On the evening of October 21, 8:00 pm ET, BTC broke through the 69,000 mark and reached a high of 69,500 USD. BTC was basically sideways throughout the weekend, with a lack of liquidity. Why did it suddenly rise during the US trading hours on Sunday? Was this rise driven by futures or spot purchases?

Recently, there have been many positive news for altcoins, starting with APE, DYDX, and SUSHI. After the good news was released, many altcoins have seen an increase of more than 20%. The altcoins at the bottom have gradually moved. Can the altcoin engine oracle sector, which was in the bull market in October last year, lead the altcoins to another bull market this time? Is it really bullish this time? Lets take a look at the views of traders from various angles.

Technical Analysis

Judging from the K-line chart, BTC price seems to have broken through the downward trend line of more than half a year, and it seems to be setting new highs every day, but the trading volume of the new highs has shrunk significantly; on the other hand, ETH broke through the previous high, but has just reached the real pressure range of 2800. ETHs increase yesterday brought high market sentiment, and for the first time, the contract price was higher than the spot price. Therefore, it is believed that the bull market is at its end and the building will collapse at any time.

Judging from the K-line chart, BTC price seems to have broken through the downward trend line of more than half a year, and it seems to be setting new highs every day, but the trading volume of the new highs has shrunk significantly; on the other hand, ETH broke through the previous high, but has just reached the real pressure range of 2800. ETHs increase yesterday brought high market sentiment, and for the first time, the contract price was higher than the spot price. Therefore, it is believed that the bull market is at its end and the building will collapse at any time.

Many people compare the current market situation with that in October 2023 and believe that both the weekly MACD golden cross and the weekly K-line big positive line broke through the previous high. However, I think the current market sentiment is completely different from the market sentiment at that time. At that time, there was a consensus on bearishness, and now there is a consensus on bullishness. I don鈥檛 think the MACD golden cross here has any practical operational significance. After all, the golden cross can be followed by a dead cross. Who is right or wrong? Let鈥檚 see whether it will replicate 2023 and continue to set a new high with a big positive line this week.

As for when I will stop being bearish, it will probably be after ETH effectively breaks through 2820 after consolidation. I currently do not have any short positions, and I am looking for an entry opportunity to short on the right side.

Judging from the ASR-VC 4-hour channel, the current price behavior is somewhat similar to the pattern at the end of September, and continues to run near the average pressure zone. It may be either accumulating momentum or running out of momentum. From the perspective of spot premium, this is a bit like the market in early June, with a long-term bullish trend under a negative premium. The key price for judging the full turn of the channel to a bullish trend is 71,000. If it breaks through the average pressure zone strongly, the first target may be near the overbought line, which is currently around 77,500.

From the weekly perspective, the market continues to rise. Currently, bsl is waiting to be plundered. This rising market must hit a new high. My personal goal is to start with 9. It is still within the range (the fvg gap will generally be filled within the shock range). Pay attention to whether there is a wfvg opportunity, which is around 64,500 US dollars.

From the daily chart, it continues to fluctuate upward, mainly waiting for BSL to be plundered. If there is a callback opportunity for BTC, it will be around 645, so you must buy it. If there are not many trading opportunities for BTC, look for trading opportunities for copycats.

From the hourly level, the market is fluctuating upward and constantly generating new highs. If it pulls back but does not break OB, you can go short during the day. If it falls below OB, you can look forward to buying opportunities on the pullback.

First of all, we believe that the downward trend line of this round of large cycle has been broken and has successfully retraced, forming a bearish rising wedge at a small level. We believe that it will weaken in the short term and fall back to the downward trend line of the large cycle and the 0.236 Fibonacci retracement position of this round of business war, which is roughly around 67,000 US dollars, forming a large-level rising wedge. The first target of this round of rise is still around 72,000 US dollars.

First of all, we believe that the downward trend line of this round of large cycle has been broken and has successfully retraced, forming a bearish rising wedge at a small level. We believe that it will weaken in the short term and fall back to the downward trend line of the large cycle and the 0.236 Fibonacci retracement position of this round of business war, which is roughly around 67,000 US dollars, forming a large-level rising wedge. The first target of this round of rise is still around 72,000 US dollars.

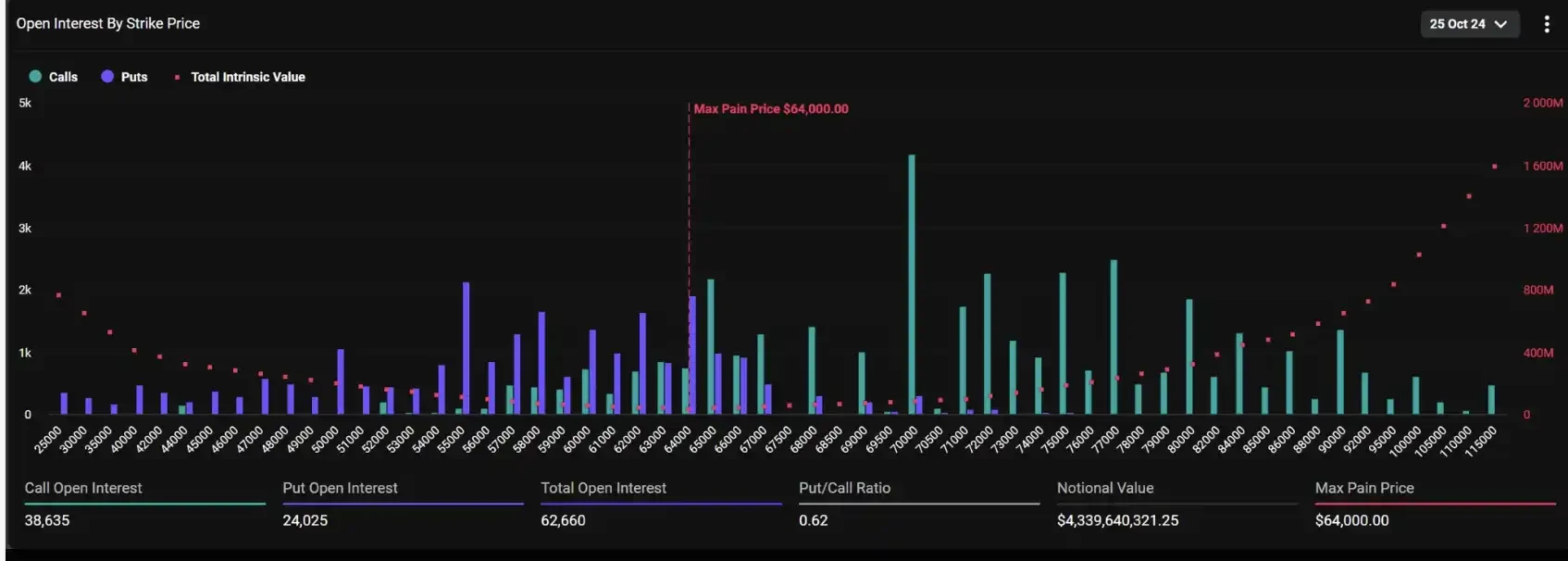

데이터 분석

According to the value zone of BTC, which has fluctuated widely in the past six months, yesterdays upward breakthrough did not break through the VAH of the past six months. In addition, the thickest distribution, that is, the largest supply area, is at 70,900. If it can continue to rise and there is no upward auction rejection, the next target of the rise will be 70,900.

According to the value zone of BTC, which has fluctuated widely in the past six months, yesterdays upward breakthrough did not break through the VAH of the past six months. In addition, the thickest distribution, that is, the largest supply area, is at 70,900. If it can continue to rise and there is no upward auction rejection, the next target of the rise will be 70,900.

From the perspective of annual VWAP, it has accumulated momentum for a breakthrough but there is no obvious downward drive, but it has fallen back without breaking. Therefore, it is believed that it will continue to break upward in the short term. According to the buyers liquidity depth chart and the liquidation heat map, a key position for a downward correction is about US$65,000-67,000.

Observing the auction form during the day, it is a very obvious upward auction structure. It also conforms to the view of continuing to break upward, so we can continue to be bullish.

@LinChen91162689

From the data level, spot: Aggregate spot maintained a small sell-off on Sunday night, but began to increase in volume on Monday morning, and the increase was carried out twice; Futures: Aggregate futures first saw continuous small selling from Sunday night to Monday morning. In the first spot increase, it was still closing long and shorting, but after the second complete breakthrough of 69,000, it turned to long; it seems that the shorts first entered the market on the left side based on the idea that 69,000 might be a false breakthrough, and then were pulled up by the strong spot buying to stop loss; it is worth noting that Coinbase changed its previous state of continuous shipments from Sunday, and began to continue to buy in small amounts, which is a relatively large change; but Binance Futures had obvious buying in three times with volume increases, and the rest of the time was small-scale closing long/shorting; in summary, spot buying has begun to appear! Although the volume is not large, if the supply of futures stop-profit selling can be taken up, the price can stand firm at 69,000;

From the perspective of USDT market share, the weekly USDT market share has slightly fallen below the upward trend line of the past six months. If this is a confirmed break, it represents the entry of idle funds. The more likely performance is that BTC dominance has temporarily peaked, and copycat and small-cap projects will gain full liquidity in the next 2-3 weeks.

From the perspective of total futures positions, the total BTC futures positions have been at the 40 billion USD mark for three consecutive days. While the positions remain high, the price has increased by 1,500 USD, indicating that there is a small amount of spot funds entering the market; but compared with the previous positions of BTC when it fluctuated between 68,000 and 69,000, the current total positions are 2.5 billion USD more. For spot bulls, although the mood is good, there has been no large-scale selling pressure. Therefore, for the current market, spot will not become a source of potential risks. The extra 2.5 billion positions may be the source of the next long kill long and the liquidation of a large number of high-level bulls. In a real bull market, every liquidation of a large number of leveraged bulls is a necessary condition for the next rise. In a market with high futures weight, shorts are the source of funds for the rise, and longs are all burdens.

Macro analysis

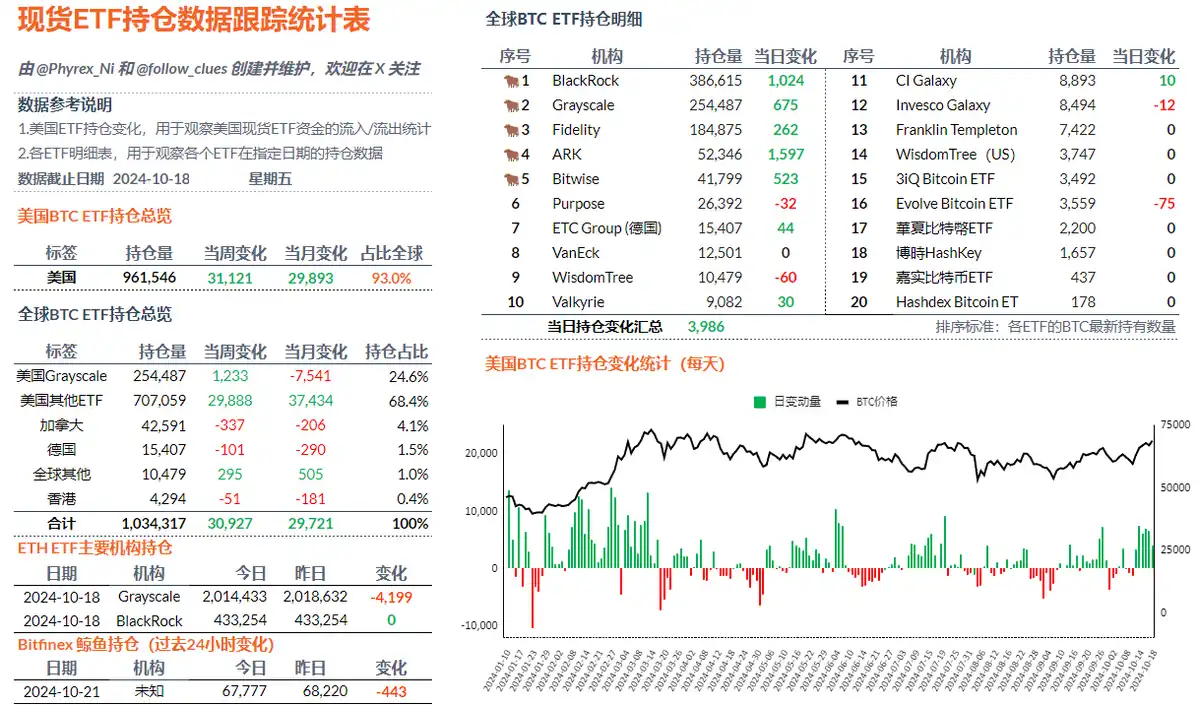

The data of BTC spot ETF still performed well last Friday. Although there is a trend of decreasing purchasing power like ETH, we can still see that a large amount of funds are concentrated in BTC. On Friday, the spot ETF had a net inflow of 4,099 BTC. Although it is the lowest data in the week, it is still much stronger than in the past.

BlackRock had net increases for five consecutive working days during the week, increasing its holdings by a total of 16,975 #BTC . Such single-week increase data has almost not been seen since March. Fidelity ranked second with a net increase of 4,807 BTC, followed by ARK with 4,538 BTC, and Bitwise ranked fourth with 2,244 BTC.

It is worth mentioning that Grayscales GBTC has increased its holdings by 963 BTC in the past week, not counting the Mini ETFs holdings, which is in sharp contrast to ETH. Even when liquidity is very tight, investors limited funds are still concentrated in BTC.

In the past week, the net purchasing power of the twelve US ETFs was 31,119.43 BTC, an increase of 685.34% compared with the previous week. This figure is also far higher than ETH. Grayscales net selling has turned from 1,103.36 BTC two weeks ago to a net inflow of 1,232.71 BTC. Grayscale is no longer synonymous with BTC selling.

Other Cryptocurrencies

The Shanzhai sector did improve over the weekend, and Meme coins pulled back, but we still need to be vigilant despite optimism. The oracle sector rose, and API 3 and DIA mean that the activity on the chain has increased, which can be used as a signal of Shanzhai optimism. APE rose after the release of the pump in the morning of October 20th, Eastern Time 8, with the highest increase exceeding 1 times, leading the joint rise of the Metaverse and NFT sectors. Overall, the narrative in the market does not seem to have hot spots related to the Metaverse and NFT. These hot spots need to be treated with caution. It is possible that the Shanzhai took the opportunity to be active and then shipped. After all, in this cycle, the lowest heat is the Metaverse and NFT sectors. I am still optimistic about the activity of the oracle sector. Last year, the Shanzhai was also the first to set sail in the oracle sector. I hope that this time I can open up the activity of the market again.

He believes that the market works in a mysterious way, and we all have the opportunity to find some currencies that may bring excess returns, or go to zero after being promoted by other KOLs. For him, he will choose $GOAT and $GNON, and he has bought the bottom of GOAT. He believes that GOAT and GNON will become key positions for future long-term trends. If he is wrong, he will become the exit liquidity for others.

This article is sourced from the internet: Interpretation of current market conditions: Good news for altcoins is emerging frequently, is BTC about to reach a new high?

Related: DeFi’s Breakout Moment: Ether.fi, Aave, Sky, and Lido’s Financial Transformation

Original author: Kairos Research Original translation: Luffy, Foresight News summary This report aims to explore some of the most influential DeFi protocols from a financial perspective, including a brief technical overview of each protocol and a deep dive into their revenues, expenses, and token economics. Given the unavailability of regularly audited financial statements, we used on-chain data, open source reports, governance forums, and conversations with project teams to estimate Aave, Maker (Sky), Lido, and ether.fi. The table below shows some of the key conclusions we reached throughout the research process, giving readers a comprehensive understanding of the current status of each protocol. While the price-to-earnings ratio is a common way to judge whether a project is overvalued or undervalued, key factors such as dilution, new product pipelines, and future profit…