Original author: Imran Khan

Original translation: 1912212.eth, ForesightNews

Start with small questions

Instead of aiming for a massive market from the start, focus on solving a small, specific problem. This practice is often counter to VC advice, as they often push for solving big market problems. Instead, you should focus on problems that affect smaller groups of users — problems that you can experience firsthand by using 암호화폐 products every day. With thousands of new products constantly being launched, use as many of them as possible to understand the pain points that everyday users face. This way, you’ll identify real, actionable problems that need to be solved.

Starting small allows you to gain a deep understanding of user needs and optimize your product without the noise and complexity of the larger market.

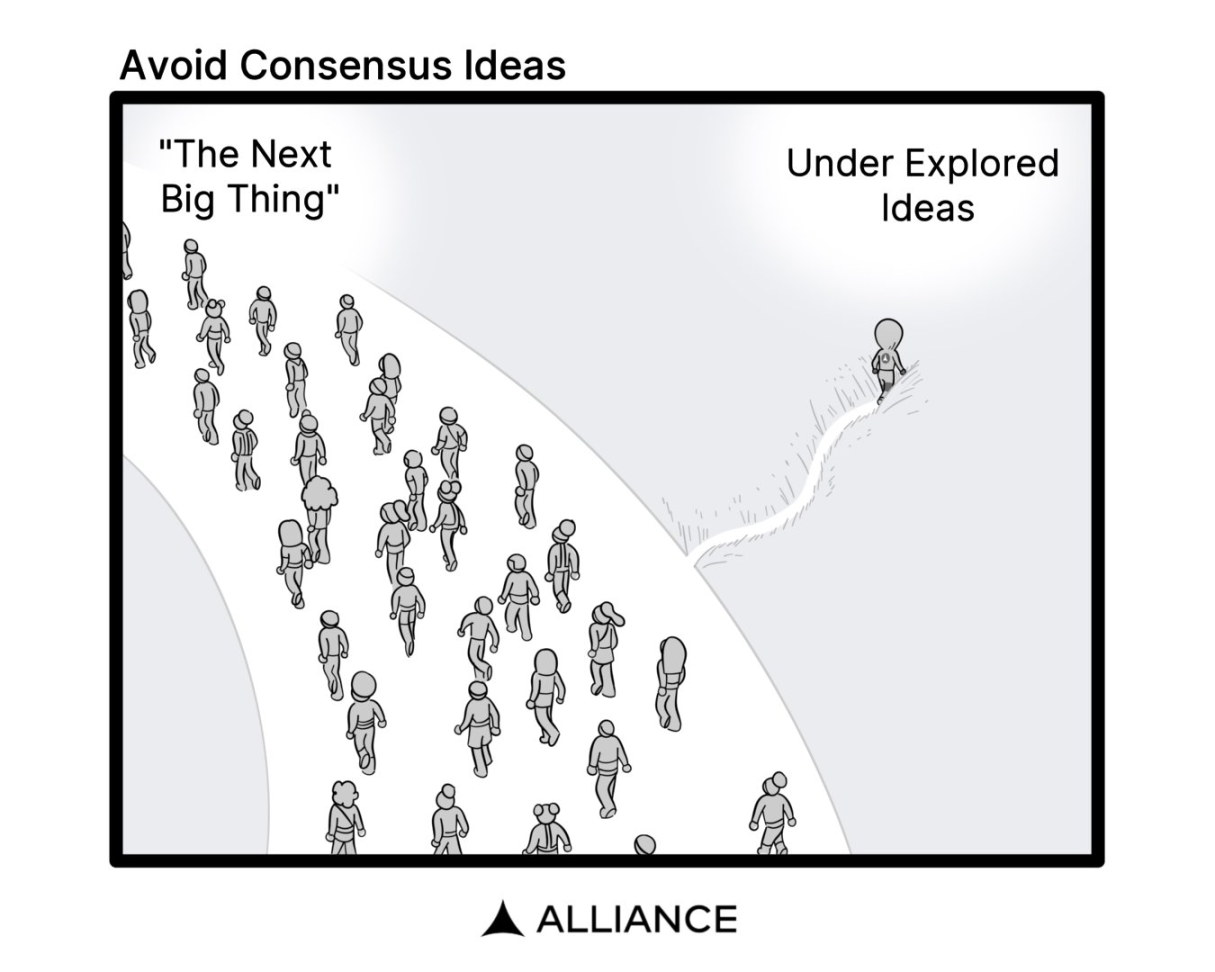

Avoiding consensus

Avoid chasing ideas that everyone thinks are the next big thing. By the time an idea becomes generally accepted, the market is often already saturated. Take Polymarket for example: now that they have validated prediction markets, there are hundreds of teams building in the space. The time to innovate is when only Polymarket is active, not after validation. Competing with established players requires a product that is ten times better than the incumbents to stand out. Instead, focus on areas that are under-explored and where there is less competition. This gives you more room for experimentation and time to develop a unique value proposition.

Build products for a small group of users

Identify a core group of early adopters — about 25 to 50 passionate users who truly care about the problem you’re solving. By focusing on their specific needs, you can build a solid foundation and cultivate authentic advocates. These early users will provide valuable feedback, helping you iterate and improve your product quickly. This process will naturally expand your user base over time. If people love what you’ve built, it’ll be natural for them to recommend it to their friends and family.

Validate your assumptions with a minimum viable product (MVP)

Before investing significant resources, like money and time, validate your core assumptions with a minimum viable product. This simplified version of your product should focus on solving the main pain points you’ve identified. You want to release a product that does minimal functionality but provides enough insights to help you decide whether to double down or move on to other ideas. It also allows you to gather user feedback faster and potentially learn something completely unexpected. Plus, releasing a product quickly can put you ahead of your competitors — many people may be considering the same idea, and often the first to release attracts attention.

Publish your idea within 30 days

Time to launch is critical. Aim to develop and launch your minimum viable product within 30 days to capitalize on the momentum of your idea and start collecting user data as quickly as possible. This rapid deployment process forces you to prioritize core features and avoid the trap of over-planning.

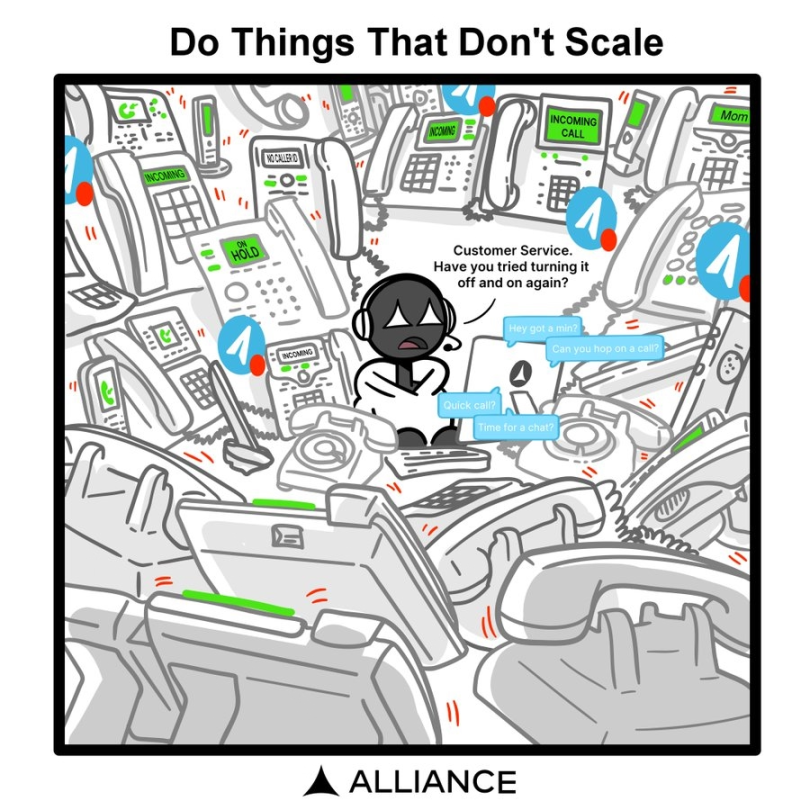

Doing things that don’t scale

In the early stages, personalized touch is more important than building a full product. Interact directly with users, handle customer support in person, and manually perform transactions that will be automated in the future. These efforts that don’t scale help you build strong relationships with early users and gain a deep understanding of their needs and behaviors. This approach not only allows you to build and release quickly, but more importantly, it gets the product into the hands of users early.

Don’t overbuild, use existing tools to simulate

Avoid creating everything from scratch. For crypto entrepreneurs, it is best to avoid building core infrastructure and instead work with existing products or leverage them to simulate the final solution. For example, use an off-the-shelf automated market maker (AMM) like Uniswap or Raydium instead of developing your own AMM for a specific product. This move can save resources and allow you to focus on perfecting the core product.

Recruit users one by one until you reach 50

Personalized outreach is essential when building your initial user base. Reach out to potential users one by one, either through email, social media platforms like Twitter direct messages, or community forums. This approach allows you to interact with users who are willing to use your product and get precise, candid feedback about it.

Continuously seek feedback and iterate on the product

Maintain an ongoing dialogue with your users. Regular feedback will surface insights you might not have considered. Use this feedback to iterate on your product and ensure it continues to meet the evolving needs of your users. It’s important to have this feedback loop in place because it keeps you focused on user needs and helps you build products that people actually love. Alon of Pump.fun DM’d 3,000 Twitter users to get Pump noticed.

Don’t take feedback literally

While user feedback is important, it should be interpreted with caution. Users may not be able to accurately express their needs or make suggestions that are inconsistent with the product vision. You need to use judgment to identify potential problems and solve them in a way that is consistent with the product direction.

Achieve stability of 50 to 100 daily active users

Aim to achieve steady growth in daily active users (DAU), with an initial target of 50 to 100 DAUs. This level of engagement indicates that your product is gaining traction and becoming part of users’ daily activities. Monitor user retention and engagement metrics to ensure you are building sustainable growth.

Refine your business model

Once you have a solid user base, it’s time to focus on achieving profitability. Develop a clear business model that articulates how your startup will generate revenue. Whether it’s transaction fees, value-added features, or token sales, a clear business model is critical to attracting investors and ensuring long-term viability.

Dig deep into the data to find growth points

Data is your ally. Dive into your data to understand what drives user acquisition, engagement, and retention. Identify key performance indicators (KPIs) that align with your business goals. Use this data to make informed decisions about marketing strategies, product features, and resource allocation.

Persistence: Contact via email, group chat, private messages, and social platforms

Persistence pays off. Don’t hesitate to reach out to potential customers, partners, or investors multiple times. Expand your reach through multiple channels such as email, private messages, group chats, and social media. Starting a business often requires relentless networking and promotion. Always maintain an Always Be Closing mindset.

Celebrate small wins and take breaks

Milestones, no matter how small, are worth celebrating. Whether it’s launching a new feature or hitting a user benchmark, acknowledging progress keeps your team motivated. Plus, taking short breaks can prevent burnout and help you and your team stay productive in the long run.

Work hard

Nothing can replace the importance of hard work. Building a successful startup requires dedication, long hours, and a willingness to go above and beyond. Your input sets the tone for the team and can mean the difference between success and failure. Think of it this way: if your competitors are working 7-8 hours a day on their ideas, how many hours are you willing to work to win? Of course, I’m not suggesting you win by working overtime, but use this idea to motivate yourself to work smarter and win.

Protect your equity

Especially in the early stages, be careful about how much equity you give away. It may be tempting to offer a large stake in order to secure funding or talent, but maintaining control is critical to shaping the future of the company. Consider alternative incentives and negotiate terms that align with your long-term vision. In the end, founders should retain enough interest to receive a return on the significant time invested early on.

Small financing will teach you how to be frugal

Getting modest funding forces you to prioritize core problems and learn to save resources. In the earliest stages, you should typically only raise $500,000 to $1 million. Operating on a lean budget forces founders to find creative solutions. This discipline can lead you toward a more sustainable business model and make you more attractive to future investors. Amazon founder Bezos once used a door as his desk to remind himself to save time and money.

frugal

Adopt a frugal mindset in every aspect of your startup. Review every expense, avoid unnecessary operating costs, and focus funds on areas that will directly contribute to growth. Being frugal will extend your capital lifecycle and provide flexibility in the face of unexpected challenges or market changes.

Keep your team small and hire as few people as possible

Grow your team carefully. Each new hire should fill a critical role that directly impacts the success of your company. Smaller teams are more nimble, easier to manage, and less susceptible to the complexities of a large startup. Keeping it small allows you to adjust direction quickly and maintain a strong company culture. If you over-hire, your company culture can quickly deteriorate.

This article is sourced from the internet: 20 Lessons for Crypto Founders: Do Things That Don’t Scale

At the Jackson Hole Annual Meeting at 10 pm on August 23, Federal Reserve Chairman Powell sent a clear signal of interest rate cuts, suggesting that the Feds monetary policy may have completed its shift. This overall dovish attitude triggered a chain reaction in the market. Last night, the SP 500 rose 1.15% and the Nasdaq Composite rose 1.45%. At the same time, Bitcoin rose 6.06% and closed at $64,037. 1. Macro-financial analysis 1. September rate cut forecast Powells dovish remarks have increased the markets expectations for a September rate cut to 100%, with a 25 basis point cut forecast at 76% and a 50 basis point cut at 24%. The significant increase in the number of forecast points for a rate cut shows the markets expectations for future loose…