Анализ макроэкономики SignalPlus (20240517): идеальное процветание возвращается

Stock prices once again challenged record highs in the early trading session before retreating, while U.S. Treasuries also experienced a bearish trend, with short-term yields rising slightly due to a sharp increase in import prices (0.7% month-on-month vs. 0.1% expected).

With little important data until next Wednesday, when Nvidias earnings report is released, options imply a +/-8% stock price volatility, slightly lower than its two-year average of +/-8.4% and +10.9% in February. Given the chip giants outsized weighting in the SPX, an 8% implied volatility means an impact of about 0.4% on the SPX, not to mention the spillover effect on sentiment for other related stocks in the index.

In addition to higher-than-expected import prices, an expected rebound in oil prices during the busy summer driving season could keep CPI pressures in place until August, though inflation traders remain confident that CPI will fall back below 2.5% by the end of the year.

Unwavering confidence in inflation and a lack of economic risk have allowed markets to focus purely on interest rate trends, resulting in a perfect negative correlation between U.S. Treasury yields and stock prices since mid-December. In other words, stock and bond prices have risen in tandem in a perfectly ideal boom, (again) ignoring tail risks that could come from a further economic slowdown, stubborn inflation, or a valuation correction.

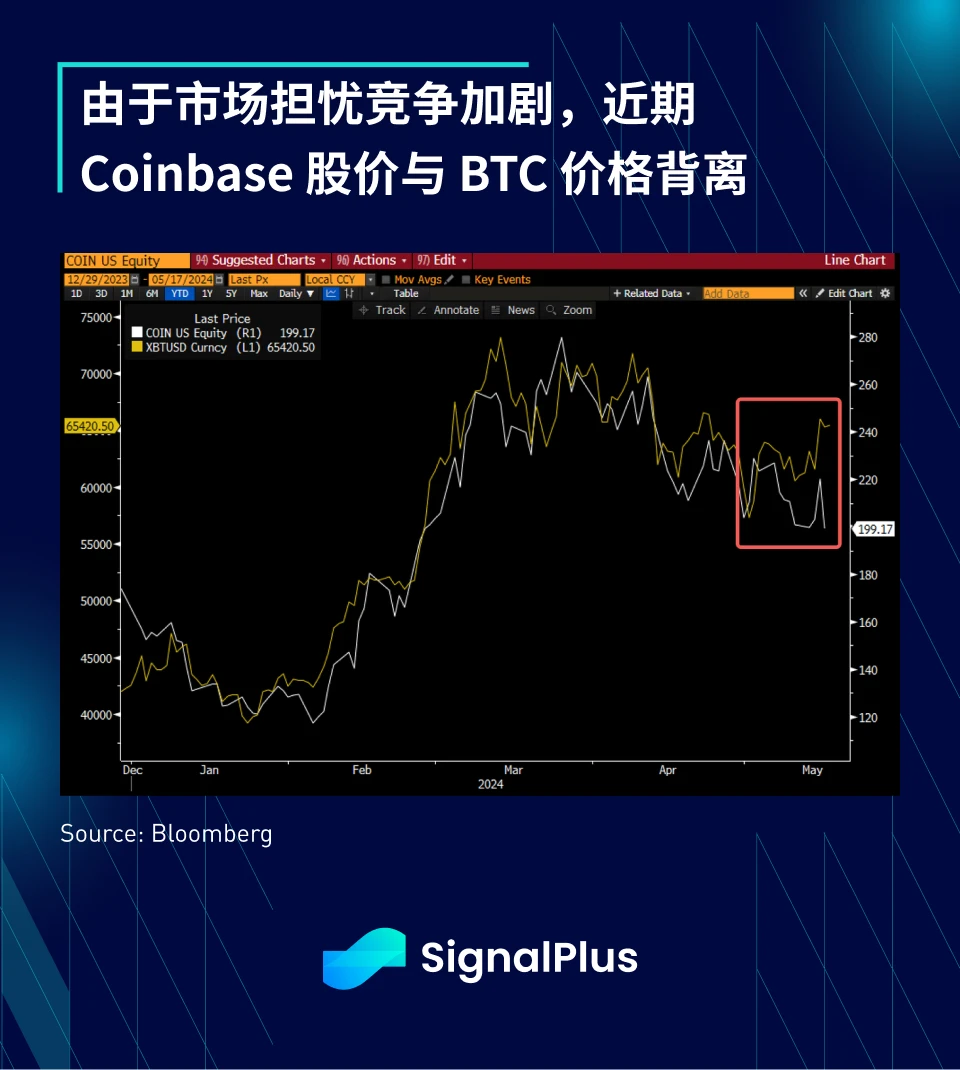

There is not much news worth noting in the cryptocurrency sector, with BTC holding steady at recent highs and trading activity flat. However, Coinbases stock price fell 9% yesterday, a significant divergence from the BTC price, as investors began to worry that the entry of institutions such as CME into the spot trading business will lead to increased competition in the compliance field. The entry of TradFi will undoubtedly bring the inflow of funds needed by the industry, but it will also certainly trigger new competition. What will the cryptocurrency market look like in a year or two? We will wait and see.

Вы можете выполнить поиск SignalPlus в магазине плагинов ChatGPT 4.0, чтобы получить информацию о шифровании в реальном времени. Если вы хотите получать наши обновления немедленно, подпишитесь на нашу учетную запись Twitter @SignalPlus_Web3 или присоединитесь к нашей группе WeChat (добавьте помощника WeChat: SignalPlus 123), группе Telegram и сообществу Discord, чтобы общаться и взаимодействовать с большим количеством друзей. Официальный сайт SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240517): Perfect ideal prosperity returns

At the BitcoinAsia conference in May, Merlin Chain founder Jeff delivered a speech titled From Bitcoin L1 to Merlin Chains Native Innovation, which explored in depth how Merlin Chains native innovation can empower the Bitcoin ecosystem. He reviewed the evolution of the Bitcoin ecosystem and explored in depth how Merlin Chains native innovation will promote the development of the Bitcoin ecosystem. The following is the full text of the speech, compiled based on the on-site recording. Before 2023, Bitcoin was always seen as digital gold for value storage, and no one was creating new concepts and applications around Bitcoin. But after the Ordinals craze in mid-2023, more and more people began to create NFT-related content on the Bitcoin network, issuing assets such as BRC-20, BRC-420, and ORC-20, and then Atomicals…