Bitcoin’s (BTC) price is taking its time to return to the recent highs. The cryptocurrency is presently at $66,000.

However, it is still vulnerable to selling from investors, which could reduce prices.

Adding Bitcoin to Wallets

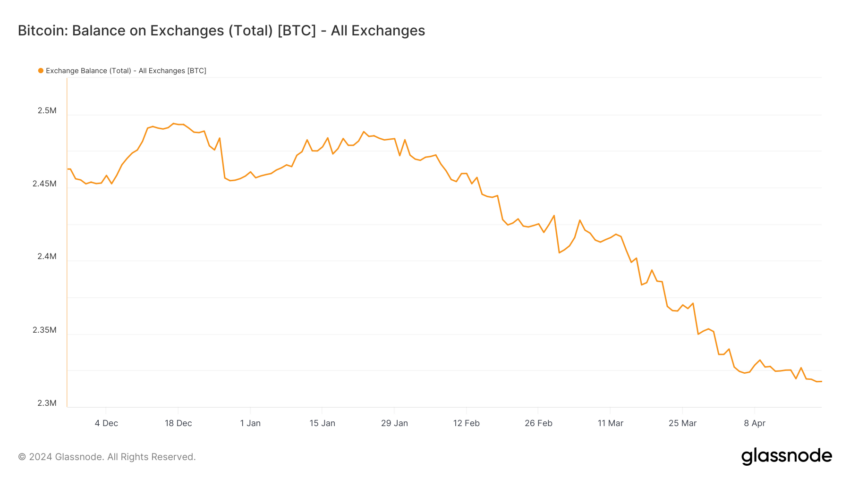

Bitcoin’s price is taking hints from both bulls and bears at the moment, as visible in their actions. The exchanges’ balance is a chart that tracks the movement of BTC in and out of exchanges’ wallets.

Over the past few months, investors have focused only on accumulation. This is evident from the consistent declines in supply on exchanges. This continued over the weekend when investors bought 9,000 BTC worth nearly $600 million.

One of the key factors contributing to this accumulation was the halving event that took place over the weekend. The anticipation surrounding the supply squeeze is expected to push the prices higher, resulting in the addition of BTC to wallets.

Although the potential rally will be slow-moving, investors are attempting to make the most of it.

더 읽어보기: 비트코인 반감기 내역: 알아야 할 모든 것

Further, the likeliness of a price rise is visible in the Exponential Moving Averages (EMA). The moving averages are together forming a potential Golden Cross, which has not been seen in the past two months.

On the four-hour chart, the 50-day and the 200-day EMAs are close to meeting. Further push from the investors will push the 50-day EMA to cross over the 200-day EMA, marking a Golden Cross. This is considered to be a signal of a potential uptrend.

Should it take place, the BTC price would not be too far from inching closer to the target.

BTC Price Prediction: Journey to $70,000

Bitcoin’s price at the time of writing is just under the $66,000 mark. It is due for a rally owing to investors’ unending optimism towards the cryptocurrency.

This bullishness could push BTC upwards, but to reclaim the crucial support of $70,000, Bitcoin’s price needs to flip $66,900 into the support floor. Doing so would allow the digital asset to eventually breach the $68,500 resistance level to hit $70,000.

On the other hand, if investors move to sell, the price could fall back down.

더 읽어보기: 마지막 비트코인 반감기에는 무슨 일이 일어났나요? 2024년 예측

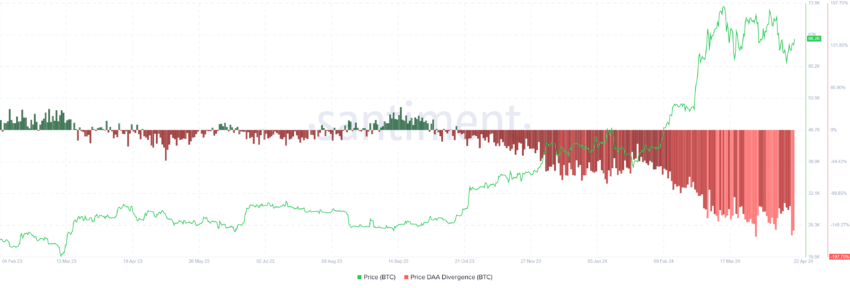

The chances of selling are high, too, looking at the Price Daily Active Addresses (DAA) Divergence indicator. This divergence is noted when cryptocurrency price diverges from the number of active addresses, indicating a potential discrepancy between market valuation and network usage trends.

When the price increases and participation decreases, the indicator flashes a sell signal. BTC could take the hit if investors move to sell to secure gains. This would result in Bitcoin’s price losing the support of $63,724 to hit $61,000. Consequently, the bullish thesis would be invalidated.