Original author: Kyle

원문: 루피, 포사이트뉴스

The liquid token thesis is simple: I believe there is a huge opportunity (alpha) in the liquid token investing space, while the VC token investing space is oversaturated.

There are a lot of great businesses being built in the cryptocurrency space, and they all have their own tokens, but they are not priced properly.

The main driver of valuations in 2021 is to paint dreams. I believe that valuations after 2024 will come from realizing those dreams.

SOL monthly trend

Solana is a prime example of this shift, where three years later people realized “maybe it wasn’t all talk.”

If you’re a fund manager, here’s your opportunity: Try to figure out who’s building the really cool stuff. You might be thinking “Shouldn’t it be time to reprice?” — No.

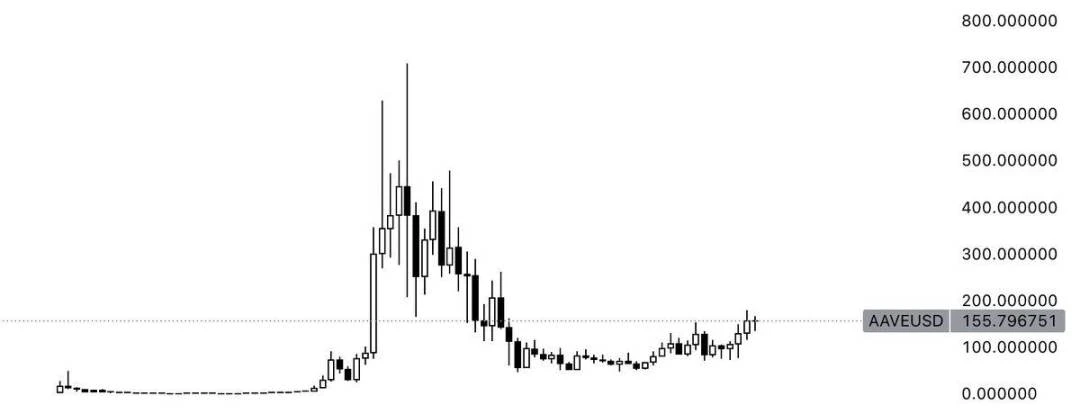

AAVE monthly trend

In his latest article on the DeFi resurgence, Arthur said that DeFi is severely underestimated and will continue to grow in the coming years. Facts speak louder than words. In the cryptocurrency field, some very legitimate companies have been overlooked, even those currently valued at billions of dollars.

But the Liquid 시장 Theory doesn’t just apply to old tokens. It’s widely believed that there are many opportunities in the liquid token space, and the businesses that are really being built are currently showing asymmetric returns. A clear example is the Banana Gun mentioned in the Theia Research article .

Banana Gun ranks 6th in revenue among all on-chain protocols, but ranks 284th in market capitalization. This shows that some real businesses that are being built are underestimated.

A more recent example is 에테나 . You may disagree with this argument, but I hope to make the point here. There are incredible opportunities in the liquid token market if you know where to look.

It’s not just “oh, it’s an AI token, go long it”, or “it’s a new thing, so the price will go up”. The core idea here is:

-

Some of the companies that have issued tokens are seriously undervalued

-

Markets will focus more on fundamentals

Below I explain the opportunities of liquid tokens using four questions.

Question 1: Aren’t scams the most profitable?

Yes. It is still crypto after all, and there is a hype factor. Things can get overvalued very quickly, and I have no doubt we will still see fake scams being pushed to sky-high prices (TRB being an example).

But if you focus on 2024, you will find that asset selection is now more important than ever, because people know how the selling dreams game works, and no one will fall into the trap of putting the world on the blockchain or income mining two tokens again.

In 2021, you can go long on anything and make money; in 2024, you can go long on hot trends and make money. But in the next few years, you will gradually reduce your preference for fake scams and choose more legitimate projects.

Question 2: When will the market pay attention?

I dont know. Im going to where the puck is going to be, not where the puck is right now. But sometimes it takes a while for the puck to get there. However, we can see that the market is starting to pay attention and asset selection becomes critical in 2024.

A lot of people seem to forget that our ultimate goal is to introduce Tradfi currency. Tradfi always needs a reason: the reason they like Bitcoin is that it is becoming a kind of digital gold, and while you may think differently, the fact is that fundamentals are what ties things together.

Anyone with enough power to move the market needs fundamentals and wants to see actual numbers.

But at the same time, another problem with this argument is that it requires bullish conditions (i.e. BTC price increases), which we have not had in the past 5 months. This is also why Memecoin has performed so well, because Memecoin is generally very resilient to market fluctuations, and it is on a completely different playing field (on-chain).

Question 3: Why don’t you buy Memecoin? Bro, just buy Memecoin

I agree with this sentiment. A lot of people reading this might think Memecoin is the pinnacle of false advertising. Its not, I think false advertising is the disconnect between promises and delivery. But with Memecoin, the promises and delivery are consistent: they dont promise anything and they dont deliver anything. What do you expect from Popcat? Or from Hat Dog?

From this perspective, you can build a basic framework for Memecoin: obviously it wont be based on how much money it makes per year, but on other factors. Does it have a cult community? Does it have memes that bring people together? And so on.

When there are 1,000 different memes for the same animal, it becomes hard to tell the good from the bad. Its not much different than if we had 100 different L1s or 100 different GameFi projects.

The strongest speculation is built on a kernel of truth, and for Memecoin, the kernel of truth is a strong community. This is completely different from a fake project that sells you a dream.

Memecoin and Liquid 토큰s are two sides of the same coin, just at opposite ends of the spectrum. In the same way some fake projects promise the world with ridiculously high valuations but no real results. At least Memecoin doesn’t promise anything, what you see is what you get.

You may disagree with this. I admit, I am not betting on Memecoin. But if I have to choose between Memecoin and a scam, I will choose the former without hesitation.

Whatever you think of the Memecoin supercycle, it’s clear that it’s a reality.

Therefore, a barbell strategy of Memecoin + liquid tokens makes sense: pick the meme with the strongest cult and the token with the best product.

Question 4: What do fundamentals represent?

All of the examples I gave above share a common point, Its making a lot of money, but its trading at X, it should be higher. But I dont think all fundamental arguments need to be stated this way. Fundamentals essentially mean there are logical arguments why it should be worth more, and valuation is a way to express that.

There are many ways to express this beyond valuation, but the core element is that the argument is rooted in sound logic and not just “it’s a new token, bro.”

결론적으로

TLDR: There are some really cool things going on with liquid tokens that haven’t really been discovered yet. Find them!

I divide the past year into three stages:

-

Phase 1 (January to March): Excitement. The bull market is really back! At this time, we still see fake propaganda, but much less than in 2021; more attention is paid to some projects that are actually doing something.

-

Phase 2 (April – present): Memes! Memes! Memes! No one cares about altcoins anymore. As the old saying goes: buy when no one is watching, sell when everyone is talking.

-

Phase 3 (coming soon): Alternatives to Memecoin have emerged.

I look forward to discovering more gems in the rough: businesses with good fundamentals that are significantly undervalued.

This article is sourced from the internet: Is the meme hype peaking? Bet on undervalued liquid tokens

관련: Roam이 DePIN 딜레마를 어떻게 해결할 수 있을까

DePIN(Decentralized Physical Infrastructure Network) 트랙은 2019년에 등장했습니다. 수년간의 개발 끝에 이제 어느 정도 규모에 도달했고, 토큰 시장 가치는 수천억 달러에 달했습니다. 하지만 DePIN 트랙은 여전히 사용자 요구와 제품 간의 엄청난 불일치, 대규모 채택 문제, 지속 불가능한 경제 모델 문제, 인프라 확장 불능 문제 등 많은 문제에 직면해 있습니다. 이로 인해 대부분의 사람들은 DePIN 트랙 프로젝트가 가져야 할 포용성을 느낄 수 없고, 토큰의 과대광고에만 참여할 수 있습니다. 따라서 DePIN의 영향력은 제한적이 되었습니다. 우수한 DePIN 프로젝트는 일반적으로 다음과 같은 특징을 가져야 합니다. 1. 실제 적용 요구 사항; 2. 요구 사항을 충족하는 사용하기 쉬운 제품; 3.…