Original author: Cyclop ( @nobrainflip )

Compiled by: Asher ( @애셔_0210 )

Editors note: You often see examples of people making a lot of money during the FOMO phase of the market, but the real wealth (I mean those 100x opportunities) is accumulated during the market correction period. People often say buy on dips (even Trumps second son Eric Trump), but rarely go into depth about how to really seize opportunities and how low to buy. This 가이드 hopes to help you find the sweet entry point during the correction.

Right now, I think the market is probably in the angry/frustrated phase, and its at times like these that a lot of people become millionaires.

Many people will hear “buy the dip” right now, but few actually explain what that means or how to do it.

First of all, what exactly does “buy the dip” mean?

Buying the dip means buying an asset when it hits a temporary or even absolute low. The problem is that no one can accurately predict that low. However, by using the right strategy, you can get close to that low point and optimize your investment opportunities.

Next, let’s break down the specific steps of “buy on dips”, which can be divided into three parts:

-

“When to buy” : 시장 cycles are divided into two phases: the buying phase and the corrective phase. In the buying phase, our goal is to build a position, while in the corrective phase, we sell to take profits . The buying phase usually lasts about 14 months , which is full of corrections and consolidation, while the corrective phase is a rapid rise phase, which lasts about 4 months and marks the market peak;

-

What to buy : depends on your risk/reward ratio, investment amount, and ability to withstand pressure. If you are a long-term investor, BTC, ETH, and SOL are enough, but if you want higher returns, you need to look for undervalued altcoins. Although many people no longer believe in the altcoin season, we will still see altcoin seasons in popular sectors. This time, not all altcoins will rise indiscriminately, but you need to choose projects that are in the price discovery stage and fit the new narrative;

-

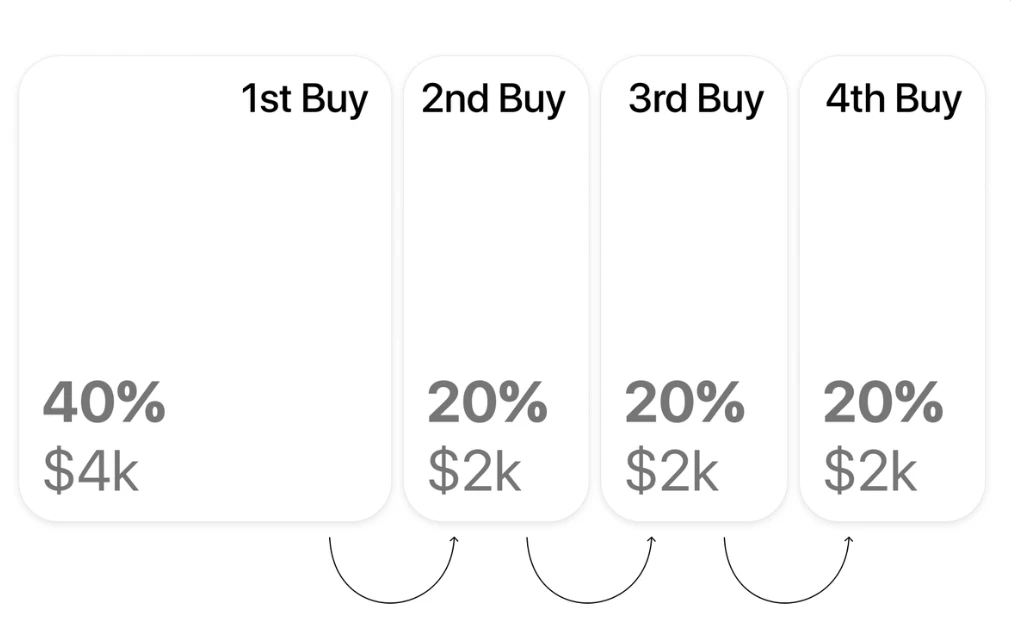

How to buy : Many people think that buying is simple, and it seems that the transaction can be completed with just one click. But because of this, people often miss the real opportunity to buy on dips. In fact, buying is much more complicated than it seems, and the key is to reduce the average purchase cost. The most effective method is to use the cost averaging method (DCA), that is, buying in batches instead of investing all the funds at once. For example, if you plan to invest $10,000 to buy BTC, you can divide the funds into four parts and buy every time BTC falls by 5-7%: $4,000 for the first time, and $2,000 for the second to fourth times. In this way, the purchase price can be optimized in market fluctuations instead of being affected by short-term fluctuations of a single purchase.

Additionally, a common mistake many people make during this correction is to put their money completely into the market and not keep enough stablecoins. Therefore, it is recommended to keep 30-50% of your portfolio in stablecoins , which not only reduce the volatility of your portfolio, but also provide you with room to operate when the market corrects. If you no longer have stablecoins, dont sit back and wait for death, you can earn additional funds by finding a Web3 job. During this correction period, you have every opportunity to make at least $10,000, especially now that there are many job opportunities in the Web3 industry.

Additionally, a common mistake many people make during this correction is to put their money completely into the market and not keep enough stablecoins. Therefore, it is recommended to keep 30-50% of your portfolio in stablecoins , which not only reduce the volatility of your portfolio, but also provide you with room to operate when the market corrects. If you no longer have stablecoins, dont sit back and wait for death, you can earn additional funds by finding a Web3 job. During this correction period, you have every opportunity to make at least $10,000, especially now that there are many job opportunities in the Web3 industry.

If you decide not to trade for a while, it is a good idea to improve your skills during the market downturn. This period can be used to study the market and discover new narratives and projects, which will be the key to your success in the next cycle.

Overall, while market corrections may seem unfavorable, it is this period that provides you with opportunities to build positions. As the 암호화폐 market grows in popularity, the future potential is huge. So stay focused, work hard, and use this cycle to become a millionaire.

This article is sourced from the internet: Cyclop: How to find the sweet entry point in a high-frequency pullback

Related: The Tragedy of Ethereum’s “Leftists”

Vitalik feels bad. Vitalik felt bad when he heard people on crypto Twitter and VCs telling him that a PVP KOL gambler casino that made 99%+ of its users lose money was the best market fit the crypto industry could get, and that hoping for something better was seen as condescending and elitist. Vitalik felt bad when people who knew nothing about the inner workings of the Ethereum Foundation told him who to kick out of the organization and who to let in, and expected him to make all these adjustments within two weeks. 2024 has been a difficult year for all Ethereum teams and communities. The community’s discontent has fallen into a cyclical cycle of anger, which erupts from time to time, and the community’s memes mocking ETH prices…