원본 | Odaily Planet Daily ( @오데일리차이나 )

저자 | Fu Howe ( @빈센트 31515173 )

As the Mme coin craze continues to heat up, many investors are deeply trapped in the PVP model of short-term surges and plunges. This high-risk market attracts people who pursue quick returns, but it also causes most people to face greater volatility risks. For investors who pay more attention to stable returns, participating in liquidity provision (LP) is becoming a path worth exploring.

To this end, Odaily Planet Daily will focus on analyzing two LP platforms – Raydium and Meme Farmer, to help investors discover stable gold-digging opportunities in the Meme wave.

Raydium: The Liquidity Engine of the Solana Ecosystem

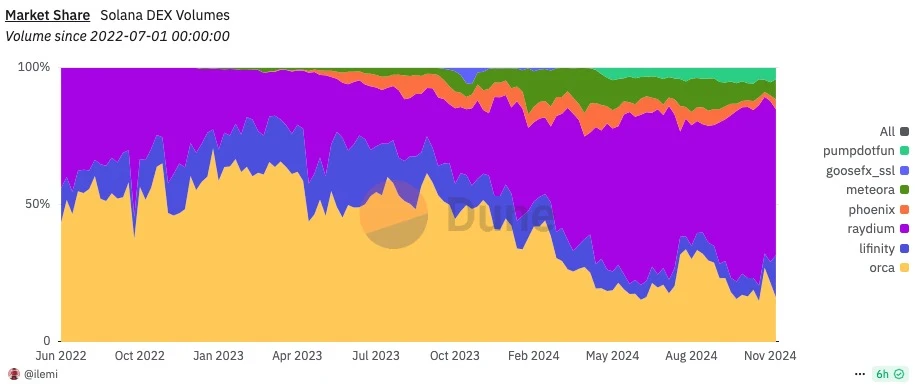

Raydium is the largest decentralized exchange (DEX) on the Solana network, and according to Dune data, it currently accounts for approximately 60% of the total trading volume of Solana DEX.

Raydiums liquidity is closely related to the issuance of meme coins. In fact, it is not difficult to find in the GMGN platform that most of the liquidity pools of Meme coins are provided by Raydium. The main reason is the linkage between the Pump.Fun platform and Raydium. Pump.Fun, as the engine of Meme coins on Solana, provides initial liquidity support for Meme coins when their market value reaches a certain scale. The liquidity pool belongs to Raydium, which makes about 90% of the Meme coin trading volume generated by Pump.Fun concentrated in Raydium, strengthening its dominant position in the Meme coin market.

As shown in the figure below, most Meme-related LPs have earned returns of more than 1000%. Compared with the fighting on the chain, investors with large capital may be more willing to provide liquidity to earn returns.

Currently, Raydium provides three different types of pools, namely standard AMM pool (AMM v4), constant product exchange pool (CPMM), and centralized liquidity pool (CLMM).

Each type of pool has different fee standards, which can be roughly divided into transaction fees, pool creation fees, buyback fees, and vault fees.

However, Meme coin liquidity providers should be aware that high volatility may cause the value of LPs to decline, resulting in impermanent losses. It is recommended to be LPs for leading projects in different sectors of Meme coins. The APY income is slightly lower than that of other new memes, but the risk is relatively controllable.

Meme Farmer: Based on Raydium, community-driven, and not yet audited

In addition to Raydium, many KOLs on social media have recently published articles to promote Farmer.Meme. This platform is a revenue platform designed specifically for the Meme economy, providing smart LP strategies and innovative ways to help users realize revenue. Its core features are as follows:

-

Intelligent LP management: The platform provides intelligent LP strategies to help users easily optimize their returns.

-

Permissionless pool creation: Users and projects can independently create centralized liquidity pools (CLMMs) or constant product pools (CPMMs), inject liquidity into these pools, and obtain corresponding returns.

-

Ecosystem Rewards: The platform allows project owners to increase the returns of liquidity providers through incentives and attract more capital participation.

-

Fair launch: Farmer.Meme emphasizes that the platform is completely driven by community users and project parties, avoiding the participation of venture capital.

Farmer.Meme provides incentives to liquidity providers by issuing BRRR tokens. The token adopts an inflation model and has no fixed supply limit. The platform charges a 10% fee on users earnings, 50% of which is used to buy back BRRR tokens and send them to the treasury to support the long-term stability of the platform.

Currently, some LP yields of Farmer.Meme are as follows:

It is worth noting that the centralized liquidity pool (CLMM) used by most of Farmer.Meme鈥檚 pools does not have a yield as high as shown in the figure. After testing, Farmer.Meme鈥檚 liquidity mining has a daily yield of about 10% – the main income comes from the incentive of the platform currency BRRR, and its own LP income is similar to Raydium.

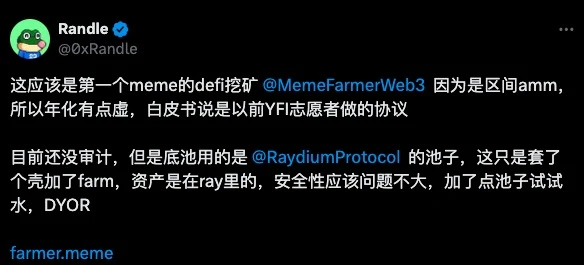

According to KOL Randle, the project has not been audited yet, and the underlying layer is Raydiums pool, so most of the assets should be in Raydium.

Farmer.Meme, as a meme coin liquidity provider, can obtain higher returns than other platforms in the short term through token incentives. However, unlimited supply will inevitably lead to the phenomenon of mining, withdrawing and selling. It is feasible to obtain short-term returns, but due to the lack of audits, it is also necessary to pay attention to security, especially wallet authorization.

Summary: How to benefit steadily from the Meme wave?

For users seeking a solid investment opportunity in the Meme market, Raydium and Meme Farmer both offer high LP return potential:

-

Raydium is more suitable for investors who value security and stability. Its rich liquidity pool types and market dominance provide investors with a reliable choice.

-

Meme Farmer is more suitable for short-term high-yield investors who can obtain higher returns through the token incentive model, but they need to pay close attention to the platform security and the long-term stability of the token economy.

In addition to the above two platforms, Orca and Lifinity also occupy a certain market share, but the returns of Meme coins are relatively low. No matter which platform is chosen, investors should fully evaluate the high volatility of the Meme market and find a balance between returns and risks.

This article is sourced from the internet: The Meme wave is not only about PVP, mining is also a good choice

관련: MicroStrategy는 1년 동안 비트코인보다 4배나 더 좋은 성과를 냈습니다. 레버리지는 정말 무위험일까요?

원저자: Yue Xiaoyu (X: @yuexiaoyu111 ) MicroStrategy Incorporated($MSTR)는 기업 분석 소프트웨어를 주력으로 하는 미국 상장 기업입니다. 최근 몇 년 사이에 대량의 비트코인(BTC)을 보유하기 시작하면서 시장의 주목을 받고 있습니다. MSTR은 주요 투자 전략으로 비트코인을 매수하기 위해 부채를 발행하는데, 여기에는 재무 레버리지 효과가 있습니다. 부채 비용은 고정되어 있지만 자산(비트코인)의 가치 성장이 더 높기 때문에 순이익 성장은 주식 가치를 직접 증가시킵니다. 이것이 이 기간 동안 MSTR의 주가가 비트코인 자체보다 더 많이 상승한 이유이며, MSTR은 "레버리지 비트코인 ETF"로 알려져 있습니다. 과거 데이터를 판단해보면 MSTR의 주가와 비트코인 가격 사이에는 명백한 동기적 변동 관계가 있습니다. 2020-2021 비트코인 강세장: MSTR 주가가 상승…