KAITO has recently experienced a slight drop from its all-time high (ATH) of $2.92, which it reached just two days ago. The altcoin is now attempting to reclaim that peak, but the broader market cues are exerting downward pressure.

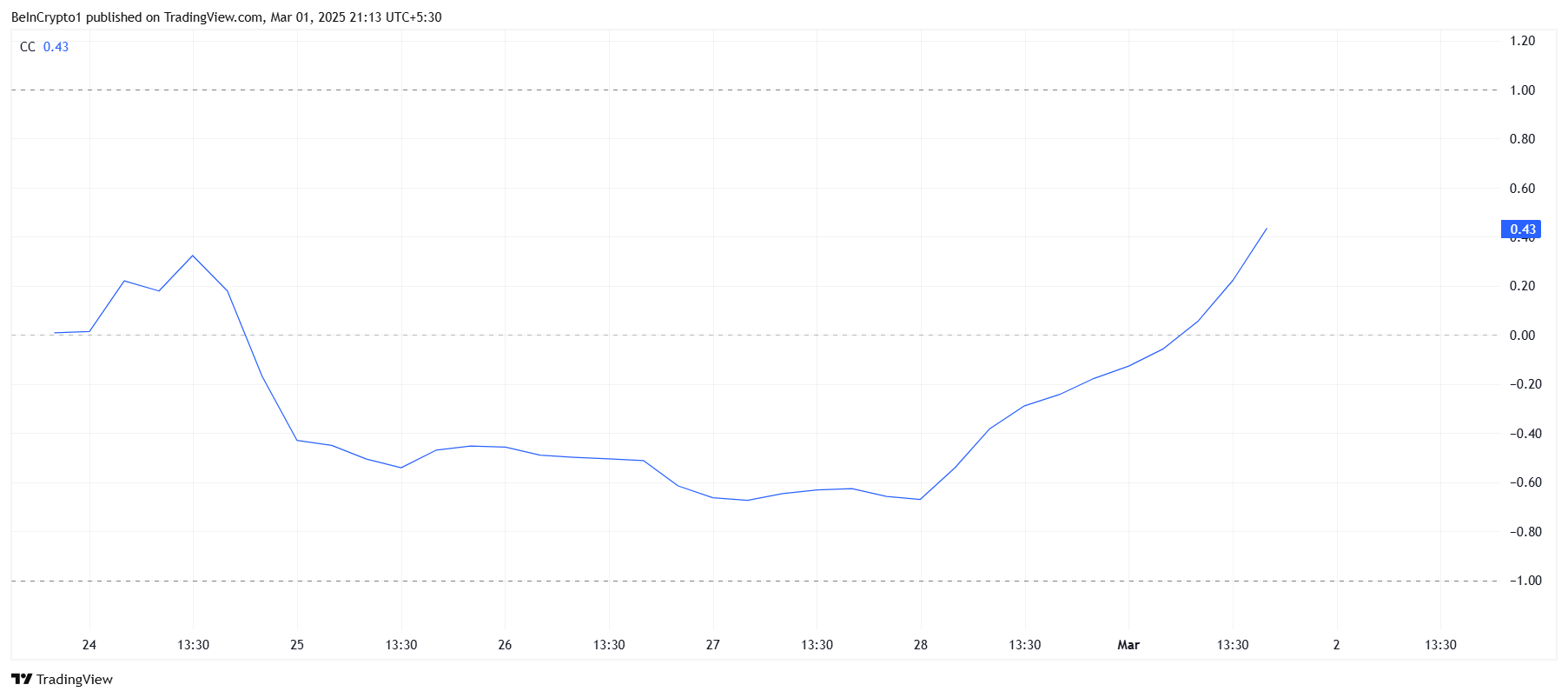

KAITO’s recovery depends heavily on Bitcoin’s performance, with both coins showing an increasing correlation in price movements.

KAITO Needs Support

KAITO’s correlation with Bitcoin has been rising, suggesting that it closely follows Bitcoin’s market trends. This uptick in correlation indicates that KAITO’s price movement is becoming more aligned with BTC’s actions.

As Bitcoin recovers from its intra-day low of $78,250, reaching a trading price of $84,719, the broader market sentiment could shift. If Bitcoin continues its upward trajectory, KAITO’s price could follow suit, assuming the correlation strengthens further.

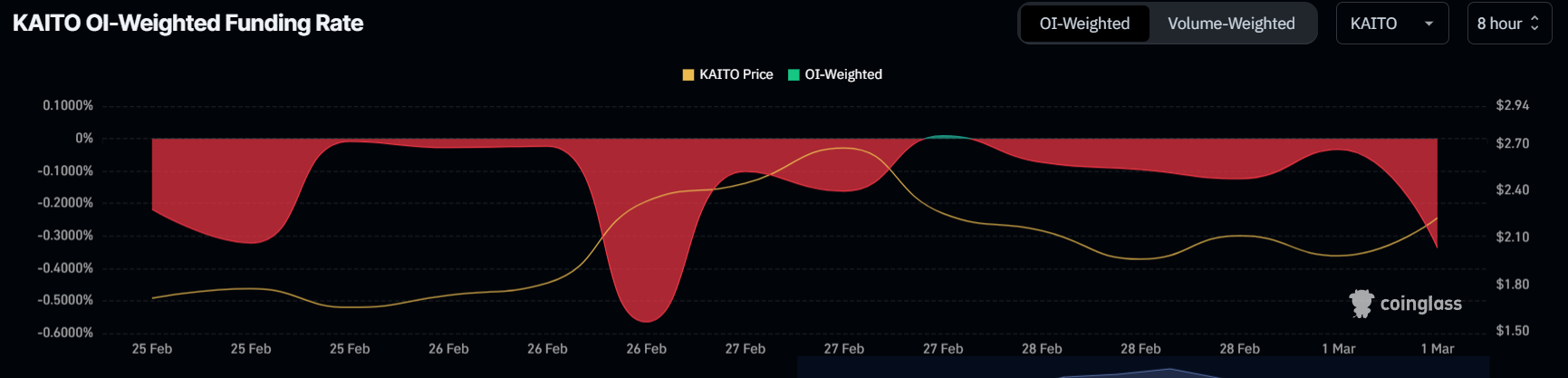

However, despite this potential for upward momentum, traders are still skeptical. The negative funding rate of KAITO, which has increased over the past 24 hours, reveals that many are betting against the altcoin.

Short contracts have dominated over long contracts, showing the traders’ reluctance to fully back KAITO’s recovery at this moment. The mixed signals from market sentiment point to a level of uncertainty that could stall KAITO’s price movement in the short term.

KAITO Price Attempts Recovery

KAITO’s price is currently sitting at $2.22, just below the resistance level of $2.26. While the broader market conditions seem favorable for a potential recovery, traders’ sentiment remains cautious.

KAITO is attempting to breach this resistance, but if the negative funding rate continues, it may struggle to secure further gains.

Given the mixed signals, KAITO may continue to trade within a range between $1.86 and $2.44 in the near term. This consolidation suggests that the altcoin could remain trapped under $2.44, a critical resistance level.

A successful breach of $2.44 would indicate the possibility of a rally, with the potential for KAITO to break its ATH of $2.92 and reach above $3.00.

A failure to break the $2.44 resistance level could result in KAITO consolidating under this price point, with the altcoin remaining stuck within the same range. A breach of $1.86 would further invalidate the bullish outlook, signaling a possible continuation of the downtrend.

이 글은 인터넷에서 퍼왔습니다: KAITO’s New All-Time High Depends on Bitcoin, Here’s Why

Original author: Frank, PANews Recently, the Solana Governance Forum launched a proposal called SIMD-0228, which aims to reduce the annual issuance of SOL by 80% by dynamically adjusting the inflation rate and direct funds from staking to DeFi. However, this seemingly smart issuance blueprint has aroused fierce controversy in the community about the inflation spiral and interest game – when the staking rate falls below the critical point, higher inflation may backfire on market confidence. The income structure of validators and the distribution of benefits to ecosystem participants have become the invisible explosives of this token economy experiment. The new proposal may reduce inflation by 80%, reducing the issuance of 22 million SOLs per year Solanas token SOL issuance mechanism has always adopted a fixed schedule mechanism, that is, the…

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”