HashWhale BTC Mining Weekly Report | Bitcoin mining difficulty continues to hit new highs; miners income has reached US$

1. Bitcoin market and mining data

From December 30, 2024 to January 5, 2025, the price trend of Bitcoin showed a certain volatility. The main changes during this period are as follows:

On December 30, 2024, Bitcoin surged to over $94,900 on the same day, but failed to maintain the upward trend and fell back to around $92,700 at the end of the day. 시장 sentiment was bearish and short-selling forces were dominant. From December 31, 2024 to January 1, 2025, Bitcoin rebounded to over $96,000 after hitting support near $92,000 at the end of the year. Despite the selling pressure from above, it still closed slightly higher, indicating the return of long forces. On the first day of the new year, the price continued to fluctuate and rise, with the price around $94,000, showing an overall upward trend. On January 3, the daily increase was significantly enlarged, and the price broke through the key resistance of $95,000 and then fluctuated to over $97,000, indicating that market funds were active and the trend was further strengthened. On January 4, the price fluctuated at a high level, and the market showed profit-taking sentiment. It may enter a consolidation phase in the short term, but it still remained above $96,000 overall, indicating strong support. On January 5, the price of Bitcoin continued to fluctuate at a high level, the market sentiment was cautious, and investors were in a wait-and-see mood. The price remained between $97,000 and $98,000.

Bitcoin price trend (2024/12/30-2025/01/05)

Market dynamics:

With the year-end fund reallocation and the start of the new year investment strategy, Bitcoin, as digital gold, has attracted capital inflows.

Institutional investors may have increased their positions, thereby driving prices up rapidly.

Analysis of influencing factors:

1. Macroeconomic policies:

Fed interest rate policy: In 2024, the Fed cut interest rates several times, and the latest rate was adjusted to the range of 4.25%-4.5%. Although inflation has fallen from its peak, it is still above the target level of 2%. According to the latest forecast, the Fed may cut interest rates twice in 2025, totaling 50 basis points. High interest rates may reduce the markets interest in high-risk assets (including 암호화폐currencies).

2. Political factors:

Trump Administration’s Cryptocurrency Policies: President-elect Donald Trump has a supportive stance on cryptocurrencies, plans to build a strategic Bitcoin reserve, and nominates officials who support cryptocurrencies. These policies could have a positive impact on Bitcoin prices.

3. Market sentiment:

Investor Sentiment: The Fear and Greed Index is 61, indicating that market sentiment is biased towards greed and investors are optimistic about Bitcoin.

4. Technical factors:

Technical indicators: Bitcoin price broke through the upper boundary of the bullish channel, showing an upward trend. The relative strength index (RSI) also showed a buy signal.

Hash rate changes:

The hash rate of the Bitcoin network experienced significant fluctuations during the period of 2024/12/30-2025/01/05. Starting from December 30, 2024, the hash rate continued to fall from 957.78 EH/s to 708.43 EH/s. However, between December 31 and January 1, 2025, the network hash rate quickly rebounded to 955.33 EH/s, and then fell again to around 655.44 EH/s, showing a fluctuating upward trend. Starting from January 2, the hash rate continued to climb to 990.64 EH/s, and hit a record high of 1,000 EH/s in the early morning of January 3, and then fell to 759.66 EH/s. On January 4, the hash rate stabilized at around 750 EH/s. It rose slightly and stabilized at around 825 EH/s on January 5. At the time of writing, the hash rate is 838.92 EH/s.

This historic growth is noteworthy—the new high of 1,000 EH/s reached on January 3 is almost double the network hash rate from 12 months ago. This drastic change reflects both the advancement of global mining technology and the increasing competition in the industry.

Bitcoin network hash rate data

Hash rate distribution and concentration of the Bitcoin network:

It is worth noting that the United States dominates the Bitcoin network hash rate, contributing more than 40% of the worlds computing resources. According to TheMinerMag, the two major mining pools in the United States, Foundry USA and MARA Pool, account for more than 38.5% of all mined blocks. Foundry USAs hash rate has increased from 157 EH/s at the beginning of 2024 to about 280 EH/s in December, becoming the worlds largest single mining pool by hash rate, controlling about 36.5% of the total hash rate of the Bitcoin network.

This regional concentration of computing power brings new considerations to mining efficiency and regulation, while also increasing attention to the potential for market expansion in other regions.

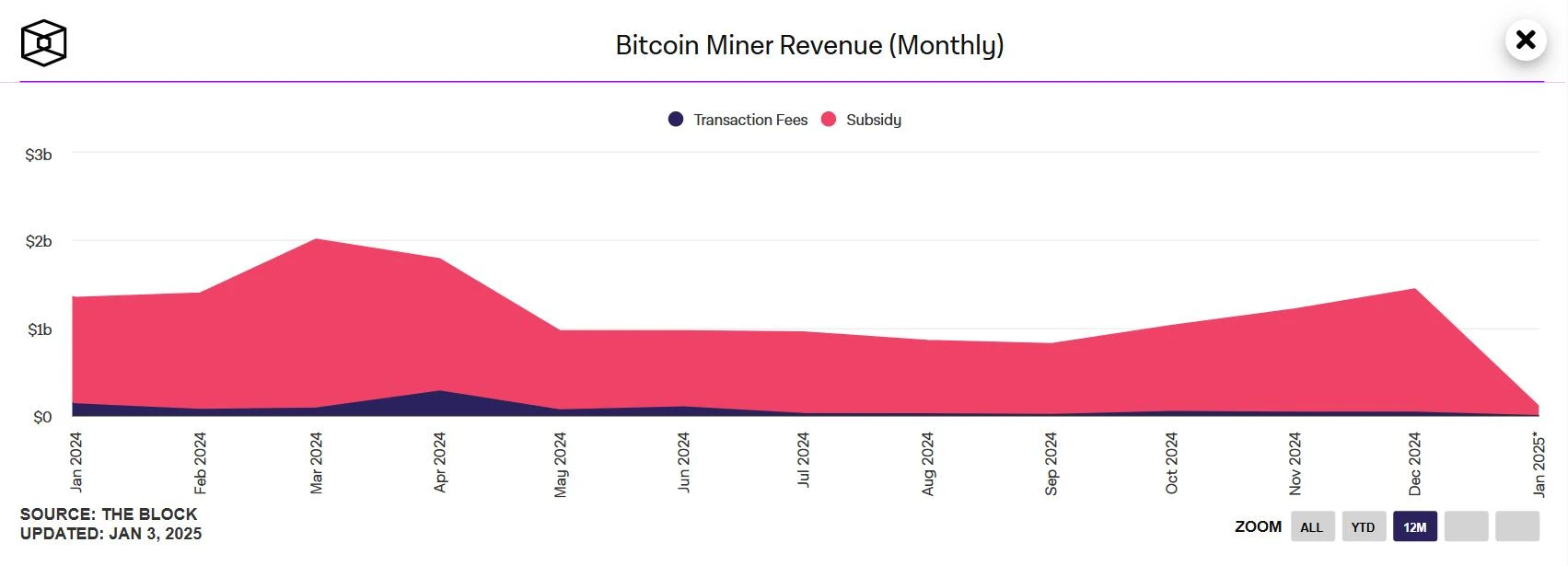

Mining income:

TheBlock data shows that Bitcoin miners revenue in December has reached $1.44 billion, a record high since May this year, exceeding the $1.21 billion in November. In addition, $38.73 million of miners revenue in November came from on-chain fees, while in December it was $37.69 million.

Bitcoin Miner Income Data

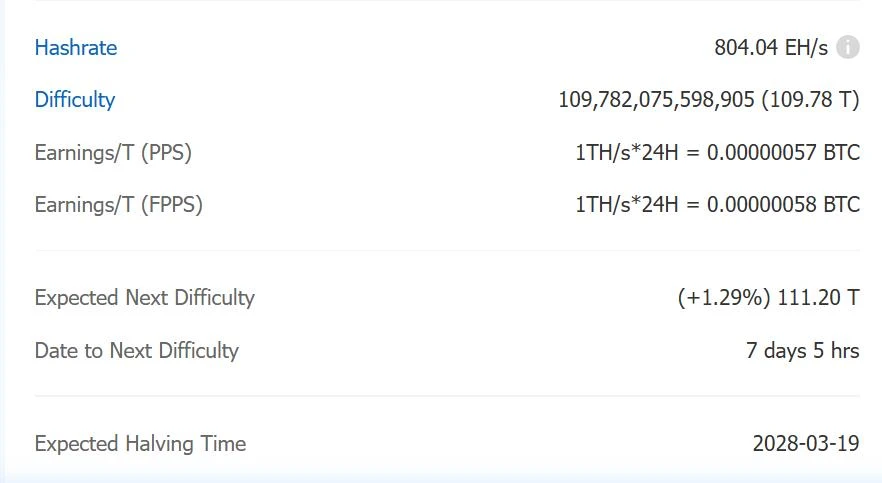

Energy costs and mining efficiency:

CloverPool data shows that Bitcoin mining difficulty has been adjusted at block height 876,960 (December 30, 2024 at 5:55:37), with the mining difficulty increased by 1.16% to 109.78 T, setting a new record high. As of writing, the average computing power of the entire network is 804.04 EH/s. It is expected that the next mining difficulty will increase by 1.29% to 111.20 T, and the next adjustment will be less than 8 days away.

From December 30, 2024 to January 5, 2025, the mining difficulty and computing power of the Bitcoin network are at historical highs. Although the efficiency of mining machines has improved, the rapid growth of global computing power and changes in energy costs have posed new challenges to mining efficiency and profitability. Miners need to continue to pay attention to market dynamics and optimize operational strategies to maintain a competitive advantage.

Bitcoin mining difficulty data

2. Policy and regulatory news

The People’s Bank of China releases a financial stability report, mentioning Hong Kong’s cryptocurrency regulation

On December 30, the Peoples Bank of China released the China Financial Stability Report (2024), which included global cryptocurrency regulatory trends and emphasized the progress of cryptocurrency compliance in Hong Kong. In view of the possible spillover risks of crypto assets to the stability of the financial system, regulators in various countries have continuously increased their supervision of crypto assets. Among them, Hong Kong, China actively explored the management of crypto asset licenses, dividing virtual assets into two categories for supervision, namely securitized financial assets and non-securitized financial assets, and implementing a special dual license system for operators of virtual asset trading platforms, which are respectively applicable to the Securities and Futures Ordinance and the Anti-Money Laundering Ordinance. The supervision and licensing system, institutions engaged in virtual asset business must apply for registration licenses from relevant regulatory authorities before they can operate. At the same time, Hong Kong requires large financial institutions such as HSBC and Standard Chartered Bank to include crypto asset exchanges in the scope of daily customer supervision.

Japans Financial Services Agency considers changing the classification of cryptocurrencies to financial assets that can be invested by the public

On December 30, the classification of cryptocurrencies may change after the Japanese Financial Services Agency announced plans to begin treating cryptocurrencies such as Bitcoin as financial assets. Official documents show that the Financial Services Agency announced its position in the request for tax reform in fiscal 2025, hoping to begin treating crypto assets as financial assets that the general public can invest in.

Currently, Japanese law classifies crypto assets as “payment instruments” under the terms of the Payment Services Act. Moving to a 디파이nition more focused on “investment” would represent some kind of legalization of cryptocurrencies, but such a change would appear to depend on the stability of the cryptocurrency industry. While the document does not call for crypto tax reform, CoinPost writes that it suggests that Japan’s controversial crypto tax rules are “likely” to be “reviewed.”

South Koreas Financial Services Commission: Will postpone decision on whether to allow companies to open cryptocurrency accounts

On December 30, the Financial Services Commission of South Korea announced that the decision on whether to allow companies to open cryptocurrency accounts will be postponed until 2025. Following the convening of the first virtual asset committee, the second meeting in January of the new year is expected to re-discuss whether to allow the opening of Korean won corporate virtual asset accounts.

Previously, the Financial Services Committee was considering allowing central government departments, local governments, public institutions, and non-profit enterprises such as universities to issue real-name accounts in the first phase, but this issue has not yet been finalized. In particular, the recent impeachment situation has made it possible for the government to postpone further deliberations on the results of the virtual asset committees discussions.

3. Mining News

Ten Russian regions ban cryptocurrency mining starting today

On January 1, 10 Russian regions completely banned cryptocurrency mining on January 1, and another three regions implemented a partial ban. The government decree was passed on December 23, stipulating a complete ban on mining from January 2025 to March 2031, and in the other three regions, mining will be partially restricted in each heating season before 2031 (from November 15 to March 15 of the following year, except for the first year from January 1, 2025, when the ban takes effect).

Deputy Prime Minister Alexander Novak said in late December that the number of regions banning cryptocurrency mining could increase if requests are received from governors. Authorities in the Republic of Khakassia have already asked the Ministry of Energy to restrict mining activities in the region.

HC Wainwright: The total market value of Bitcoin mining companies may exceed $100 billion in 2025

On January 3, the US investment bank HC Wainwright wrote an article this week stating that it expects the price of Bitcoin to reach US$225,000 per coin by the end of 2025, which means that the market value of Bitcoin will reach US$4.5 trillion, accounting for about 25% of the market value of gold. At the same time, HC Wainwright also expects the total market value of Bitcoin mining companies to exceed US$100 billion.

The total amount of BTC transferred to exchanges and miner outflows have dropped significantly since November last year

On January 5, the exchange BTC inflow (the total amount of BTC transferred to the exchange) and miner outflow (the amount of BTC sent to the exchange by miners) have dropped significantly since November 2024, indicating that the selling pressure has eased. According to CryptoQuant data, after about two months of peak exchange inflow activity, the exchange BTC inflow in November 2024 peaked at 98,748 BTC on November 25. In December 2024, the exchange inflow declined, and the total number of 비트코인s sent to the exchange per day ranged from 11,000 to 79,000. The reduction in exchange inflows was accompanied by a reduction in miner outflows, indicating a reduction in the selling pressure of Bitcoin miners, who often sell their Bitcoin holdings to pay for operating expenses.

Miner outflow from July 2022 to January 2025

4. Bitcoin related news

The total holding value of the US spot Bitcoin ETF on the chain exceeds $100 billion

On December 30, according to Dune data, the total on-chain holdings of the U.S. spot Bitcoin ETF have exceeded 1.12 million BTC, and are now approximately 1.129 million BTC, accounting for 5.70% of the current BTC supply, and the on-chain holding value has reached approximately US$106.8 billion.

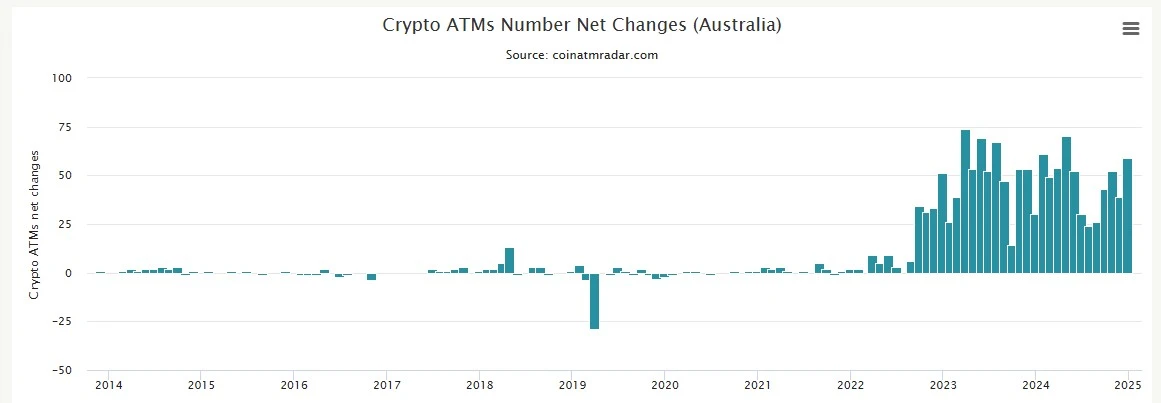

Number of Bitcoin ATMs in Australia grows for 29th consecutive month

According to Coin ATM Radar data on December 30, the number of Bitcoin ATMs in Australia has increased for 29 consecutive months. Australia currently has 1,359 ATMs, accounting for 3.5% of the total number of Bitcoin ATMs in the world. In addition, as of December 29, there were 31,516 Bitcoin ATMs in the United States. This means that the United States has 81.3% of all Bitcoin ATMs in the world. Canada ranks second with 3,027 Bitcoin ATMs, accounting for about 7.8% of the entire cryptocurrency ATM market.

Crypto ATMs removed or installed in Australia

Bitcoin mining uses more than 50% clean energy, and the market is waiting for Musk to fulfill his promise to resume accepting Bitcoin payments at Tesla

On December 30, according to Watcher.Guru, the clean energy usage rate of the Bitcoin network has now exceeded 50%.

Musk said in June 2021 that Tesla would resume accepting Bitcoin payments after the clean energy utilization rate for Bitcoin mining exceeded 50%.

Global Bitcoin holdings: BlackRock holds over 550,000 Bitcoins, El Salvador increases holdings by 53 Bitcoins

El Salvador: Added 53 BTC in the past 30 days, with total holdings now exceeding 6,002.77, with a Bitcoin market value of approximately $556 million.

Australias Monochrome: As of December 30, the Spot Bitcoin ETF (IBTC) held 266 BTC, with assets under management (AUM) of approximately US$39.957 million.

Yuxing Technology (Hong Kong stocks): Recently sold about 6.3 million USDT and purchased 78.2 BTC.

BlackRock: As of December 31, 2024, the number of Bitcoin held was 551,917.901, with a total market value of approximately US$51.731 billion.

CNBC: Many institutions are optimistic about the trend of Bitcoin in 2025, with the highest expected price of $250,000

On December 31, several industry observers interviewed by CNBC predicted the price of Bitcoin in 2025, with the highest expectation being that Bitcoin would rise to $250,000. James Butterfill, head of research at CoinShares, said that the price of Bitcoin could be between $80,000 and $150,000 in 2025. Matrixport said that Bitcoin could reach $160,000 by 2025. Alex Thorn, head of research at Galaxy Digital, expects Bitcoin to break through $150,000 in the first half of this year and reach $185,000 in the fourth quarter.

Standard Chartered Banks head of research expects Bitcoin to reach $200,000 by the end of 2025. Carol Alexander, a professor of finance at the University of Sussex, believes that the price of Bitcoin could reach $200,000 next year. Youwei Yang, chief economist at Bit Mining, expects Bitcoin to reach $180,000 to $190,000 in 2025. Sid Powell, CEO and co-founder of Maple Finance, predicts that Bitcoin will reach $180,000 to $200,000 by the end of 2025. Elitsa Taskova, chief product officer at Nexo, believes that Bitcoin will reach $250,000 within a year.

Industry insiders and institutions generally believe that the price of Bitcoin will reach $180,000-200,000 in 2025

On January 1, according to the forecast data compiled by Trader T, industry insiders and institutions generally believe that the price of Bitcoin will reach US$180,000-200,000 in 2025.

Historically, Bitcoin has performed well in the first quarter of the year following the halving.

On January 2, according to Coinglass data, historically, Bitcoin has performed well in the first quarter of the second year after the halving. The specific data are: Q1 2013: 539.96%; Q1 2017: 11.89%; Q1 2021: 103.17%.

Dennis Porter: A US state will start buying Bitcoin within 4 months

On January 2, Dennis Porter, co-founder and CEO of Satoshi Action Fund (SAF), posted on the X platform that a certain U.S. state is almost 100% certain to start buying Bitcoin within the next four months. He also said that his team is actively promoting the passage of relevant legislation, which is not a simple prediction, but a real progress that is happening.

Screenshot of Dennis Porter posting on X platform

Investment bank HC Wainwright raises Bitcoin price target for this year from $140,000 to $225,000

On January 3, investment bank HC Wainwright raised its target price for Bitcoin this year from $140,000 to $225,000, saying that price increases could be driven by regulatory clarity and institutional adoption.

MicroStrategy plans to raise $2 billion in the first quarter through the issuance of preferred shares and will buy more BTC

On January 4, according to an official announcement, MicroStrategy announced plans to raise up to US$2 billion through the issuance of preferred shares. This move is part of its 21/21 Plan, which aims to raise US$42 billion in three years (US$21 billion each in equity and fixed income).

The purpose of the offering is to allow MicroStrategy to continue to strengthen its balance sheet and acquire more Bitcoin, and the offering is expected to take place in the first quarter of 2025.

The announcement stated that the decision to proceed and complete the offering is at MicroStrategys sole discretion and is subject to market and other conditions, and MicroStrategy may choose not to proceed or complete the offering.

This week, Bitcoin spot ETFs had a net inflow of $255.3 million and increased their holdings by 2,421.94 BTC

On January 5, Lin Chen, head of Asia Pacific business at Deribit, wrote on X: “This week, the overall performance of BTC spot ETFs was a small net inflow. Although the market was closed on Wednesday and there was a large net outflow on Thursday, the inflows on the remaining days made up for this gap. The total net inflow for the week reached US$255.3 million, with an increase of 2,421.94 BTC.

Among them, BlackRock IBIT once again set a record of the largest single-day reduction of 3516.57 BTC on Thursday, while market sentiment rebounded on Friday, with an inflow of 2601.9 BTC, and Fidelity increased its holdings by 3684.64 BTC on the same day. The current BTC price has rebounded and remains in a wide range around $98,000.

This article is sourced from the internet: HashWhale BTC Mining Weekly Report | Bitcoin mining difficulty continues to hit new highs; miners income has reached US$1.44 billion (2024.12.30-2025.01.05)

Animoca Brands, a company dedicated to promoting games and digital property rights in the open metaverse , announced today that it has completed a $10 million financing for its Mocaverse, which has previously raised $31.88 million in financing (see the announcement on December 8, 2023 for details ). The funds raised will be used to build an interoperable infrastructure technology stack for consumer adoption of cryptocurrencies and build a large user base ecosystem. At the same time, the investment comes with a free warrant for the utility token MOCA, which has a fully diluted value (FDV) of $1 billion. Participants in this round of financing include OKX Ventures, CMCC Global, Hong Shan (formerly Sequoia China), Republic Crypto, Decima Fund, Kingsway Capital, etc. Their participation will help Mocaverse expand its operating…

Will see