Weekly Editors Picks는 Odaily Planet Daily의 기능적 칼럼입니다. Planet Daily는 매주 방대한 양의 실시간 정보를 다루는 것 외에도 많은 고품질 심층 분석 콘텐츠를 게시하지만 정보 흐름과 핫 뉴스에 숨겨져 있어 지나칠 수 있습니다.

따라서 저희 편집부는 매주 토요일마다 지난 7일간 게재된 콘텐츠 중에서 시간을 들여 읽고 수집할 만한 고품질 기사를 엄선하여 여러분께 새로운 영감을 선사할 것입니다. 암호화폐 데이터 분석, 업계 판단, 의견 출력의 관점에서 세계를 바라봅니다.

이제 와서 우리와 함께 읽어보세요.

투자와 창업

Follow Trump and start the easy mode of this bull market

Instead of focusing on the alpha of each track, studying the alpha of Trump may be the most cost-effective way – the coins that benefit from Trump include BTC, DOGE, PEPE, WIF, PNUT, the companies that benefit from Trump include COIN, MSTR, and the Western concept public chains include SOL, XRP, UNI, and BASE.

OBV (OBV indicator) combines trading volume with price changes to provide another unique perspective on market movements – signaling potential trend reversals.

OBV has the following classic uses: confirming trends, escaping tops and buying bottoms, and judging the behavior of major players; it is also often used in conjunction with moving averages to predict market conditions, with price moving averages to find key points for price breakthroughs, and with volume moving averages to identify institutional entry.

The funding rate is in a safe zone, the transaction volume hit a record high, indicating risks, and the market share of copycats is close to the first starting point in 2021.

There are currently 32 projects in the DeSci track, but there are very few projects that have an outstanding Founder or Co-Founder. It can be said that if these DeSci track entrepreneurs are ranked, a DeSci founder contempt chain can be formed: highly vertical entrepreneurs>top elites in encryption/other industries>financial practitioners>serial entrepreneurs in other industries.

The article further introduces the representatives of the first and second echelons: Tyler Golato, Alok Tayi, Simone Fantaccini; Brian Armstrong, Paul Kohlhaas, Laura Minquini, Vincent Weisser.

또한 추천: Dialogue with the founder of MicroStrategy: Bitcoin will reshape the global wealth landscape , Ten years ago, Pantera bought 2% of the worlds BTC at a minimum of $65. What is the founder thinking today? and Ray Dalios new article Coming Soon: The United States and the Changing World Order under the Trump Administration .

공중 투하 기회 및 상호 작용 가이드

Step by step guide to get the Story Odyssey badge

나 나

This article analyzes the performance of more than 1,500 tokens promoted by 377 Twitter influencers and concludes:

-

76% of Twitter influencers have promoted the “death” Memecoin;

-

2/3 of the Memecoins promoted by influencers are “dead”;

-

86% of Memecoins promoted by influencers saw their value plummet by 90% within 3 months;

-

Only 1% of Memecoin promoted by influencers achieved a 10-fold growth.

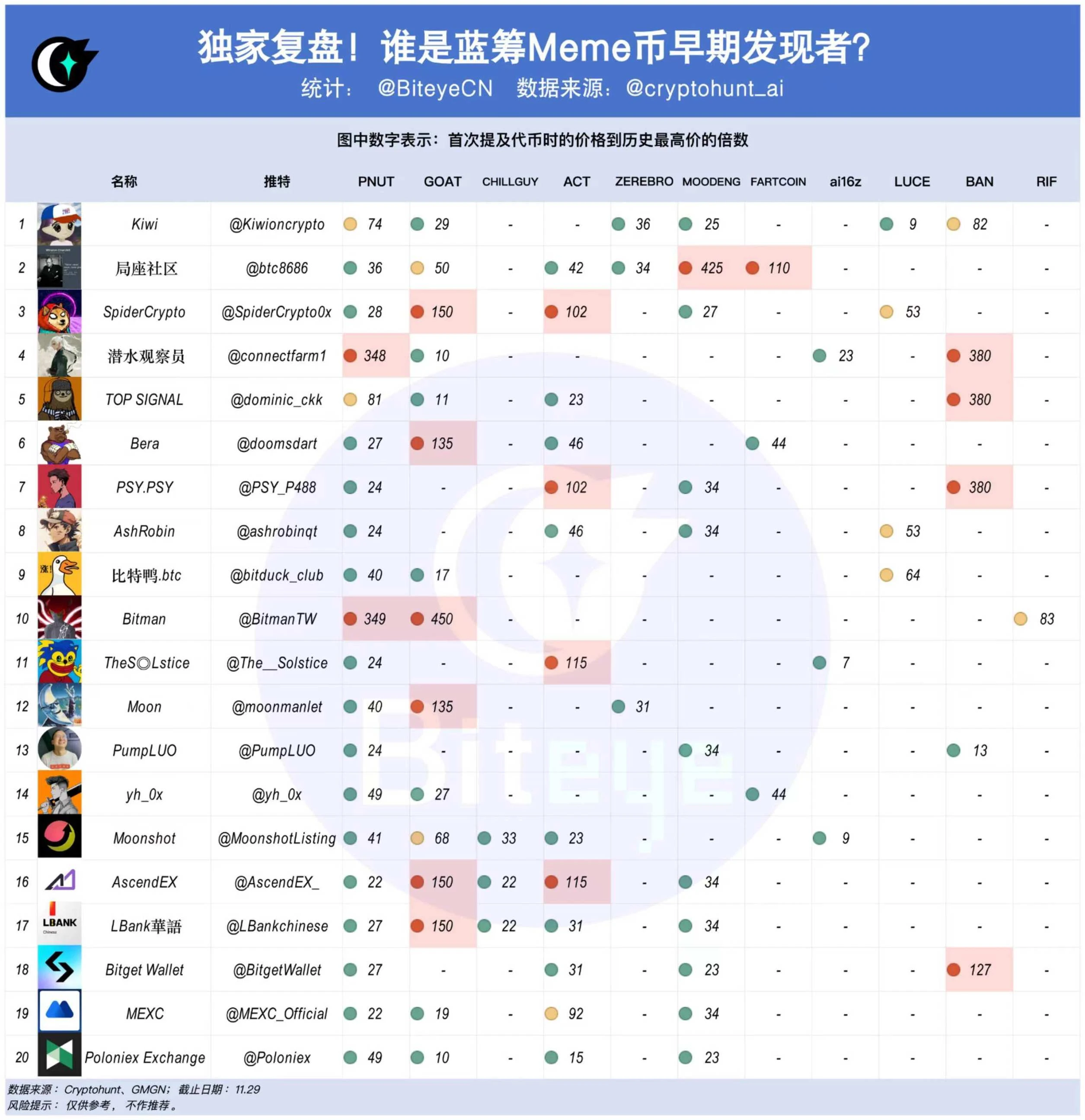

KOL Data Review: Who is the Early Discoverer of Blue Chip 밈 코인?

Meme Training Manual: 48-day 24x copy trading system ushered in a new upgrade | Produced by Nanzhi

There is no need to evaluate loss-making tokens. As long as the address is profitable overall and in the long term, it can be used as a copycat.

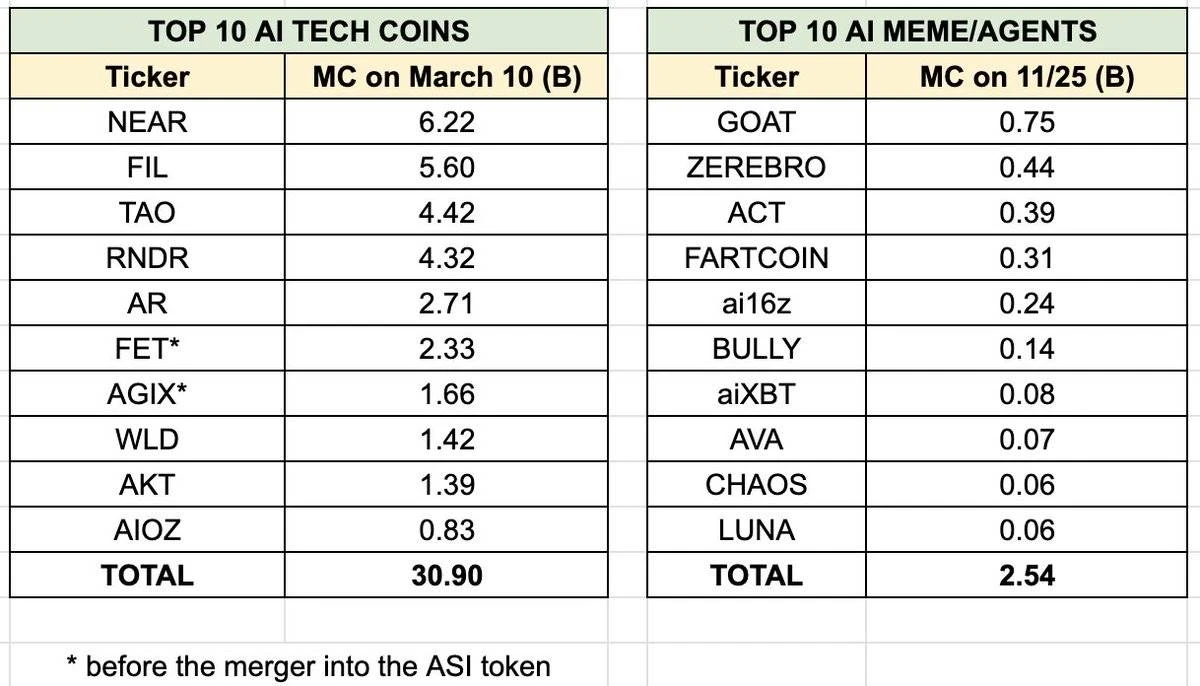

AI Meme: The biggest trend in 2024, a repeat of history from DeFi Summer to AI Winter

CHILLGUY grows 12 times a day, but most people can’t afford the riches created by Moonshot

CHILLGUY is just a special case among Moonshot’s coin listings. Moonshot’s “short-term coin listing effect” is enhanced, but only the arbitrage bot can make a profit, and the “medium- and long-term wealth creation effect” still does not exist.

Clanker: Base’s “Meme Generator”

clanker combines three elements: AI Agent, meme platform, and Web3 social. Its transaction fee and revenue sharing model are different from pump.fun.

There are two types of app-based memes on Base: one is memes that make applications, and the other is applications that make memes. Representatives of the first type are: Degen, Higher (Aethernet); representatives of the second type are: Farcaster, Virtuals (LUNA), clanker (LUM).

Breakout players of the Clanker system: CLANKER, LUM, ANON.

Clanker system small market value currencies: BLONDE, 33 BITS, BUG.

Clanker will lower the threshold for issuing coins again, and the Meme craze of Ethereum and Base ecosystem will continue.

This weeks Meme bargain hunting list: FREDs top holdings increased, ai16z released good news

The author believes that FRED and ai16z series (ai16z, ELIZA, degenai) have a second chance to get on board.

또한 추천: From getting started to catching the golden dog, how can Meme novices use GMGN to sweep the chain? Dialogue with the founder of Pump.Science: The next DeSci+meme after $RIF and $URO Is BNB Chain season coming? A list of projects and memes worth paying attention to .

이더 리움

These signals suggest that ETH may be about to break through $4,000

The ETH/BTC exchange rate has shifted again.

Ethereum plus its top three meme coins performed well due to Solana.

Institutions strongly support Ethereum.

Ethereum DAPP transaction volume grew during the month.

Ethereum spot ETF is expected to be pledged, which currencies will benefit?

It is directly beneficial to ETH, and indirectly beneficial to the staking sector and the higher-level re-staking sector.

However, even if the Ethereum spot ETF is confirmed to introduce the staking function, it may be difficult for this part of the business to flow to the native liquidity staking tokens (LST) or liquidity re-staking tokens (LRT) in the cryptocurrency world, such as stETH, rETH, and eETH. ETF issuers may acquire staking service providers on their own like Bitwise, or directly choose platforms with good reputation such as Coinbase.

Dialogue with Vitalik: The world should not fall into the power kingdom dominated by AI

The full text of the interview with Periscope focuses on two technologies: AI and Crypto.

다중 생태 및 크로스 체인

Play with the Base ecosystem and collect this tool collection

디파이

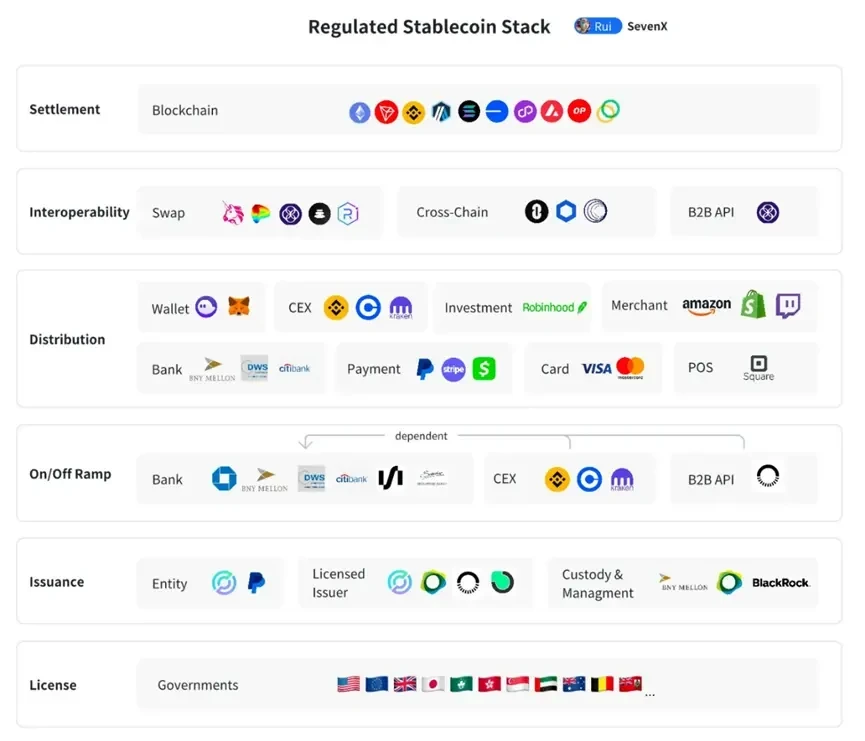

Observation on the stablecoin track: How did a trillion-dollar market come into being?

8 Major Stablecoin Opportunities

The Regulated Stablecoin 시장 Stack

The crypto market is not the key in the stablecoin competition, distribution and real adoption are crucial.

Stablecoin adoption is primarily seen in three areas: the crypto-native, fully banked, and unbanked worlds.

From Traditional DeFi to AgentFi: Exploring the Future of Decentralized Finance

AgentFi has three characteristics: self-hosted, personalized, and peer-to-peer.

The article focuses on the AO ecosystem and its DEX leaders Permaswap and FusionFi Protocol.

게임파이

Web3 AI

Overview of the AI Agent Track Landscape: AI Meme, Distribution Platform, and Infrastructure

AI Agent Explained: Are Attention and Price Movements Correlated?

The integration of decentralized technologies has transformed AI agents from mere tools to autonomous entities capable of performing complex financial operations.

Key advances include: achieving greater autonomy through blockchain integration, expanding utility in the DeFi ecosystem, and a seamless user experience to drive accelerated adoption.

In the world of AI agents, the relationship between attention and market capitalization doesn’t seem to be entirely symmetrical. “Intelligent interactions” — interactions from accounts with financial influence — may be a more accurate indicator of market potential.

The key indicators for evaluating AI agents include intelligent interaction, segment dominance, and cash flow potential.

The new infrastructure, called Loria, will integrate the core technologies of Truth Terminal, Fi, and SAN, with the goal of making each model more powerful. In addition, the IO infrastructure built by the team behind Fi will also be open to Truth Terminal and SAN, giving these virtual characters digital appearance and voice capabilities.

Through this system, the three AI models can not only communicate with each other, but also interact with humans, thus establishing a closer relationship. Each intelligent agent has a unique and potentially conflicting personality, and this interaction may create a whole new form of media.

안전

pump.science private key leaked, fake currency market value soared to tens of millions of dollars

The attacker used the private key to issue fraudulent URO tokens on pump.fun, and community members mistakenly believed that these were officially issued tokens. However, pump.science officials did not take any remedial or compensation measures for users who mistakenly believed and accepted the fraudulent URO tokens.

이번 주의 핫 토픽

In the past week, WSJ: Cantor Fitzgerald reached an agreement to invest in Tether ; Trumps nominee for Secretary of Commerce Lutnick is negotiating with Tether to launch a $2 billion Bitcoin lending project ; foreign media: The Trump administration is considering letting the CFTC lead digital asset regulation ; the court ruled that OFAC sanctions Tornado Cash are illegal ;

In addition, in terms of policy and macro market, Mark Uyeda, a potential candidate for the new chairman of the US SEC, advocates the establishment of a regulatory sandbox in the crypto field; US Congressman French Hill: Hester Peirce may become the new acting chairman of the SEC ; the former chairman of the CFTC is expected to serve as the first crypto czar , saying that Crypto is an important priority for the Trump administration; the Financial Services Commission of South Korea : market volatility has increased, and abnormal cryptocurrency transactions will be closely monitored; Hong Kong plans to provide cryptocurrency tax breaks for hedge funds and super-rich families; Russia approves the Crypto Tax Law, classifying digital currencies as property and exempting mining businesses from value-added tax ; Elon Musk confirms that X is preparing to launch a remittance function in its X Payments service ; Elon Musks net worth is approaching $350 billion, setting a new record ;

In terms of opinions and voices, Fundstrat executives: The current Kimchi Premium in South Korea is about 0% , and Bitcoin may still have room to rise; Bloomberg: Bitcoins rise has temporarily stagnated after approaching the $100,000 level, and may experience consolidation in the short term; VanEck reiterated his prediction that Bitcoin will rise to $180,000 in the current cycle : the next stage of the bull market has just begun; Arthur Hayes: Bitcoin will reach $250,000 by the end of 2025 ; Top trader Eugene: Ideally, Bitcoin will not fall below $85,000 ; Placeholder partner: Dont expect too much from the bull market, and keeping profits is the kingly way ; Vitalik: Crypto is a safe bottom layer, Crypto+DeAI may save the world , and this year is the best time to make meaningful applications; QCP Capital: Changes in the ETH/BTC exchange rate show that the market is turning to ETH , and the market rebounded due to the news of the appointment of the US Treasury Secretary; Ordinals founder: Except for the Lightning Network, all other Bitcoin L2s are castles in the air ; Murad: Chinese cryptocurrency investors should join Memecoin Big cycle; Bankless co-founder: Clanker and other Base ecosystem updates may lead the Ethereum ecosystem Meme coin craze; Farcaster founder: We want to create a hundred Clanker opportunities ; Ansem: Top Virtual ecosystem tokens are very likely to be listed on Coinbase; Movement CEO denounced Scrolls seven sins; Scroll co-founder: Admitted that the airdrop design was poor and will make up for it through Session 2 ; Telegram founder: Received 1% of MAJOR donated by Major founders, and will not sell these tokens in the next 10 years ;

In terms of institutions, large companies and leading projects, Bitcoin mining company MARA purchased 5,771 BTC through convertible note issuance ; the Ethereum Foundation invested tens of millions of dollars in zkVM ; Sky Mavis, the developer of the blockchain game Axie Infinity, announced that it would lay off 21% of its employees ; Justin Sun invested $30 million in the Trump familys encryption project WLFI , becoming its largest investor; chaos abounded, and pump.fun shut down its live broadcast function ; WalletConnect has launched an airdrop query page , where users can apply for and pledge WCT; Lnfi Network announced token economics , with 10% of tokens pre-mined and airdropped before TGE; EigenLayer governance system EigenGov plans to form a council network, and EIGEN holders have the right to veto the councils decisions ;

According to the data, on November 25, pump.funs 24-hour revenue exceeded Solana, Circle, and Ethereum; SecondLane listed a 1% stake in Pump.fun at $15 million; 90.8% of ETH holders are currently in profit , the highest level since June;

In terms of security, Cosine: Solana and Tron chain phishing does not use the private key to change the owner through a signature ; ZKasino misappropriated user assets to go long on ETH on the chain ; the DEXX attacker has exchanged various tokens into SOL , but has not transferred them out;… Well, its another week of ups and downs.

첨부된 포털이다 "주간 편집자 추천" 시리즈로

다음에 또 만나요~

This article is sourced from the internet: Weekly Editors Picks (1123-1129)

In the past few days, both the U.S. stock market and the crypto market have been dazzled by MSTR. In the latest wave of Bitcoins market, MSTR not only took the lead in leading the rise, but also continued to maintain a premium growth over Bitcoin for a period of time. Its price has also soared from US$120 a week or two ago to the current US$247. Most people in the market still interpret MSTRs surge as leveraged Bitcoin. However, this does not seem to explain why MSTRs premium suddenly soared when the fundamentals of issuing bonds to buy coins remained unchanged. After all, MicroStrategy has been buying coins for so many years, and has never seen such a high premium. In fact, the recent surge in MSTR premium, in…