Bitget Research Institute: Индекс доллара США вернулся к 106, рисковые активы оказались под давлением, а повествование Уровня 2

За последние 24 часа на рынке появилось много новых популярных валют и тем, которые могут стать следующей возможностью заработать деньги, включая:

-

The sectors with relatively strong wealth-creating effects are: Ethereum ecosystem (MKR, ENS), TON ecosystem (TON, NOT);

-

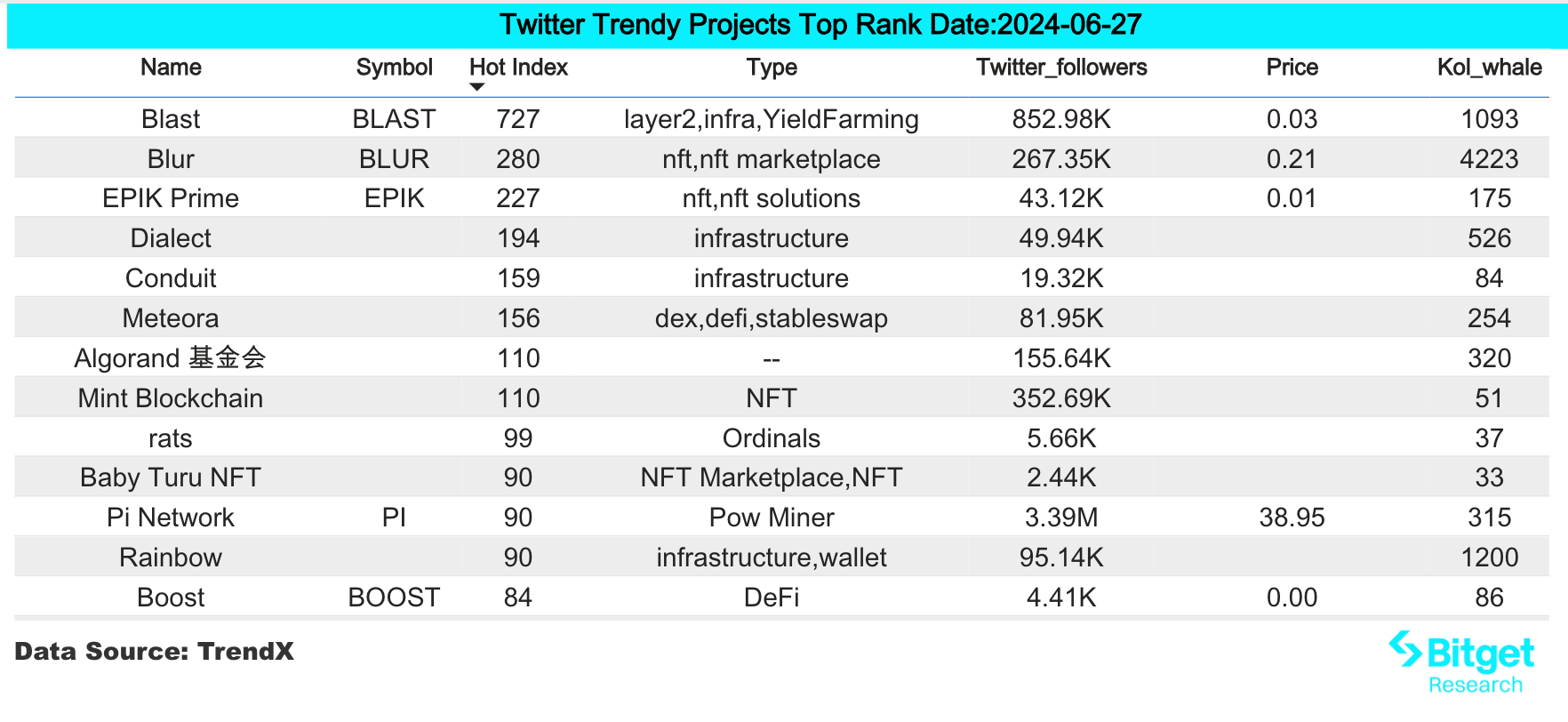

The most searched tokens and topics by users are: BLAST, BLUR, Solana Blinks;

-

Potential airdrop opportunities include: Tonstakers, EVAA;

Data statistics time: June 27, 2024 4: 00 (UTC + 0)

1. Рыночная среда

Yesterday, the US dollar index returned to 106, emerging markets and risky assets came under pressure, all types of assets in the cryptocurrency industry continued to weaken, and the price of Bitcoin continued to fluctuate between US$58,000 and US$62,000.

As for Bitcoin ETF, the continuous net outflow ended yesterday, with a net inflow of 31 million US dollars. The overall market selling pressure is relatively large, and both governments and MotGox have continuously exposed outflows from addresses. Yesterday, the market reported that ETH ETF may be approved as early as July 4, and ETH-related assets may rebound in a small range in the future.

In the crypto ecosystem, the Blast Layer 2 airdrop ended yesterday. The top projects that have accumulated TGE in the first half of this year have all performed poorly, including zkSync, LayerZero, Blast, etc., which have disappointed the community and investors. The wealth-making myth of Layer 2 has gradually faded.

2. Богатый сектор

1) Sector changes: Ethereum ecosystem (MKR, ENS)

Main reason: Reuters reported yesterday that the Ethereum ETF may be approved for listing before July 4. The Ethereum-related ecosystem may usher in many positive factors. Major projects in the Ethereum ecosystem have rebounded slightly, such as MKR, ENS, etc.

Increase: MRK 24 hours increased by 7.11%, ENS 24 hours increased by 3.1%

Факторы, влияющие на перспективы рынка:

-

Whether ETH continues to rise: ETH ecosystem Dex has good liquidity, and many tokens are denominated in ETH on DEX. The rise of ETH can be directly superimposed on the rise of ETH ecosystem assets. If the price of ETH continues to rise, the core assets on Ethereum can often maintain their popularity;

-

Project development trends: Ethereum mainstream projects have strong profitability and future transformation capabilities, such as MakerDao joining the RWA concept. Investors should focus on the project dynamics of mainstream projects in the Ethereum ecosystem, as well as the opinions of key Ethereum-related figures on these projects, such as Vitaliks love and praise for ENS.

2) Сектор, на котором необходимо сосредоточиться в будущем: экосистема TON

Main reasons: Ton tokens continue to maintain an upward momentum, and the price trend is strong and good. Applications in the Ton ecosystem are flourishing, and various projects are rapidly rising with the help of Telegrams huge daily activity. The tokens of various projects are rapidly moving towards Mass Adoption, injecting fresh blood into the encryption industry. It is a relatively unique narrative and ecological track in the current market environment.

Increase: TON 24 hours increase 1.5%;

Список конкретных валют: TON, NOT, STON, GRAM, FISH

Influencing factors:

-

As the broader market continued to fall and altcoins plummeted, TON tokens and Ton ecosystem tokens performed relatively well.

-

The two leading DEXs in the Ton ecosystem are also the two protocols with the highest TVL: DeDust and STON.fi, whose TVLs have bucked the trend and increased by 12% and 3% respectively in the past 7 days.

-

The number of users of Ton ecosystems high-traffic Telegram Mini App Catizen and Hamster Kombat continues to soar, attracting market attention. The total number of users on the Catizen chain has exceeded 1.25 million, and the number of Hamster Kombat users has exceeded 150 million, becoming one of the few hot spots in the recent cryptocurrency market.

-

Pantera Capital is raising money for a new fund dedicated to investing in TON tokens. The fund, called Pantera TON Investment Opportunities, aims to raise funds to buy more TON tokens, with a minimum investment of $250,000 per backer.

3. Горячие поисковые запросы пользователей

1) Популярные децентрализованные приложения

-

Blast (Dapp)

The Blast Foundation announced that it will airdrop BLAST to the community at 22:00 on June 26, Beijing time. Blast announced the token economic model. The total supply of BLAST is 100 billion, 50% of which will be airdropped to the community, and the initial airdrop volume is 17 billion. Blast is currently the sixth largest on-chain economy. Bitget launched a limited-time airdrop of BLAST, and users can pay attention to the opportunity to participate. According to the current secondary market, the current price of BLAST fluctuates around 0.025. The volatility of the new token is relatively large in the early stage of its launch, so you can pay attention to trading opportunities.

2) Твиттер

Solana Blinks: Yesterday, Solana Blinks was officially launched and received widespread attention from the community. Solana Blinks (Blockchain links) is a protocol product in Solana Actions. Solana attempts to make blockchain transactions spread across every corner of the Internet of Things in a fast and easy way. In the traditional blockchain experience, users need to complete a series of operations such as installing and configuring wallets, linking Dapps, and configuring parameters to achieve their goals. Solana Blinks will break this operating habit. It will complete the on-chain operation in one step by building an Internet connection, so that the effect of on-chain activity = one link can be achieved. The main significance of the launch of Solana Blinks is that it simplifies the difficulty and links of user interaction. In the future, the route of Solana+ social media may be widely popularized because of this function. It is recommended to pay attention to the first MEME coin promoted by Blinks recently.

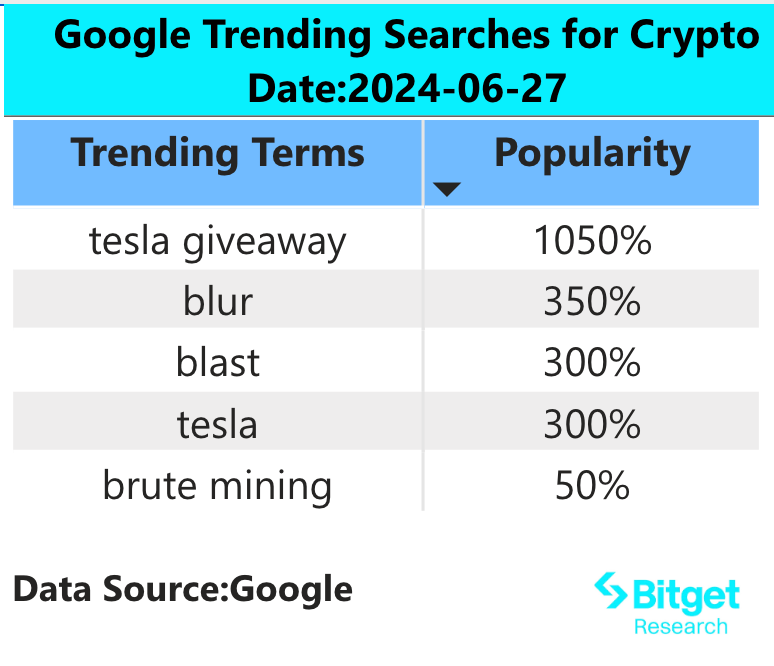

3) Регион поиска Google

С глобальной точки зрения:

BLUR: Yesterday, the Layer 2 project Blast, developed and operated by BLUR founder Pacman, launched an airdrop event, and BLUR pledgers of BLUR Season 3 can claim BLAST tokens. However, there are anomalies in the Blur Season 3 airdrop claiming contract, and some users are prompted to pay more than $1,000 in Gas when claiming.

Из горячих запросов в каждом регионе:

(1) In the hot searches in Asia, projects such as ETH and ADA are relatively prominent, mainly because the market showed signs of rebounding yesterday, and Asian users are paying attention to the trading opportunities of weighted tokens.

(2) In Europe and the United States, pay attention to the recent popular tokens and projects, including NOT, Depin, AI, FLOKI, SHIB, etc., which have rushed to the hot search list. In addition, Italian users searched for Bitget and it ranked in the top ten;

(3) The CIS region focuses on a wide range of areas, including projects such as BLAST, GRASS, and ETH;

Потенциал Аирдроп Возможности

Тонстейкерс

Tonstakers is the largest liquidity staking service provider in the TON ecosystem. Users can stake TON in the protocol to earn an annualized return of 3.8%. The current project TVL is 256 million US dollars, and the potential valuation is relatively high.

The project has received attention from the Ton Foundation, and currently the protocol has 68,000 pledgers. The project is cooperating with Ton core developers, Tonkeeper, OKX and other institutions, and will be supported in the future coin issuance.

Specific participation methods: 1) Visit the project official website and click stake now; 2) Link the Ton wallet to stake.

EVAA

EVAA is the largest lending protocol in the TON ecosystem. Users can deposit assets such as TON, USDT, stTON, etc. into the protocol to obtain lending income. The current project TVL is 40 million US dollars, the potential valuation is relatively high, and there are wealth opportunities in airdrops.

The project has received attention from the TON Foundation and is currently open for EVAA XP Mining, which has been going on since March 29. The project team has transparent information, and the core developers are from the TON Foundation, which has official endorsement.

Specific participation methods: 1) Visit the project official website, find the Supplies port, and click on the assets you want to deposit; 2) Link the Ton wallet for Supply.

Исходная ссылка: https://www.bitget.fit/zh-CN/research/articles/12560603811829

銆怐isclaimer銆慣рынок рискованный, поэтому будьте осторожны при инвестировании. Эта статья не является инвестиционным советом, и пользователи должны подумать, подходят ли какие-либо мнения, взгляды или выводы в этой статье для их конкретных обстоятельств. Инвестирование на основе этого осуществляется на ваш собственный риск.

This article is sourced from the internet: Bitget Research Institute: The US dollar index returned to 106, risk assets were under pressure, and the Layer 2 narrative was no longer accepted by the market

Related: Deep Parsing Chain Abstract Key Elements (CAKE) Framework

Original author: Favorite Mirror Reads Archive Original translation: TechFlow Summary of key points The default crypto user experience today is for users to always know which network they are interacting with. However, Internet users do not need to know which cloud provider they are interacting with. Bringing this approach to blockchain is what we call Chain Abstraction. This article introduces the Chain Abstraction Key Elements (CAKE) framework. The framework consists of four parts : application layer, permission layer, solver layer, and settlement layer , and aims to provide users with a seamless cross-chain operation experience. Achieving chain abstraction requires a complex set of technologies to ensure the reliability, cost-effectiveness, security, speed, and privacy of the execution process. We define the cross-chain tradeoff in chain abstraction as a trilemma and propose…