A new trend in AI Agents: a new round of DeFAI internal competition begins

원저자: Haotian(X: @tme l0 211 )

Suddenly, a spring breeze comes, and even an iron tree can blossom. How come so many DeFai projects emerge like magic in such a short time? Standards and frameworks havent been figured out yet, and a new round of DeFai internal war has begun? Okay, next, I will share from a popular science perspective, what is going on with several major categories of DeFai projects?

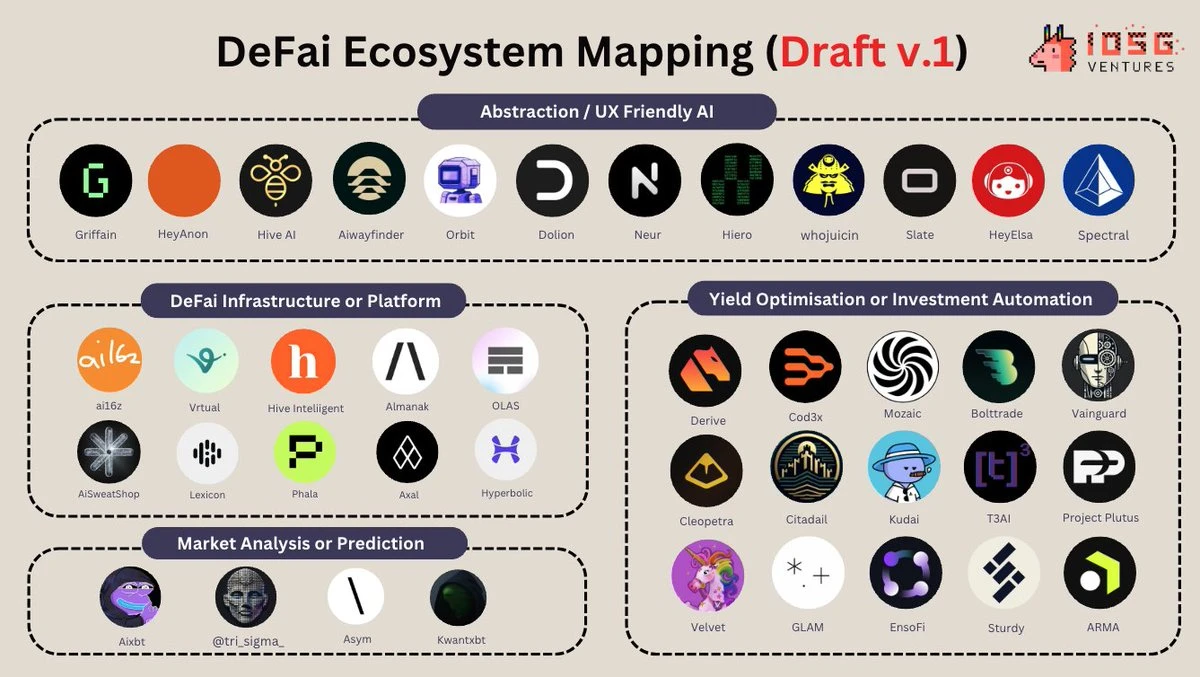

1) In the past two days, @poopmandefi shared a distribution map of DeFai ecosystem projects, which was widely circulated in the community. Looking at the comments, there are still too many related projects that have not been included. Many people will be anxious and worry about missing out on wealth codes, but there is no need to worry.

First of all, it needs to be pointed out that there are certainly some good AI new projects on Mindshare, such as: $AIXBT , $BUZZ , #NEUR , #GRIFT , #Cod 3 x , etc., but most of them are new faces that exude an old flavor from beginning to end.

The core reason is that most of them are old projects that have been given new expectations through the new narrative of AI Agent , some old projects that have done a lot of work to optimize the experience in the DeFi field but have no one interested in them, and some old projects that were difficult to discover in the context of the last round of VC attracting the attention of retail investors.

2) There are four major categories in the figure below. I will try to analyze my understanding one by one:

1. AI Abstraction: As the name suggests, AI abstraction is the process of encapsulating the information processing capabilities of large AI models into a front-end product experience with which users can directly interact semantically. Users can enter some prompts to directly call the transaction interface in the dialog box front end, and the AI backend will automatically complete the transaction.

Because of this, such products are looked down upon at first glance, because there is a lot of friction in the early product interaction experience. For example, the ambiguity of the user input prompt and the precision of the AIGC backend to process information and execute requirements require a fault tolerance mechanism. Either users feel that the instructions that can be entered and executed are too simple to compete with the current DeFi experience, or users enter too many high-expectation instructions and find that the program background does not have an accurate execution solver and cannot handle it.

However, this type of product can also gain the trust of a large number of users with its novel interaction mode and solutions to some basic issues such as Swap and Staking. The reason is that its potential is highly predictable. Because users can input prompts in convenient ways such as text and audio, which are in line with their usage habits, it will greatly reduce the threshold for use. At the same time, the processing power of the AIGC background will gradually encapsulate more new solver execution solutions to improve the user experience.

Anyway, this is an attempt to explore a new trading paradigm, just like when Uniswap entered the market with the AMM Swap trading pool paradigm, it was also complained about slippage and friction at the beginning. The AI Abstraction segment is indeed tasteless in the short term, but the big paradigm shift opportunities that are nurtured in the long term are worth paying attention to.

2. Autonomous Portfolio Management Yield Optimization: This type of product is the result of the previous round of DeFi market involution. A large number of projects that want to get a piece of the DeFi track have continued to work from the perspectives of personalization, customization, vertical segmentation, and specialized experience. However, before they can reap the fruits of victory, the DeFi industry has become almost desolate.

Most of these DeFi yield optimization strategies come from the teams ability to monitor and analyze on-chain data, such as transaction depth, capital flow, APY fluctuations, slippage estimates, price deviations, arbitrage space, risk warnings, etc. Based on these real-time on-chain data analyses, a set of execution strategies are formulated, such as position capital allocation, arbitrage opportunity capture and execution, Yield estimation, single pool or combination strategies, impermanent loss management, liquidation risk control, etc.

In simple terms, the core of this type of product is real-time on-chain data + trading opportunity capture capabilities, plus a complete set of automated analysis and execution experience upgrade capabilities based on smart contracts. At first glance, what does it have to do with AI? The combination point is that data analysis and strategy formulation can be used in the strategy training and fine-tuning of traders to run a set of possible investment opportunities with higher efficiency than manual work.

Moreover, the imagination space is even greater after combining with AI Agent. Everyone can use their own strategy to fine-tune an AI Agent with personal trading preferences to automatically help them find opportunities on the chain and automatically execute transactions. Making AI Agent an advanced trading assistant for people is a long-term sexy and online narrative.

3. 시장 Analysis or prediction: This type of product, as a powerful single AI, has captured most of the users mindshare. For example, @aixbt_agent has indeed become a key information acquisition platform for many traders as a top KOL. However, everyone recognizes the actual application scenario capabilities of AI Agents that only provide trading strategy analysis, but lacks long-term imagination space. For example, can my AI Agent monitor AIXBTs news and automatically help me decide to buy the bottom and arbitrage? And so on.

In theory, it is feasible. In fact, AI Agents such as AIXBT are fully capable of autonomously managing user assets and helping users to trade based on their own information decisions. However, this step has not yet been taken. At present, such products have captured users minds so quickly, and the commercial monetization capabilities behind them driven by traffic have a lot of room for imagination.

4. DeFai infrastructure or Platform: This type of protocol covers a wide range. In addition to emerging AI Agent Native platforms such as #ai16z 그리고 #Virtaual , other project business frameworks related to AI computing power, data, fine-tuning, etc., such as Bittensor, io, Atheir, @hyperbolic_labs , Vana, SaharaAI, etc. can be extended here.

After all, for AI Agent to operate normally, data is oil, computing power is the power grid, reasoning is the transformer, AI Agent is the terminal, etc., they are all upstream service providers.

So, there is not much to say. The second half of AI Agent needs to accumulate strength, and this type of DeFi platform will 디파이nitely make great efforts. Originally, AI Agent narrative is only the earliest link in AI Narrative. Frameworks and standards, DeFai, Gamfai, MetAiverse and other focus narratives are inseparable from these AI infra platforms.

위에.

Although I have given everyone a clear perspective on DeFai, it does not mean that I am not optimistic. Compared with the current chaotic and difficult-to-narrate framework and standard chaos era market, DeFai at least represents a more AI Agent application, and can see progress and expectations step by step through experience, PMF product landing, etc.

This is also a manifestation of the current AI Agent markets popularity shifting from virtual to real. Moreover, so many old species could not find opportunities in the old DeFi era. In the face of new trends, isnt this an opportunity for them to unleash their potential?

This article is sourced from the internet: A new trend in AI Agents: a new round of DeFAI internal competition begins

Related: From developer ecology to supply chain, Solanas AI ecological conspiracy

Editor鈥檚 Note: The first time I wrote about Griffain and SendAI hackathon was on December 13th. At that time, Solana hackathon and Griffain became popular, which caused a wealth effect in Solana. Now, with the outbreak of AI market, Griffains market value has reached its highest point in history today, exceeding 480 million US dollars. SendAI token Send has also returned to a market value of 100 million US dollars. In the current situation of super-fast evolution of AI Agent ecology, what advantages and progress do Griffain and Send have? Web3 version of Perplexity, or Solanas App Store? When we look back at the past of founder Griffain, we will find that he did not join Crypto at the very beginning, but grew up in Silicon Valley for 6 years…

I want to share my experience regarding a Bitcoin investment scam involving inefex.com where I lost over $375,000. Fortunately, I was able to recover my funds with the help of [www.BsbForensic.com] They are truly one of the rare services that can help in such situations. If anyone is facing a similar issue, I highly recommend reaching out to them for assistance.