ETHFI: ведущий продукт Restaking, недооцененный рынком

введение

Ether.fi is committed to Ethereum staking and liquidity re-staking. The biggest pain point in the current Ethereum staking and re-staking area is that users lose control of Ethereum after staking it. Therefore, Ether.fi aims to help users enjoy staking and re-staking benefits while maintaining control of Ethereum by developing a non-custodial staking solution.

Project Strength

основная команда

Mike Silagadze: Founder CEO. Graduated from the University of Waterloo, Mike Silagadze began investing in the cryptocurrency industry in 2010. He founded Gadze Finance and served as CEO, and founded Top Hat.

Chuck Morris: Chief Engineer. Graduated from the University of Chicago with a major in computer science. Has extensive experience in cryptocurrency development engineering teams.

Partner

Kiln: Provides infrastructure services for Ethereum.

DSRV: A company that provides blockchain infrastructure support, including node services and other technical support.

Chainnodes: A blockchain service provider focusing on node operation and management.

Obol: A company focused on distributed trust protocols or decentralized technologies related to blockchain.

From the team and partner information disclosed by ether.fi, it can be seen that its development team has very rich investment and development experience in the cryptocurrency industry, and has established cooperative relationships with many cryptocurrency infrastructure companies, and has obtained strong support in infrastructure construction.

Financing Strength

ether.fi has raised approximately $32.3 million in two rounds of funding.

-

Seed round: February 2023, led by Version One Ventures, with participation from Purpose Investments, North Island Ventures, Node Capital, Maelstrom, Kommune.one, Chapter One Ventures, and Arrington XRP Capital. The amount was $5.3 million.

-

Series A: February 2024, led by Version One Ventures and OKX Ventures, with participation from White Star Capital, White Loop Capital, Stani Kulechov, Selini Capital, Sandeep Nailwal, North Island Ventures, Node Capital, and Matthew Howells-Barby. The amount is US$27 million.

Version One Ventures and OKX Ventures are the top investment institutions in the Crypto industry. AAVE founder Stani Kulechov, Polygon founder Sandeep Nailwal, and Kraken founder Matthew Howells-Barby also participated in ether.fis financing. It can be seen that the top people in the industry have a very high degree of recognition for Eth.fi.

Operation Mode

According to the amount of ETH and LST tokens deposited by users, it can be divided into two types: 32 ETH and multiples of LST; other amounts of ETH and LST tokens.

-

When the amount of ETH and LST tokens deposited by the user is an integer multiple of 32

Node operators submit bids to get assigned to run a validator node. Trusted node operators can submit a nominal bid to be marked as available. Untrusted node operators participate in an auction mechanism and are assigned validators based on their bid price. A depositor deposits 32 ETH into the ether.fi deposit contract. This triggers the auction mechanism and assigns a node operator to run a validator. This also mints a withdrawal safe and two NFTs (T-NFT, B-NFT) that give ownership of the withdrawal safe. T-NFT represents 30 ETH, which is transferable at any time. B-NFT represents 2 ETH and is mandatory. The only way to withdraw the 2 ETH is to exit the validator or exit completely. The validator encrypts the validator key with the public key of the winning node operator and submits it as an on-chain transaction. The node operator starts the validator with the decrypted validator key. The subscriber (or node operator) can submit an exit command to exit the validator and deposit the subscribed ETH into the withdrawal safe. The subscriber can then burn the NFT and recover the ETH after deducting the transaction fee.

B-NFT is used to provide a deductible for price reduction insurance (in the event of a price reduction event) and represents the monitoring responsibility for the performance of the validator node. Due to the increased risk and responsibility, B-NFT has a higher yield than T-NFT.

-

When the amount of ETH and LST tokens deposited by the user is other amounts

When the user deposits ETH and the number of its LST tokens is other amounts. When the user has less than 32 Ethereum or does not want to bear the responsibility of monitoring the validator node, he can participate in ether.fis staking by minting eETH in the NFT liquidity pool. The liquidity pool contract contains a mixed asset consisting of ETH and T-NFT. When a user deposits ETH into the liquidity pool, the liquidity pool mints eETH tokens and transfers them to the user. The minter holding T-NFT can deposit T-NFT into the liquidity pool and mint eETH equal to the value of T-NFT. Market makers holding eETH can convert it to ETH in the liquidity pool at a ratio of 1: 1, provided that there is sufficient liquidity. If there is insufficient liquidity, the conversion triggers a verification exit. Users who use B-NFT for staking deposit their ETH into the pool and enter the queue for the allocation of B-NFTs. When the amount of Ethereum in the liquidity pool exceeds the threshold, the next holder in the queue will be allocated. In this process, a private key is generated and the staking process is triggered. 32 ETH will be staked into the pool, and two NFTs will be minted at the same time: T-NFT will be put into the pool, and B-NFT will be given to the bond holder. When the amount of ETH in the liquidity pool falls below the threshold, the T-NFT with the earliest minting time will trigger an exit request. The exit request will record a timestamp and start counting. If the timer expires and the validator has not exited, the value of the B-NFT holder will be gradually reduced. Node operators can receive rewards when they exit expired validators. When the validator exits, T-NFT and B-NFT will be burned, and ETH (minus fees) will be deposited into the liquidity pool.

At the same time, in order to increase the returns of stakers, ether.fi has set up a node service market in addition to providing staking rewards in the design of the project, allowing stakers and node operators to register nodes, provide infrastructure services, and share service revenue. When users deposit funds in ether.fi and receive staking rewards, ether.fi will automatically re-stake the users deposit to Eigenlayer to obtain returns. Eigenlayer uses staked Ethereum to support various AVS and increase the returns of stakers by establishing an economic security layer. The total amount of all staking rewards will be distributed to stakers, node operators, and protocols, accounting for 90%, 5%, and 5% respectively. Users can receive Ethereum staking rewards, ether.fi loyalty points, re-staking rewards (including EigenLayer points), and rewards for providing liquidity to Defi protocols.

Decentralized Validator Technology (DVT)

In the ether.fi white paper, Distributed Validator Technology (DVT) is introduced. The emergence of DVT is mainly to solve the problem of validator centralization in Ethereum staking. In traditional Ethereum staking, a validator is usually designed to be managed by a single node operator. In this model, there are two obvious problems:

-

If this node fails, it will affect the security and benefits of the ETH staked in this validator;

-

If this node is unreliable or attacked, it could affect the performance and security of the validator. Therefore, the design of DVT disperses the risk of single point failure by allowing multiple independent entities to jointly manage a single validator.

The implementation of DVT technology is mainly through the upgrade and improvement of two aspects:

-

First, in DVT, the key is split. Instead of being controlled by a single key, the validators key is split into multiple parts. Each entity involved in managing the validator only has a part of the key. Whenever an operation is performed, it needs to obtain the consensus of the majority of entities. This effectively reduces the risk of a single node controlling the key.

-

Second, there must be clear contracts and agreements between DVT participants to regulate the responsibilities and rights of each participating entity and ensure the fairness and transparency of the entire system.

In summary, ether.fi has greatly reduced the centralization risk of the original nodes by introducing DVT technology, and further ensured the security and fairness of stakers and participants.

NFTization of Validator Management

In the design of ether.fi, two NFTs are generated when each validator is created, namely T-NFT and B-NFT. T-NFT represents 30 ETH, which can be transferred at any time. B-NFT represents 2 ETH, which is mandatory and can only be returned when you withdraw completely. The minted NFT not only represents the ownership of the funds staked on the validator, but also contains all the key data required to manage and run the validator. The NFT contains: detailed information about the created validator, such as the node, physical location, node operator, and detailed information of the node service on which the validator runs; the NFT holder has control over the validator.

The NFT design of ether.fi is an upgraded version of the LST in previous LSD projects. It allows stakers to manage their validators in a more flexible and decentralized way by holding NFTs. This also reduces the trust issues that stakers previously had to transfer their ETH to a third party.

Инновации по сравнению с аналогичными проектами

Compare ether.fi with other Restaking projects.

-

Security: The most obvious advantage of ether.fi over traditional staking projects is security. In traditional staking projects, users stake their ETH directly to the node through the project. When users stake ETH to the node, they also lose control of the key. If the node is malicious or attacked, the staker will suffer corresponding losses. Ether.fi aims to develop a non-custodial staking solution, through the reference of DVT technology and the management of NFT by validators, so that the stakers can control their keys and retain the custody of their ETH while entrusting the stake to the node operator, and realize multiple independent entities to jointly manage a single validator, thereby dispersing the risk of failure at a single point. Ether.fi minimizes the risk of users participating in Ethereum staking.

-

Exit mechanism: In other Restaking projects, when users need to redeem ETH or LST staked in the protocol, they need to wait 7 days to redeem it. However, ether.fi provides a unique exit mechanism, that is, users can unstake eETH back to ETH through Unstake. This means that users can not only swap back ETH through DEX, but also choose to Unstake 1: 1 to redeem ETH, with a shorter waiting time. And ether.fi is the only protocol that supports direct exit of LRT, while other protocols such as Curve, Balancer, etc. exit through LP pool exchange, but the withdrawal time will change according to the liquidity reserve situation.

In the Crypto industry, especially for active users on the chain, the most important issue is the security of their assets, followed by the rate of return. Ether.fi minimizes the security of users assets by using DVT technology to reference and manage NFT. At the same time, it has a very user-friendly mechanism for exiting pledges, which reduces a lot of concerns for users when participating in the project.

Модель проекта

Бизнес-модель

The economic model of ether.fi consists of three roles: node operators, staking users, and active verification service providers (AVS)

-

Node operators: ether.fis node operators are mainly entities that can use ether.fis infrastructure to provide high-quality services to stakers and other network participants. Node operators play a very important role in ether.fis economic model. First, users must stake their ETH or LST through node operators, and then node operators will mint NFTs for stakers. Ether.fi will charge a certain fee when minting or destroying NFTs, which is also one of the sources of ether.fis income. Then the node operator will stake the staked ETH to Eigenlayer to obtain income, or provide services to AVS connected to ether.fi to obtain income.

-

Пользователи ставок: After ether.fis staking users stake their ETH to ether.fi, in addition to receiving Ethereum rewards for node staking incentives, they mainly stake to Eigenlayer to earn income and can also provide services to AVS to earn income. Of the income earned by staking users, 5% will be allocated to the node and 5% will be allocated to the ether.fi project, which is also one of the sources of ether.fis income.

-

Active Verification Service Provider (AVS): ether.fi is a project in the Restalking track, which will inevitably involve AVS. Although most projects in the Restaking track now connect the staked ETH of their projects to Eigenlayer, allowing Eigenlayer to complete the AVS docking to obtain excess rewards, the next step in ether.fis plan is to establish its own AVS ecosystem. AVS is the source of excess returns provided by the ether.fi project to staking users.

From the above analysis, we can see that ether.fis revenue is:

-

When minting or destroying NFT, ether.fi will charge a certain percentage of the fee

-

Staking users receive 5% of the income

Модель токена

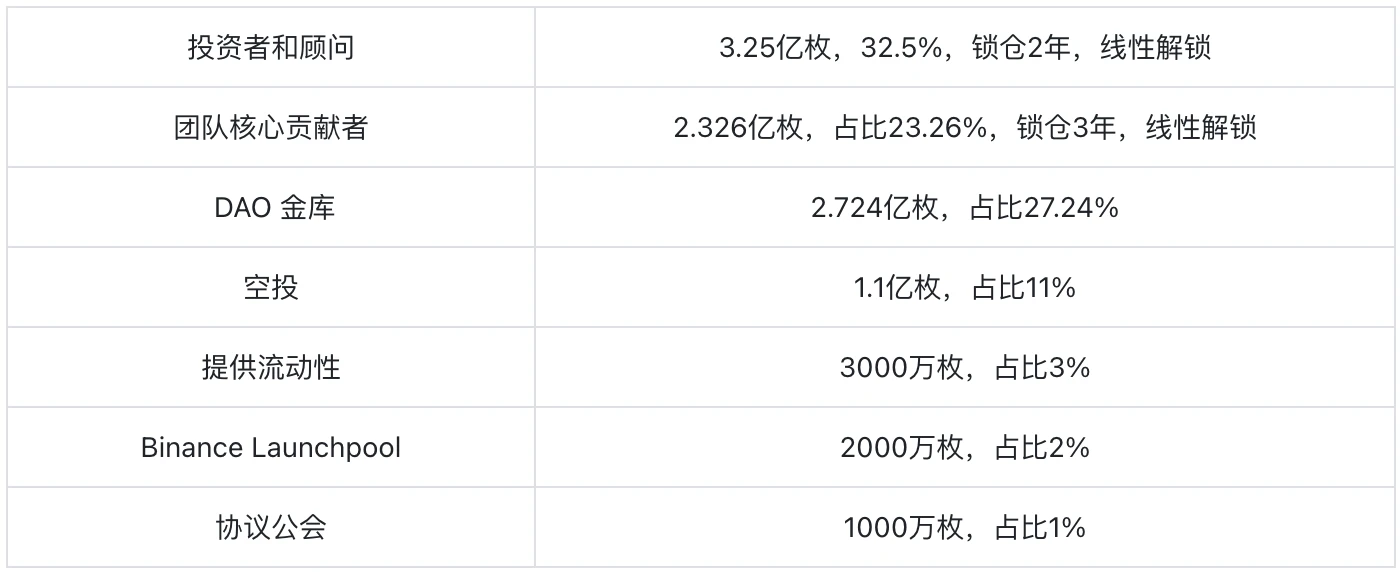

According to the white paper: the total amount of ETHFI is 1 billion, the initial supply of tokens is 115.2 million, and the circulation rate of modern coins is 11.52%.

The distribution of ETHFI is as follows:

Token Empowerment

According to the white paper, the uses of ETHFI in ether.fi are as follows:

-

Payment of protocol fees: Users need to use ETHFI to pay for operations and transactions in ether.fi.

-

Project incentives: Reward users who participate in staking and run nodes.

-

Participate in governance: Holding ETHFI tokens can participate in the governance of the project.

ETHFI鈥檚 value judgment

According to the white paper, in the ether.fi project, there is no scenario of centralized or regular destruction of ETHFI.

Less empowerment of ETHFI is a significant shortcoming of the ether.fi project. There is no staking mechanism in its design, which reduces the key point of locking ETHFI tokens to increase the value of the project. However, according to the allocation of ETHFI in the white paper, the two parts of the token that most affect the market are investors and consultants, and core contributors of the team. The tokens allocated to these two parts account for 55.76% of the total. Although the proportion is relatively high, judging from the lock-up time, most of the tokens will not be released until after March 2026, so it will not affect the circulation rate of the tokens for the time being.

The future trend of ETHFI will still depend more on whether the price of ETH can continue to rise after passing the spot ETF and whether ether.fi can connect to more AVS in the future to bring more ETH staking additional income to the pledgers of the ether.fi project.

TVL

https://defillama.com/protocol/ether.fi#information

https://defillama.com/protocol/ether.fi#information

https://dune.com/ether_fi/etherfi

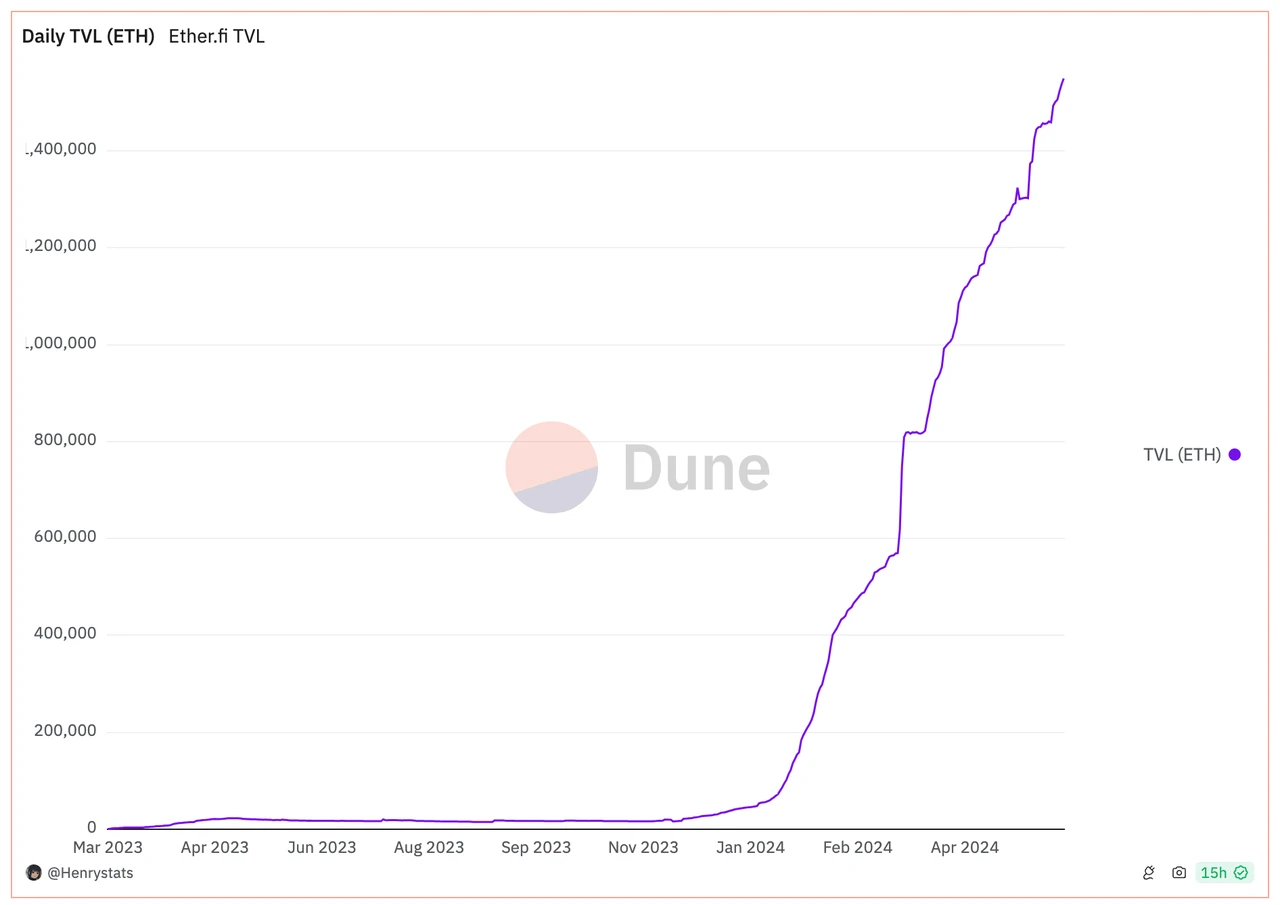

As can be seen from the figure, ether.fis TVL has reached 5.88 billion US dollars, and now its TVL ranks first in the Restaking track. And it can be seen that ether.fis TVL has maintained a rapid upward trend since 2024.

APY

https://www.ether.fi/

We can see from the official website of ether.fi that the APY of ether.fi has reached 14.4%, which is very attractive to staking users.

Top 10 holders

https://ethplorer.io/en/address/0xfe0c30065b384f05761f15d0cc899d4f9f9cc0eb#pageTab=holderstab=tab-holders

The top ten coin holding addresses include ether.fi鈥檚 DAO treasury, Binance and OKEX鈥檚 official addresses. The remaining coin holdings account for 7.07%. The number of ETHFI is 77.07 million, and the current circulation is 115.2 million, accounting for 66.91% of the circulation, indicating that most of the tokens are concentrated in the hands of whales.

Риски проекта

-

In addition to being the governance token of ether.fi, the main function of the ETHFI token is to pay fees when users use the project and to distribute rewards to stakers and node operators. Although the unlocking volume of ETHFI tokens is not high at this stage, and the lock-up time for the two largest groups of investors and consultants and core contributors in ether.fis distribution mechanism is reasonable, there will not be much unlocking in this round of bull market, but ETHFI lacks a repurchase and pledge mechanism, which has led to the continuous increase in the circulation of ETHFI, and there is no mechanism that can achieve the effect of deflation, which in turn affects the rise in the price of the currency to a certain extent.

-

Although ether.fi has the advantage of solving the problem of pledgers always holding ownership of their assets and being able to release the stakes in a timely manner compared to other Restaking projects, the most important thing for a Restaking project is to increase the additional real income of pledged users. Now ether.fi, like other Restaking projects, relies on Eigenlayer to connect the staked tokens to Eigenlayer to provide AVS active verification services. Although it plans to launch its own AVS active verification service this year, there is still a lot of uncertainty as to whether other projects can use ether.fi. If it is not realized, it will have a big impact on the currency price.

Подведем итог

The development direction of ether.fi is committed to Ethereum staking and liquidity re-staking. By citing DVT technology and NFTization of validator management, it solves the common problem in the current Ethereum staking and liquidity re-staking track that users lose control of Ethereum after staking Ethereum. It also realizes the control of the key of the staking user and realizes the joint management of a single validator by multiple independent entities, so that the centralization risk of the staking user in the node is well solved. At the same time, ether.fi is also the only protocol in the Restaking track that allows users to exit directly with LRT. Therefore, ether.fi has a very large advantage in the Restaking track, and now TVL ranks first in the Restaking track.

However, the token economics of ether.fi itself is too simple, and there is no staking mechanism and destruction mechanism, which has led to the continuous increase in the circulation of tokens, which has indirectly had an adverse impact on the rise in token prices. Although ether.fi plans to launch its own AVS active verification service, there is still great uncertainty as to whether it can be used by other projects. If it fails to be realized, it will have a great impact on the price of the currency. Its specific effect remains to be seen.

In summary, the ether.fi project solves the problem of losing control of Ethereum after staking in traditional staking through its unique DVT technology and validator management NFT mechanism. At the same time, its LRT exit mechanism is also very reasonable and has been recognized by users. It solves the concerns of users and common problems in the industry from the two aspects of security that on-chain users are most concerned about. In addition, Ethereums spot ETF has been basically approved. If ETH can have a good increase in the subsequent bull market, then ether.fi based on Ethereum will definitely have a very impressive performance.

This article is sourced from the internet: ETHFI: The leading Restaking product underestimated by the market

Related: io.net, valued at $1 billion, is listed on Binance Launchpool, the next big money is coming

Original | Odaily Planet Daily Author | Asher This morning, Binance announced that its 55th new coin mining project is io.net (IO), and will launch IO/BTC, IO/USDT, IO/BNB, IO/FDUSD and IO/TRY trading markets at 20:00 Beijing time on June 11. As soon as this news came out, major money-making communities immediately became active. Next, Odaily Planet Daily will take you to understand the io.net project, IO token economy and over-the-counter trading. io.net comprehensive analysis Project Description Image source: Official Twitter io.net is a decentralized computing network that has built a two-sided market around chips. The supply side is the computing power of chips (mainly GPUs, but also CPUs and Apples iGPU, etc.) distributed around the world, and the demand side is artificial intelligence engineers who want to complete AI model…