The 암호화폐 market has fallen nearly 10% in the last 24 hours as the hype around the US crypto reserve fades and Donald Trump imposes new tariffs on Mexico, Canada, and China. This puts more pressure on a market that was already correcting.

Despite the downturn, crypto whales bought ADA, CAKE, and RENDER, showing signs of accumulation as prices fell. ADA has dropped 16% in a day, struggling to hold support below $0.85, while CAKE has seen rising interest as one of the top revenue-generating protocols in recent weeks. Meanwhile, RENDER is down 33% in the last 30 days.

Cardano (ADA)

Crypto whales bought ADA during the recent market crash, with its price down 16% in the last 24 hours. The spike following its inclusion in the US crypto strategic reserve was short-lived, with bearish momentum taking over.

Despite this, whale accumulation suggests confidence in ADA’s long-term potential.

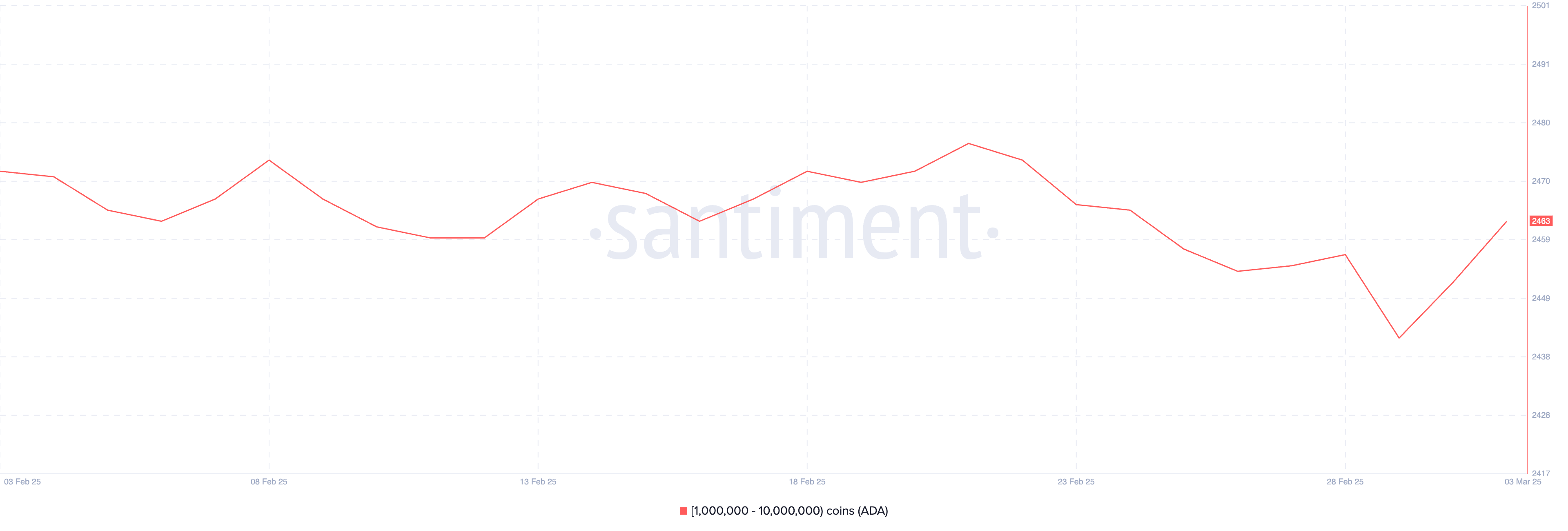

The number of whales holding 1-10 million ADA grew from 2,442 on March 1 to 2,464 on March 3. This increase confirms that whales bought more ADA as the price dropped.

While this could indicate a future recovery, ADA still struggles to regain key resistance levels.

After briefly reclaiming $1, ADA is now trading below $0.85, with risks of dropping toward $0.70. The community remains uncertain about what is behind its inclusion in the US crypto strategic reserve, adding to the selling pressure. If sentiment improves, ADA could return to an uptrend and test $1.10 or even $1.20 soon.

PancakeSwap (CAKE)

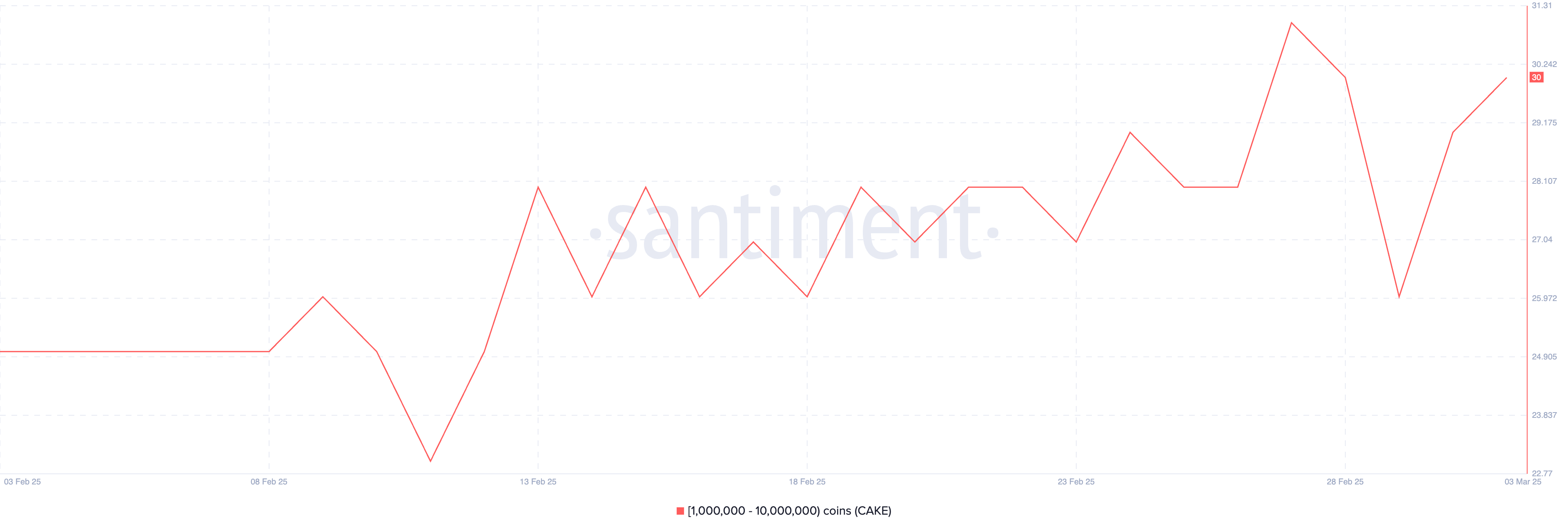

CAKE has been on the rise in recent weeks, becoming one of the top revenue-generating protocols in the last 30 days. Its growing traction comes as BNB volume competes with Solana and Ethereum, boosting market interest.

With this surge, crypto whales bought CAKE in the last few days, increasing accumulation. The number of wallets holding 1M–10M CAKE rebounded from 26 on March 1 to 30 now.

CAKE currently holds strong support at $1.35, a key level for maintaining its bullish trend.

If BNB and CAKE momentum recovers, it could test resistances near $2 and, with enough strength, potentially rise above $2.60.

Render (RENDER)

RENDER remains one of the leading AI cryptocurrencies, but like the rest of the sector, it has struggled in 2025, with its price down 33% in the last 30 days.

The bearish trend has weighed on sentiment, keeping selling pressure high. RENDER is now at a critical point, needing a shift in momentum to avoid further declines.

Despite the downturn, crypto whales bought RENDER in the last few days, increasing accumulation. The number of wallets holding 100,000 and 10 million RENDER rose from 153 on March 1 to 161 now.

RENDER is on the edge, currently testing the $3.30 support, a crucial level that, if lost, could trigger more corrections. If an uptrend emerges, it could test the $3.90 resistance and attempt to break above $4 levels.

이 글은 인터넷에서 퍼왔습니다: What Crypto Whales Are Buying After the Market Crash?

Related: AI is booming again, Actual creates a personalized DeFAI assistant

Today, President Trump announced that OpenAI, SoftBank, and Oracle have announced the establishment of the Stargate project, which will invest at least $500 billion in artificial intelligence infrastructure. Now, $100 billion will be invested immediately to build AI infrastructure, which is expected to create 100,000 jobs. AI is still popular, and AI agents will become the new upstarts that technology companies will compete to pursue in the future. However, AI agents and cryptocurrencies are a perfect match, and each has its own needs, which will inevitably change the evolution path of the crypto market, including the path to large-scale adoption. Among them, DeFAI has become an important branch, and DeFAI will definitely become the future of DeFi. With the Federal Reserves interest rate cuts in the future, on-chain DeFi will…