CEO of BlackRock, said: The next generation of markets, the next generation of securities, will be the tokenization of securities. BlackRocks entry into Bitcoin is much bigger than we thought. Then we saw that the BUIDL fund, a US dollar institutional digital liquidity fund launched by BlackRock, was launched on Ethereum.

On April 30, BUIDL, the first digital asset fund launched by BlackRock in cooperation with Securitize, successfully topped the list in just six weeks, accounting for nearly 30% of the digital treasury market with a total size of US$1.3 billion.

The market value of tokenized U.S. Treasuries has grown significantly this year, with tokenized RWAs (including Treasuries, bonds, and cash equivalents) up 35% in the two months. Leading the way is BlackRock鈥檚 BUIDL, which has grown 65% since the beginning of the quarter, pushing the total market value of tokenized Treasuries to over $1.5 billion. During the same period, the total locked value of Ondo Finance, one of the leading RWA-focused DeFi protocols, increased from $221 million in April to $507 million.

Less than a month after BUIDL was launched, the Ethereum spot ETF, which had regulatory issues in staking, staged a dramatic reversal and was approved directly on the first application.

On May 24, the Ethereum spot ETF went from being unpopular and having an approval rate of only 7% to an approval rate of 75% overnight, and the price of ETH also repeatedly broke through the $3,800 mark.

The U.S. Securities and Exchange Commission (SEC) launched an investigation into the Switzerland-based Ethereum Foundation after Ethereum switched to a new governance model called Proof of Stake (POS) in September 2022. Proof of Stake actually provides the SEC with a new excuse to try to define Ethereum as a security.

As a compromise, BlackRock and other companies applying for ETFs deleted the pledge part in their ETF proposals, indicating that they would not pledge part of the trusts assets. On May 30, BlackRock also stated in a document submitted to the SEC that it would purchase $10 million in ETH to fund its Ethereum ETF.

BlackRocks three moves have helped resolve the many difficulties that the SEC has brought to the industry over the past year. The big brother leads the charge, and a series of younger brothers follow to eat meat. BlackRock has led countless institutions to enter the market, and a new situation has emerged in the mainstreaming process of crypto logic/crypto terminology.

Can ETF funds also cover altcoins?

Whether there is still a bull market for altcoins has been a question that the cryptocurrency circle has been discussing for the past six months.

On the one hand, VC funds are large, and the number of new retail investors entering the market is lower than expected. It is difficult for funds to take over new coins and old coins that are still alive in the market, resulting in the increase in project valuations in the primary market, and high FDV and low circulation after the token is launched. Secondly, due to the saturation of applications in the last round of bull market, the block space is overloaded. VCs capital deployment during the bear market is mainly concentrated in the infrastructure field, which makes the application layer, which is most perceived by users, lag behind in development, and presents the problem of narrative poverty when the market suddenly ushered in a market.

But in the final analysis, what everyone is most worried about is that the money coming in from the Bitcoin ETF will not flow into altcoins.

In the last cycle, crypto institutions mortgaged BTC, leveraged it, and then these leveraged funds flowed into the altcoin market, thereby driving the overall crypto market value growth and bringing about the so-called altcoin bull market. However, the logic has obviously changed in this cycle. Spot ETFs are managed by custodians and cannot be leveraged, which directly killed an important source of funds for the altcoin market.

However, the new developments of ETH and SOL spot ETFs this month have brought newer and clearer logic to attracting and creating liquidity in the crypto industry. ETF funds will not be exclusive to Bitcoin, but will also cover altcoins.

But the next question is, will consumers in the capital market pay for crypto assets other than Bitcoin?

It may be difficult in the short term, as the worlds general perception of cryptocurrency is still Bitcoin. It will take some time to digest concepts such as smart contracts, the differences between Ethereum and Solana, etc., but this is precisely where the business opportunities for institutions such as BlackRock lie (Packaged Crypto Index).

In contrast, the entry of traditional institutions may lead to the gradual squeezing of the market for many crypto-native institutions, especially roles such as market makers and OTCs. The regular army can bring in funds, but they can also steal your job.

In short, regardless of whether the SOL ETF is approved or how the ETH ETF performs in the future, the logic and trend of the ETF bull market seem to be unstoppable.

This article is sourced from the internet: This is a bull market for ETFs

Headlines Consensys: SEC will end investigation into Ethereum 2.0 and will not charge ETH sales as securities transactions Odaily Planet Daily News Consensys announced on X that Ethereum developers, technology providers and industry participants have achieved a major victory: the US SEC Enforcement Division has notified us that it will end its investigation into Ethereum 2.0. This means that the SEC will not accuse the sale of Ethereum of being a securities transaction. This decision follows our June 7 letter asking the SEC to confirm that its approval of the Ethereum spot ETF in May was based on the premise that ETH is a commodity, meaning that the agency is concluding its investigation into Ethereum 2.0. This decision is significant, but it is no panacea for the many blockchain developers,…