Unveiling the Trump family’s crypto project WLFI’s “asset package”, a spillover of the Trump effect?

원본 | Odaily Planet Daily ( @오데일리차이나 )

저자: Wenser ( @웬서 2010 )

With Trump being elected as Time Magazines Person of the Year on the 12th of this month and appearing on the cover , the Trump effect in the 암호화폐currency market continues. Recently , the Trump familys crypto project WLFI (World Liberty) has brought a new wave of attention to the various tokens on the market. After purchasing a series of mainstream coins, infrastructure project tokens and RWA tokens, the project officially announced its cooperation with Ethena Labs at around 2 am today. The two parties plan to integrate Ethenas revenue token sUSDe into the WLFI lending platform.

Odaily Planet Daily will sort out WLFI’s recent operations and transmission impacts in this article for readers’ reference.

WLFI has been active recently : buying ENA, ONDO, etc.

At about 4 am yesterday, according to Onchain Lens 모니터링 , the Trump familys crypto project WLFI (World Liberty) spent another 250,000 USDC to purchase 231,726 ENAs, and its ENA holdings rose to 741,687, with a total cost of $750,000. In addition, it also exchanged 103 cbBTC worth $10.36 million into WBTC.

On December 16, WLFI spent 250,000 USDC to buy 134,216 ONDO .

On December 15, WLFI spent 500,013 USDC to buy 509,955 ENA at an average price of $0.981.

On December 13 , WLFI spent 1 million USDC to buy 37,052 LINK, and spent 151,985 USDC to buy 422 AAVE; within 48 hours, the project spent a total of 10 million USDC to buy 2,631 ETH; spent 1,246,722 USDC to buy 4,043 AAVE; spent 2 million USDC to buy 78,387 LINK.

On December 12, according to Arkham 모니터링 , WLFI multi-signature addresses held 14,573 ETH (about 57.03 million US dollars), 102.9 CBBTC (about 10.38 million US dollars), 3.108 million USDT, 1.515 million USDC, 41,335 LINK (about 1.17 million US dollars), 3357 AAVE (about 1.16 million US dollars) and other cryptocurrencies. It is worth mentioning that the project just exchanged a large amount of stablecoins from token sales into ETH on that day, and its ETH holdings were worth more than 50 million US dollars at that time.

As previously mentioned ~에 의해 Ai Yi, an on-chain analyst , the non-stablecoin assets purchased by WLFI include LINK/AAVE/ENA/ONDO, half of which belong to DeFi head applications and half to RWA assets. Interestingly, although COW is not in World Libertys Portofolio, since Cowswap has been used to purchase tokens on the chain in recent times, its price has also skyrocketed by nearly 93% in the past seven days. This driving effect is also reflected in other tokens it has purchased:

On December 14 , after buying LINK and AAVE, WLFI had a floating profit of US$299,000 on the former and US$338,000 on the latter.

On December 16 , after the news of WLFI’s purchase spread, ONDO broke through 2.1 USDT, setting a new historical high, with a 24-hour increase of 16.33%.

On December 16, boosted by news such as WLFI buying various tokens, 암소 broke through $1, setting a new all-time high; the price of 에나 once rose to $1.33, only less than $0.2 away from its previous historical high.

If the BTC price was previously affected by the Trump effect and broke through the $100,000 mark from $70,000, then there is no doubt that WLFIs holdings were also affected by this effect.

After all, in the eyes of cryptocurrency traders in the United States and around the world, WLFI is Trumps open project.

WLFI current holdings statistics: AAVE, COW

From the end of November to December 19, after completing the $30 million token sale target, the WLFI project’s previous token purchase operations included:

– 30 million USDC purchased 8,105 ETH;

– 10 million USDC was used to purchase 103 cbBTC (already converted into WBTC);

– 2 million USDC purchased 78,387 LINK;

– 1.91 million USDC was used to purchase 6,137 AAVE;

– 741,687 ENA were purchased with USDC worth $750,000;

– 134,216 ONDOs were purchased with $250,000 USDC.

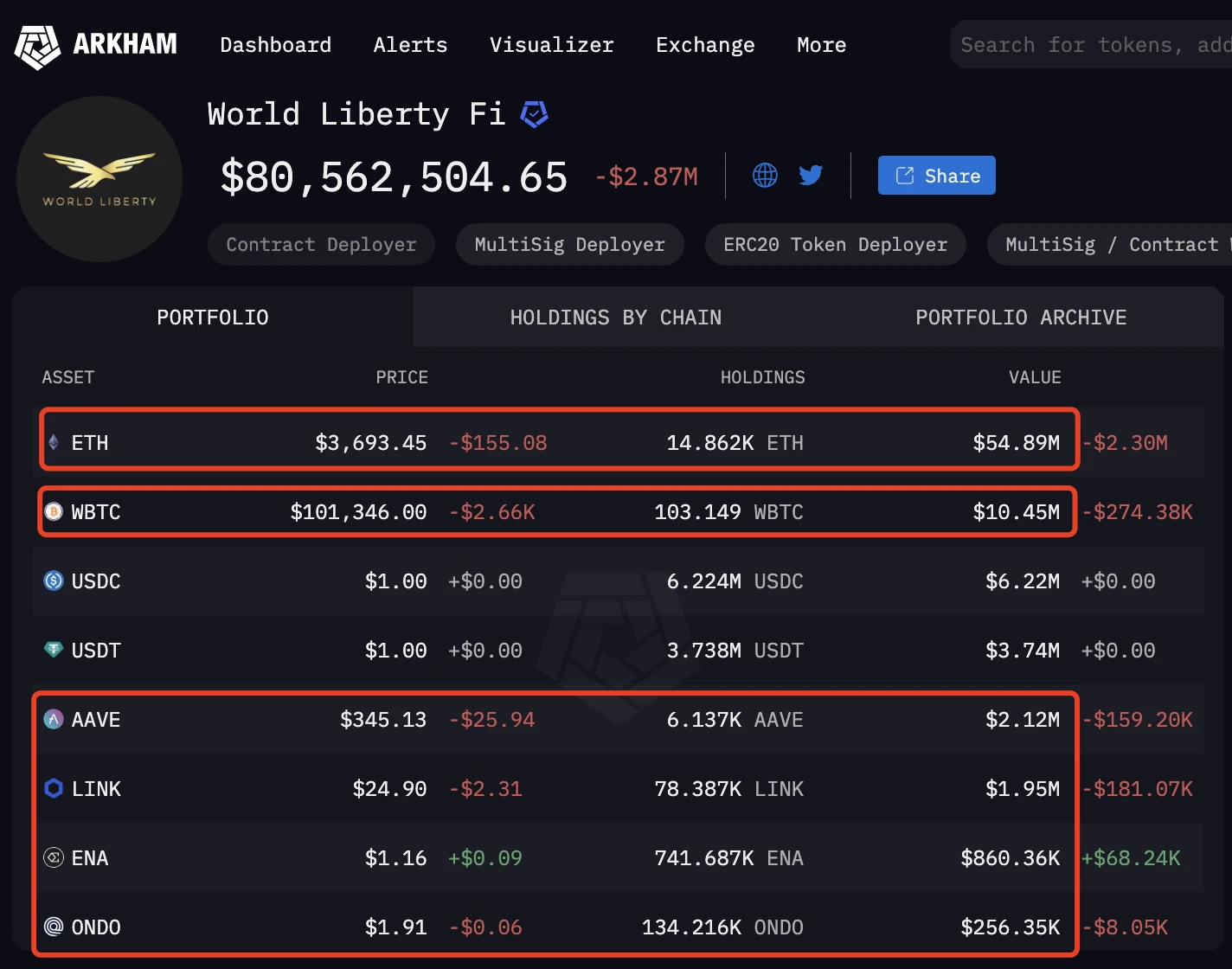

According to the on-chain data website Arkham, 그만큼 current holdings of the WLFI project are as follows:

-

14,800 ETH, worth $54.89 million;

-

103 WBTC, worth $10.45 million;

-

6,137 AAVE, worth $2.12 million;

-

78,300 LINK, worth $1.95 million;

-

741,000 ENA, worth $860,000;

-

134,000 ONDO, worth $256,000.

-

Stablecoin (USDT+USDC) holdings are approximately US$10 million.

-

Currently, the total value of assets in this multi-money address is approximately US$80.56 million.

WLFI token holding information (as of 17:00, December 19)

WLFIs difficult growth path: from a target of 300 million to barely raising 30 million

Looking back at the growth of the WLFI project, it can hardly be said to be smooth sailing.

~에 the end of August , Eric Trump, the second son of Trump and current executive vice president of the Trump Group, announced the official launch of the crypto project WLFI (@WorldLibertyFi), which is committed to creating a new era of finance. It is worth mentioning that after Trump won the presidential election in early November, people familiar with the matter revealed that the project was prepared and established due to insufficient funds during Trumps presidential campaign.

After inviting a number of well-known figures including Paxos CEO, Tomo Wallet founder, Mixie Studios Mixie Media CEO, and Glue co-founder to join, and after experiencing a series of market doubts and questioning, the WLFI project token pre-sale finally started as scheduled on October 15.

Despite the impressive result of raising $5 million in one hour of pre-sale , the market feedback was not ideal due to issues such as KYC certification, website downtime, and the previous project token distribution ratio. According to media reports , the roadmap shows that WLFIs initial sale will seek to raise $300 million and sell 20% of the token supply at a FDV of $1.5 billion.

As of October 17, according to Lookonchain 모니터링 , WLFI sold 833.73 million tokens with sales exceeding US$12.5 million; more than 10,000 users participated in the token sale, among which address 0x2d24 spent 351.3 ETH (US$903,000) to purchase 60.43 million WLFI, becoming the largest buyer.

Subsequently, ~에 따라 to a 13-page World Liberty Gold Paper document for the project, the Trump family would receive 75% of the projects net profits without having to bear any responsibility.

As the news came out, there was an uproar.

Animoca Brands co-founder and executive chairman Yat Siu , Kenetic Capital co-founder and managing partner Jehan Chu , and Synthetix founder Kain Warwick each raised questions, comments and even suggestions from their own perspectives.

In early November, WLFI cut its funding target by 90%, planning to sell only $30 million worth of WLFI tokens instead of the originally planned $300 million).

On November 20 , WLFI sold approximately 1.35 billion tokens for $20,283,014, or approximately 68% of its reduced funding target.

Just when many people thought that the project had hit a dead end and even the goal of raising $30 million would be difficult to achieve, someone took action.

On November 26, Justin Sun 발표 that he had invested $30 million in the Trump familys crypto project WLFI, becoming its largest investor. He also said that the United States is becoming the center of blockchain, thanks to Trumps support for Bitcoin. He then joined WLFI as a consultant .

The author personally speculates that this is also the reason why WLFI recently exchanged cbBTC for WBTC.

As for the purchase of AAVE and LINK tokens, it is also related to the previous cooperation——

On November 14, WLFI officially 발표 that it would adopt the Chainlink standard for on-chain data and cross-chain connections as a secure way to bring DeFi into the next stage of mass adoption.

On December 13, the first community proposal initiated by the WLFI community to deploy an Aave v3 instance for the WLFI protocol was finally passed . It is understood that the instance will be managed by an external risk manager, and will be built on the existing Aave v3 infrastructure and eventually launched on the Ethereum mainnet.

In this regard, WLFI has transformed itself and not only successfully stayed at the table, but is now expected to become the American encryption weathervane in the future.

Conclusion: WLFI will continue to be active in the US crypto market and become a crypto flag

According to a previous 분석 , WLFIs previous exchange of stablecoins for ETH indicates that the project is seeking to participate in a deeper crypto economy. This may also indicate that the team believes that ETH is a better reserve asset than the US dollar. It is reported that the first person to notice this transaction was Eric Conner, a well-known Ethereum investor and consultant.

처럼 mentioned above, 75% of the net proceeds from the WLFI project pre-sale will be received by the Trump family without any liability. The document also emphasizes that Trump and his family members are not directors, employees, managers or operators of WLFI or its affiliates, and states that the project and tokens have nothing to do with any political activities. The remaining 25% of the net agreement income will belong to Axiom Management Group (AMG), a Puerto Rican company wholly owned by project co-founders Chase Herro and Zachary Folkman. AMG has agreed to allocate half of its profit rights to WC Digital Fi, an affiliate of Trumps close friend and political donor Steve Witkoff and some of his family members.

From this perspective, WLFI may become the subsequent crypto flag of the Trump faction. On the one hand, it will use trading operations to carry out in-depth cooperation with more crypto projects to promote the development of the US crypto economy; on the other hand, the project will also provide certain financial support for Trump and his faction members, facilitating many personal and political behaviors during his future administration.

A group of core team to promote the development of the US crypto economy may be born around WLFI, and the project is expected to become Trumps Crypto Huangpu Military Academy.

This article is sourced from the internet: Unveiling the Trump family’s crypto project WLFI’s “asset package”, a spillover of the Trump effect?

Original title: Pump.science wallet private key leak: an unfinished storm Original author: Karen, Foresight News On the evening of November 25, the address marked as the creator of RIF and URO on pump.fun issued the Urolithin B (URO) token, which made many community members mistakenly believe that this was the official token issued by pump.science. Urolithin B (URO) quickly graduated and within two minutes of joining the liquidity pool, its market value soared to $10 million, but then began to fall continuously, and its current market value has fallen back to about $100,000. The event also appears to have had an impact on the market performance of Urolithin A (URO) and Rifampicin (RIF), both of which fell more than 30% in 24 hours. So, what exactly is going on? pump.science…