Layer-2: Unleashing the potential of Ethereum and reshaping contract transactions

주요 시사점

-

Not just for DeFi: Layer-2 (L2) also brings huge advantages to centralized exchanges (CEX) and their users.

-

Better user experience: Faster deposits and withdrawals make dynamic trading strategies possible.

-

Security and reliability: Most L2 solutions inherit the security guarantees of 이더 리움 .

-

Future Outlook: With the improvement of interoperability and user experience, L2 will attract more traders, whether in DeFi or centralized trading scenarios.

이더 리움 has become the mainstay of decentralized innovation, driving the development of many cutting-edge applications such as DeFi and NFT . But with success comes high gas fees and network congestion, especially during peak trading hours. At this time, Layer-2 solutions have become the savior, not only alleviating Ethereums scalability issues, but also making centralized exchanges like XT.COM more efficient.

So why should contract traders on centralized exchanges care about Layer-2? The answer is simple: Layer-2 makes on-chain transfers faster and cheaper, making account top-ups and profit withdrawals smoother and more efficient than ever before. Although XT.COMs contract trading engine runs on an offline architecture, the bridge to the L2 network significantly reduces fees and speeds up transfers, which ultimately improves trading efficiency and profitability.

Table of contents

Layer-2: Advantages for Traders

Layer-2 Core Solution: The Cornerstone of Ethereum Scaling

-

Optimistic Rollup

-

ZK-롤업

-

국가 채널

-

사이드체인

-

Plasma

-

Validium

From CEX to Layer-2: Reshaping Contract Trading

Asset Bridging: Real-World Applications

-

Bridging Basics

-

Example flow: From Ethereum to Arbitrum to XT.COM

Challenges and future trends

-

Current Challenges

-

Future Innovation

Layer-2: Trader Advantages

When it comes to gas fees and network congestion, these issues are fatal profit killers for active traders. Layer-2 (L2) is a scaling solution running on top of the 이더 리움 mainnet (Layer-1), which greatly alleviates the pressure on the mainnet by moving a large number of transactions to off-chain processing. What are the benefits for traders?

-

Lower fees: Reduce network congestion and significantly reduce Gas fees.

-

Accelerate trading: Nearly instant trade confirmation is critical to the fast-paced contract market.

-

Improve user experience: recharge and withdrawal become easier and smoother.

Although L2 is often used in DeFi, NFT , and gaming scenarios, it is also applicable to CEX users. Fast recharge allows you to seize trading opportunities in time, and low-cost bridging ensures that your funds are invested in transactions more efficiently.

Image Credit: Geek Culture

Layer-2 Core Solution: The Cornerstone of Ethereum Scaling

When it comes to 이더 리움 s scalability, Layer-2 (L2) technology is undoubtedly the key weapon to solve annoying problems such as congestion and high gas fees. Different Layer-2 solutions have their own advantages and disadvantages, with different focuses on security, speed, and user experience. Dont worry, we have highlighted the key points for you! Here are several mainstream Layer-2 technologies, see which one best suits your needs:

Optimistic Rollup

-

How it works: The principle is simple – batch transactions off-chain, and all transactions are valid by default unless someone raises a challenge and requires verification.

-

Best for: This is ideal if you’re looking for fast, low-cost transfers, such as depositing funds into a CEX or participating in DeFi applications.

-

Advantages: Low cost, fast speed, and significantly reduces the load on the Ethereum mainnet.

-

Disadvantages: Withdrawals can be a bit slow as there is a “challenge period” (usually one week).

-

Example projects: Arbitrum , Optimism (widely used in DeFi platforms such as 유니스왑 ).

Image Credit: Foresight Ventures

ZK-Rollups

-

Operating mechanism: It uses zero-knowledge proof technology to compress a large number of transactions into one batch and then submit it to the Ethereum mainnet. This not only saves space, but also ensures the privacy and security of transactions.

-

Applicable scenarios: If you have high privacy requirements or are a high-frequency trader, this technology is perfect for you.

-

Advantages: Transaction confirmation is very fast and highly secure.

-

Disadvantages: The technical difficulty of development and deployment is relatively high, and the initial cost is relatively high.

-

Example projects: 지케이싱크 , StarkNet.

Image Credit: Smartosky

국가 채널

-

Operation mechanism: Users conduct transactions directly off-chain, and only the final transaction results will be submitted to the 이더 리움 mainnet.

-

Best for: This is a perfect option if you make small, frequent transactions, such as micropayments or blockchain games.

-

Pros: Instant transactions with almost zero fees.

-

Disadvantages: Transactions can only be made between participants in the channel, and all participants need to be online.

-

Example project: Raiden Network .

Image Credit: Nuggets News

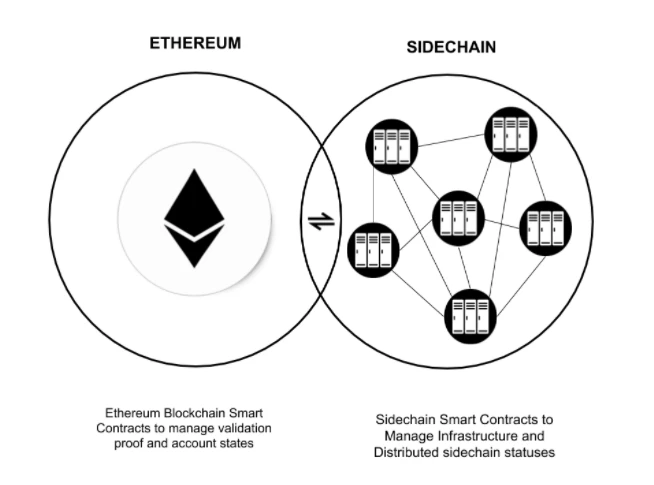

사이드체인

-

Operating mechanism: The sidechain is a chain independent of 이더 리움 , connected to Ethereum through a bridge, but runs using its own consensus mechanism.

-

Suitable for: If you are looking for low fees and high speed, but do not have high requirements for the security of the Ethereum mainnet, such as general DeFi and NFT market users, this is the solution you are looking for.

-

Pros: Low fees and fast transactions.

-

Disadvantages: Security relies on the sidechain itself, not the Ethereum mainnet.

-

Example projects: Polygon PoS , Gnosis Chain .

Image Credit: UC Berkeley

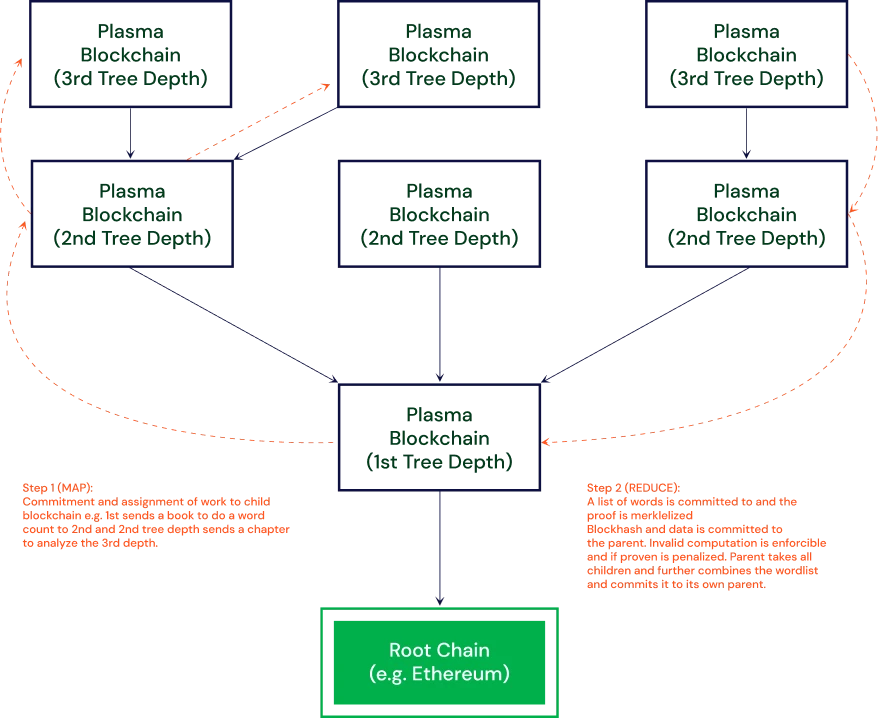

Plasma

-

Operation mechanism: Plasma processes off-chain transactions by creating sub-chains, and the Ethereum main network is required to intervene only when there are disputes about the transaction.

-

Applicable scenarios: Mainly applicable to payment scenarios, but compared with Rollup, its functional scope is more limited.

-

Advantages: low cost and high scalability.

-

Disadvantages: does not support complex smart contracts and has relatively simple usage scenarios.

-

Example project: OMG Network .

Image Credit: Crypto Exchange

Image Credit: Crypto Exchange

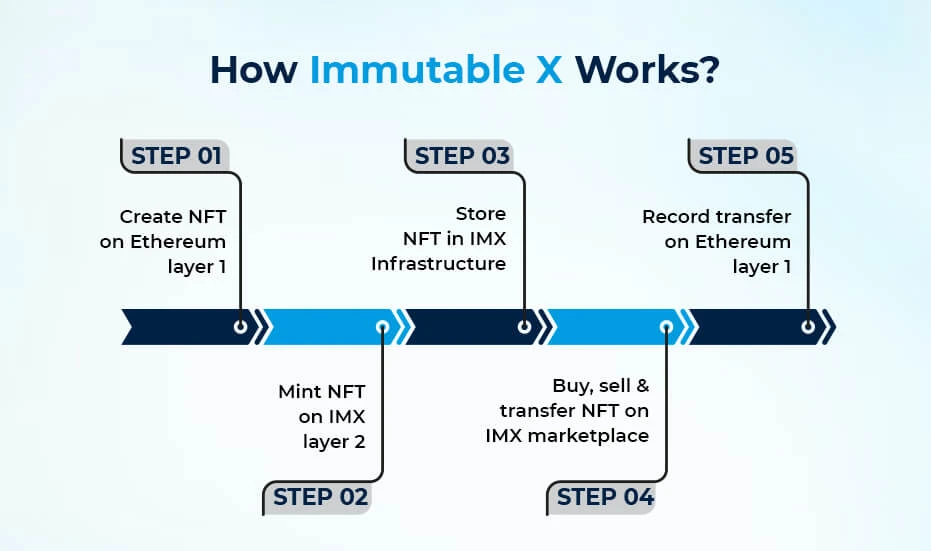

Validium

-

Operating mechanism: Similar to ZK-Rollup, but the data is stored off-chain, further reducing the load pressure on the chain.

-

Best for: If you need to process a large number of transactions, such as enterprise applications or NFT markets, Validium is a good choice.

-

Advantages: extremely fast transactions, high security, and extremely low fees.

-

Disadvantages: Data is stored off-chain, which may require additional trust in a third party and involve certain risks.

-

Example project: Immutable X (widely used for NFT trading).

Image Credit: Antier Solutions

From CEX to Layer-2: Reshaping Contract Trading

Want to take your contract trading to the next level? Don’t be held back by high gas fees and slow transfer speeds! At XT.COM, we have thoroughly optimized the deposit and withdrawal process by introducing Layer-2 (L2) technology, making your trading experience fast and worry-free. Here are a few reasons why L2 can make contract trading more efficient:

Lower fees and faster payment

Gas fees are ridiculously high? Transfers are so slow that it drives you crazy? Dont worry, Layer-2 technology can help you easily solve these problems. With L2, transfers are faster and fees are lower, and your funds can be invested in transactions more efficiently instead of being wasted on high network fees.

Greater liquidity and more efficient markets

Lower fees and faster capital turnover will attract more traders, which means stronger market liquidity and tighter spreads. This is a win-win for futures trading – not only do you enjoy fairer prices, but you also gain an advantage in a more active market.

Safe and reliable, rest assured trading

Worried about the safety of your funds? Dont worry, the Layer-2 solution inherits the strong security of 이더 리움 . Coupled with XT.COMs solid trading infrastructure, your funds can be protected both on and off the chain. You only need to focus on trading, and leave the rest to us!

Smoother experience, easier transactions

Are you still worried about the slow recharge and withdrawal? After using L2, the operation becomes very simple. Fast recharge, faster withdrawal, less waiting time, you can seize market opportunities more timely and adjust trading strategies flexibly.

XT.COM + Layer-2, transaction efficiency doubled!

Lets put it bluntly: XT.COM combines a powerful contract trading engine with Layer-2 technology to provide a fast, efficient, and low-cost contract trading experience. Whether its reducing fees, speeding up capital flow, or making the entire operation more worry-free, we are escorting every transaction for you.

Asset Bridging: Real-World Applications

Bridging, as the name implies, is the transfer of assets from one blockchain network to another. For traders, this usually means bridging assets from the 이더 리움 mainnet (Layer-1) to the Layer-2 network, or switching between different L2s. The benefits of bridging are obvious: lower fees, faster transfers, and a more efficient trading experience.

Bridging Basics

During the bridging process, assets will be locked on the source chain (such as the Ethereum mainnet), and corresponding wrapped tokens will be generated on the target chain (such as Arbitrum). When it is necessary to return to the source chain, the wrapped tokens of the target chain will be destroyed and the original assets of the source chain will be unlocked.

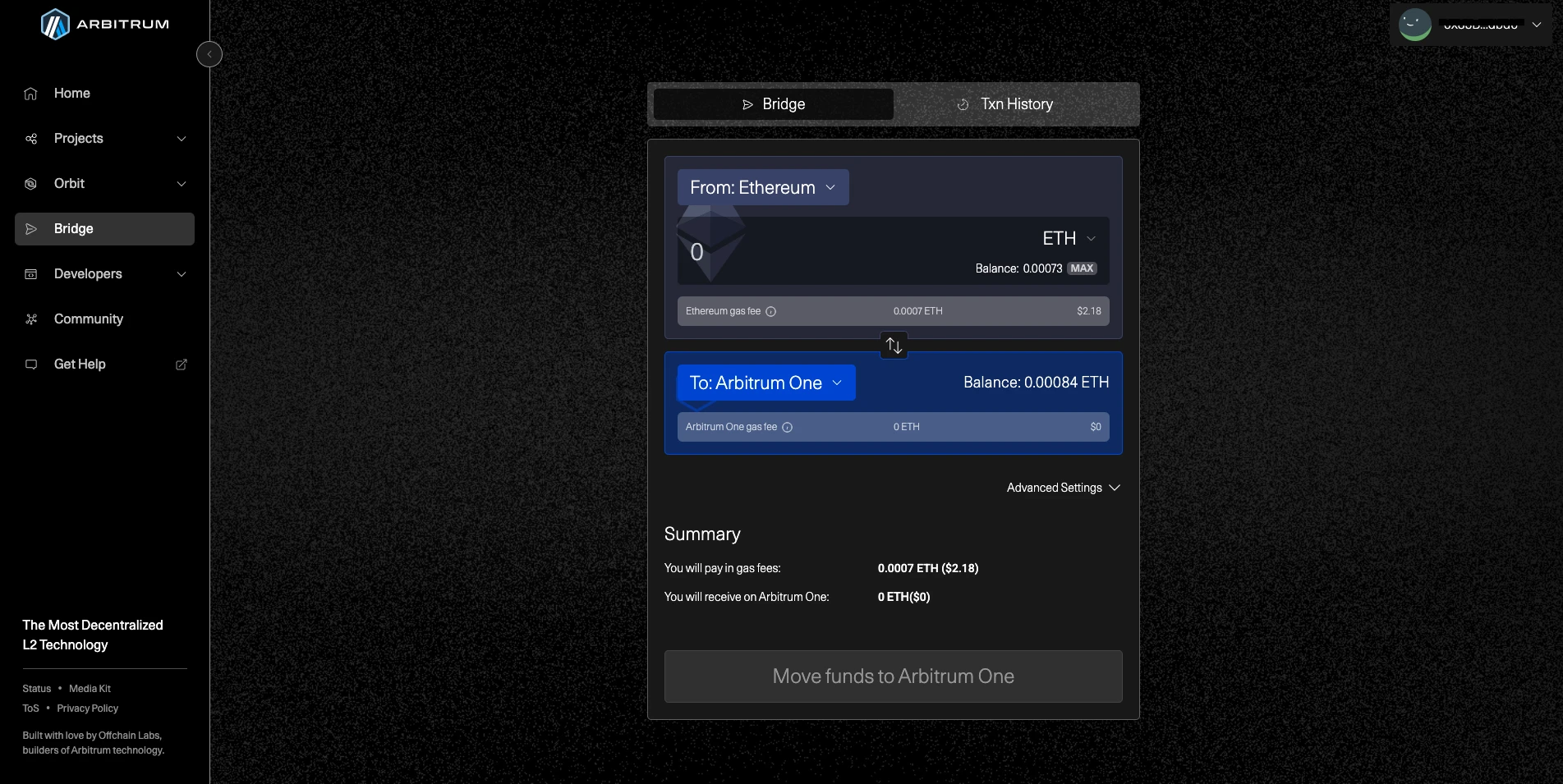

Example flow: From Ethereum to Arbitrum to XT.COM

Here are the detailed steps on how to transfer assets from 이더 리움 to Arbitrum via the bridge and then deposit them into your XT.COM account:

1. Select a supported bridge tool

-

I. First, choose a bridge tool that supports Arbitrum.

-

II. Recommended tools: Arbitrum official bridge ( bridge.arbitrum.io ) or other reliable third-party services, ensure compatibility with XT.COM.

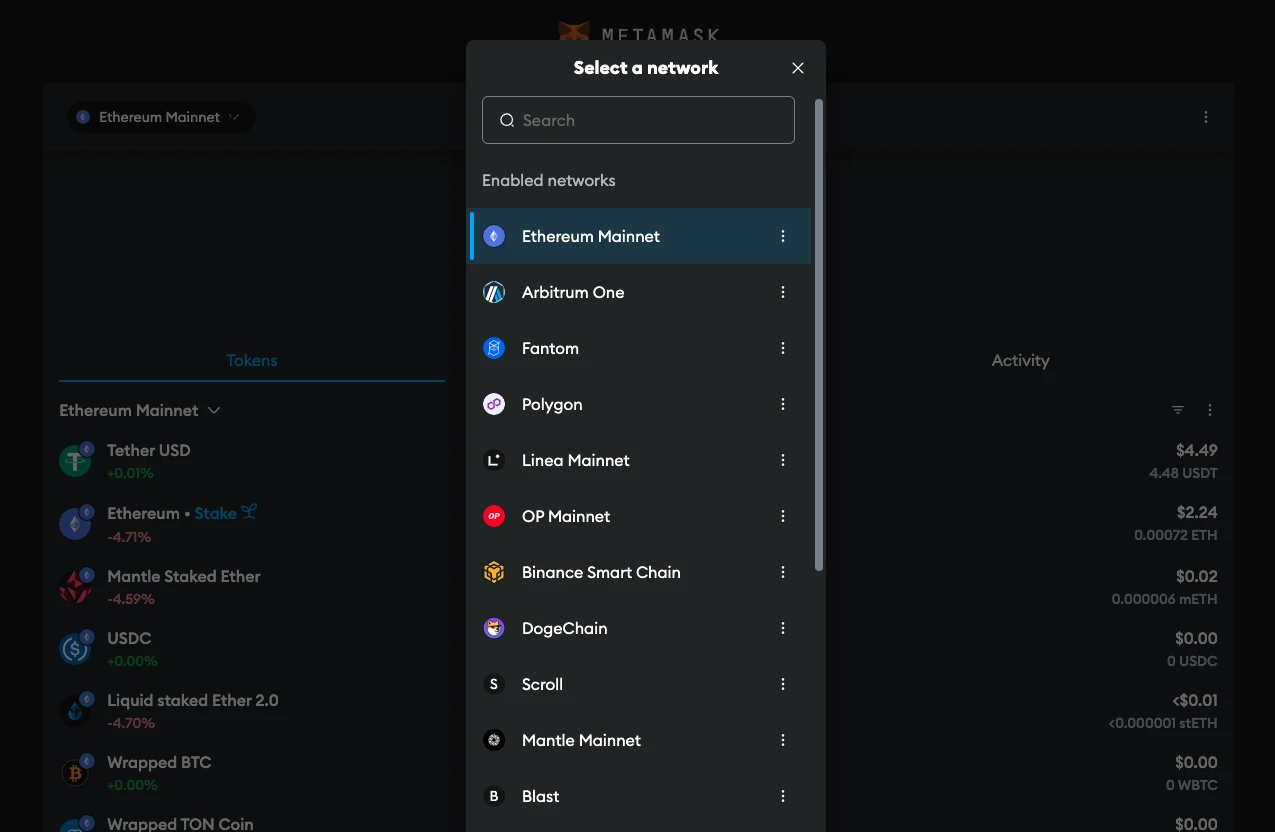

2. Connect your wallet

-

I. Open MetaMask (or other compatible wallet) and switch to the 이더 리움 network.

-

II. Make sure you have enough ETH in your wallet to pay for the gas fee, which is essential for approving the bridge transaction.

3. Initiate a bridge transaction

-

I. In the bridge interface, select 이더 리움 as the “Source Chain” and Arbitrum as the “Target Chain”.

-

II. Select the token you want to bridge (e.g. ETH, USDT or other ERC-20 tokens) and confirm the transaction.

-

III. Wait for on-chain confirmation. Once completed, your tokens will appear on the Arbitrum network in a “wrapped” form.

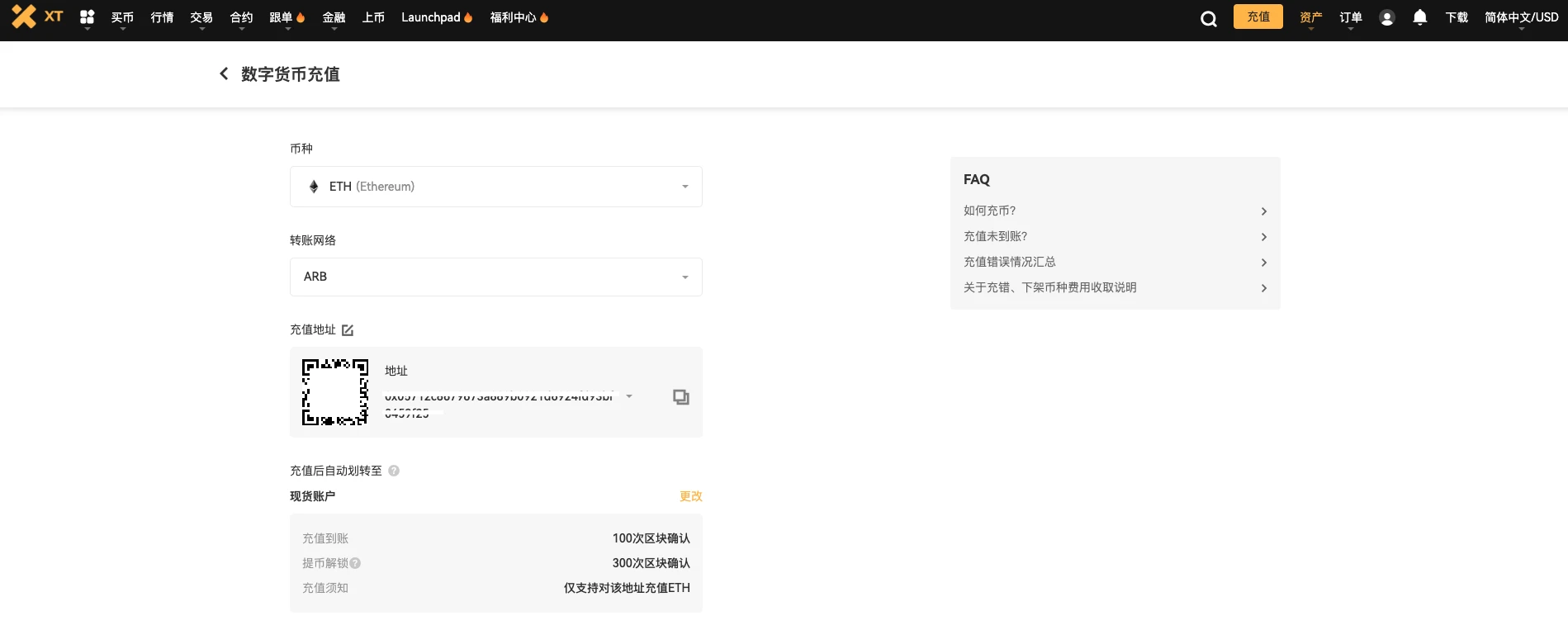

4. Deposit to XT.COM

-

I. Log in to XT.COM and find your Arbitrum deposit address.

-

II. Send tokens from your Arbitrum wallet to the XT.COM deposit address.

5. Start trading!

-

I. Once the tokens arrive in your XT.COM account, you can start contract trading immediately without worrying about high gas fees or long waits.

-

II. Enjoy faster capital turnover, lower transaction costs and more market opportunities!

Why is bridging important to traders?

-

Save on gas fees: After bridging to Arbitrum, the fee for recharging XT.COM is much lower than using the 이더 리움 mainnet directly.

-

Accelerated transfer times: The Arbitrum network’s faster processing speed means you can deposit funds almost instantly.

-

Seamless trading experience: With the efficiency of Layer-2, you can allocate funds more flexibly and devote more time and energy to trading strategies instead of worrying about network latency and fees.

XT.COM Case: Why choose Layer-2?

Improve user experience: XT.COM simplifies the users deposit and withdrawal process by supporting the Layer-2 network, providing traders with a smoother operating experience.

More efficient cost management: Low fees and fast deposits mean traders can manage capital more efficiently and reduce waste.

What Ethereum (ETH) trading pairs does XT.COM have?

Spot market: ETH/USDT spot

Leveraged market: ETH/USDT leverage

Contract market: Perpetual Ethereum (ETH) contract , Futures Ethereum (ETH) contract

Rise to the challenge and embrace the future of Layer-2

Current Challenges

Cross-chain is too troublesome!

-

Although there are many Layer-2 solutions and bridge tools, the transfer of assets from one Layer-2 to another is not smooth enough. You may need to go through several steps or even rely on third-party tools, which is really a headache.

A bit complicated to use

-

For those new to 암호화폐, Layer-2 bridge tools and interfaces are not always user-friendly. Setting up a wallet, selecting a network, and confirming transactions are all part of the process, which is a real adventure.

Safety hazards cannot be ignored

-

The security of Layer-2 mostly relies on Ethereum, but don’t forget that the bridged smart contracts may also have vulnerabilities. In addition, some off-chain data storage methods may increase trust risks, so be extra careful when choosing tools.

Regulation will become increasingly strict

-

As the crypto market continues to develop, regulation is also gradually increasing. Transferring assets through multiple chains may involve KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance issues, which may bring some restrictions to operations in the future.

Future Innovation

Faster Rollup technology is on the way

-

Technical developers are improving optimistic Rollup, such as shortening the challenge period to make withdrawals faster! At the same time, ZK-Rollups privacy protection function will be more powerful and support more complex operations. The future of Rollup technology will become fast and smart.

Cross-chain bridging is easier

-

Still worried about cross-chain operations? Cross-chain protocols such as Polkadot 그리고 코스모스 , as well as some bridge tools designed specifically for Layer-2, are working to make asset transfers between different blockchains smoother. No more hassles of switching networks.

The DeFi ecosystem will be richer

-

DeFi on Layer-2 is expanding rapidly, and you may see deeper liquidity pools, more complex financial instruments (such as options and margin trading), and even almost free operation costs in the future. Whether you are a novice or an old hand, you will find it easy to get started.

The perfect combination of CEX and DeFi

-

Some exchanges have begun to mix DeFi features, such as completing staking or liquidity mining directly on Layer-2. This combination will make operations efficient and simple while retaining the CEX-friendly user interface.

Image Credit: Finshots

Summary: meet challenges and embrace innovation

Although 이더 리움 s Layer-2 still faces some challenges, these problems are being gradually solved, and the future development space is undoubtedly exciting. From faster Rollups to seamless cross-chain bridges to exchanges with hybrid DeFi functions, everything is moving towards a more efficient and secure direction.

For traders like you, understanding these trends can help you better grasp market changes. On trading platforms that support Layer-2 (such as XT.COM), you can easily take advantage of these advantages and gain an advantage over your competition. The future of the crypto world belongs to those who dare to try new technologies, and now is the best time to start!

About XT.COM

Founded in 2018, 엑스티닷컴 currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading 및 contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

This article is sourced from the internet: Layer-2: Unleashing the potential of Ethereum and reshaping contract transactions

Related: BTC Volatility Weekly Review (December 23-30)

Key indicators: (December 23, 4pm -> December 30, 4pm Hong Kong time) BTC/USD fell 1.9% ($95,300 -> $93,500), ETH/USD rose 3.0% ($3,300 -> $3,400) The price action over the past week was quite volatile, but it ultimately held between $92,500 and $99,000, resulting in a reduction in realized volatility (at least the volatility between settlement points). We speculate that this trend will continue in the next few trading days, but there is a possibility of volatility at the end of the year settlement. At the same time, this long round of price adjustment may end before the end of the year and prepare for the next round of increases. The current support level is as low as $92,000, and we expect to find good support at the $90,000 level, with…