Following MicroStrategys lead, how long can the coin hoarding craze in the U.S. stock market last?

Original article by: Aoyon Ashraf, Nick Baker

Original translation: BitpushNews

summary:

-

After MicroStrategy’s coin hoarding strategy worked, many companies (some small-cap and non-암호화폐-related) began to announce similar moves.

-

The strategy has led to sharp short-term gains in the share prices of some of these companies, but the long-term remains uncertain, according to market watchers.

-

While optimists see this as a step towards more mainstream Bitcoin adoption, skeptics see it as just short-term hype from a few small companies.

텍스트:

Fitness equipment manufacturers, biopharmaceutical companies, battery materials producers…what do these diverse companies have in common?

Of course it’s Bitcoin.

As BTC surged to unprecedented levels this month, at least a dozen public companies that had nothing to do with crypto previously announced plans to buy Bitcoin (BTC) as a medium to store idle cash — and indeed have been quite profitable recently. This is the path that Michael Saylor has been illuminating with his “laser eyes” since 2020, when he began transforming his obscure software maker MicroStrategy into a Bitcoin vault.

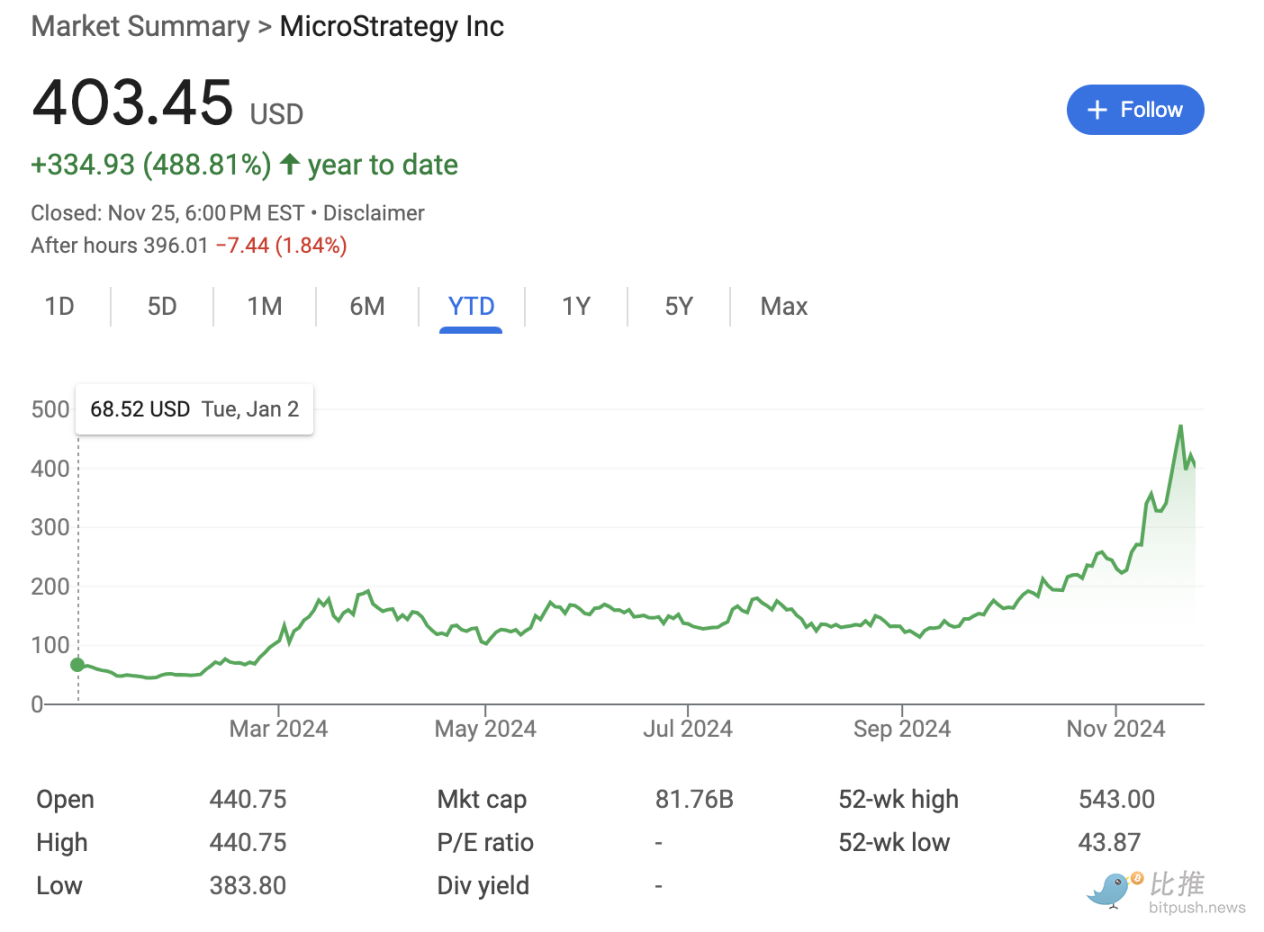

This has made MicroStrategy a huge success in the US stock market – since Saylor started buying Bitcoin for the company, its value has increased by about 30 times, amassing a huge reserve worth (as of this writing) about $38 billion.

Just this month, the company’s shares have nearly doubled since Donald Trump pledged to embrace cryptocurrency and was elected president of the United States. (Other crypto stocks have also seen gains. 교환 operator Coinbase is up nearly 70% since the day before the election.)

Other companies have tried to replicate that success.

On Friday, Anixa Biosciences (ANIX), a biotech company, said its board approved the purchase of a certain amount of Bitcoin to diversify the companys financial reserves. The stock rose as much as 19%, but closed up only 5%. Meanwhile, fitness equipment company Interactive Strength (TRNR) said on Thursday that it plans to buy up to $5 million worth of Bitcoin after its board approved the cryptocurrency as a treasury reserve asset. After the news was announced, the companys stock price soared more than 80% at one point, but rose only 11% throughout the day.

Earlier this week, biopharmaceutical company Hoth Therapeutics (HOTH) announced a $1 million 비트코인 purchase plan, sparking a 25% rally in its stock price — though almost the entire gain was erased by the close. Similarly, companies including LQR House (LQR), Cosmos Health (COSM), Nano Labs (NA), Gaxos (GXAI), Solidion Technology (STI), and Genius Group (GNS) also saw brief surges in their stock prices after announcing bitcoin vault plans in November. Only one company fell after the announcement: Acurx Pharma (ACXP).

“The recent bitcoin craze, coupled with MicroStrategy’s share price rally of more than 500% by 2024, has inspired a wave of companies (especially small-caps) to announce bitcoin buying strategies,” said Youwei Yang, chief economist at BIT Mining (BTCM).

Whether these companies that follow MicroStrategys lead will achieve the same success as Saylor remains to be seen.

“This behavior will likely end the same way [as previous bull runs]: unsustainable hype followed by a sharp correction as the market realizes that many of these announcements lack substance,” said Youwei Yang.

It is also technically unknown whether the latest entrants will stick with it. So far, only artificial intelligence company Genius Group is known to have actually purchased Bitcoin.

But who can blame them?

Early investors in MicroStrategy have made a killing, and even more recent investors have made easy money. Saylor raised money primarily through the issuance of stocks and bonds, which it then used to buy Bitcoin. These copycats may have gained access to capital markets that they would not otherwise have.

The market follows the old adage of never fight the market which means you should follow the trend regardless of the fundamentals. Businesses want to meet the needs of the market and no one wants to be the one telling their bosses or shareholders that they are underperforming because they did not follow MicroStrategys lead.

“Just a few years ago, it was almost too risky to buy Bitcoin. However, now the risk seems increasingly the opposite — not buying is the real risk,” said Brian D. Evans, CEO and founder of BDE Ventures, adding that “not having exposure to Bitcoin is really painful.”

For those who are hopeful, this sudden corporate scramble could be a sign that mainstream adoption of Bitcoin is finally here, especially as President-elect Trump has expressed his desire for the U.S. government to hoard Bitcoin as well.

“For BTC supporters, expectations of macro factors such as inflation and new regulatory friendliness will spur more companies to bring the asset on their balance sheets,” Toronto-based crypto platform FRNT Financial said in a report.

Additionally, a Bitcoin buying strategy can open up capital markets for companies, as MicroStrategy and miner MARA Digital (MARA) have done. Both companies were recently able to raise capital through convertible bonds that pay no interest to investors, meaning those investors are willing to forgo current income in exchange for the ability to eventually convert debt into equity and gain exposure to Bitcoin.

BDE’s Evans said that indicating their plans to buy Bitcoin “is a useful way for companies to raise capital, not dissimilar to how MicroStrategy has done over the past few years.”

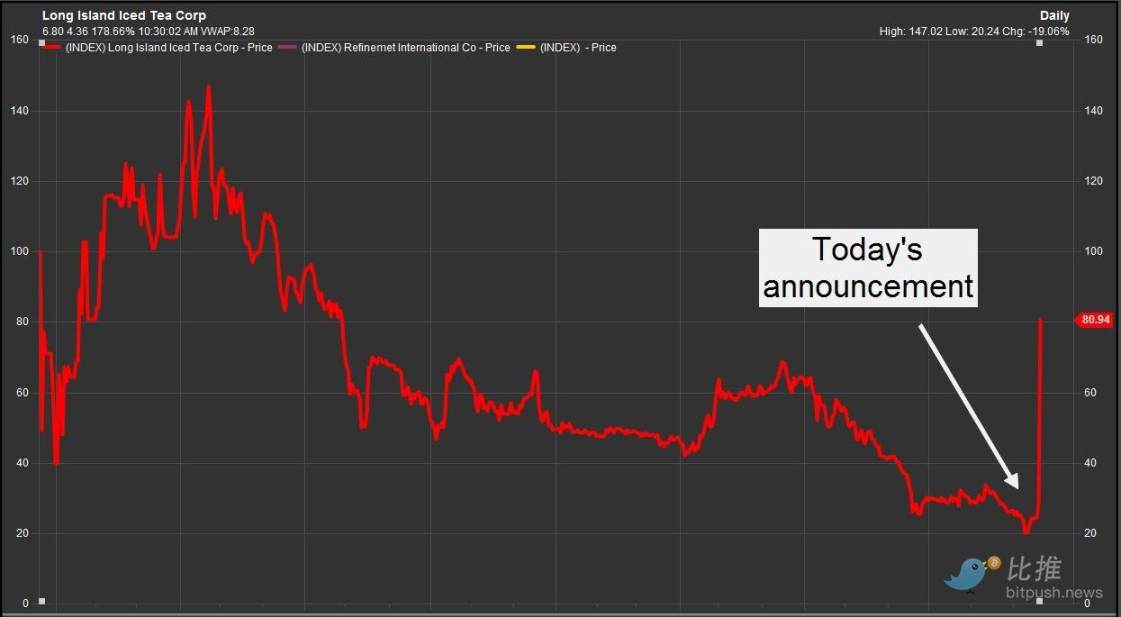

To some, however, it sounds like a repeat of a short-lived trend in the late 2010s, when companies that had nothing to do with cryptocurrency added the word blockchain to their names.

The most famous example is when obscure beverage maker Long Island Iced Tea rebranded itself as Long Blockchain, with explosive results, at least initially: Its stock price nearly tripled in a day after the cryptocurrency rebrand. The gains failed to last, and the stock was later delisted from Nasdaq. (Three people were charged with insider 거래 by the SEC.)

There are other magic words. In the 2021 crypto bull market, many large companies have tried to drive up their stock prices by using slogans such as Web3, Metaverse and NFT. Even Facebook changed its name to Meta and bet on the Metaverse. However, these moves ultimately led to huge losses.

At the same time, some companies with low stock prices and no connection to cryptocurrencies also began to get involved in Bitcoin mining, which was considered a lucrative business at the time. However, the subsequent brutal bear market caused these once highly anticipated crypto concepts to fall from the altar and become rats crossing the street.

Youwei Yang said that although MicroStrategy has been able to raise billions of dollars from the capital markets to finance Bitcoin purchases, if others also adopt this strategy, it may have an adverse impact on small companies. For small-cap stocks, it may be seen as a short-term gimmick, thereby deterring serious investors. If the price of Bitcoin stabilizes or falls, the speculative appeal of these stocks may weaken, making these companies vulnerable to investor skepticism and regulatory scrutiny.

David Siemer, co-founder and CEO of Wave Digital Assets, echoed that sentiment, saying: “While this approach may provide short-term gains in a bull market, it also carries significant risks. Unlike holding assets directly, leverage amplifies potential losses during market corrections, highlighting its inherent dangers,” noting that some companies are taking advantage of Bitcoin’s hype to add debt to their balance sheets.

Regardless of who is right, and as Bitcoin continues to hit record highs after Trump won the US election, the magic still remains: announce a Bitcoin plan similar to Saylors and see if your stock takes off.

“We seem to be at a point where a lot of companies feel they have to do this,” said Brian D. Evans, founder of BDE.

Anyway, welcome to the new crypto bull market.

This article is sourced from the internet: Following MicroStrategys lead, how long can the coin hoarding craze in the U.S. stock market last?

관련 항목: 트레이더 스튜어트와의 대화: 이번 주기에서 100배 코인의 특징은 무엇인가요?

이번 에피소드의 게스트는 First Class Warehouse의 투자 리서치 디렉터인 Stewart입니다. Twitter: @Jindouyunz Toudest Warehouse의 오랜 팬인 저는 오랜 친구인 투자 리서치 디렉터인 Jindouyun을 초대하여 지난 사이클에서 aave에 1,000배 투자한 방법과 이번 사이클에서 가치 투자 개념의 변화에 대해 이야기했습니다. 또한 이번 사이클에서 알파를 찾는 방법론에 대해 논의했고 저에게 인상 깊었던 몇 가지 요점을 요약했습니다. *다음 텍스트는 공유만을 위한 것이며 투자 조언을 구성하지 않습니다. TL;DR 1. 투자 전략 펀드 규모 및 배분 비율: First Class Warehouse 펀드의 총 규모는 약 수천만 달러이며 각 투자 관리자가 10…