1. Introduction to LST and LRT

What is LST

stETH obtained by users through liquidity staking protocols such as Lido

Behind LST: PoS network security, staking interest

What is LRT

Users entrust lsdETH assets such as stETH to the liquidity re-pledge protocol, and the protocol deposits lsdETH into EigenLayer for re-pledge on behalf of the user to obtain the mortgage certificate token, i.e. LRT asset

*Restaking is a concept first proposed by Eigenlayer.

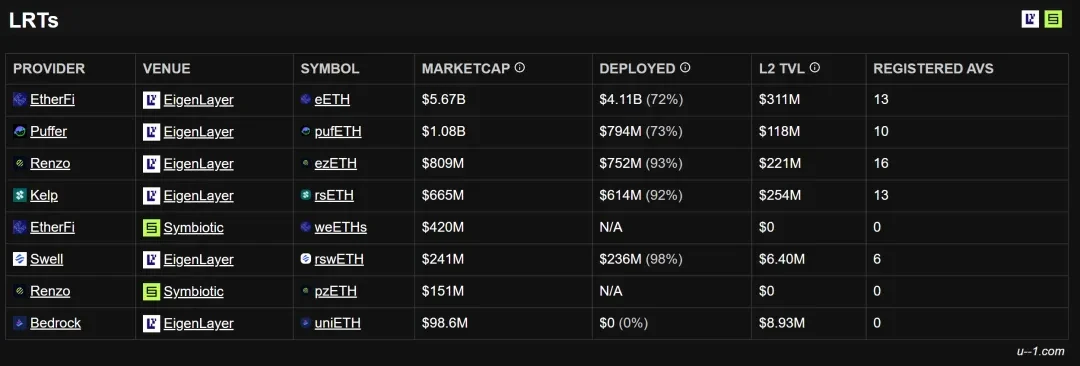

2. LRT Rewards Data Overview

For EigenLayer’s latest rewards, Renzo was the first (even the only) to announce the distribution data and execute the distribution. Let’s take a look at the data:

“Between August 15 and October 8, 2023, ezETH generated 769.01 ETH (593,727.31 EIGEN) in rewards through restaking.

ezEIGEN generated 1,731.05 EIGEN in just one week from October 1st to October 8th”

Users earned more than $2 million from EigenLayers restaking rewards between August 15 and October 8, 2023, which were directly transferred to user accounts through an automatic compounding mechanism. At the same time, the price of ezETH jumped from 1.0224 to 1.0242 and is currently 거래 at a premium of 0.043%. A total of more than $2 million in restaking rewards were distributed and continue to roll over. These rewards are directly distributed to user accounts through an automatic compounding mechanism, without the need for users to manually claim them, greatly improving the participation experience.

3. Advantages of LRT re-pledge

1. High re-detention rate

From the third-party data in the above figure, we can see that among the many EigenLayer protocols, Swell, Renzo, and Kelp are far ahead with their high re-staking rates. Compared with Puffer (73%) and EtherFi (72%), the TVL ratio of total re-staking is significantly higher, thereby maximizing the benefits of AVS rewards.

2. Automatic compounding of interest

The traditional re-staking process is not only complicated, but also accompanied by high gas fees and cumbersome manual management. Taking EigenLayer as an example, users usually need to select operators, manage risks, and manually collect and process rewards through the EigenLayer App. In addition, EIGEN pledgers also have to face long unlocking cycles and frequent tax events. For most users, this series of operations is time-consuming and laborious.

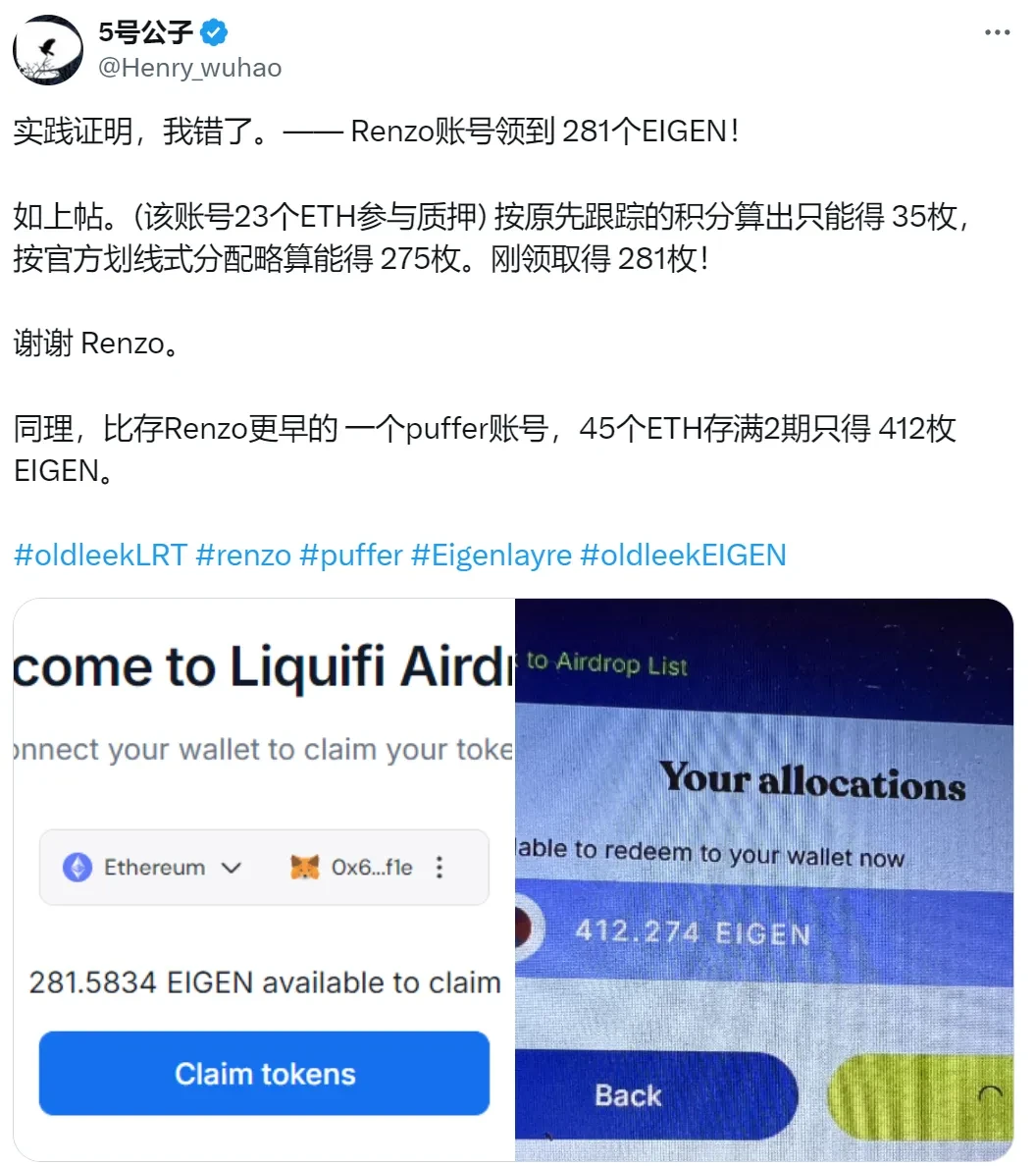

$ezEIGEN provides an automated solution to these pain points. By automatically managing the operator and validator service (AVS), $ezEIGEN greatly reduces the burden on users, while automatically collecting rewards and performing compounding operations every week, thereby reducing gas fees and increasing overall yields. Perhaps it is because of this (of course not only!) that we can see the true feelings of community users

4. LRT revenue efficiency calculation

EigenPods are a tool for Ethereum validators to interact with EigenLayer, ensuring that the UniFi AVS service can slash validators that violate pre-confirmation commitments. As the number of EigenPods increases, the gas fees for claiming rewards rise significantly. With only 5 EigenPods, Renzo keeps its weekly gas fees in the range of a few hundred dollars, while other protocols, such as EtherFi, may have thousands of EigenPods and spend up to 35 ETH per week on gas. With fewer EigenPods, Renzo not only reduces gas costs, but also ensures efficient reward distribution.

In addition, the distribution of AVS rewards will be carried out on a weekly basis, which further enhances the users participation value and benefit frequency.

In general, Renzo itself not only provides basic staking or re-staking services, but also focuses on providing professional operation and maintenance support and technical services for AVS, such as network management, node operation and maintenance, etc. Therefore, I think it is reasonable that Renzo stands out in the AVS reward competition through high re-staking ratio, automatic compounding and lower gas cost, plus the efficient use of EigenPods.

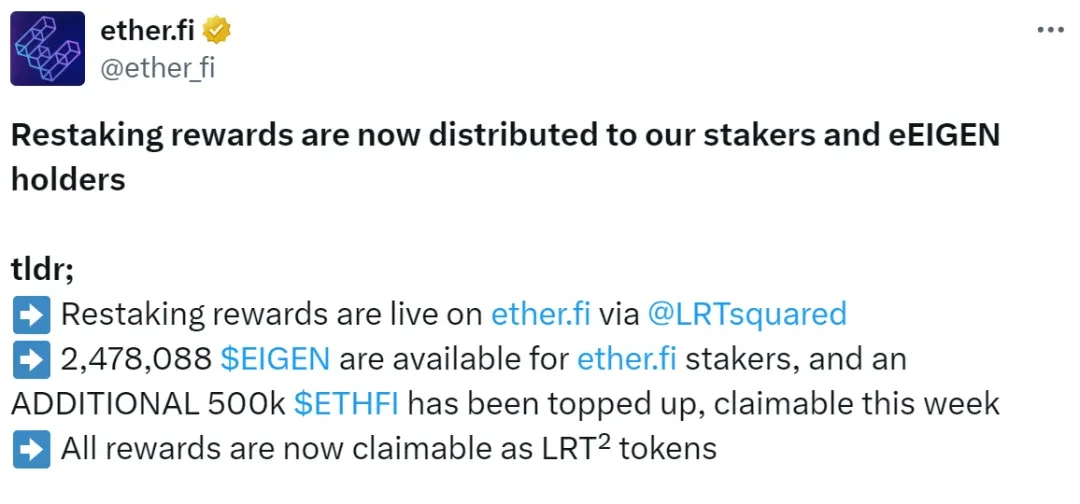

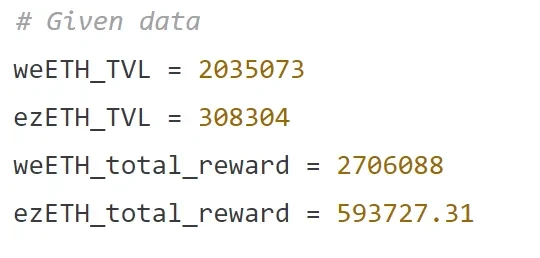

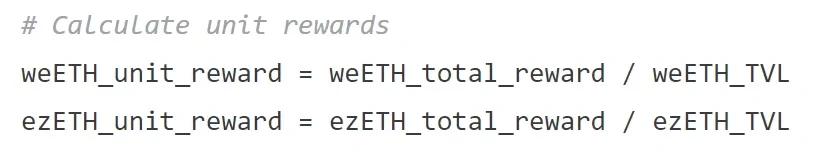

Let’s compare Renzo and Ether.Fi:

TVL and re-staking: According to EtherFis latest reward distribution tweet, its first batch of re-staking rewards has 2,478,088 EIGEN, plus 500K ETHFI to claim. ezETH stakers received 593,727.31 EIGEN, while weETH stakers received 2,478,088 EIGEN. On the surface, weETH stakers received 4.17 times the reward. However, considering the unit income in combination with TVL, Lets do the math.

According to the calculation results, the reward per weETH unit is 1.33 EIGEN, while the reward per ezETH unit is 1.93 EIGEN. Therefore, the unit reward of ezETH users is 1.45 times that of weETH users. Therefore, after this distribution process, the total reward amount of EtherFi looks large, but the actual benefits are not satisfactory.

Renzos automatic compounding vs. EtherFis manual collection: Renzos automatic compounding mechanism saves users high gas fees. Users do not need to manually collect rewards, and all income is automatically compounded to re-staking. EtherFis rewards require users to manually collect them, resulting in higher gas fees and lower actual income.

Gas Fee Issue: Since EtherFi users need to manually claim rewards, especially on the Ethereum network, this means that users face high Gas costs. Renzo’s automatic compounding function eliminates this cost, allowing users to claim and reinvest their rewards without paying Gas fees.

5. Incentive rules for each LRT

As the Eigenlayer-based re-staking track continues to develop and the market share is gradually divided up, users who are looking for airdrops instead of (so) caring about staking rewards have a good understanding of their own gains. We can also look at the basic situation of this track from the perspective of incentive rules.

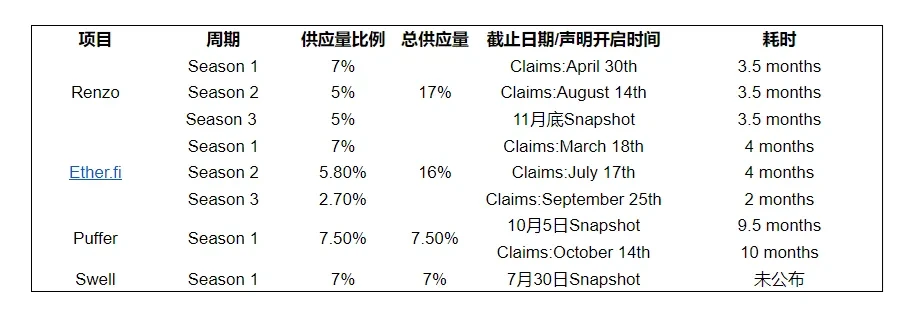

Obviously, the incentive rules of each project are different in different aspects:

Expected short time: Ether.fi and Renzo’s incentive activities take the shortest time. Compared to, for example, Puffer’s first season took nearly 10 months, users spend less time on Ether.fi and Renzo and can complete participation and earn benefits faster.

Expected token distribution: Puffers single-period distribution ratio is 7.5%, the highest among all projects, but considering the market and re-staking rate, the author believes that Puffer is just a paper fortune. In comparison, Ether.fi and Renzo appear to be more sincere.

Expect long-term participation: Compared with other projects that are eliminated in one round, projects that can be continuously participated and profitable are the best choice in todays market fluctuations. Renzo, which has a total season length of 10.5 months, and Ether.fi, which has a 10-month data rush at the end of the year, are both very good choices.

6. Future prospects of the re-pledge industry

Currently, the relevant protocols based on Eigenlayer are still in the initial stage. In the end, there will 디파이nitely be one or two companies that dominate the market. It depends on which protocol can continue to grow and create an absolute gap with the second and third. The basic leader can be determined. Each round of bull market will always bring new narratives. Lido has stood the test of time. So who will be the next lido in the staking track?

With the emergence of more and more staking platforms, who can really calculate the users income and platforms interests clearly? This is a track that needs time to test, and time is exactly what everyone lacks the most. So how to exclude the fake projects in the market? Everyone has his own set of indicators, and the author does not make any biased comments.

This article is sourced from the internet: LRT Battle: Earn AVS Rewards in the Midst of Volatility

This article Hash ( SHA1 ): bd9ca749e77416b81d65fff2457626ecfdaf59e2 No.: Lianyuan Security Knowledge No.022 The recent domestic 3A game Black Myth: Wukong has attracted the attention of gamers around the world, successfully attracted a large number of domestic and foreign players, and also triggered everyones thinking about the development of blockchain games (GameFi). In the continued development of Web3 games, security and innovation models are always key issues. Take the EVM-compatible game-specific chain Ronin Network as an example. In March 2022, Ronin Network experienced a serious security incident. Hackers stole the private keys of 5 validators and forged withdrawals, resulting in a loss of more than 600 million US dollars. This incident is not only one of the largest hacker attacks in the history of cryptocurrency, but also one of the most…