When Bitcoin reaches $1 million, everyone will recall 2024, a year that will go down in history for the 암호화폐currency industry. Bitcoin was officially approved by the U.S. SEC for ETFs, and like gold and silver, it has become one of the worlds assets that cannot be reduced to zero. The price of a single coin of $100,000 also makes the market full of imagination about the future of cryptocurrency. Rhythm BlockBeats has sorted out 5 data, hoping that these data can help everyone understand what happened to Crypto this year? I also hope to help everyone look forward to what will happen in the future?

Chart 1: BTC market share

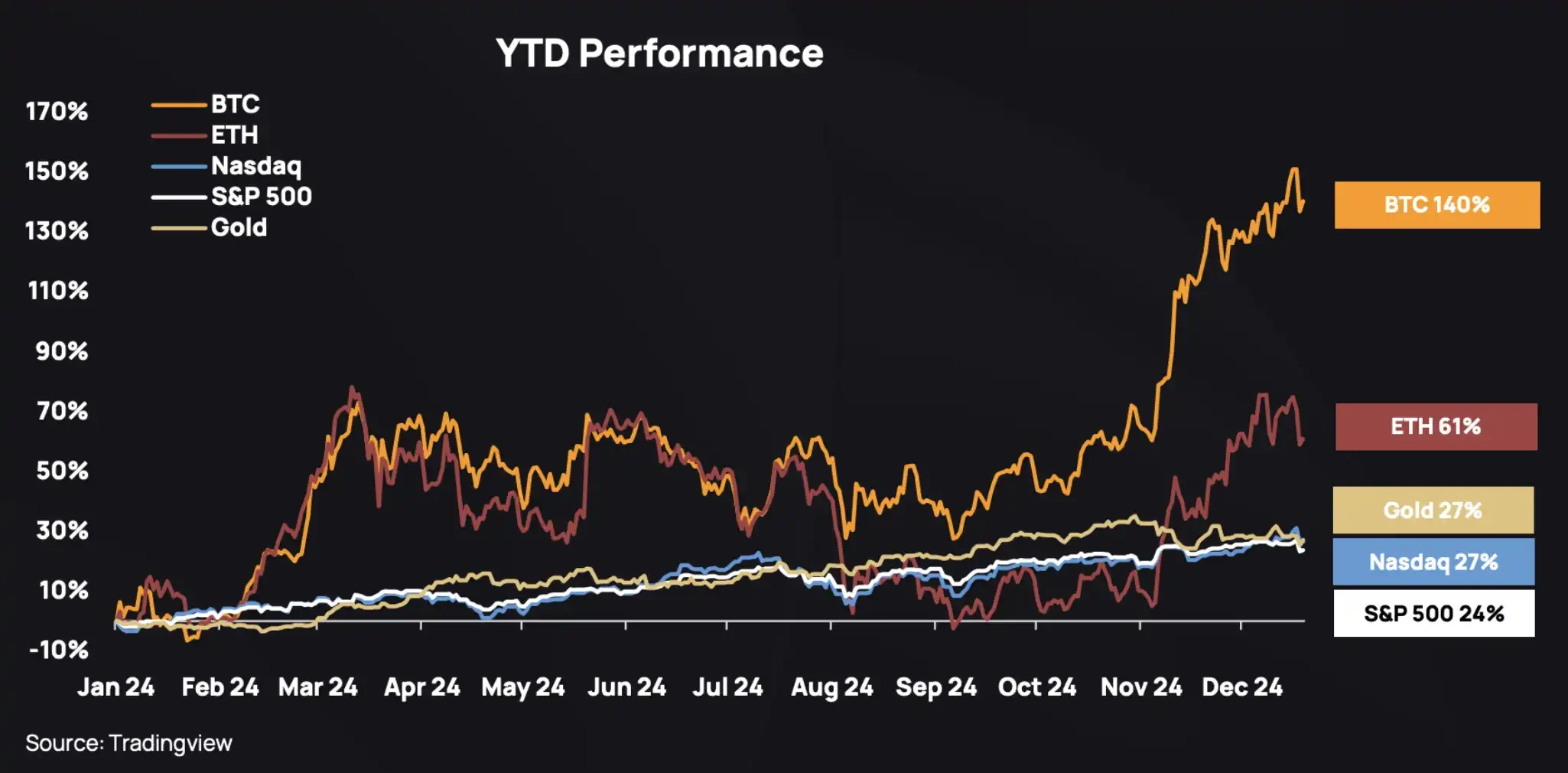

In 2024, Bitcoin rose by more than 130% this year. This increase is inseparable from the two key words Wall Street and Trump. In addition, Bitcoins pricing power and liquidity have undergone a structural shift after the explicit support of the U.S. financial and political circles.

Institutional entry, rapid progress

On January 11, ten Bitcoin spot ETFs were approved. After the good news came into effect, the price of Bitcoin experienced a period of Grayscale dumping and reached its first historical high in 2024 on March 13.

관련 자료: Bitcoin hits record high 15 years after its birth, and returns to $69,000 per coin in 800 days

Currently, Bitcoin spot ETFs absorb 259% of the average daily new issuance of Bitcoin. Since listing, these funds have received a total of $30 billion in positive inflows and hold more than 1.408 million Bitcoins, equivalent to 7% of the total circulating supply. Bitcoin ETFs have a total of 155 days of net inflows in 2024, with an average daily net inflow of 5,233 BTC; in contrast, there are 93 days of net outflows, with an average daily net outflow of 2,702 BTC.

Bitcoin spot ETF inflows and outflows in 2024; Source: SoSoValue

Bitcoin returns and ETF flows also showed a close correlation throughout the year. Sustained strong ETF inflows are usually accompanied by strong market performance, and vice versa. This relationship is also intuitively understandable, with ETF inflows reflecting the absorptive capacity of the spot market, i.e. buying pressure, while outflows reflect selling pressure.

The stable to negative capital flows during the summer corresponded to the market conditions of excessive selling by institutions such as the German government and Mentougou at the time, while the surge in capital flows in the fourth quarter coincided with Trumps election and MicroStrategys active holdings.

As of December 20, institutional investors purchased a total of 859,454 비트코인s in 2024, accounting for approximately 4.3% of the total circulating supply. Currently, institutional investors account for 31% of all known Bitcoin holders, a significant increase from 14% in 2023. In terms of listed companies, a total of 297,673 bitcoins were added in 2024, of which MicroStrategy purchased nearly 250,000 bitcoins through an active financing strategy, and currently holds 439,000 bitcoins. Although approximately 230,000 bitcoins came from bankruptcy liquidations and seized assets this year, institutional demand has effectively absorbed the selling pressure, and approximately 22% of the circulating supply is currently tradable in the market, close to the 2021 high level.

The fact that CME dominated the open interest volume throughout the year also shows that the Bitcoin market has shown a significant institutionalization trend. As the worlds top financial derivatives trading platform, CME has attracted a large number of professional institutional participants such as directional funds, basis traders and market makers with its strict regulatory framework and transparency.

Bitcoin contract holdings; Source: Coinglass

These institutions trade Bitcoin derivatives through CME, which not only brings higher capital efficiency and liquidity, but also gradually changes the market structure, making trading more concentrated in the derivatives market. At the same time, the activeness of complex financial products such as 2x leveraged Bitcoin ETFs has further consolidated the dominant position of institutional capital in the Bitcoin market, marking the Bitcoin markets move from retail-driven to institutional-led mature market.

Gradually deviating from the fundamentals of the cryptocurrency circle?

On April 20, Bitcoin ushered in its fourth halving, but the price on that day was inconsistent with the previous historical performance of an average increase of 22%, but fell by 8%. In the following 125 days, 2024 also became the worst performance after each halving.

One of the reasons for this phenomenon is that the actual impact of each halving relative to the circulating supply is constantly weakening, and this year, under the superposition of macro factors, this weakening is more significant. Data shows that the circulating supply of Bitcoin is expected to increase by 216,158 BTC in 2024, while the annual issuance in 2025 will be only 164,250 BTC, which is lower than the purchase amount of MicroStrategy between November 1 and December 12, 2024, making the annual inflation rate of the network only 0.8%.

Therefore, in the long run, the supply shock caused by halving will have less and less impact on Bitcoin prices. The greater determinant of Bitcoin prices in the future may shift to structural changes on the demand side, rather than relying mainly on the supply contraction caused by halving.

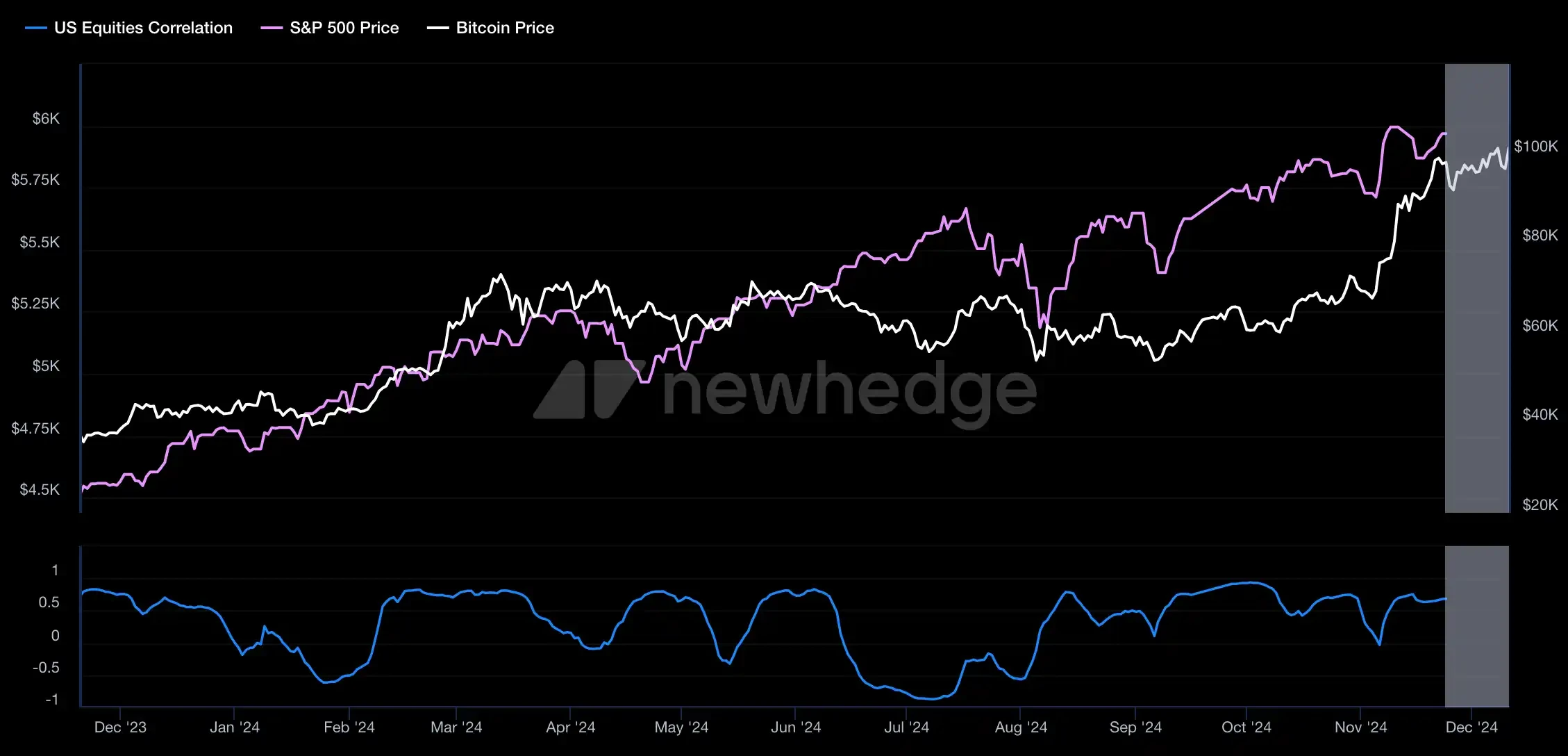

On the other hand, the correlation between Bitcoin and U.S. stock assets is getting stronger. In the financial market, asset allocation requires that when there is a large volatility, the assets in the basket will not rise or fall together. Therefore, when Grayscale bought Bitcoin crazily in 2019, the market understood it because Bitcoin had a very low correlation with all other dollar-denominated assets at that time.

But in 2024, the correlation coefficient between Bitcoin and the US stock market is positive most of the time, and the trend of Bitcoin and the US stock market is more synchronized than almost any time in the past, which shows that the macroeconomic variables that drive the stock market are also shaping the crypto market. Unless there is a black swan event specific to cryptocurrencies, this situation may continue throughout the Feds easing cycle.

Correlation coefficient between Bitcoin and US stocks in 2024, source: Newhedge

On August 5, the Japanese stock market collapsed, and global stock markets fell to varying degrees. Bitcoin also fell to its lowest level in months on the same day. Investors sold Bitcoin and Ethereum spot ETF stocks one after another, and the liquidation amount of Bitcoin reached US$1.16 billion within 24 hours.

Subsequently, analysts attributed the plunge in Bitcoin to the Bank of Japans unexpected rate hike, coupled with market expectations of a rate cut by the Federal Reserve, which increased uncertainty in central bank policies and led to deleveraging in the financial system. Many financial market participants borrowed yen to invest in high-yield assets and reversed their positions, and Bitcoin became a victim of this process. It was not until October that Bitcoin prices broke through $73,000 again, boosted by the prospect of a more crypto-friendly political climate.

At the same time, MicroStrategy (MSTR), the US stock with the highest correlation with Bitcoin this year, also joined the Nasdaq 100 Index on December 23, further pushing up the correlation between Bitcoin and US stock assets. In addition, the final rebalancing mechanism of funds investing in BTC ETFs will also enhance structural correlation.

Trumps market starts to show its power

In 2024, as Trump sought support from the crypto industry, the price of Bitcoin was closely linked to Trumps election chances. After Trumps victory was confirmed, the price of Bitcoin soared to $99,500, just one step away from six figures. On December 4, Bitcoin broke through $100,000 for the first time in history, pushing its market value to nearly $2 trillion, second only to Apple, Nvidia, Microsoft, Amazon and Googles parent company Alphabet in the market value ranking of US stocks.

Comparison of Bitcoin market value changes in 2024; Source: K 33 Research

관련 자료: Bitcoin Never Gives Up: $100,000 per coin, from zero to $2 trillion in 16 years

Michael Saylor and Trump are two key figures who are indispensable in summarizing Bitcoin in 2024. The former has crossed cycles and used financial instruments to leverage Bitcoin, becoming the happiest person in this bull market; while Trump announced at the Bitcoin conference that he would establish a national strategic reserve, and then fired Gensler and appointed a pro-crypto White House team, entering the game himself, opening up imagination for the development of Bitcoin as a mainstream asset in the new cycle.

Since the beginning of the year, institutions and MicroStrategy have net bought 683,000 bitcoins, of which 245,000 inflows occurred in the weeks after the US election, proving that the policy inclinations of the Republican Party and Trump will greatly boost the importance of Bitcoin in mainstream US assets, and that the market is full of expectations for Trumps presidency and its impact on the cryptocurrency market.

Late copycat season

Changes in Bitcoins market share have always been an important indicator for observing the market dynamics of the crypto industry. In 2024, Bitcoins market share has climbed all the way to 61% from the beginning of the year. At the same time, investors lamented that not many assets could outperform Bitcoin this year. The price performance of altcoins also made people in the circle frequently lament the difficulty of operations in this cycle.

Bitcoin price chart in 2024; Source: TradingView

Bitcoins market value increased by 141% in 2024, soaring from US$828 billion to US$1.98 trillion; Ethereums market value increased by 72% in 2024, from US$274 billion to US$473 billion; the market value of the rest of the altcoin market increased by 129% in 2024, from US$389 billion to US$886 billion, which was mainly due to the strong performance of SOL and meme coins. Only 25 of the top 100 altcoins by market value outperformed Bitcoin.

On the one hand, the highly valued VC coins are not recognized by the market this year, and on the other hand, Bitcoin, whose market share has been rising steadily in 2024, has not brought much real liquidity to the crypto market. Shenyu asserted in March this year that there is no alt season in this cycle because the liquidity injected by the Bitcoin spot ETF is less likely to flow into the crypto alt market, resulting in the market performance of Bitcoin is the only bull.

Looking back on this year, Bitcoin completed a capital relay race driven by Wall Street and policies, and re디파이ned its position as a global financial asset by breaking through the $100,000 mark. However, this is not just a breakthrough in price, but also a profound change in market structure, capital flows and asset cognition. The ETF trend of Bitcoin and the institutional-led market are pushing this decentralized asset to a broader mainstream stage, but also making it more complex and sensitive under the influence of macro variables.

From the marginal reduction of the halving effect to the boost of Trumps policies, what Bitcoin has demonstrated in 2024 is not only its ability to control the cycle, but also its ability to integrate into the global financial system. At present, the market may still be entangled in the problems of concentrated liquidity and the absence of altcoins, but in the long run, Bitcoin is evolving into a more resilient and more recognized global value storage.

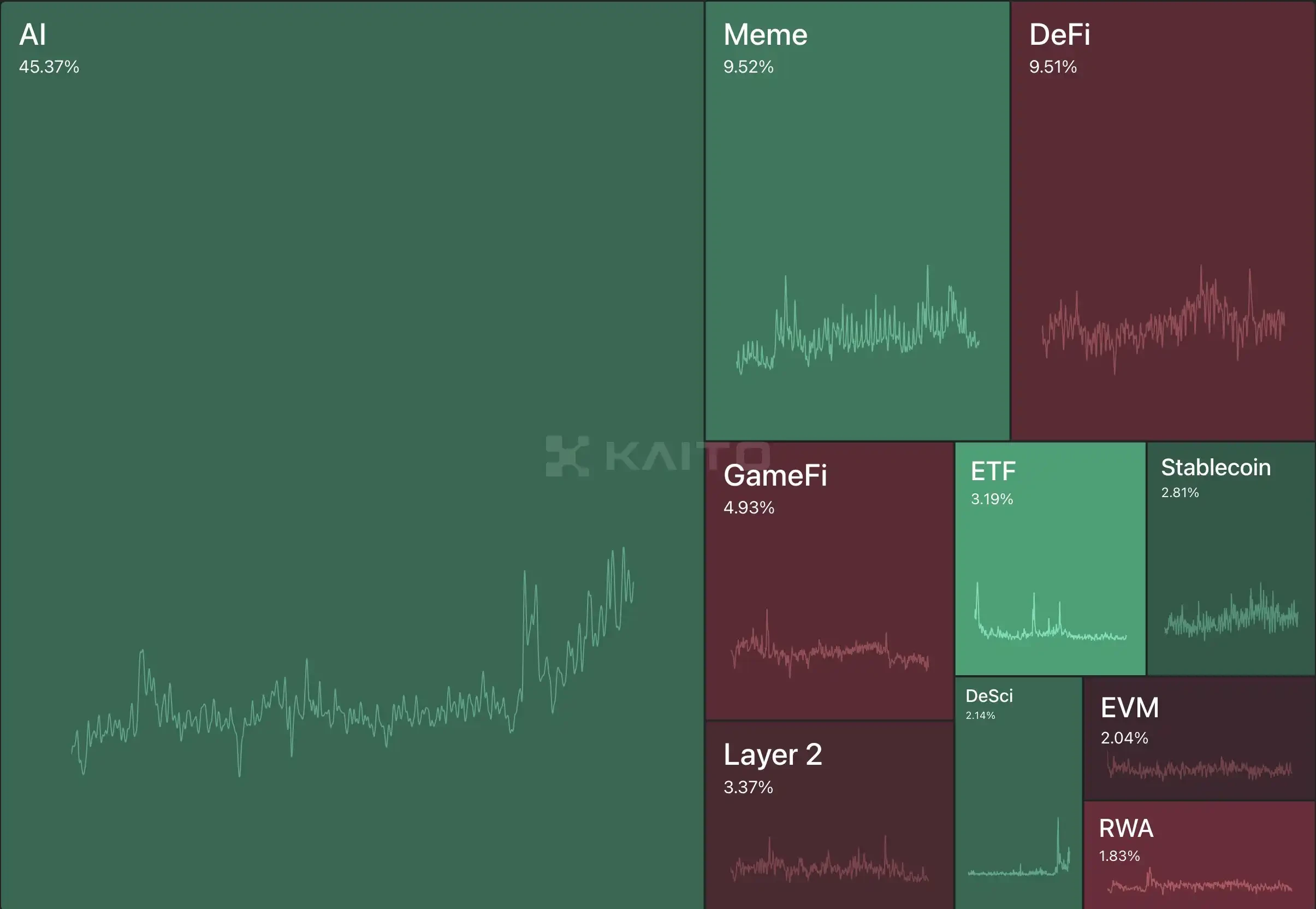

Figure 2: AI Mindshare

2024 is a magical year for CryptoAI. From the rise of the DePin concept driven by the surge in Nvidias stock price at the beginning of the year, to the development of data sets and machine learning, and finally the AI Agent craze ignited by Truth Terminal. Whether it is traders or developers outside the circle, whether it is retail investors or institutions, they have all set their sights on the AI Agent track. Lets review how this track with the most consensus has exploded in the past year.

2024 is a magical year for CryptoAI. From the rise of the DePin concept driven by the surge in Nvidias stock price at the beginning of the year, to the development of data sets and machine learning, and finally the AI Agent craze ignited by Truth Terminal. Whether it is traders or developers outside the circle, whether it is retail investors or institutions, they have all set their sights on the AI Agent track. Lets review how this track with the most consensus has exploded in the past year.

Decentralized computing power, the touchstone of CryptoAI

DePin sector index changes in 2024; Source: SoSoValue

In January 2024, OpenAI CEO Sam Altman pointed out at the Davos Forum that computing power and energy shortages are the biggest bottlenecks in the current development of AI, and predicted that computing power will be equivalent to currency in the future. Driven by ChatGPT sweeping the world and Nvidias stock price hitting new highs, the markets attention to the field of AI has increased unprecedentedly, especially in the context of scarce GPU resources around the world, the concept of distributed GPU projects is quite popular in the market. Not only are old projects such as FileCoin and Arweave returning to the market, new DePin projects are also emerging like snowflakes.

관련 자료:

What innovations will the combination of AI and DePIN bring?

Until around June, a large number of emerging Depin projects began to airdrop TGE tokens. This was a period for LuMao Studio, but then Nvidia surpassed a number of technology giants with its AI chip business to become the worlds most valuable listed company, and then began to fall. The reason was the FUD voice in the market. Many people believed that DePins computing power stability was not enough to support large model training or similar companies with medium and high demand at the time. In addition, the MeMe market was booming. Compared with the fast pace of MeMe, DePins verification cycle was too long, so they reduced their asset allocations and the market entered a period of cooling off.

Datasets and machine learning, the arsenal of AI agents

In addition to computing power requirements such as GPUs, data is the most important resource for AI development. Blockchain data provides unique value for AI/ML machine learning due to its open, transparent and verifiable characteristics. ML algorithms convert data into useful insights or actions through technologies such as GAN, VAE and Transformer. Now many large companies collect their own user data, because it can not only be used for AI training but also for training big data recommendations. Information data-related tokens have also followed the surge in popularity from AI at the beginning of the year to AI Agent at the end of the year.

In this era, data is a high-value asset. People have become accustomed to the fact that traditional companies directly obtain user information to make money, while users cannot make any profit from it. However, this year, the first awakening of information rights emerged, and DataDao was born, because Reddit revealed in its IPO prospectus in February this year that it had signed a data licensing agreement with an AI company and had achieved a total revenue of US$203 million, while Reddit users did not receive a penny.

r/datadao was born for this reason, issuing the token $RDAT to empower user data, allowing users to export their data on the Reddit platform and upload it to the community database to obtain tokens. This is also the first time that Dao has fought for the rights and interests of user data, and the driving force behind it is Vana, a machine learning platform listed on Binance in December.

Earlier this year, Vitalik put forward his views on the current CryptoAI in Prospects and Challenges of Crypto+AI Applications , in which he discussed the possibility of combining zero-knowledge proofs (ZK-SNARKs) and multi-party computing (MPCs) technologies with AI training sets. The improvement of these two technologies this year has also promoted the development of CryptoAI privacy algorithm projects, and several projects that provide platforms and ecosystems for machine learning have emerged.

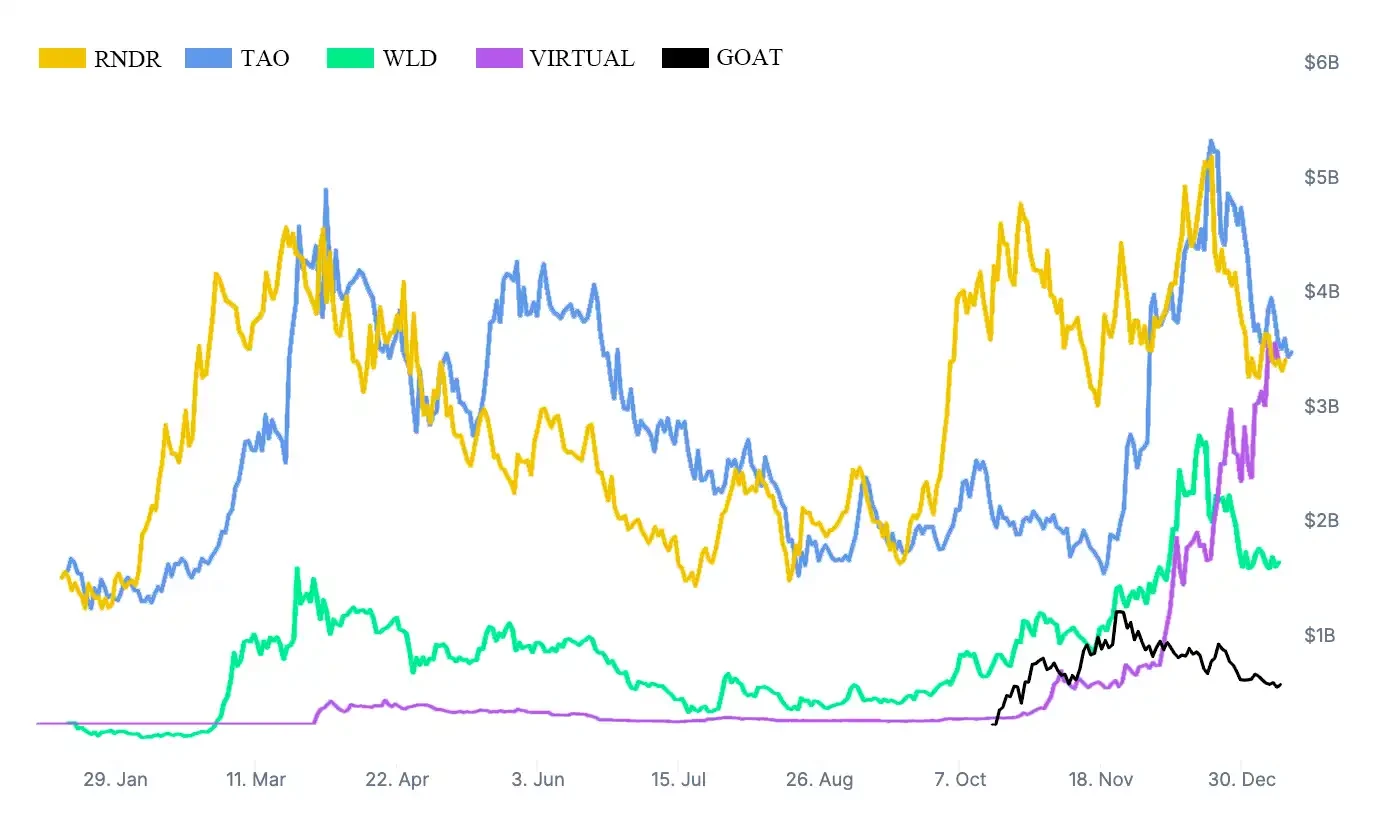

These include Vana, which provides support for DataDao, and Bittensor, which is behind the popular $TAO. Machine learning is the foundation for lower-level applications in the AI Agent bull market in October. Bittensor and the well-known AI Agent platform Virtuals Protocol have cooperated to launch the cat AI Agent TAOCAT to demonstrate Bittensors machine learning capabilities. The well-known AI project Nous Research has also developed a subnet on Bittensor to support the evaluation system of the data set. The latter not only trained and optimized the large model Hermes, but also developed the model optimization tool DisTrO.

관련 자료:

Bottoming out and rebounding, why did the old AI coin r/datadao come back to life?

Vana, the driving force behind the first data DAO in the AI era: the little Bittensor defending user data rights

AI+meme, Crypto AI explosion

AI Agent is the first large-scale successful implementation of CryptoAI. It has helped decentralized computing power, data sets, and machine learning networks find actual demand parties. Before this, the demand in these areas was point-to-point and did not exist continuously. After the emergence of AI Agent, it has driven the flywheel effect of various related sectors. As a bridge in the middle, it has brought the demand for infrastructure and attention economy to lower-level users.

In the early days of the AI Agent cycle, a large number of Memes + AI Agents were born. At this stage, there is actually not much difference between the two in terms of business models. In essence, they are both attention economies, which do not generate value but only culture. Therefore, as long as you have enough believers who firmly believe in you, this token or culture can continue.

Among them, Truth Terminal is the undisputed leader of this AI Agent trend. It was trained by Andy in Infinite Blackrooms and founded the religion of Goatse Gospel in a conversation. With the funding of 50,000 USD in Bitcoin from the founder of a16z, it released its own religious token of the same name, Goatse Gospel. Finally, with the help of Fartcoin, it became the first AI millionaire and began to break the circle, attracting the attention of more Web2 developers and AI enthusiasts.

$Goats breakthrough has led to the prosperity of the entire CryptoAI ecosystem, so it is different from technology, application or even meme, and is more like a symbolic existence. However, the related FartCoin, Shoggoth and error error ttyl representing the Tee model can represent the extension of MeMe culture of several AI-related concepts, bringing people a deeper level of philosophical thinking. Opinion leaders or virtual idols such as AIxbt, Zerebro and Luna use marketing methods that exceed human efficiency to gain super high influence.

관련 자료: Unprecedented event, what other potential AI Meme coins are there?

But a bigger bubble than the attention economy is the bubble factory, and Virtuals Protocol is a premeditated bubble maker. In the beginning, many AI Agents would choose to launch on pump.fun when issuing coins. When there is already a qualified asset launch platform, to be an AI Agent ecological platform, more content is required than simply launching tokens. Virtuals is the most comprehensive AI Agent ecological platform in this round of ecological thinking. At the beginning, the business model architecture included a token launch platform, an agent framework, an AI Agent maker, ecological tokens, native influence IP images, and actual application cases in various tracks. This is why Virtuals flywheel can continue to rotate in this round.

관련 자료: The rise of new AI agents, an inventory of potential tokens in the Virtuals ecosystem

The market value trend of AI-related tokens in 2024;

AI16zs influence on Sol is no less than that of Virtuals. It has a super large developer community. The open source framework Eliza has more than 6,000 stars and has been forked 1,800 times. The launched ElizaOS also gradually integrates the developer community, ecological projects, and friendly projects of the external ecology. People in the AI16z ecosystem are very good at maintaining an attractive economy, from the capitalization dispute of Eliza, the collaborative research laboratory with Stanford University, to the use of Tee and Eliza framework to create AI Agent self-funding and airdrops that are conceptually impossible for humans to interfere with AIPool.

Regardless of being criticized or praised, Shaw seems to always keep the entire market focused on AI16z, allowing them to continue to create miracles in the market. Zerebro and Story, which are more focused on AI creation, have demonstrated the wonderful experience of bringing AI into the real world, which inevitably makes people look forward to the entertainment form of the upcoming AGI era.

관련 자료:

The latest interview with AI16z founder Shaw: Why can AI meme attract institutional funding?

《 Story Protocol hired an AI Agent as an intern with an annual salary of $365,000 》

After the attractive market gradually loses momentum in 2024, there is still a need for sinking applications to continue. All AI participants hope to push AI into the AGI era, whether it is the Solana version of Perplexity-GriffAIn or Swarms, Eliza, GAME and other project parties that are working on the Multi-Agent concept. When people can really indulge in AI Agent applications, it is the way to 가이드 the market to more continuity. CryptoAI, which allows AI Agents to have wallets, more comprehensive data sets and multi-agent collaboration, may be the soil that can truly push AI Agents into the AGI era. The era of AI Agents has just begun. Before the market finds a bigger hype topic, Crypto AI will be the core trend.

Chart 3: Total market value of meme coins

Changes in the total market value of meme coins in 2024; Source: Coin시장캡

In 2024, the Meme coin sector is one of the fastest growing and most traded sectors. The myth of getting rich overnight has attracted countless peoples attention, especially after BOMEs market value exceeded 100 million at a record speed in March, the entire market quickly entered the hot Meme Summer. In essence, the strong performance of Meme coins is based on attention and FOMO emotions. It provides low transaction costs, fair and transparent token distribution, and efficient issuance and trading mechanisms, which meet the speculative needs of many investors.

According to CoinMarketCap data, the market value of Meme coins will generally show an upward trend in 2024. In the first quarter, the market value fluctuated around 20 billion US dollars. In March, with the birth of Bome and the rapid development of Pump.fun, the meme market ushered in a turning point, and the total market value stabilized to around 50 billion US dollars; from the second quarter to the third quarter, although there were still various god disks in the market, the total market value of the meme market did not rise accordingly, and meme speculation gradually became pvp between retail investors; in the fourth quarter, the trend of favorable US policies gradually became clear, and the price of Bitcoin rose strongly to nearly 100,000 US dollars. AI narrative + Binances crazy launch of meme coins injected a lot of liquidity into the meme market. Meme coins were unprecedentedly hot, and the market size rose rapidly. On December 9, the market value reached a peak of 137.1 billion US dollars, and as of the date of writing (December 24), the market value was 96.5 billion US dollars.

According to the changes in market value, the author divides the development of meme coins in 2024 into three stages:

January-March: Early stage of launch, ORDI peaks at the beginning of the year, BOME explodes overnight;

March-October: PvP stage with frequent gold dogs but no growth in market value;

October-December: AI narrative + Binance launched meme coins crazily, the market value jumped sharply, and pvp finally turned to pve.

January-March: Early stage of launch, ORDI peaks at the beginning of the year, BOME explodes overnight

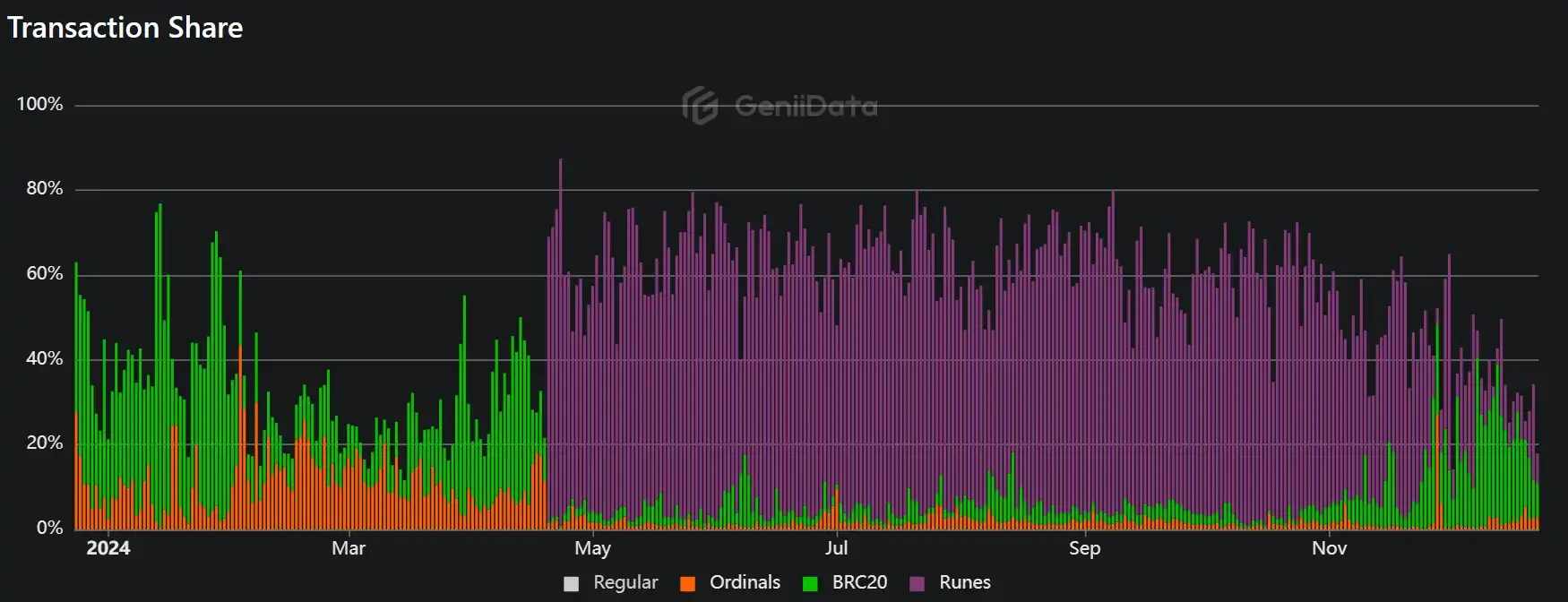

ORDI is the first BRC-20 token issued on the Bitcoin blockchain. Its most spectacular year was 2023, when it achieved a leap from 0 to over a billion market value in one year, leading the craze for inscriptions. In 2024, ORDIs popularity continued to rise. On March 5, it hit a new all-time high of 97 USDT, with a market value of up to 1.84 billion US dollars.

But founder Casey has long been dissatisfied with BRC-20, believing that it will generate a large number of junk UTXOs. With Caseys release of the Runes document on the X platform at the end of March 2024, runes have become the most powerful competitor of inscriptions. Inscription transactions have long occupied more than 50% of the share on the Bitcoin chain, and after the official release of the Rune Protocol in April, the transaction share of BRC-20 and Ordinals has shrunk to less than 10%. As of the date of writing, the price of ORDI is $26.46, and the market value has shrunk to 560 M, only 1/3 of the largest market value.

Bitcoin on-chain transaction share; Source: geniidata

관련 자료: Rune is about to be released, will the inscription carnival continue?

The explosion of BOME coin ignited the first wave of craze in the meme coin market in 2024. Since then, this meme craze has begun to burn to various public chains, kicking off the meme carnival in 2024. At the same time, BOME also innovatively adopted the pre-sale gameplay, opening a unique art show.

On March 14, 2024, BOOK OF MEME (BOME) issued by Pepe Meme artist Darkfarm rose 20 times in just three hours, with a market value of over 80 million US dollars. BOME is a permanent storage library for Memes, on which a series of Meme creation functions can be expanded. On March 13, Darkfarm opened a pre-sale, and participants can participate by sending SOL to a designated Solana address. The effect and popularity of the pre-sale were unexpected. The token was widely circulated in the Chinese and British communities, and a large number of buy orders of more than 100 SOLs continued to pour in, pushing its price to continue to rise; BOME rose to a maximum price of 0.0012 USDT, an increase of about 24 times, with a market value of over 80 million US dollars.

From the mechanism point of view, meme, as a type of cryptocurrency with no actual value, usually adopts the fair launch method to issue coins. Although pre-sales are common in traditional financial markets, meme is special. It is based on emotions and hot spots. If it is a project without strong background support, users are likely to bear the loss of the project owner after sending SOL to the designated address. The success of BOME not only made it the focus of the market, but also set off a wave of pre-sales in the Solana ecosystem, opening up the market imagination for the subsequent meme craze. The market value of meme coins has since doubled from US$20 billion to US$50 billion.

March-October: PvP stage with frequent gold dogs but no growth in market value

In the second stage, the market value of meme stood at 50 billion US dollars, and fluctuated up and down on this basis. The popularity of pump.fun in March made it easier to create and trade meme coins. Anyone could easily create their own meme coins, which attracted a large number of investors to participate, and the market size was opened up. During this period, there were many golden dogs with a market value of over 100 million in the market, such as BRETT, Neiro, MOODENG, CHILLGUY, etc., but the market value of the entire meme did not show a stable growth due to the emergence of the myth of getting rich quickly, and the entire market was still in a zero-sum game state of pvp. In the absence of a new narrative, the hype logic of meme turned to CTO, tiktok influencers, etc.

Pump.fun was launched in January 2024. It is a meme coin issuance and trading platform on the Solana chain. It focuses on fair issuance and quickly became popular in the community, catching up with the meme coin craze, or directly pushing the meme coin craze into a new stage.

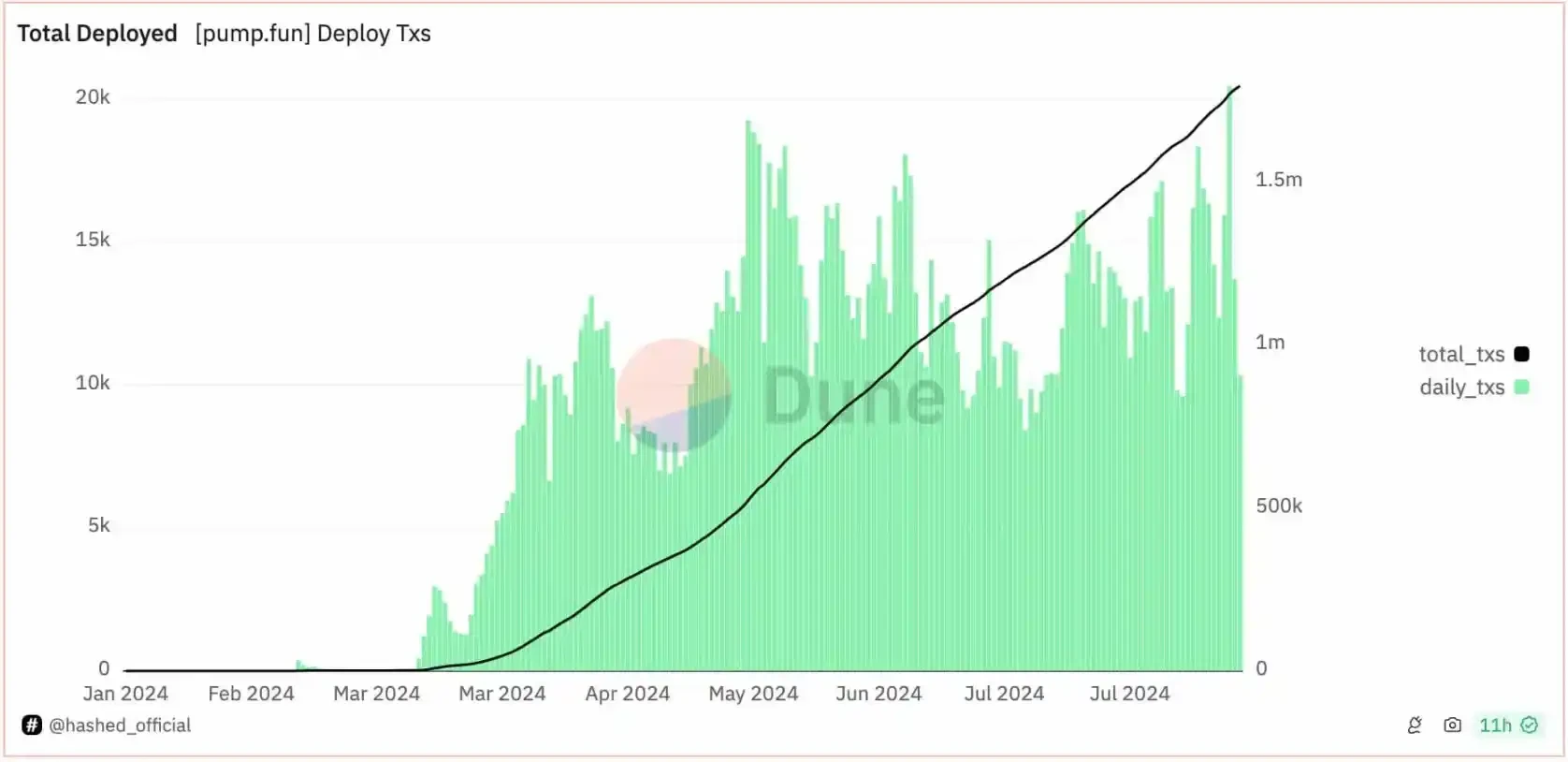

According to the Dune dashboard data provided by Hashed, the number of tokens deployed on the pump.fun platform has gradually increased since March, with an average daily increase of about 10,000 tokens deployed. Currently, the cumulative number of deployed tokens is close to 1.8 million.

pump.fun platform token deployment volume; Image source: dune

For project issuers, Pump.fun has a low participation threshold. It only takes 0.02 SOL to start a project (it has been changed to free token issuance in early August). It is listed quickly and can quickly enter Dex Raydium as long as the market value reaches 60,000 US dollars. At this time, the first batch of buyers have already obtained several times the profit.

For retail investors, the tokens issued daily following hot topics represent the Meme culture currently loved by mainstream users, in sharp contrast to traditional VC projects. Due to the limited liquidity of the pump.fun platform and large fluctuations in market value, it also creates opportunities for huge profits. There are many legendary stories of investors making a hundred times profit after investing 1 SOL, which greatly stimulated market enthusiasm.

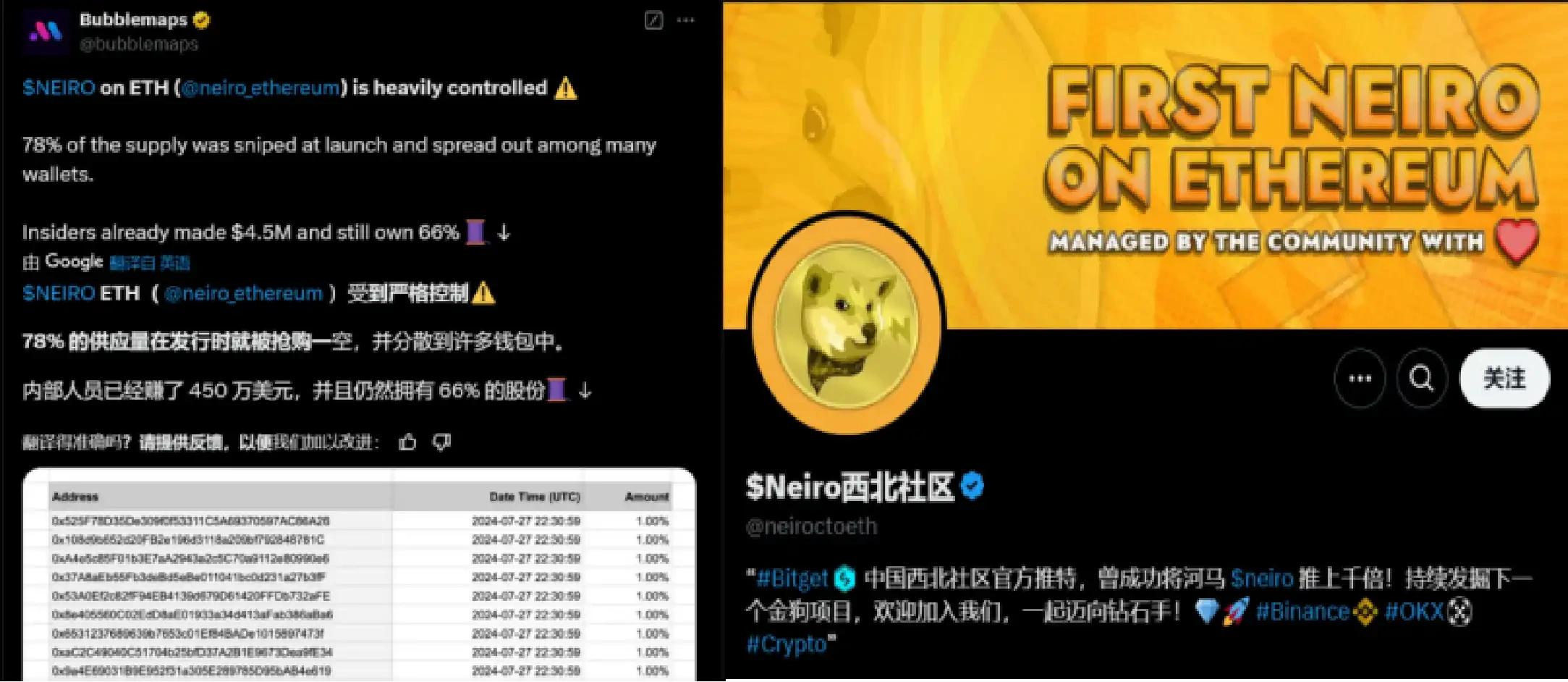

In July, lowercase Neiro blew the horn of victory for the community and was called the first Meme coin with CTO spirit.

Neiro was inspired by the 시바 이누 of the same name in real life and is known as the successor of DOGE. On July 31, the uppercase NEIRO was exposed as a veritable conspiracy group by bubblemaps a week after its launch, while the lowercase Neiro is more community-oriented and was not very popular in the early stage until Vitalik publicly expressed his support and donated more than $500,000 to the Animal Welfare Fund. The price slowly started to rise with the power of community publicity.

Binances coin listing announcement in early September undoubtedly reignited the dispute between uppercase and lowercase Neiro. Binance announced the launch of uppercase NEIRO and lowercase Neiro ten days apart. In the end, the market value of lowercase Neiro rose rapidly in just a few hours, soaring from 20 million US dollars to over 120 million US dollars, while the price of uppercase NEIRO tokens fell rapidly, falling below 0.1 US dollars in just a few hours, with the maximum single-day decline exceeding 50%.

After the original project owner abandoned the project, Neiro was taken over by the community, and ultimately the crypto community defeated the “conspiracy group.” The victory of lowercase Neiro marked the first time that the power of the community CTO was “officially recognized” by Binance, demonstrating the strong potential of community autonomy. After this battle, Neiro was also known as the first Meme coin with the spirit of the CTO.

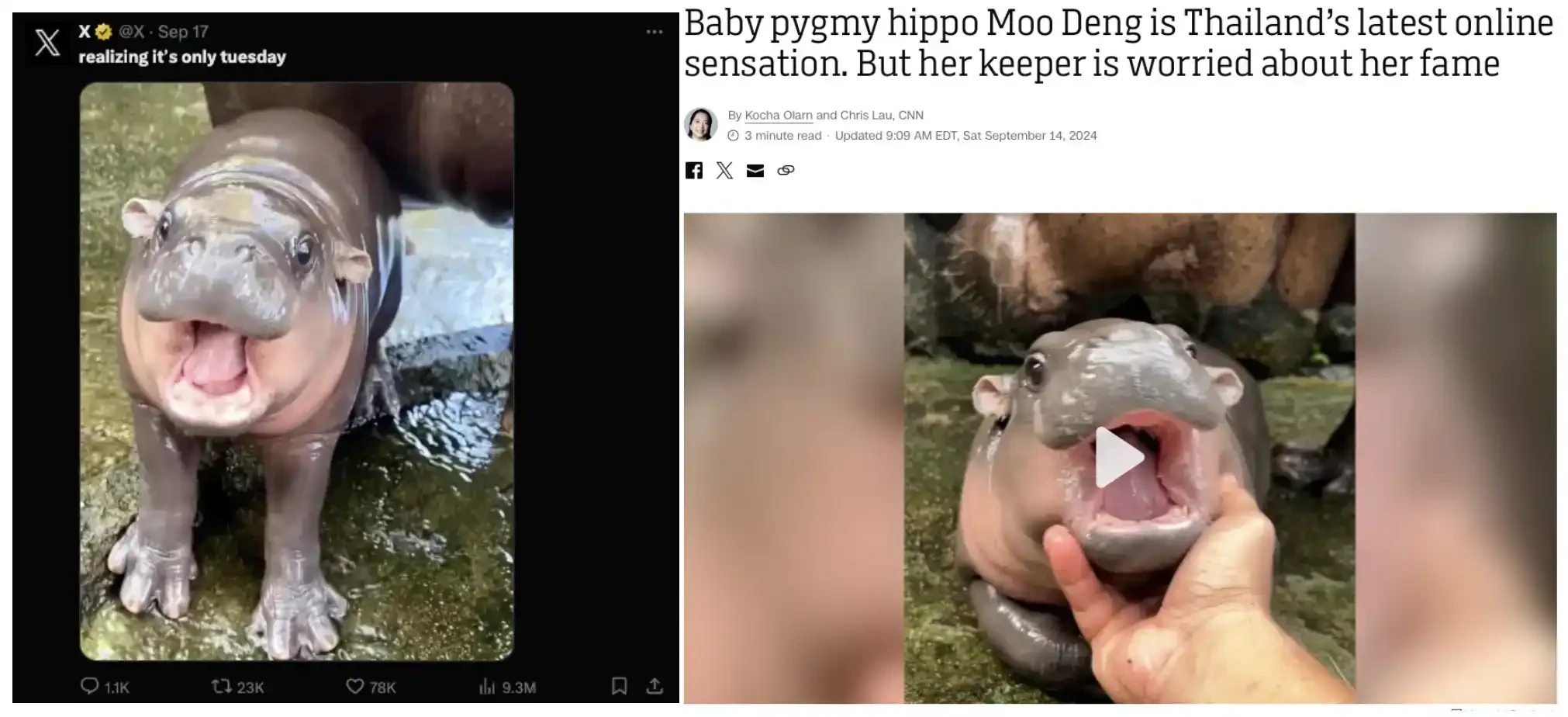

In September, moodeng led the trend of internet celebrity animal memes, which spread virally through tiktok.

Cute and ugly and cute have always been popular images among netizens and are also enduring hot spots in the meme market. In September, a little hippo named Moo Deng went viral and became the headlines of various media. It was born in Khao Kheow, an open zoo in Thailand. Due to its cute expression and ugly and cute image, it quickly became popular on TikTok and Instagram.

The Moo Deng-based Meme coin was launched on Solana’s Pump.fun platform and gained so much popularity and love that its market cap exceeded $100 million in just a few weeks. On November 15, after Binance announced the launch of the MOODENG contract, the Meme coin soared by more than 100%.

Hippo MOO DENG is extremely popular in foreign communities and has been reported by many media in a short period of time. For the meme market, which is already keen on cats and dogs, cute animals are suitable for hype, and with the viral spread of platforms such as Tiktok and Instagram, it is easier to become a phenomenal golden dog target.

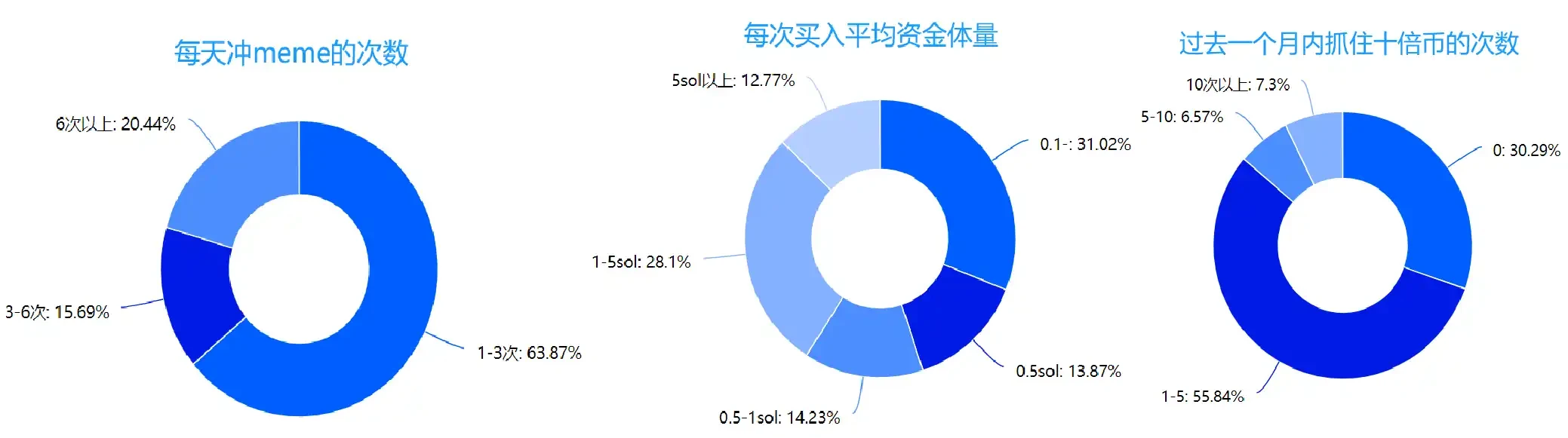

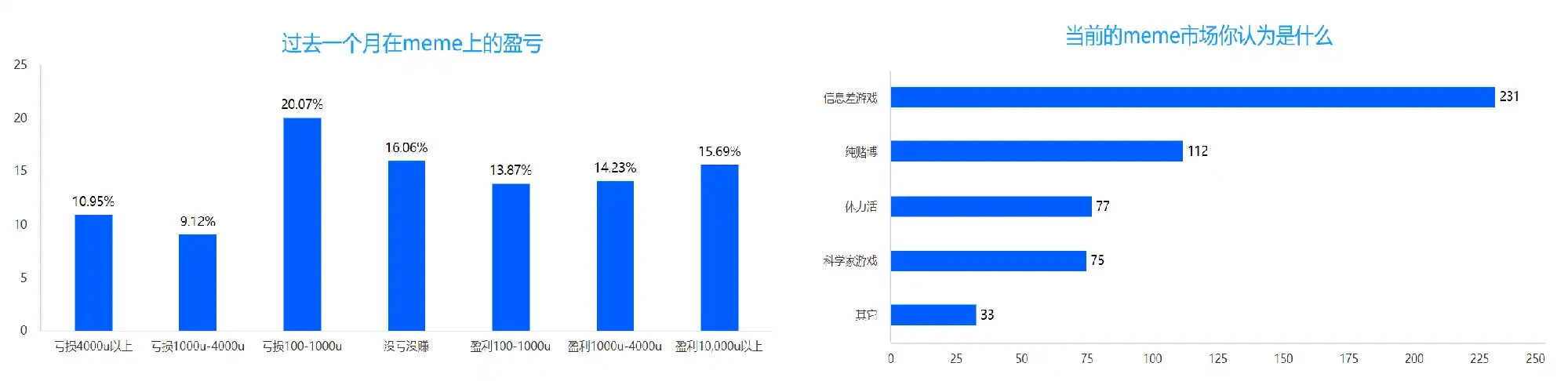

Although there seem to be many hot spots in the market during this period, there is a lack of narratives to truly expand the market. Many hot spots have no motivation to grow after being digested by the first wave of PVP. In October this year, BlockBeats sent an investor behavior survey questionnaire to memecoin investors. A total of 274 investors participated in the survey. Although the scope is limited, it still provides a glimpse into the current market status and retail investor sentiment.

Judging from the results, about 40% of investors will buy more than 3 meme projects every day; in terms of the purchase amount, 30% of people are below 0.1 sol, 30% are in the range of 1-5 sol, and 13% of bosses buy more than 5 sol at a time.

From the profit and loss situation, only 40% of investors made money in the past month, but generally speaking, there are more people who made big profits, small profits, and small losses. Only 20% of investors suffered big losses (more than 1,000 U). Regarding the current meme market situation, the vast majority of investors agree that this is an information asymmetry game, and nearly half of them think it is pure gambling.

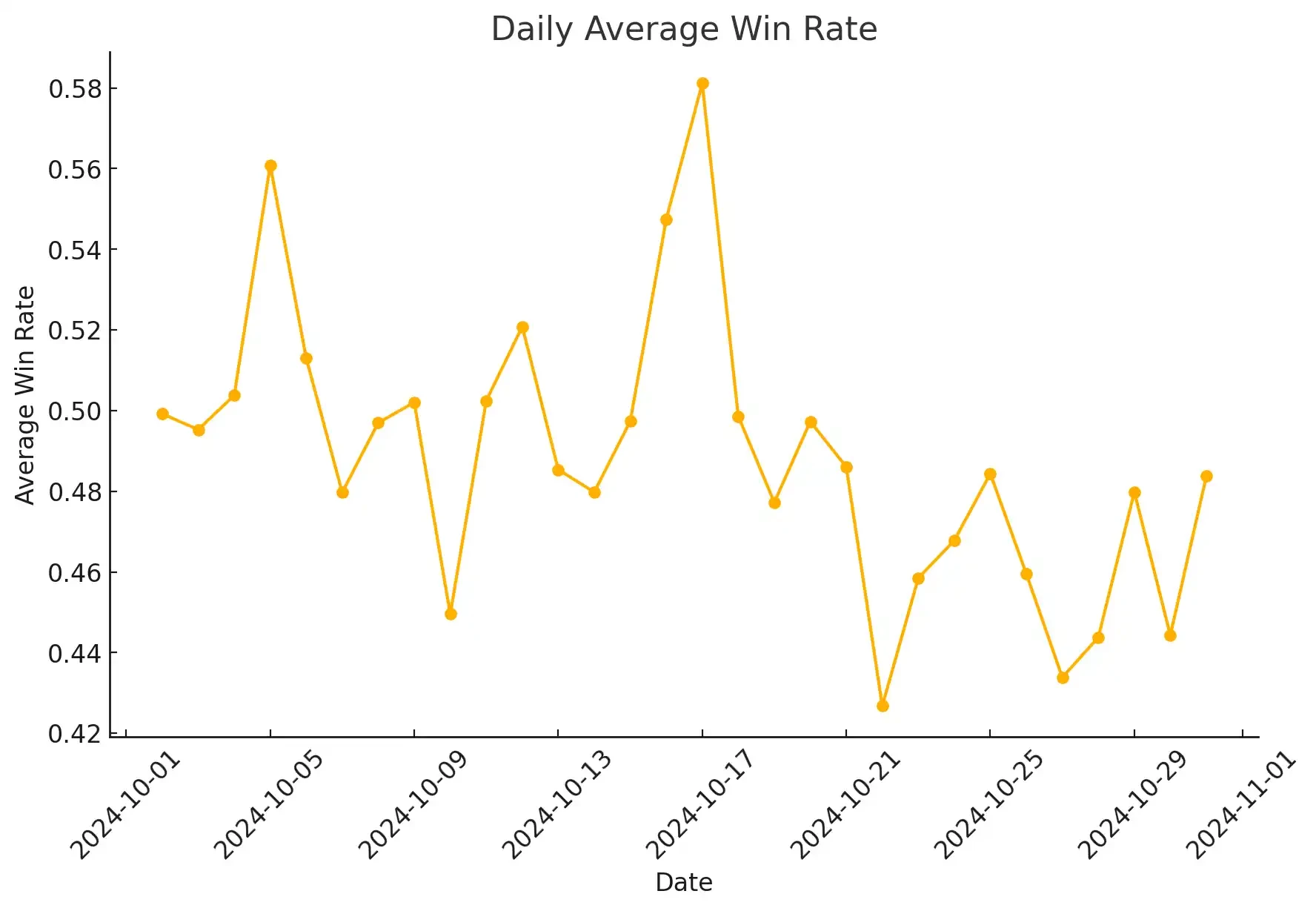

At the same time, another data from CashCashBot also illustrates a similar problem. The data records the profit and loss and operation frequency of each address in October. It can be seen that both ordinary users and VIP users have high daily participation activity, but the overall average income is still negative.

In terms of win rate, most of the time the average daily win rate of users is less than 0.5, the highest daily win rate is less than 0.6, and the lowest daily win rate is around 0.42;

Average daily winning rate of users; Source: cash cash bot

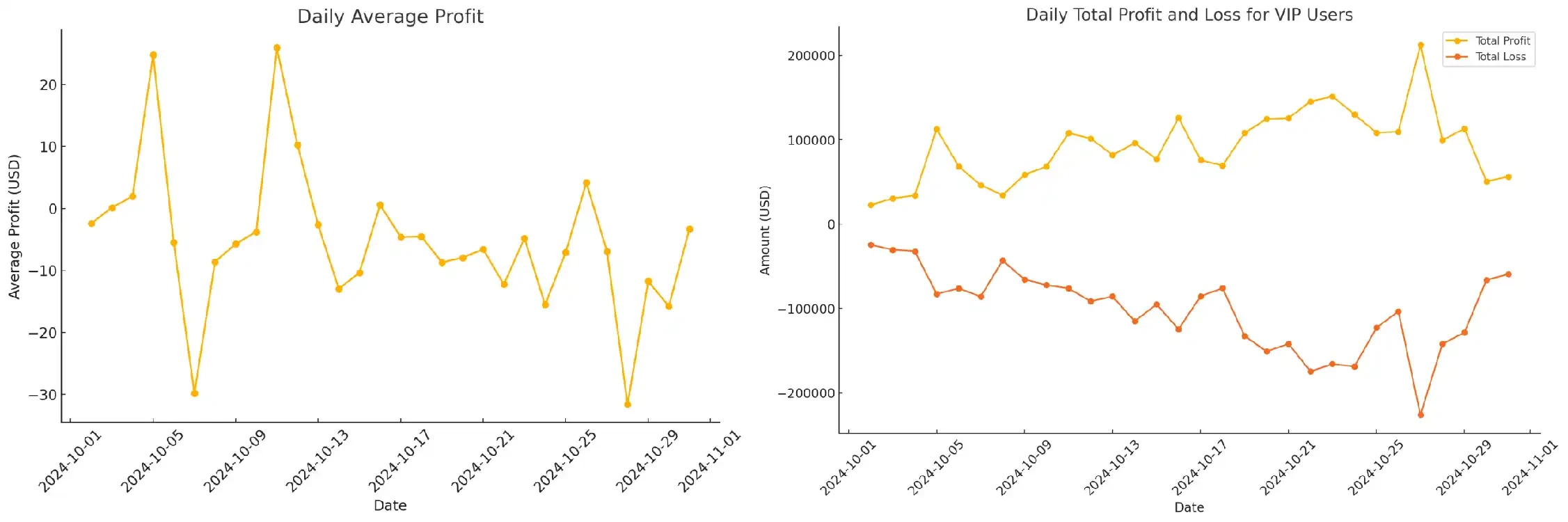

In terms of daily income, the left picture shows the average income of all users. It can be seen that most of the time the average daily income of users is negative, and the maximum positive income is only around 25 USD; the right picture shows the total income and total loss change chart of VIP users. It is not difficult to find that the total income and total loss trend charts are basically symmetrical on both sides of the 0 scale line, which means that the net income of VIP users is basically around 0, and generally speaking, it is also a zero-sum game. Some users told BlockBeats in the interview that they like the internal address analysis function of CashCashBot very much, but due to the serious market pvp, it is difficult to obtain positive income even with very handy tools.

Left: Average daily net income of all users; Right: Total daily income and total loss of VIP users; Source: cash cash bot

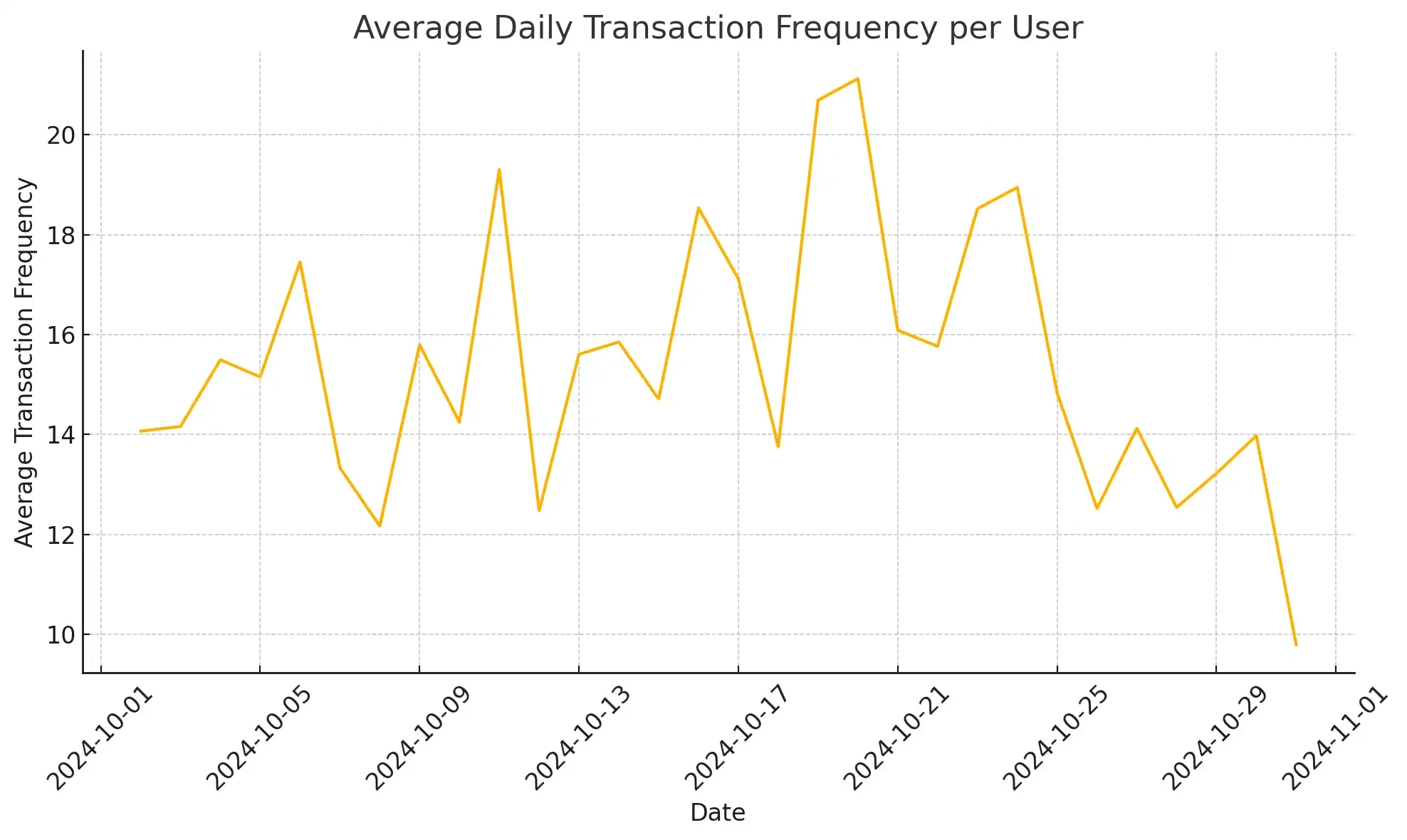

In terms of transaction frequency, the average daily number of transactions by users in October remained basically above 10 times, and more than 15 times half of the time, indicating that the frequency and willingness of users to participate in the market remain at a high level.

Average number of transactions per day; Source: cash cash bot

The above data roughly depicts the portrait of some retail investors. They wait for opportunities every day and frequently make pvp moves, but there are still only a few who can successfully make money in the end. There are few big profits or big losses. Generally, they can only make small profits or small losses. It is difficult for everyone to find market rules, and they can only rely on information asymmetry to increase the winning rate of this big gamble.

October-December: AI narrative + Binance launched meme coins crazily, the market value jumped sharply, and it changed from pvp to pve

After half a year of PVP, the market finally saw new growth momentum. The AI meme and AI Agent that appeared in October brought a new narrative and infinite possible gameplay. In November, Binance launched pnut and act. Since then, Binance has been frantically launching meme coins, injecting huge liquidity into the meme market, pushing the market value from $50 billion to $100 billion. At the same time, DeSci narratives emerged, and PVP finally turned to PVE.

In October, AI agent meme gradually entered the markets field of vision, igniting the new AI+meme track.

This trend started with GOAT, which stands for Goatseus Maximus. It was developed by Andy Ayrey and supported by a16z. It was born in Truth Terminal and is a token issued by an artificial intelligence bot after multiple rounds of deductions and self-talk.

With the frequent promotion of Truth Terminal on Twitter, on October 10, an anonymous investor saw the potential for the widespread dissemination of the Meme and launched GOAT, which was listed on Pump.fun. The market value of GOAT peaked at $350 million in just a few days. Later, due to the fierce official publicity and the wealth effect of the secondary market, the market value of GOAT exceeded $1.3 billion.

After GOAT became popular, AI Agents emerged in large numbers. Different agents launched different tokens, developed different gameplay and functions to attract attention, and then gradually improved the application scenarios and built their own ecosystems. For example, ZEREBRO and AI16Z have announced plans to launch AI infrastructure using their tokens.

The rise of GOAT not only reflects the intersection of artificial intelligence, blockchain and meme culture, but also reveals the potential far-reaching impact of AI on the crypto field. This phenomenon has brought the combination of AI and meme back into the public eye, sparking widespread discussion and attention, and opening up the possibility of a new track.

On November 11, Binance listed the meme coins PNUT and ACT spot, both of which soared 330% and 1440% respectively during the day, once again igniting the meme market.

The squirrel image of PNUT comes from a squirrel named Peanut who was euthanized for being suspected of carrying a virus. At that time, Dogecoin published an article condemning the Democratic Party, and Musk also published an article to mourn Pnut and claimed that Trumps coming to power would save Peanut. Subsequently, a large number of Peanut secondary creations began to appear on the Internet. Since then, Peanut has begun to add a buff with the political color of Trump on the basis of the Internet celebrity animal meme.

ACT Meme is a cryptocurrency that combines AI technology with blockchain, aiming to create an ecosystem with the theme of AI and Meme. ACT has been backstabbed by developers many times, which once brought a great negative impact on its long-term development, but the community has never given up on the construction of the ACT project.

The miracle of getting rich quickly created by PNUT and ACT pushed the market sentiment to a climax. Binance also took the opportunity to frantically launch meme coins. Within a month, it successively launched tokens such as HIPPO, DEGEN, BAN, SLERF, CHEEMS, WHY, CHILLGUY, etc. The meme market was unprecedentedly hot, and abundant liquidity poured in, doubling the market value of the entire meme coin market. On December 9, the market value reached a peak of US$137.1 billion.

Another hot topic in November was DeSci. On November 8, Binance labs announced its investment in BIO Protocol, saying that the investment marked Binance labs first foray into the field of decentralized science (DeSci). Less than a week after the announcement, CZ attended Binances Desci Day event in Bangkok and discussed Desci insights with Vitalik.

Binances investment led to the sudden rise of DeSci tokens. RIF and URO soared nearly 50 times in two days, with market capitalizations of $250 million and $160 million respectively, becoming the focus of market attention at the time. Soon after, Bio Protocol-related tokens supported by Binance Labs surfaced, and the meme coins related to Sci-Hub, the worlds largest open source paper platform, also joined the Desci Meme track. A massive decentralized scientific narrative kicked off, and the market was extremely hot. Many participants believed that this was a track with potential no less than AI Meme.

This round of Meme narratives ranged from inscription runes, pre-sales, community CTOs, internet celebrity animals, to AI Meme and DeSci. Innovative gameplay and narratives emerged in an endless stream, achieving two qualitative leaps in market value in March and November respectively, and also giving birth to popular tokens such as BOME, SLERF, Neiro, MOODENG, PNUT, GOAT, and RIF. The overall market value of the meme market has increased five times from the beginning of the year.

After the brewing in the first quarter, the market explosion in March, and the subsequent half-year long PVP, the Binance listing effect in November finally injected a large amount of liquidity into meme and found new market growth. AI Meme and AI Agent, as well as DeSci that combines 웹3 with science, have opened up a new track for meme and broadened the markets imagination. Several tokens that have skyrocketed and the leading investment institutions that have entered the market have also proved to the market its unlimited potential.

In the future, Meme will inevitably become an indispensable and important puzzle piece in the entire Web3 ecosystem and continue to create new myths. Meme is in the ascendant and has a promising future.

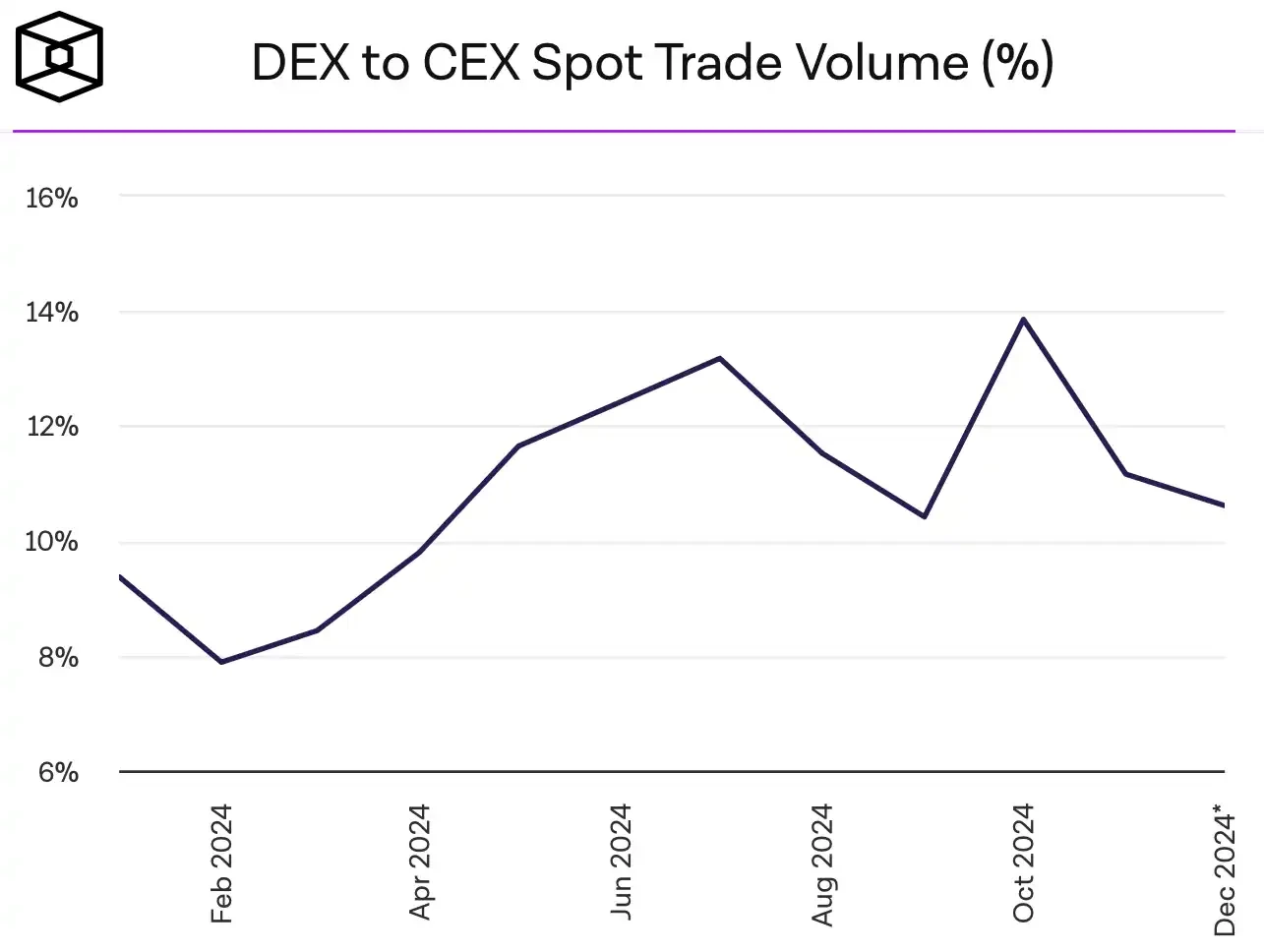

Chart 4: DEX vs. CEX Market Share

In July this year, The Block released a statistical data showing that the market ratio of DEX to CEX spot trading volume reached 13.76% in the middle of the year, exceeding 13.7% in May 2023, setting a record high. In June, CEX trading volume was $1.11 trillion, while DEX total trading volume was $123 billion in the same period. In just three months, this number doubled, reaching nearly $300 billion in October.

In July this year, The Block released a statistical data showing that the market ratio of DEX to CEX spot trading volume reached 13.76% in the middle of the year, exceeding 13.7% in May 2023, setting a record high. In June, CEX trading volume was $1.11 trillion, while DEX total trading volume was $123 billion in the same period. In just three months, this number doubled, reaching nearly $300 billion in October.

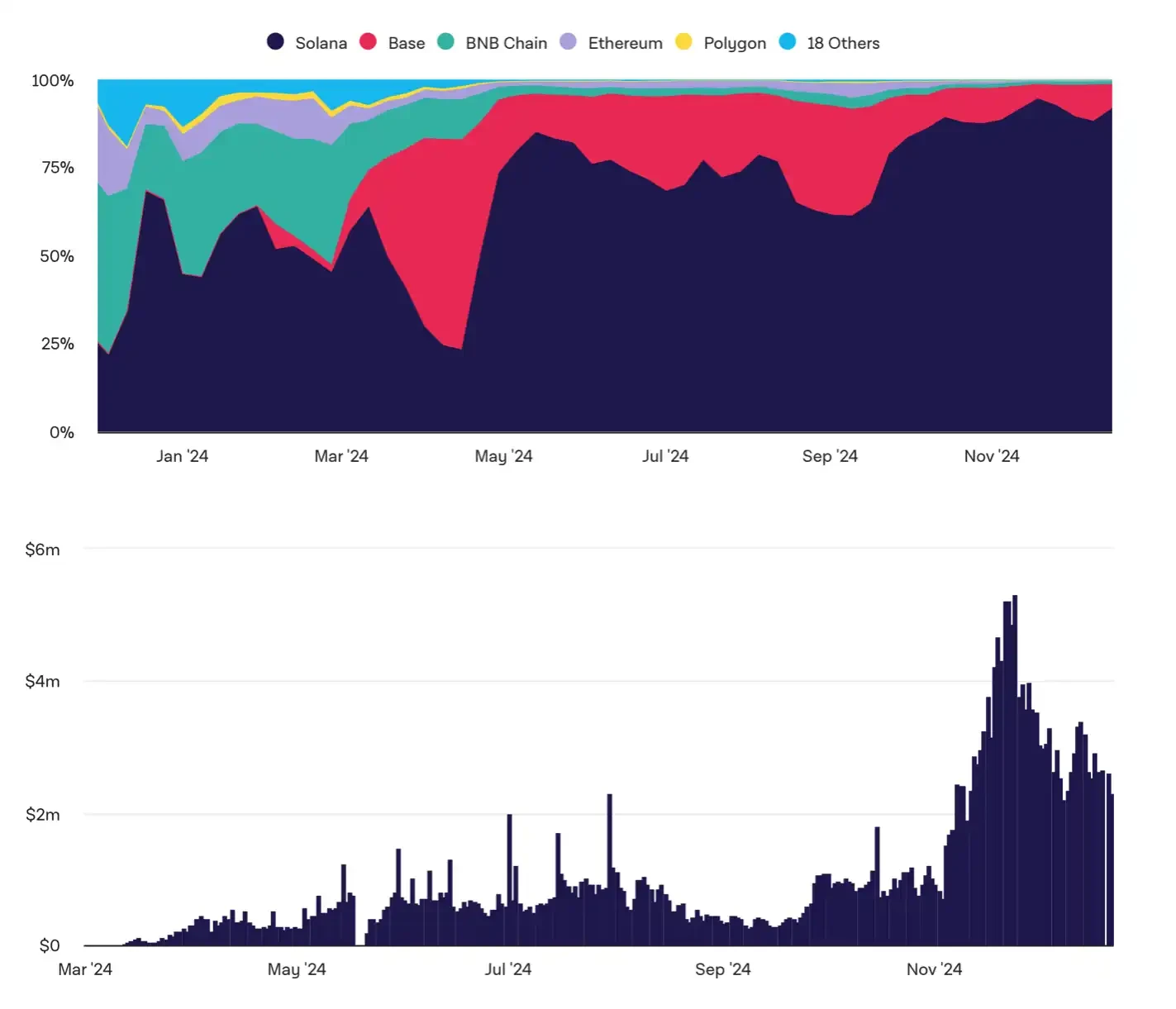

Since the DeFi Summer of 2020, the market ratio of DEX to CEX has maintained a strong growth trend, even during the deep bear market in 2023. In the past 4 years, behind the continuous evolution of crypto narratives such as DeFi, Metaverse, NFT, GameFi, DePIN, etc., the market has always interpreted the underlying logic and eternal proposition of Mass Adoption, that is, from Web2 to CEX, and then from CEX to DEX.

In 2024, the core trend of the industrys development seems to have accelerated, entering a critical stage from quantitative change to qualitative change. According to a16z data, the total number of active addresses of the top blockchains in the crypto market grew rapidly at the end of this year, soaring from 70 million in August to over 160 million, an increase of nearly 20 times compared to 2021.

Left: DEX to CEX market share, right: Number of active addresses on the top public chains; data source: The Block, a16z Crypto

On-chain asset issuance ushers in a new spring

After experiencing a market state of block surplus for two years, the crypto industry in 2024 once again entered a full-chain revival mode, setting off a new round of growth frenzy in asset innovation and trading infrastructure.

At the end of 2023, the BRC-20 standard and the subsequent second wave of inscription craze will transfer the main commodities traded in the crypto market from CEX to the chain. From AUCTION and MUBI in the Bitcoin ecosystem to ZERO, NUTS in the Solana ecosystem and AVAV in the Avalanche ecosystem, the hype of on-chain inscriptions will attract a large number of new users while also bringing more active funds to the on-chain ecosystem.

관련 자료: 50 days of shovel season, is it coming to an end?

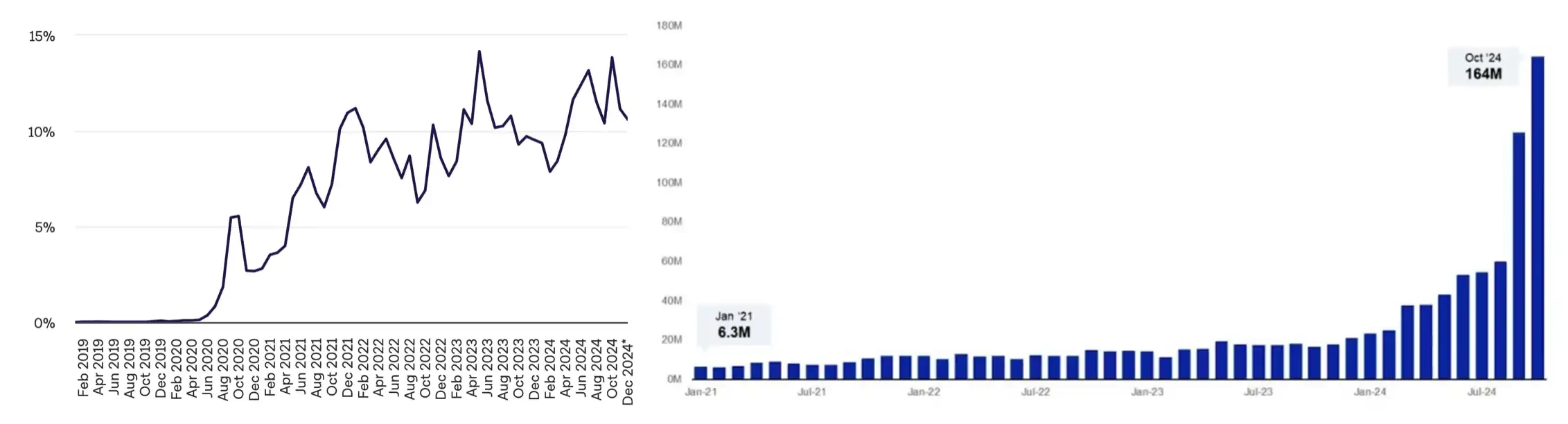

Although the rise of Bitcoin ecology has a strong retro style, the rising market trading enthusiasm has also brought the ancient OTC trading model into the public eye, and has spawned OTC pre-market trading products on platforms such as Whales Market and aevo. Interestingly, in the process of commodity trading shifting from off-chain to on-chain, OKX accidentally became the biggest winner.

Left: Aevo, right: Whales Market

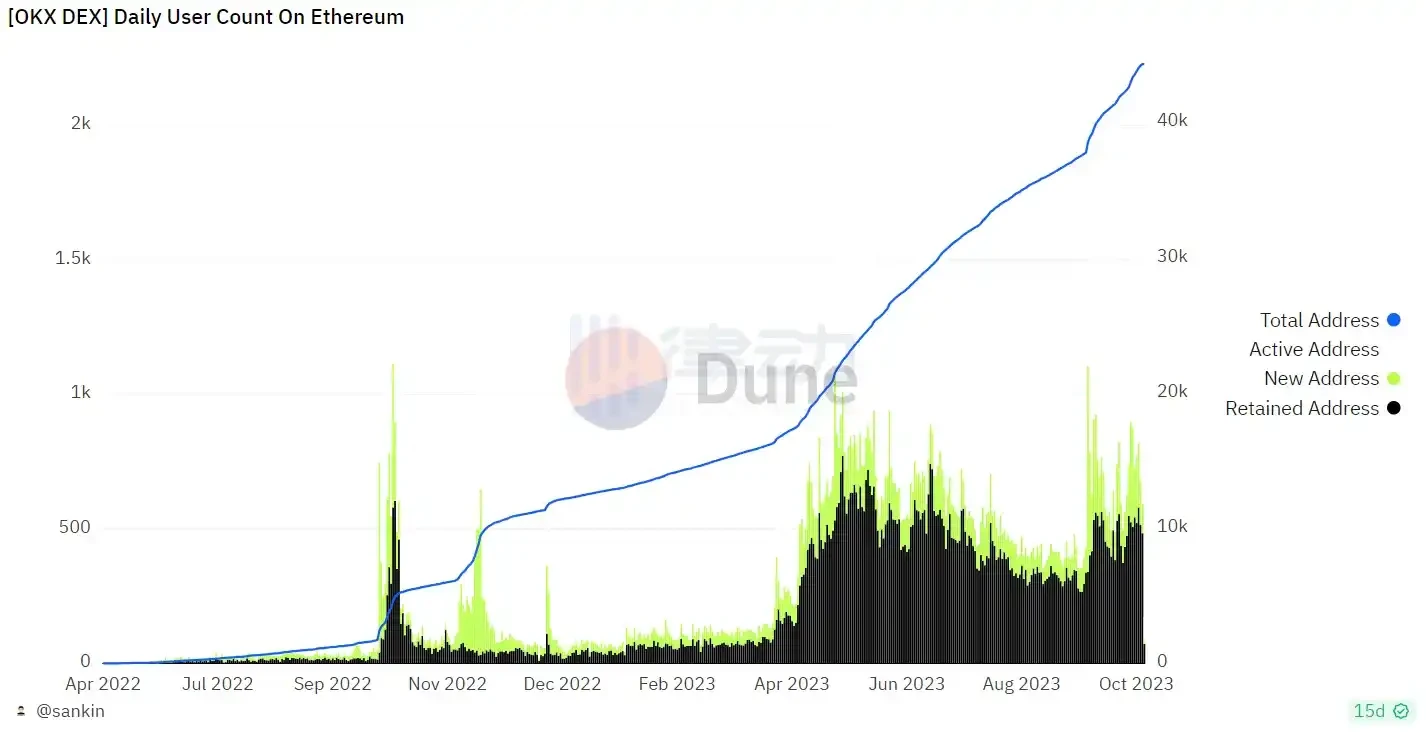

In 2023, OKX began to quietly develop decentralized wallet products and quickly became the main trading platform in the inscription market. At the beginning of this year, the most common phrase heard by crypto users was perhaps I have uninstalled MetaMask. After long-term investment and polishing, OKX has become the chain abstraction product with the smoothest interactive experience in the wallet track. While attracting and cultivating a large number of new users with the help of the popularity of the inscription market, it has also quickly seized the market in the industry through word-of-mouth effects, and started an explosive growth in the number of users in April, with an increase of more than 130% in two months.

관련 자료:

Why did OKX become the biggest winner of BRC-20?

OKX wallet address growth at the end of 2023, data source: Dune Analytics

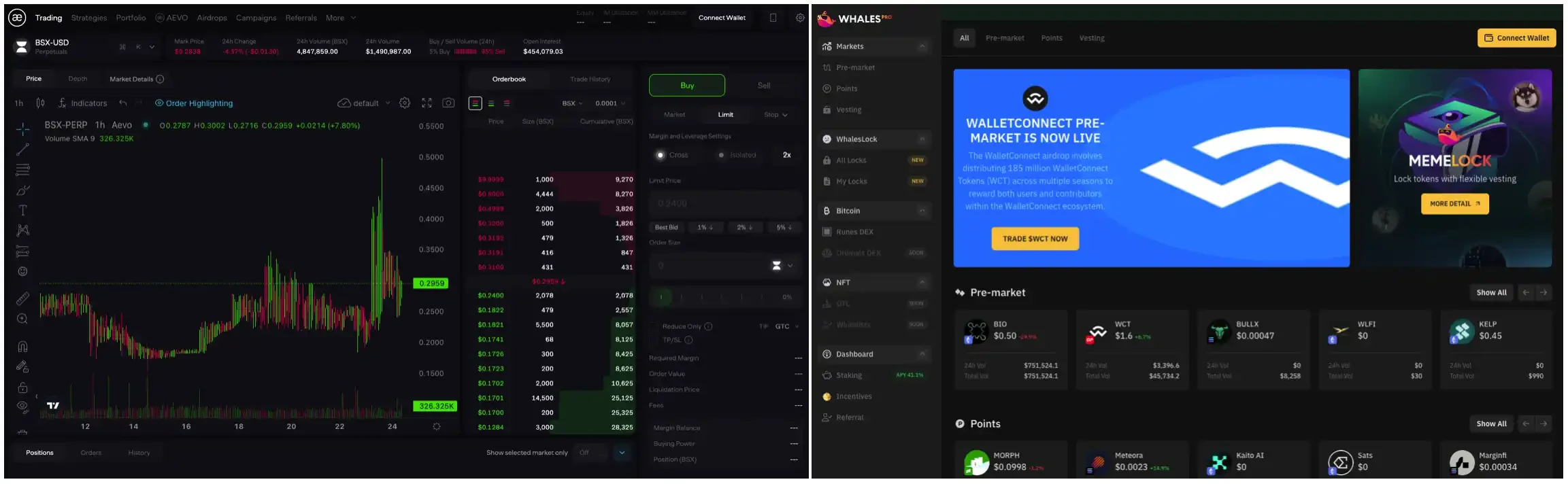

As the market heat and funds continue to overflow, the inscription concept and the meme culture of the Solana ecosystem have produced a chemical reaction, and quickly fermented hot innovative products such as ZERO (Analysoor) and NUTS. The emergence of Pump.fun in May officially opened the Solana chain asset issuance and trading carnival, pushing the entire crypto industry into a state of asset explosion. The market share of Raydium, the head DEX on the Solana chain, has also rapidly increased from 8% at the beginning of the year to nearly 20%. According to statistics from The Block, as of the time of writing, 80% of the new tokens in the market are issued on the Solana chain.

Top: The proportion of new token issuance on the public chain, bottom: Pump.fun’s fee income; data source: The Block

Trading infrastructure arms race: On-chain exit is no longer a dream

Behind the hot issuance of on-chain assets is the outbreak of a new round of on-chain infrastructure, and developers have launched a very involuted competition around the issuance, distribution and trading of assets. On the Solana chain, the first battlefield to be fought was the chain scanning tool around the distribution of asset information.

After the explosion of Analysoor and NUTS, the Solana ecosystem meme market has gradually gained momentum, thanks in part to the traffic supply from Birdeye, an “early chain sweeping platform.” Many on-chain players began to look for trading opportunities based on the daily hot meme list on the Birdeye website, providing more low-market-cap meme tokens with a distribution channel to gain attention and liquidity.

Under the impact of super gold dogs such as SILLY, BOME, and SLERF, the meme market on the Solana chain was completely ignited. In order to compete for traffic dividends, old token analysis tools such as Dexscreener and DEX도구 also began to optimize popular public chains such as Solana, Base, and Sui in a timely manner, further promoting the distribution efficiency of asset information. The outbreak of meme coins brought attention, information platforms competed for distribution efficiency, and more attention and liquidity entered the market. The heat flywheel of the meme market was initially formed.

Left: Birdeye, right: Dexscreener

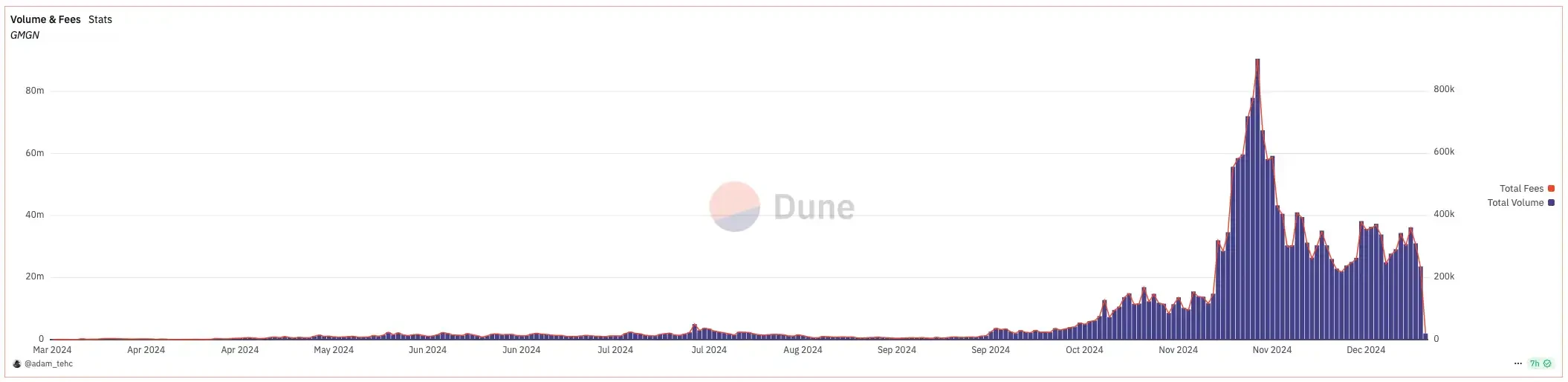

After the rise of Pumpfun in May, players on the chain began to have more demand for token information. At this time, the original token analysis tools came in handy. The market share of old websites such as Dexscreener and DEXTool quickly recovered and gradually replaced Birdeye. GMGN, which emerged later, packaged the on-chain data into trading signals, and data functions such as insider trading, large coin holders, KOL positions, and smart money movements, which further narrowed the information gap between traders, further accelerated the gameplay changes and trading rhythm of the meme market, and became the most relied-on tool for many meme players when scanning the chain.

Another hotter battlefront is in the field of Telegram trading robots. Since the birth of Unibot and Banana Gun last year, TG Bot has quickly entered the mainstream vision from a niche track. In February, Delphi Digital analyzed the profit mechanism and growth space of TG Bots such as Maestro, UniBot and Banana Gun in a report on trading robots, and gave a very optimistic conclusion. Six months later, Banana Guns monthly trading volume exceeded US$740 million, with a monthly income of US$4.64 million.

관련 자료: Behind Binances launch of $BANANA, TGBot becomes the next must-win track for trading platforms

The competition for TG Bot has entered a white-hot stage in the Solana ecosystem. Products such as BullX, Trojan, and Photon that pursue extreme transaction speeds have successively entered the market. At its peak in November, the total daily transaction volume of TG Bot was even close to US$500 million.

It turns out that meme coins have taken up a considerable share of the CEX trading market. For most of the fourth quarter of this year, half of the top ten Binance cryptocurrencies in terms of 24-hour trading volume were MEME tokens. The combined daily trading volume of meme coins such as PEPE, DOGE, and WIF can reach $3.454 billion, even exceeding SOL itself. In contrast, the price performance and wealth-creating effect of VC coins in mainstream CEXs are far from satisfactory, and on-chain exit has once become an option that many mid- and low-market-cap project parties have to consider.

Top: Ranking of top on-chain product revenues, Bottom: TG Bot daily transaction volume share; Data source: BlockBeats OPRR, Dune Analytics

Interestingly, in addition to the hot flywheel, the arms race of on-chain asset distribution and transaction efficiency also helped participants complete the business closed loop. In order to facilitate users to complete the one-stop interactive experience of target mining, information acquisition, and token trading on the platform, platforms such as GMGN and ABot (formerly NFT Sniper) have integrated transaction APIs into users token analysis systems.

This exploration has opened up a new trend of token analysis + trading bot integration. The subsequent platforms such as Cash Cash Bot and DEXX have optimized the experience of combining token information with transactions, and even the slogan Binance on the chain was once heard. Creating additional income through API fees has changed the monetization method of token analysis tools that relied mainly on advertising in the past. According to Dune data statistics, during the peak of meme trading in November, the daily transaction volume completed through the GMGN API reached a maximum of US$90 million, and the average daily income achieved by the GMGN platform through API fees that month was nearly US$400,000.

GMGN platform revenue; data source: Dune Analytics

Of course, the process of on-chain defeating off-chain cannot be achieved overnight. In the blockchain world, no one can break the impossible triangle. While TG Bot pursues scale and speed, the security of user funds is often sacrificed. In November, DEXX suddenly suffered a theft of user assets, with a total loss of tens of millions of dollars. After obtaining the stolen assets, the hackers sold them in large quantities, causing the on-chain meme market to collapse, which directly affected the duration of the market liquidity boom.

DEX explodes

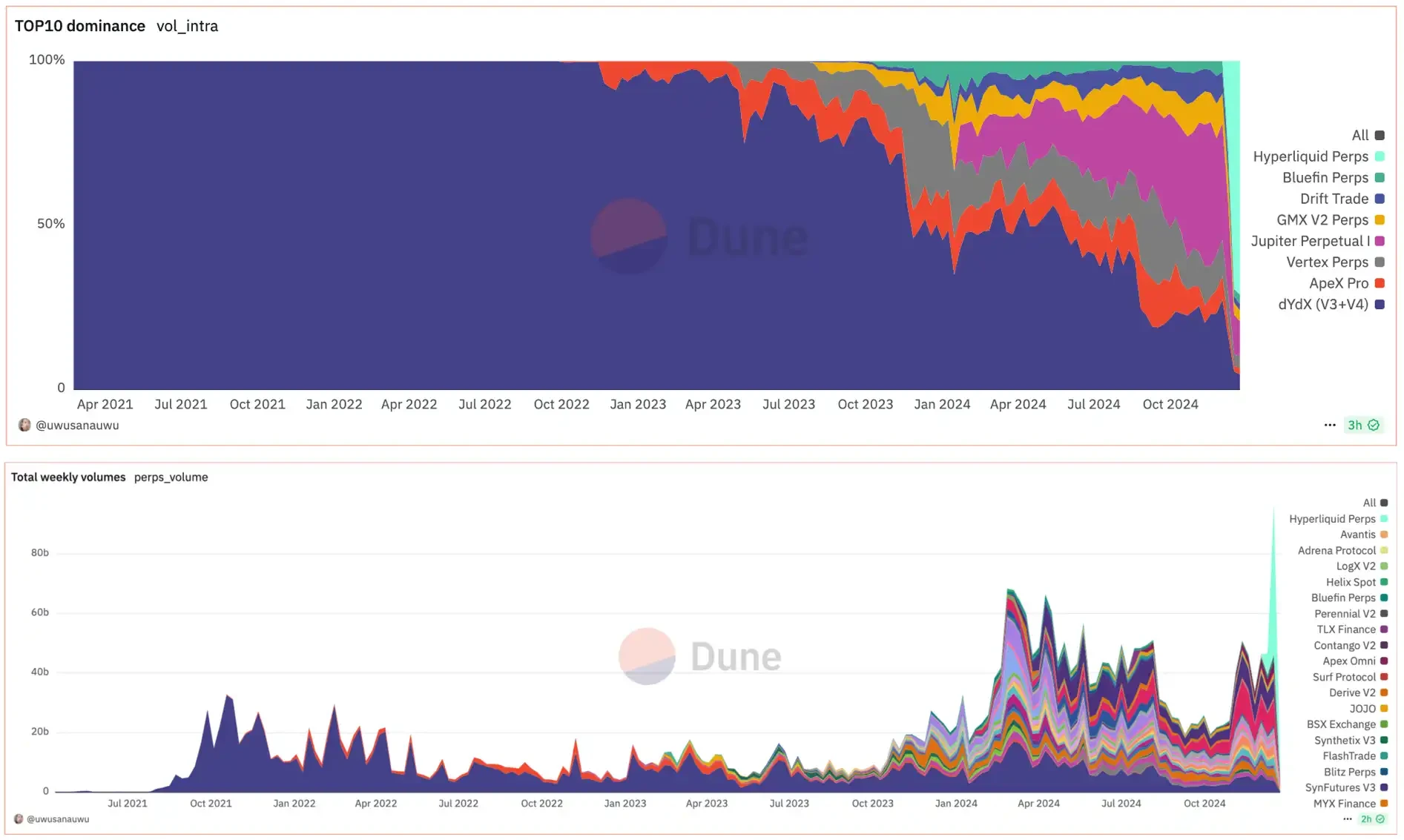

The trading infrastructure arms race in 2024 is not limited to the meme token field. Perp DEX, which failed to rise in the last round of Monday, and the new generation of DEX logic such as CLOB (central limit order book) and intention trading have also ushered in a full-scale outbreak. In the fourth quarter of this year, Hyperliquids price continued to hit record highs after the token TGE. It took only two weeks to break into the top 50 of the crypto market value, even surpassing its old owner Arbitrum, sweeping the entire attention market of the industry.

Hyperliquid platform capital inflow; data source: Dune Analytics

Behind the new high, Hyperlqiuids success is inseparable from the precise market aesthetics. While keenly capturing the market pulse of VC coins encountering obstacles in this round of cycles and refusing to take the path of financing and cashing out, the team has also done an excellent job in building low-latency, high-throughput infrastructure and high-frequency trading products. Of course, Hyperlqiuids most innovative feature is still its innovative coin listing mechanism.

Hyperliquid uses a Dutch auction to auction the token ticker. The listing process is open and transparent. If the project party wants to list the spot, it needs to apply for the deployment permission of the HIP-1 native token. Then the Dutch auction mechanism will be used to decide who will get the final token Ticker.

In the past period of time, some mainstream CEXs have been caught in the whirlpool of public opinion about currency listing fees. In the centralized and opaque currency listing market dominated by CEX, crypto projects often need to spend huge costs on listing. Hyperlqiuid provides a more economical solution, which can not only meet the needs of the first major exchange for the time being, but also grab a seat on a good trading platform at a low cost. After the subsequent access to HyperEVM, the tokens purchased from Hyperliquid can be used in other EVMs, which further highlights its relative advantage in cost-effectiveness of currency listing.

Perp DEX market share (above) and weekly trading volume (below), the light green part is Hyperliquid; data source: Dune Analytics

Another encouraging on-chain development comes from CowSwap. Since Binance launched COW spot, CowSwap and the narrative of its intentions have become hot again.

Due to different views on transaction matching methods such as AMM and order books, the DeFi protocol has gradually evolved into two technical development directions. One is the AMM on-chain LP trading pairs represented by Uniswap, and the other is the on-chain + off-chain order book settlement represented by Cowswap.

Unlike Uniswap, which calculates the final transaction price in the liquidity pool as x*y=k, Cowswap users sign their specific transaction intentions (such as price, subject matter, quantity and other transaction parameters) on the chain, and then the rest of the work is left to the protocols solver to complete through an on-chain + off-chain approach.

관련 자료: In addition to MEV, you can also run Didi on Everclear

Although the on-chain + off-chain solution does not sound very Crypto Native, it does bring a significant improvement in user experience. The order book and off-chain batch processing trading method allows the protocol to aggregate the on-chain LP pool, counterparties, market makers own funds and liquidity from CEX, with faster transactions and less wear and tear. Users do not even need to prepare additional Gas tokens for transactions, and the experience is extremely smooth.

Not long ago, CowSwap, as Genosiss designated DEX, became the official DEX for Trumps DeFi project WLFI to purchase on-chain assets, which once again attracted peoples attention. It is foreseeable that in the process of continued Mass Adoption in the on-chain world, intention infrastructure represented by CowSwap will play a more important role.

Chart 5: Proportion of pro-crypto senators in the U.S. Senate and House of Representatives

In Q4 of 2024, as Trump won the US election with an overwhelming victory of 270 votes and entered the White House again after 4 years, BTC ended its six-month-long volatile market and began to soar. In the golden window period under the relaxation of regulatory agencies, the off-chain ushered in an unprecedented institutional bull.

In Q4 of 2024, as Trump won the US election with an overwhelming victory of 270 votes and entered the White House again after 4 years, BTC ended its six-month-long volatile market and began to soar. In the golden window period under the relaxation of regulatory agencies, the off-chain ushered in an unprecedented institutional bull.

In order to win this election, Trump has been frantically courting people in the crypto industry during this years campaign and has become an out-and-out Bitcoin activist. At the Bitcoin 2024 conference held in Nashville in July, Trump mentioned that if he wins the election, he will formulate a series of pro-crypto policies to ensure that the United States becomes the worlds crypto center and Bitcoin superpower. These promises include firing the current SEC Chairman Gray Gensler, appointing a presidential advisory committee on cryptocurrencies, and using Bitcoin as a strategic Bitcoin reserve for the United States.

관련 자료: 트럼프, 미국 역사상 최초의 '비트코인 대통령'으로 등극

Not only did Trump become the first Bitcoin president of the United States, but Congress was also filled with pro-crypto officials.

After Trump won the election, many industry insiders began to be optimistic about the industrys more clear and supportive regulatory policies in the future. However, what really makes institutions and practitioners excited about encryption, and what can fundamentally reverse the pressure that cryptocurrencies face at the political level in the United States, is that the United States is about to usher in a new pro-crypto Congress.

The Crypto-Dollar Era of American Politics

Stand With Crypto 통계에 따르면, 이번 선거에서 암호화폐를 지지하는 후보 261명이 하원에서 의석을 차지한 반면, 암호화폐에 반대하는 의원은 116명에 불과했습니다. 동시에, 새로운 상원도 암호화폐를 지지하는 경향이 더 강해 17명이 찬성하고 12명이 반대했습니다.

At the same time, in this unprecedented Bitcoin election, crypto companies are also indispensable. In 2024, crypto companies have become the main contributors to US political donations. Coinbase and Ripple are the largest corporate political donors this year, contributing nearly 48% of the total corporate donations. Fairshake is a super political action committee (Super PAC) founded in 2023 by Josh Vlasto, a former assistant to the Governor of New York. It has raised more than $200 million to support pro-cryptocurrency candidates, becoming the PAC with the most spending in this election cycle.

Fairshake aims to elect pro-cryptocurrency candidates and combat skeptical opponents, and has received support from companies such as Coinbase, Ripple, and Andreessen Horowitz. These funds not only influence the policies of presidential candidates, but also promote pro-cryptocurrency congressional election strategies.

A typical example occurred in March this year, when progressive Democratic star Katie Porter raised more than $30 million in the California Senate election and was expected to win. However, because she adopted Elizabeth Warrens political stance and stood on the same front with Harris on bank regulation, Fairshake saw her as an ally of the anti-crypto movement.

During the California primary, Fairshake spent more than $10 million against Porter, eroding her base of support among young voters. Through Hollywood billboards and speeches targeting her, Fairshake claimed that Porter misled voters into supporting pro-corporate legislation. As a result, her campaign funds suffered and she ultimately failed to make the general election in the fall.

After the election dust settled, Musk became the biggest winner besides Trump and the Republican Party.

Trump spent a lot of time thanking Musk during his national address on election night. Musk has recently invested more than $130 million and a lot of time and tweets to support conservative politics, and Trump especially praised Musks rocket company SpaceX and its Starlink internet satellites. We must protect these super geniuses, the president-elect said. During the campaign, Trump also revealed that at Musks request, he would create a government efficiency position specifically to support the tech entrepreneur.

Musk is known for his opposition to government interference, and whenever he faces fines or penalties, he always points to government overreach. Therefore, it is not surprising that he has allied himself with Trump, who has promised to relax regulations. In addition to the possible reduction of government regulations, Musks alliance with Trump may also help him obtain more federal contracts. According to the New York Times, SpaceX and Tesla have received at least $15.4 billion in government contracts in the past decade. According to Reuters, Musks colleagues and government officials said that the billionaires support for Trump is also to better protect his company from regulation and ensure government subsidies.

After Trump announced that Musk would lead the government efficiency department, Musk posted a picture of the DOGE Logo on his personal Twitter. Source: Musk Twitter

At 9:30 a.m. on November 13, Trump issued a statement announcing the appointment of Elon Musk to lead the Department of Government Efficiency (DOGE) to eliminate government bureaucracy, cut excessive regulation, cut wasteful spending, and reorganize federal agencies. Musk then released the logo of the Department of Government Efficiency and said that it would make government more interesting.

관련 자료: How did 50 billion Dogecoins allow Musk to enter the new US government department?

Since then, the crypto industry has moved from behind the scenes to the forefront and has become a core force in American politics.

Institutions take the lead in the market: old coins are revived, DeFi is revived

With the intervention of institutions, ISO 20022 series tokens, led by XLM, IOTA, HBAR, etc., began to take off. The logic of the bull market in the second half of the year is fundamentally different from that in the first half of this year. In the first half of the year, under the catalysis of ETF benefits, the market followed the hype of hot spots such as meme and AI, forming a situation where the increase of hot coins was much greater than that of other tokens; in the second half of the year, Trump brought a spring breeze of compliance to encryption. ISO 20022, as a standard for electronic data exchange between financial institutions, covers financial information transmitted between financial institutions. ISO 20022 is more advanced than the traditional format used by banks, supporting larger amounts of data and faster processing rates. If the token complies with ISO 20022, it will be used for international payments first. As a result, institutions began to scramble for shares on a large scale, and compliant assets began to repeatedly appear on the list of gains.

ISO 20022 migration timeline, source: cryptopolitan

관련 자료: How did the Zombie Coin suddenly come back to life?

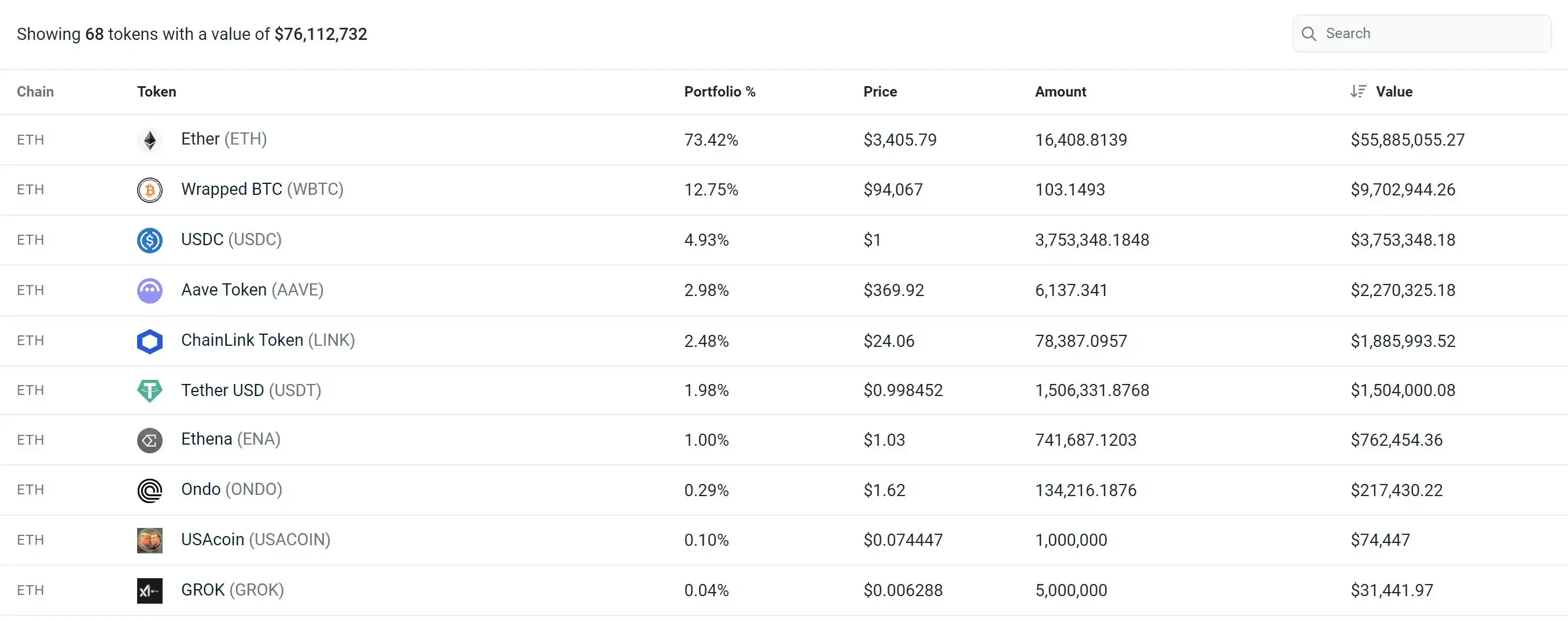

If Trump started the institutional bull market, then DeFi has also become the earliest and easiest field for traditional money to get involved in. The most representative of these is World Liberty Financial (WLFI), which is closely related to Trump.

WLFI was officially launched in September this year, claiming to be a DeFi platform that has nothing to do with Trump himself. However, on the official website of WLFI, Trump is listed as the Chief Crypto Advocate, while his sons Donald Trump Jr., Eric Trump and Barron Trump are all Ambassadors.

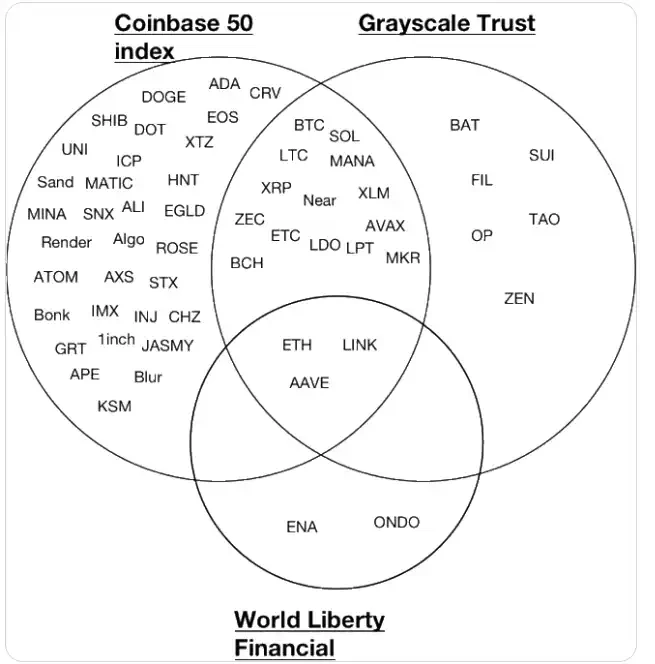

Since November this year, WLFI has purchased a variety of mainstream and emerging crypto assets through a major wallet address. In addition to leading crypto assets such as BTC and ETH, WLFIs wallet purchased LINK at an average price of 25.5, AAVE at an average price of 324.4, ENA at an average price of $1, and ONDO at $1.86.

Crypto assets in the WLFI wallet. Image source: Arkham

It can be seen that even after several pullbacks after breaking through 100,000 and a sharp drop affected by the Feds hawkish rate cut news, as of December 19, the tokens purchased by WLFI still have a strong trend in the 30-day trend. The US Presidents involvement has brought full confidence to all investors and institutions. Even after a short decline, these tokens will rebound strongly due to the strong market consensus. Some vigilant institutional investors have begun to choose one-click copy Trump. For example, ArkStream Capital made a heavy bet on Ethena after Trump took office and received rich returns.

관련 자료: ArkStream Capital: Why did we invest in Ethena after Trump took office?

After the election, the markets funds and attention have begun to face up to and focus on these institutional conspiracies. The Grayscale concept that once dominated the entire currency circle in 2021 began to go viral again, and the Coinbase 50 Index has also become a reference benchmark for secondary investment. In the general rise mode under the money-picking time, how to select the tokens with the highest increase has become the most important lesson in secondary trading from maximizing the use of funds. Which altcoins should you buy to outperform the market average? Instead of following the KOLs orders, it is better to let Grayscale and Coinbase work for you.

Take Grayscale Decentralized Finance (DeFi) Fund as an example. This fund is one of the first securities to invest in a basket of decentralized financial applications in the form of securities, including UNI, AAVE, LDO, MKR, SNX, etc. The tokens in these DeFi funds performed well after the election, and NAV per share (net asset value per share) soared from US$13 to US$35.

Grayscale decentralized finance fund list and token performance, source: Grayscale official website

Grayscales decentralized AI fund and mainstream currency fund also performed well. In addition to Grayscale, Coinbase has also begun to actively deploy in the crypto industry. First-rate companies set standards, second-rate companies set brands, and third-rate companies make products. With the original intention of benchmarking the SP and Nasdaq, Coinbase has weighted the top 50 high-quality cryptocurrencies by market value to form COIN 50, establishing the worlds leading digital asset benchmark index. The tokens in the Coin 50 index have also become a bellwether for cryptocurrencies.

The COIN 50 index achieved a return rate of 68.30% in the 30 days after its launch, and a return rate of 99.64% in the 90 days. This amazing return rate can still be achieved when the weight of BTC and ETH accounts for 70%. It can be seen how exaggerated the return rate of other crypto assets within this index is, except for large-cap currencies such as BTC and ETH.

Coin 50 Index, Grayscale Trust Fund and WLFI Crypto Asset Collection, pictures from the Internet

For the coming 2025, we can foresee that since there are ETFs and crypto indices for mainstream currencies, will there be copycat ETFs? In the traditional financial market, the first ETF in the United States, the SPDR SP 500 ETF, was listed on the New York Stock 교환 in 1993. From 2000 to 2009, the US ETF market expanded rapidly, forming a diversified asset class including broad-based, industry-themed, Smart Beta, fixed income and commodity ETFs. The crypto market is still in its infancy compared to the mature traditional financial market, and it is conceivable that US-funded institutions will further deploy copycat ETFs and copycat indices.

In 2024, Bitcoin’s fourth halving cycle came to a perfect end with the institutional bull market after Trump took office!

This article is sourced from the internet: Five charts to look back at crypto performance in 2024

Related: Meme super cycle, which targets are worth paying attention to?

After Trump was basically confirmed as the US President, Bitcoin continued to charge upward. After Bitcoins market share reached 60%, this rise was different from the previous ones in that it did not suck blood from the altcoins but rose together. Web3 investors seem to have discovered that chasing high Bitcoin is not the best choice at present. It is better to choose altcoins that are obviously oversold. A large number of altcoins are in the stage of undervaluation. Among them, the most violent rebound is Meme coin. As Murad said in a post on social media, Understanding that Meme is an unstoppable tokenized community is the real enlightenment. We are in the early stages of the Meme coin super cycle. Binance, the leading CEX, has also recently launched a…