원본 | Odaily Planet Daily ( @오데일리차이나 )

DeFi and stablecoins have always been seen as the two pillars of the long-term growth of the BNBChain ecosystem. DeFi is used to build the on-chain economy, while stablecoins are committed to large-scale applications and attracting the next billion Web3 users.

This article will start from the recent achievements of BNB Chain in stablecoin gas-free transfers and TVL incentive programs, analyze the strategic measures behind these activities of BNB Chain, and the strong development potential of BNB Chains DeFi ecosystem.

Results

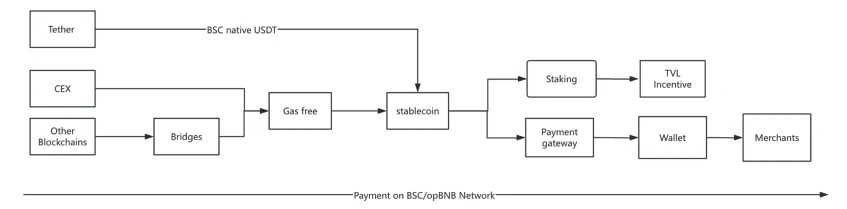

BNB Chain recently launched a gas-free transfer event and TVL incentive plan in the field of stablecoins and DeFi. During the event, users can transfer stablecoins from CEX or other chains to BNB Chain or opBNB for free. At the same time, in order to enhance the retention of stablecoins on its network, a TVL incentive plan was also held to accelerate the growth of the DeFi ecosystem on BNB Chain.

The event also achieved good results:

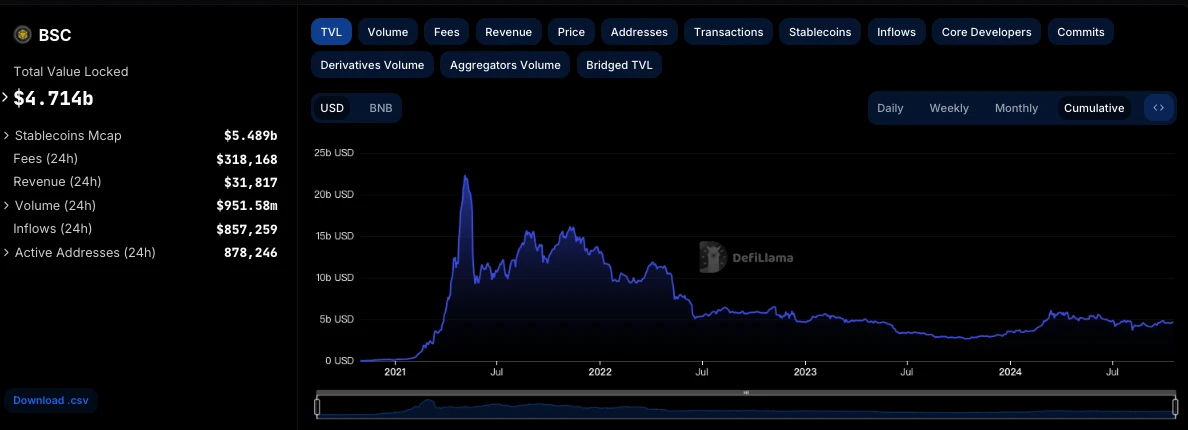

According to DefiLlama data, as of October 18, the market value of BBNB Chain stablecoin was US$5.489 billion, an increase of US$491 million compared to the market value before the start of the stablecoin gas-free transfer activity (September 19) (US$4.998 billion).

At the same time, since the start of the TVL incentive plan (September 12 to present), BNB Chains TVL has increased from US$4.408 billion to US$4.714 billion, with a cumulative increase of more than US$300 million in TVL, and is still on an upward trend.

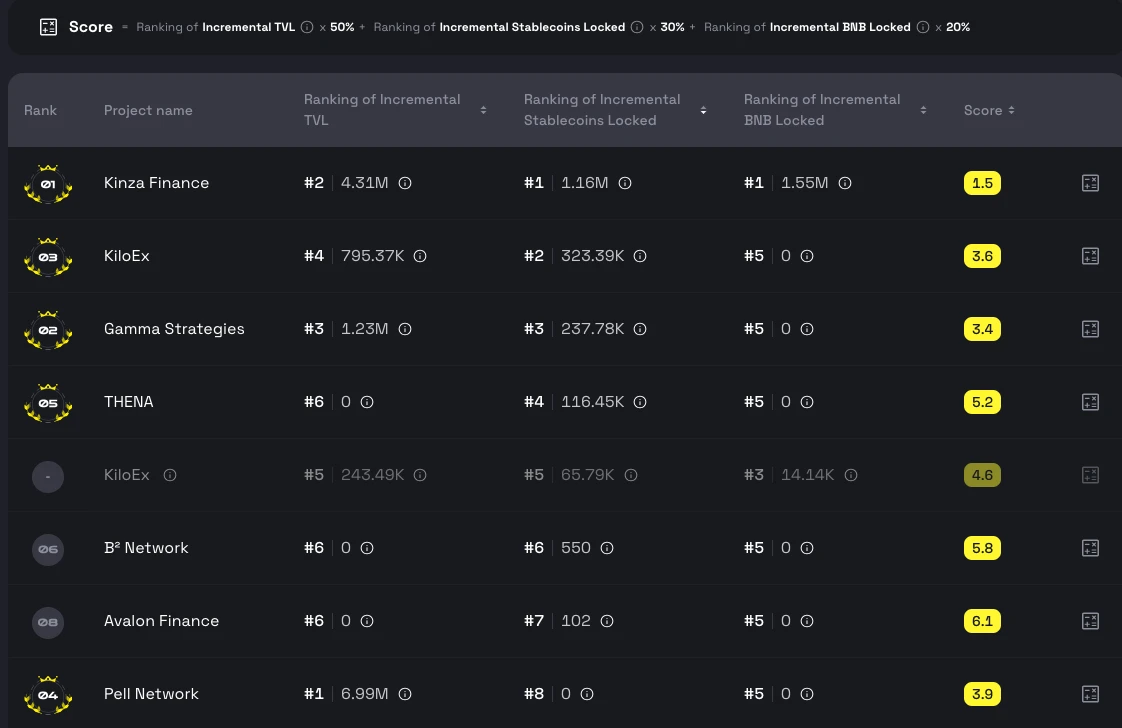

The TVL incentive plan has also attracted a lot of incremental funds for applications within the DeFi ecosystem. According to the official updated rankings, as of October 11, the TVL Challenge Plan has attracted more than $1.904 million in incremental stablecoins to the ecosystem.

BNBChains strategic measures in the DeFi ecosystem

Any activity is temporary and full of changes. It is valuable to understand the strategic intentions behind multiple activities. So, what strategic intentions can BNBChain have behind the above activities? The answer is the emphasis on vigorously building DeFi.

To understand how BNBChain builds the DeFi ecosystem, we must first look at the current environment of the entire industry.

According to DefiLlama data, the TVL of the BNB Chain ecosystem currently ranks fourth in the entire network, while the top three are Ethereum, Tron and Solana; but from the perspective of the market value of stablecoins, the market value of BNB Chain stablecoins ranks third in the entire network, and the top two are Ethereum and Tron.

From the above data, it can be seen that although BNB Chain ranks among the best in the entire industry, there is still some gap between it and Ethereum and Tron.

As the birthplace of DeFi, it is not surprising that Ethereum ranks first in TVL, but why can Tron surpass Solana and BNB Chain to take the second place? In fact, this is related to its excellent performance in stablecoin transfer in the early days.

In a sense, stablecoins are also one of the killer applications of blockchain. With advantages such as lower stablecoin transfer fees than Ethereum (exchange withdrawal fees were once less than 1 USDT) and faster block times, Tron has gradually grown into a public payment chain, with stablecoin transfer transactions accounting for more than 90% of on-chain activities, and has also accumulated a large number of users. Based on the unique advantages of stablecoins, the subsequent TRON DeFi ecosystem has also shown a colorful appearance.

BNB Chain鈥檚 strategy in building the DeFi ecosystem is somewhat similar to that of the BNB Chain. It first incentivizes users to transfer stablecoins from off-chain exchanges and other chains to the BNB Chain ecosystem. The purpose is to attract users from the capital side to transfer stablecoins from exchanges and other chains to the BNB Chain, thereby laying a financial foundation for the development of the on-chain DeFi ecosystem.

When users transfer stablecoins to BNB Chain, they will use rewards to encourage the development of DeFi applications within the ecosystem. High-quality and powerful applications and generous rewards can not only attract the retention of new funds, but are also the key to attracting long-term users on the chain.

DeFi is more than just on-chain retention

The competition among major public chains has long gone beyond transaction speed and throughput capacity, and has also focused on ecosystem construction, differentiation, and other aspects. Even in the competition for users, a differentiated, rich and unique ecosystem is the real moat of the public chain.

At present, mainstream public chains all have their own strengths. Ethereum is the smart contract chain with the richest and most complete ecosystem due to its long development history, the largest number of users and developers; Tron has risen to become a payment public chain due to its low-cost stablecoin transfers; Solana is unique due to its unique and prosperous Meme and DEPIN ecosystems; TON chain is deeply bound to Telegram and continues to grow and develop through mini-program applications…

For BNB Chain, DeFi has always been the cornerstone of ecological development. Building DeFi is not limited to on-chain retention. Although there are similarities with Tron in activity strategy, BNB Chain鈥檚 ambition is not to develop into another payment public chain, but to build a strong ecosystem based on DeFi. In addition to linking with CeFi and other chains to attract stablecoins, it also includes the combination with on-chain revenue (Stacking) and stablecoin off-chain payment.

-

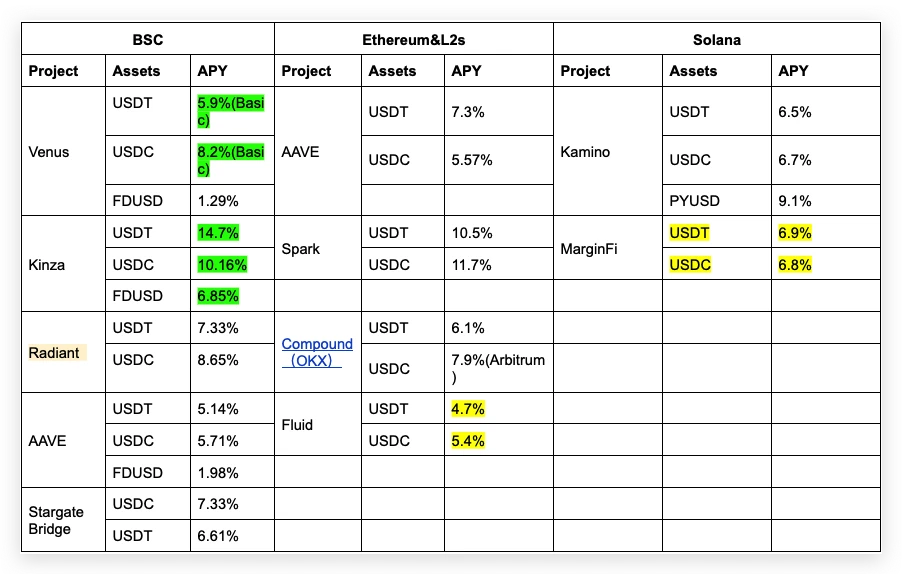

On-chain excess returns

In terms of on-chain returns, users can stake stablecoins on platforms such as Venus and PancakeSwap, which offer users more attractive returns than Solana. As shown in the figure below, Kinza in the BNB Chain ecosystem has an annualized return of 14.7% for staking USDT, which is much higher than Ethereum and Solana (data as of 10/17).

At the same time, compared with the local national currency, holding stablecoins is also a good choice for asset preservation and financial management. For example, from December last year to September this year, Argentinas inflation rate was as high as 153%, while the increase in various unofficial US dollar exchange rates was less than 20%. The US dollar exchange rate has fallen below 1,200 pesos and is looking for support between 900 and 1,050 pesos.

Similarly, Turkeys inflation rate has reached over 80%, and the fiat currency lira has hit a historic low of 18.41 lira against the dollar. The exchange rate has fallen by nearly 30% so far this year and by about 70% in the past three years.

In short, for some countries with weak economic foundations and severe inflation, it is better for citizens to hold stablecoins on the chain to earn relatively more stable and value-preserving returns.

-

Integrated stablecoin off-chain payment

In terms of off-chain payments, BNB Chain also cooperates with payment gateways such as 알케미 페이 , Oobit , Lunu , MugglePay , Now Payment , Depay , Xion , Portal Pay 그리고 Slash Vision , enabling users to use stablecoins for shopping in real life, breaking the on-chain boundaries of decentralized finance and providing users with a new payment alternative besides traditional payment methods.

In addition, BNB Chain is also exploring the combination of stablecoin payments and AI Agents . Imagine that with the maturity of AI technology in the future, AI Agents can help humans in more aspects such as life management and intelligent decision-making, while blockchain technology and stablecoin payments can help AI realize more complex payment scenarios and automated transactions, and realize a truly intelligent economy.

In summary, BNB Chain maintains its differentiation and unique advantages in the multi-chain competition with its low gas fees and high TPS in hardware, and its high daily active users and mature DeFi system that develops both on-chain and off-chain in ecology.

요약하다

BNB Chains mission and vision is to attract the next billion users to 웹3. Whether it is increasing the adoption of stablecoins on and off the chain or providing more attractive DeFi income strategies, they are all moving closer to the original intention and mission of BNB Chain.

As a user, if you stand with the BNB Chain ecosystem, actively participate in early activities and integrate into the development process of BNB Chain, you will surely receive rich ecological rewards.

This article is sourced from the internet: A brief analysis of BNB Chain stablecoin and DeFi development potential

Related: On-chain data comprehensively interprets the development status of BTCFi

원작자: 코인시장Cap Research Footprint Analytics Original translation: Vernacular Blockchain Bitcoin’s role in DeFi (decentralized finance) is changing dramatically. From its humble beginnings as a peer-to-peer transfer, the world’s first cryptocurrency is now emerging as a powerful force in the DeFi space, challenging Ethereum’s long-standing dominance. By comprehensively interpreting the current status and growth trajectory of the Bitcoin ecosystem through on-chain data, we have found a clear picture: BTCFi (the combination of Bitcoin and DeFi) is not just a technological shift, but may also trigger a paradigm shift in the role of Bitcoin in DeFi. As we will explore in depth, the impact of this shift may re디파이ne the landscape of the entire DeFi field. 01. The rise of BTCFi In 2008, Satoshi Nakamoto launched Bitcoin, which was originally designed…