Колонка волатильности SignalPlus (20240621): падение и падение

Yesterday (JUN 20), in terms of macroeconomics, the number of initial jobless claims in the United States last week slightly exceeded expectations (235,000) and recorded 238,000. At the same time, the number of new housing starts in May fell by 5.5%, the lowest level in four years. The U.S. Treasury yields remained slightly volatile and closed down. The three major stock indexes rose and fell differently. The SP and Nasdaq fell by 0.25% and 0.79% respectively, and the Dow closed up 0.77%.

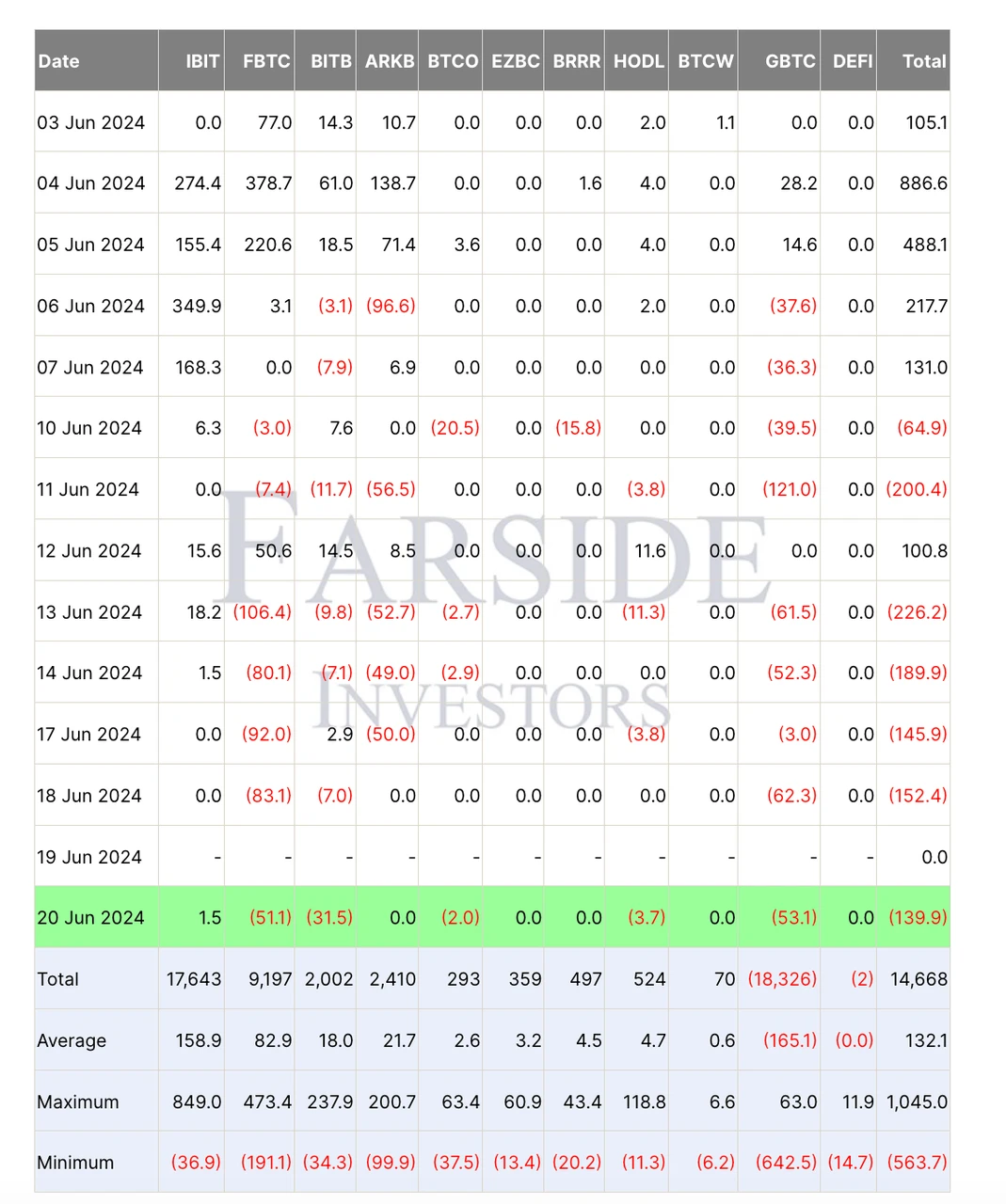

Источник: Farside Investors.

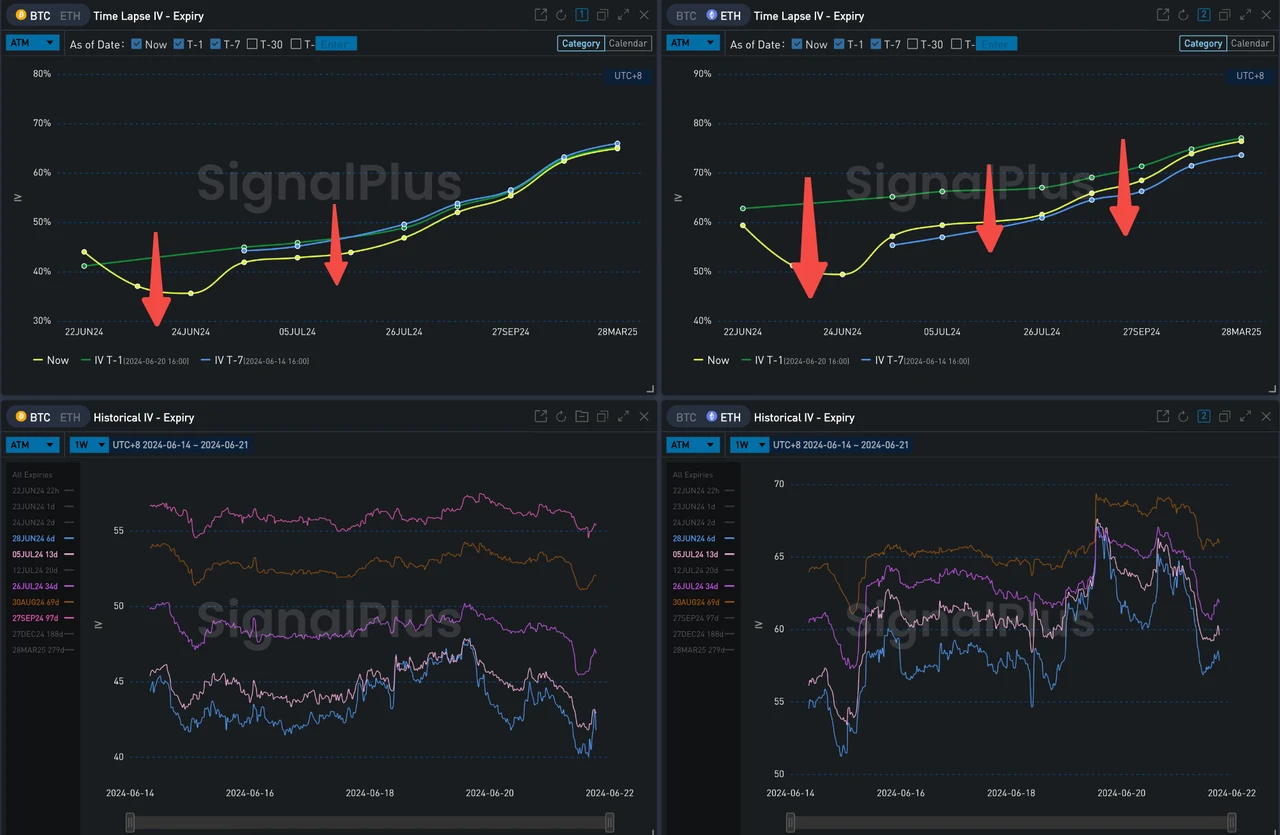

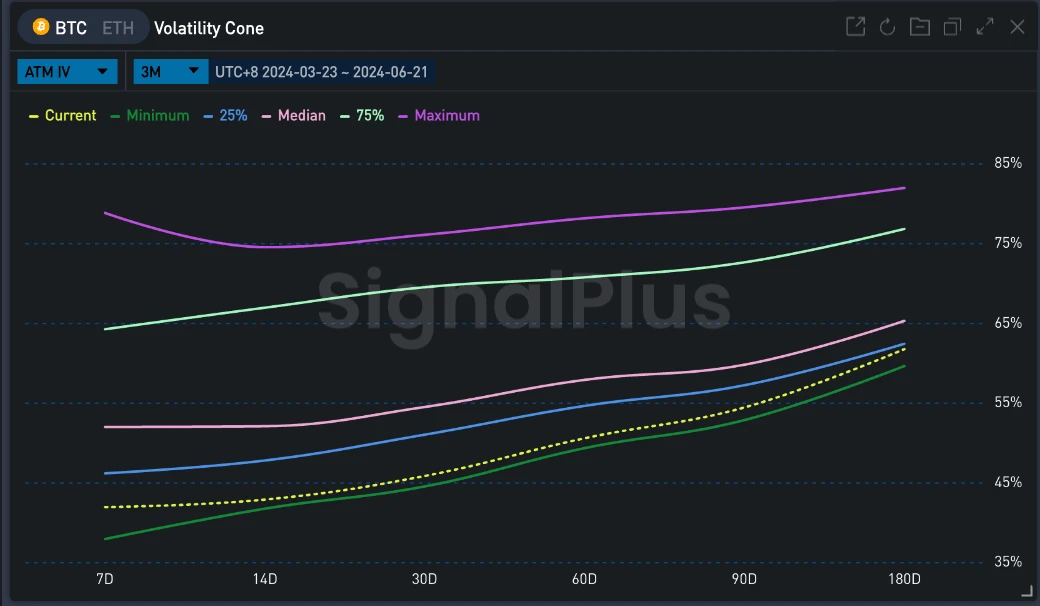

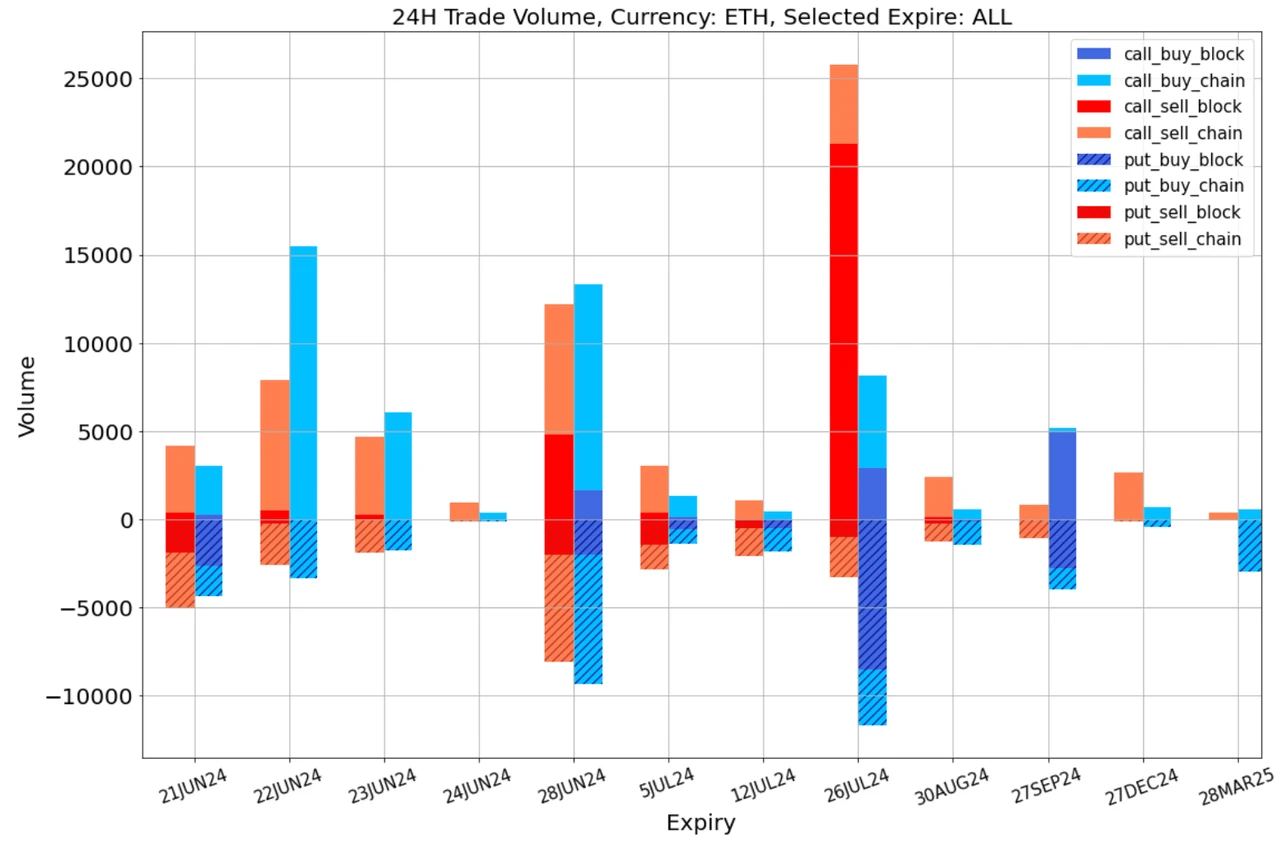

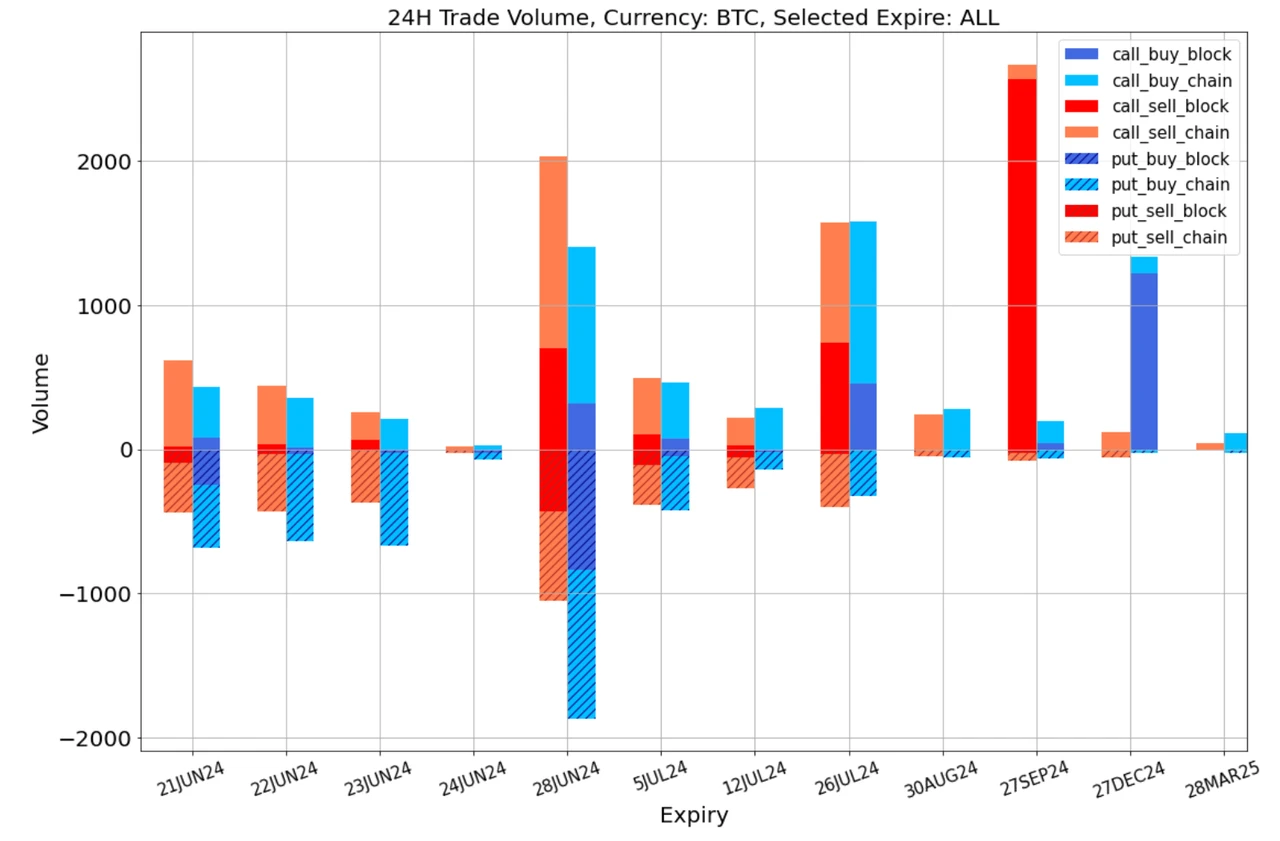

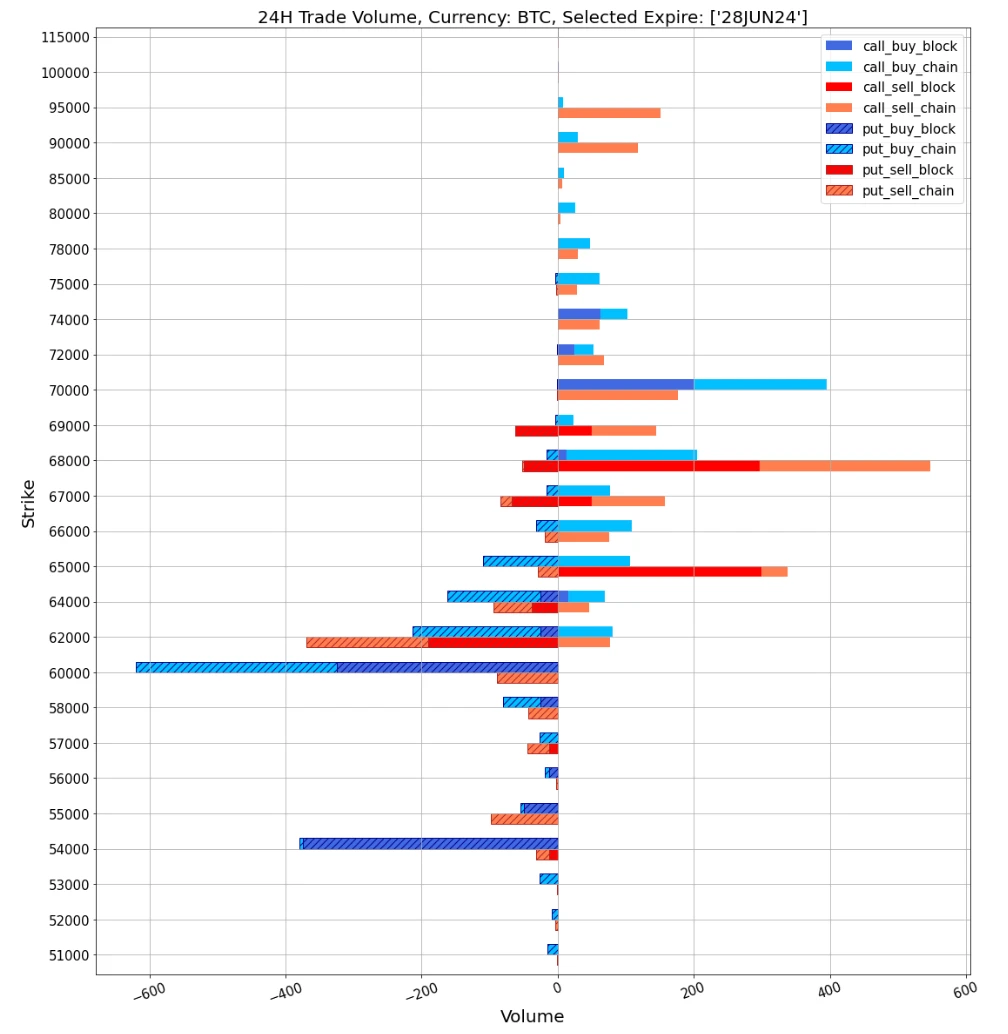

In terms of digital currencies, BTC spot ETF has seen a large outflow for several consecutive days, and the price of the currency has continued to fall, breaking the support level of $64,800 and currently fluctuating around $64,000. The sentiment in the options market is not good. BTC showed a significant Long Risky Flow of buy puts and sell calls at the end of June. ETH also reflected strong selling pressure of call options at the end of July, driving the overall Vol Skew of the market downward. At the same time, the implied volatility level is also declining, with BTC/ETH falling by about 3%/7% respectively. Judging from the data of the past three months, BTC ATM IV is close to its historical low.

Source: Deribit (as of 21 JUN 16: 00 UTC+ 8)

Source: SignalPlus, IV overall level drops, BTC drops to historic low

Source: SignalPlus, affected by intraday trading, the mid-front Vol Skew collapsed, and the forward rose slightly

Источник данных: Deribit, общее распределение транзакций ETH.

Data Source: Deribit, BTC transaction overall distribution; 28 JUN 24 Risky Flow

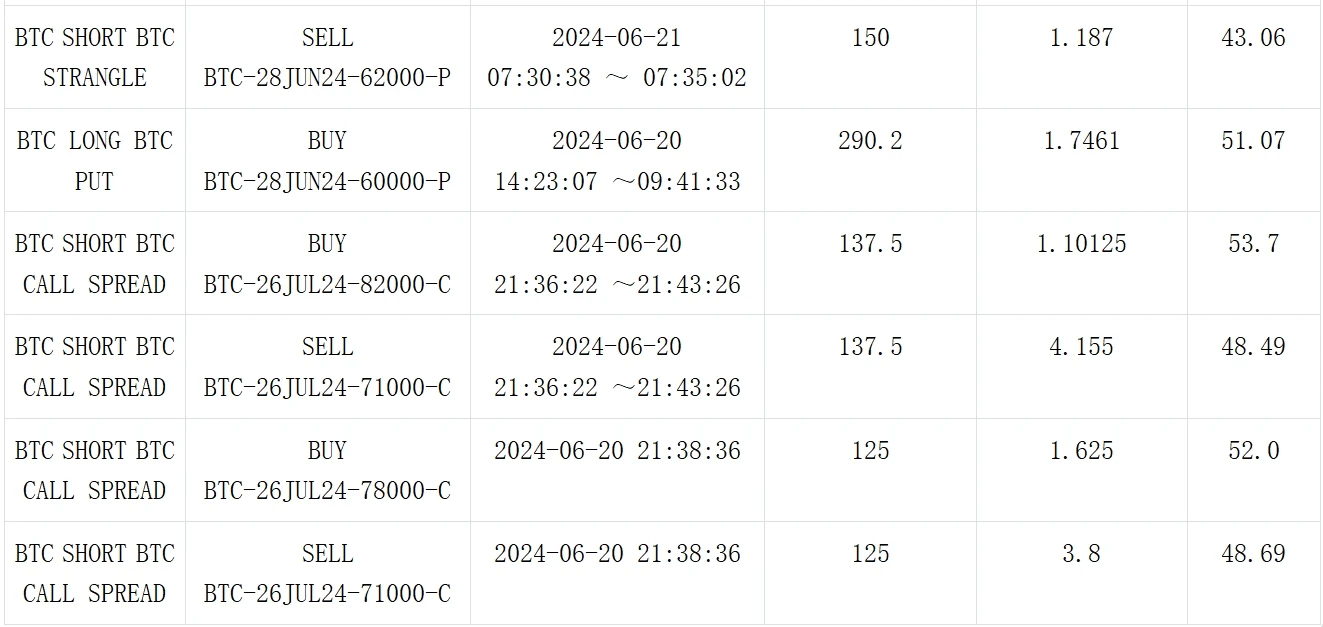

Источник: Deribit Block Trade.

Источник: Deribit Block Trade.

Вы можете найти SignalPlus в магазине плагинов ChatGPT 4.0, чтобы получить информацию о шифровании в реальном времени. Если вы хотите получать наши обновления немедленно, подпишитесь на нашу учетную запись Twitter @SignalPlus_Web3 или присоединитесь к нашей группе WeChat (добавьте помощника WeChat: SignalPlus 123), группе Telegram и сообществу Discord, чтобы общаться и взаимодействовать с большим количеством друзей. Официальный сайт SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240621): Falling and falling

Original title: SENATE PASSES BILL TO OVERTURN SEC RULE ON BITCOIN AND CRYPTO CUSTODY, BIDEN THREATENS VETO Original article by Nik Hoffman, Bitcoin Magazine Original translation: shushu, BlockBeats Today, the Senate passed HJRes 109, which would overturn SEC Staff Accounting Bulletin (SAB) No. 121, preventing heavily regulated financial firms from custodial custody of Bitcoin and other cryptocurrencies. The bill passed by a vote of 60 to 38, indicating bipartisan support for the measure. SAB 121 imposes strict restrictions on financial institutions, prohibiting them from acting as custodians for digital assets such as Bitcoin. Pursuant to the Congressional Review Act, HJRes 109 seeks to remove these barriers, thereby enabling strictly regulated financial firms to provide custody services for Bitcoin and other cryptocurrencies. However, the White House has made its position on…