Знаменитости не занимаются тайным сбором средств: является ли выпуск Дженнер новых монет способом монетизации своего влияния или злонамеренным

Оригинал | Odaily Planet Daily

Автор | Наньчжи

Yesterday, Kardashian’s stepfather Caitlyn Jenner released the Pump token JENNER. At that time, most users believed that it was hacked. After that, many reversals occurred, and finally the token’s market value rose to 40 million US dollars.

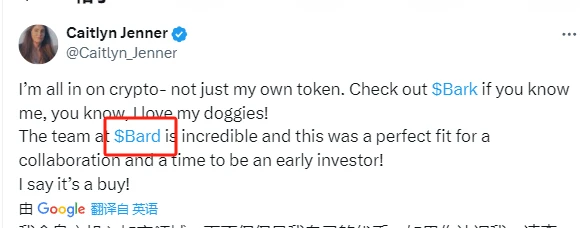

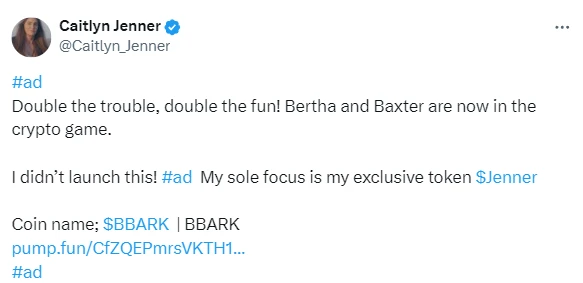

While the community was still paying attention to JENNER, Caitlyn Jenner released a new Pump token BBARK without any warning at around 2 a.m. today. After the news was released , JENNER plummeted from $0.027 to $0.011, a drop of about 60% .

In fact, the tokens had been basically sold out before Jenner released the pump link, and the top ten addresses held 49% of the tokens . Due to Jenner鈥檚 example, many users sniped the tokens at the opening, causing the market value to rise directly from $70,000 to $5 million after trading began.

In just over ten minutes, the transaction volume reached 20 million US dollars, but there was no sign of an increase in the token price.

Through some data websites, we can see that the large holders who purchased coins on the market at that time continued to sell them, and each address made a profit of hundreds of thousands of dollars.

Jenner then posted a new tweet with the sentence Not just my own token, implying that the newly released token BBARK was not planned and launched by her personally, but the tweet did not affect traders, and the currency price continued to fluctuate sideways.

A few minutes later, Jenner deleted the previous tweet about the launch of BBARK, and the token price fell by 50%. The top holder also sold 10% of his tokens at once. Jenner then updated his tweet with an ad logo, directly stating that the token was not his, but a promotion for a token issued by another team. An hour after the token was launched, Jenner deleted all posts about BBARK and said: That third-party token ad has been removed. As I said from the beginning, the only person I care about is JENNER , and the ad I posted confused too many people and it wasnt worth it.

The token market value has been falling since the first post was deleted, from $2 million to the current $100,000. However, JENNER has started to recover and has now recovered 50% of its losses, with a market value of $20 million again.

Open harvest?

Assuming that this incident is a malicious manipulation of the market, we can speculate that the story behind it is:

- Jenner first bought the vast majority of the chips using Pump;

- Post a tweet announcing a new coin, and use the FOMO sentiment created by JENNER to sell at a large profit;

- The release of new coins causes JENNER to plummet, and chips are collected at the bottom;

- After the profit-taking is complete, delete the new token related messages to draw attention back to JENNER and profit from the recovery.

Of course, this is just speculation from a conspiracy theory perspective, and we have no way of knowing the truth. However, the extreme allocation and dumping of new coins, the multiple deletions of tweets, and the modification of caliber all suggest that this is not just a simple promotion.

Jenner is the first celebrity to use Pump to issue coins. Unlike the use of fake influencers mentioned in the Pump PVP Manual , Jenner is a celebrity who can truly use her influence to monetize. The situation is similar to the peak of NFT in 2022. With the explosion of NFT, many celebrities began to support projects, and after completing a round of profit harvesting, they left a mess.

As a type of attention economy model, Meme is more difficult to maintain attention than NFT, and it is also more difficult to generate added value through operation and creation. For users, it is just a short-term hype project. For example, early this morning , rapper Rich The Kid (with about 2.4 million fans on the X platform) also started his Pump coin issuance, which quickly rose and has now fallen to the bottom.

As celebrities join the ranks of Pump token issuance, it is a way for them to monetize their influence, but it will become increasingly difficult for users to make a profit. They need to be wary of influence-harvesting scams from celebrities.

This article is sourced from the internet: Celebrities don’t do secret harvesting: Is Jenner’s issuance of new coins a way to monetize her influence or a malicious harvest?

Связанный: a16z crypto: Критика Memecoin

Оригинальное название: Как плохая политика отдает предпочтение мемам, а не материи Оригинальная статья: Крис Диксон Дата выхода: 20.04.2024 Поскольку цены на криптовалюту в последнее время достигли новых исторических максимумов, существует риск чрезмерной спекуляции на рынке криптовалют, особенно с учетом недавнего ажиотажа вокруг мем-монет. Почему рынок продолжает повторять эти циклы вместо того, чтобы поддерживать действительно преобразующие инновации на основе блокчейна? Мем-монеты — это, по сути, мем-монеты, созданные людьми в онлайн-сообществах, которые понимают мем. Возможно, вы слышали о Dogecoin, который основан на давнем меме о собаке с изображениями сиба-ину в интернет-сообществе. Когда кто-то самоуничижительно дал ему криптовалюту, которая впоследствии имела некоторую экономическую ценность, он сформировал более широкое онлайн-сообщество. Эта мем-монета отражает разнообразие интернет-культуры, большинство из которых безвредны, в то время как…