Next week, a total of 10 projects will unlock, and ZETA will unlock nearly 10% of the tokens in circulation.

ZetaChain

프로젝트 트위터: https://twitter.com/zetablockchain

프로젝트 웹사이트: https://www.zetachain.com/

Number of unlocked tokens this time: 54.91 million

Amount unlocked this time: Approximately 32.54 million US dollars

ZetaChain is a foundational public blockchain that enables full-chain, universal smart contracts and messaging between any blockchain. ZetaChain aims to build a fluid multi-chain 암호화폐 ecosystem. These “full-chain” smart contracts can send data and value between connected blockchains, including Bitcoin, Ethereum, Polygon, and more.

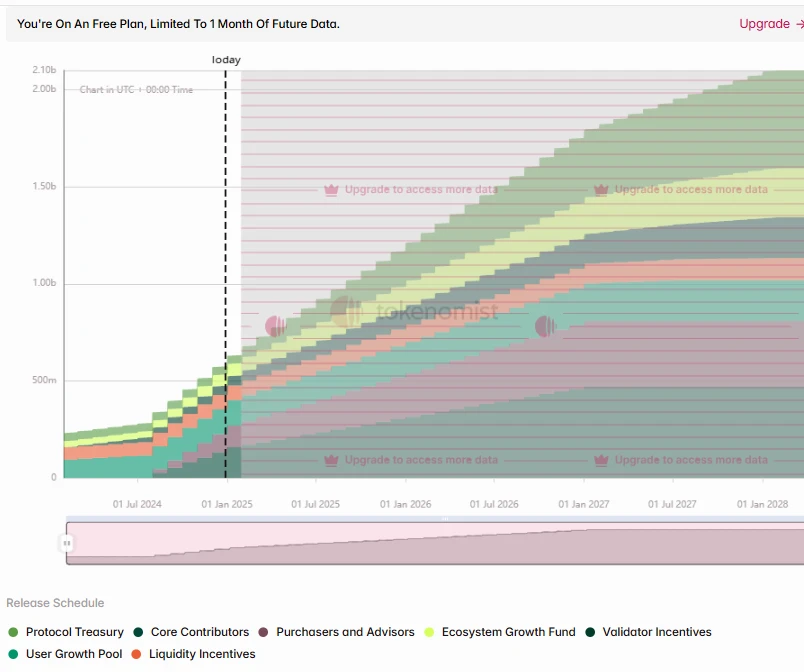

ZETA has only unlocked 27% so far and is currently in a period of rapid release. This round of unlocking is for five categories of people, the most important of which are core contributors (26.25 million) (US$15.52 million), consultants (18.67 million) (US$11.04 million), and ecological development funds (5.25 million) (US$3.1 million).

구체적인 릴리스 곡선은 다음과 같습니다.

수이

프로젝트 트위터: https://twitter.com/SuiNetwork

프로젝트 공식 웹사이트: https://sui.io/

Number of unlocked tokens this time: 68.33 million

Amount unlocked this time: Approximately US$278 million

Sui is one of the earliest projects in the Meta public chain, developed by the Mysten Labs team. Sui aims to create an environmentally friendly, low-cost, high-throughput, low-latency permissionless blockchain. Compared with traditional blockchains, Suis most critical innovation lies in Suis data model and transaction processing channel.

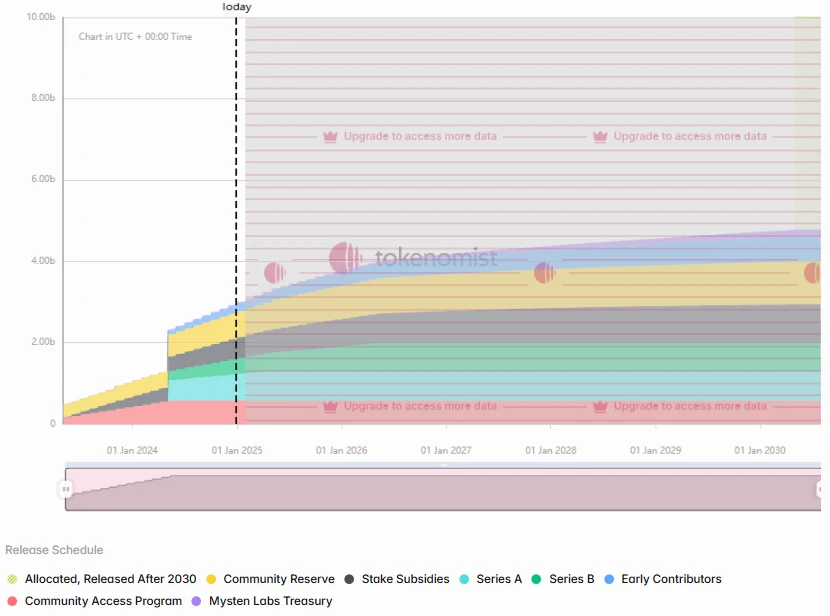

The current circulation ratio of SUI is 29%. The unlocking objects in this round include 19.84 million pieces (80.94 million US dollars) from Series A financing, 19.32 million pieces (78.83 million US dollars) from Series B financing, 12.63 million pieces (51.52 million US dollars) from community reserves, 10.34 million pieces (42.18 million US dollars) from early contributors, and Mysten Labs treasury (8.44 million US dollars).

구체적인 릴리스 곡선은 다음과 같습니다.

Optimism

프로젝트 트위터: https://twitter.com/Optimism

프로젝트 웹사이트: https://app.optimism.io/governance

Number of unlocked tokens this time: 31.34 million

Amount unlocked this time: Approximately 58.61 million US dollars

Optimism is a Layer 2 scaling solution that achieves the goal of scaling the Ethereum network by adopting the Optimistic Rollup solution. It can process transactions on a large scale while maintaining the security of Ethereum. Ethereum developers can efficiently use all tools on Ethereum without making changes.

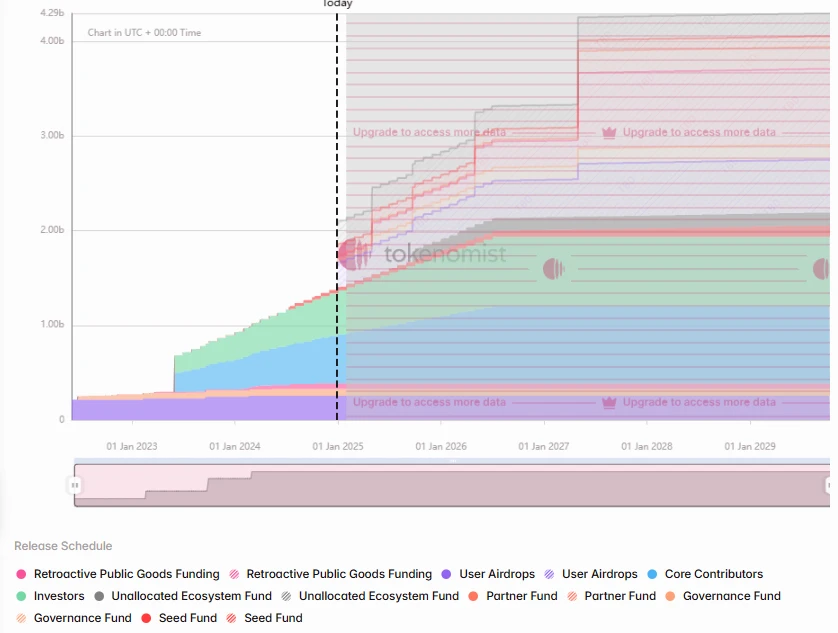

The current unlocking amount of OP is only 32%, and there are only two unlocking objects, namely core contributors 16.54 million (US$31.1 million) and investors 14.8 million (US$27.82 million).

구체적인 릴리스 곡선은 다음과 같습니다.

This article is sourced from the internet: One-week token unlock: SUI unlocks nearly $280 million worth of tokens

Related: Shorts rebound, BTCs key support is around 88,000

Original source: BitpushNews The cryptocurrency market continued its correction trend on Tuesday. According to Bitpush data, Bitcoin continued to be under pressure after hitting a high of $95,000 in the morning. In the afternoon, bulls tried to rebound, but encountered bearish resistance at $94,800 and fell below $91,000. At the time of writing, Bitcoin was trading at $91,646, down 2% in 24 hours. The altcoin market performed even weaker, with more than 90% of the top 200 tokens by market value recording losses. The overall cryptocurrency market cap is currently $3.14 trillion, with Bitcoin’s dominance rate at 57.3%. In the U.S. stock market, the SP, Dow Jones and Nasdaq indices all closed higher, up 0.57%, 0.28% and 0.63% respectively. The decline may be due to overheating of the leveraged market…