On October 14th, Eric He, 엘뱅크‘s Chief Angel Officer and Risk Control Advisor, shared insights into the exchange’s future market plans and global compliance strategy via social media. He noted, “To better meet the regulatory requirements of various jurisdictions, our official independent sites will launch in several regions by the end of this year and early next year! “

As a global leader in cryptocurrency trading, LBank is pushing forward with compliance efforts and expanding its operations. This strategic initiative signifies a new chapter in LBank’s global roadmap. The exchange aims to offer more localized and compliant trading services while speeding up its global expansion to tap into new market possibilities.

LBank: The Pioneer in the Crypto 교환 Industry

Established in 2015, LBank has steadily grown into one of the world’s top cryptocurrency exchanges, now serving over 12 million registered users across more than 200 countries and regions.

As an innovative and comprehensive exchange, LBank offers a wide range of products and services, including spot trading, futures trading, copy trading, and staking, to meet the diverse needs of investors. According to CoinGecko, LBank garners 10.8 million monthly visits, has listed 712 tokens and 861 trading pairs which currently boasts a daily spot trading volume of $1,871,492,281. This solid performance ranks it among the top10 in the crypto industry, with a global ranking of 15th.

LBank was the first to launch meme contracts—a distinctive feature of the platform. The exchange allows users to use USDT as margin, offering up to 200x leverage, giving investors with a taste for experience a wider range of trading opportunities.

In July 2023, LBank launched its “Copy Trading” feature, which rapidly gained traction in the futures market by lowering entry barriers and simplifying the trading process. LBank has since optimized the product with a range of updates, including more diverse copy-trading strategies and robust stop-loss tools, enabling even novice users to manage their trades intelligently. For signal providers, LBank introduced advanced features like partial position closing, one-click reverse trading, and limit order management, while also offering automated API support—making the exchange ideal for professional traders seeking precise control in futures trading. According to LBank’s official website, as of October 14th, this feature has attracted thousands of top traders, with the highest 30-day cumulative return reaching an impressive 1,284.82%.

Leveraging MEME to Dominate the Crypto 시장

Gaining more market share in an already crowded space is a challenge. Amid the FOMO and turbulence in the crypto market, LBank embarked on a different course. Recognizing the importance of liquidity, LBank Labs established a $10 million MEME special fund in July 2023. In 2024, LBank further revolutionized its token listing strategy, gradually turning its attention toward emerging meme assets and launching a dedicated meme section to stay ahead of market trends.

On March 18th, LBank listed SLERF and led the charge in response to SLERF’s “unexpected burn,” becoming the first to donate and serve as the custodian of the donation address. Together with SLERF, LBank launched an on-chain donation campaign, drawing participation from nearly 100,000 users. On June 10th, LBank kicked off the “LBank MEME King” competition, featuring over 30 meme projects and attracting close to 300,000 meme enthusiasts. By August 15th, LBank had partnered with GMGN.AI, helping to drive the onset of the “meme super cycle.”

In addition, at the 2024 Wiki Finance Expo in Hong Kong, LBank was honored with the “Crypto Exchange for Altcoins and Memes Award.” As of now, LBank has listed over a hundred meme assets, including popular meme like $MooDeng, $Neiro, $Miggles, $SPX, and $Fight, all of which have seen massive gains of over 500%. This meme-fueled wealth boom has drawn in tens of millions in capital and sparked a wave of market excitement.

LBank Drives Global Expansion Strategy

Since 2024, LBank has sped up its global compliance efforts. At the “Web3 Summit Dubai” held by LBank Labs in March, the exchange successfully brought in high-profile partners, including Mohammed Alblooshi, CEO of the Dubai International Financial Centre (DIFC), and Ahmed Bin Sulayem, CEO of the Dubai Multi Commodities Centre (DMCC). Together, they engaged in deep discussions around key issues like compliance and regulatory policies.

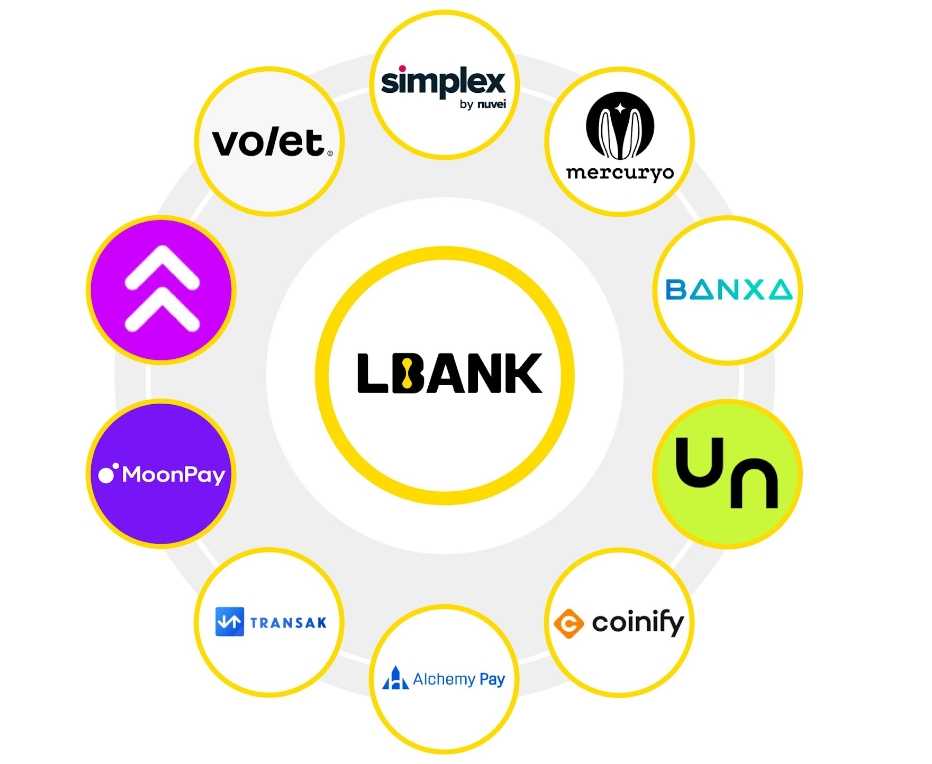

To date, LBank has successfully integrated 10 fiat transaction service providers, such as Simplex, Mercuryo, Banxa, and Alchemy Pay, enabling users to convert between crypto and fiat currencies safely and easily. Currently, LBank supports 113 fiat currencies and 4 crypto currencies across more than 200 countries and regions, offering multiple settlement options, including Visa and Apple Pay.

At the heart of LBank’s operations is a commitment to the highest standards of security and regulatory compliance. To date, LBank has secured compliance licenses in numerous countries and regions, including the United States, Canada, Italy and Australia. This proactive approach to compliance ensures that LBank stays ahead of industry trends, ready to navigate the rapidly shifting regulatory landscape on a global scale.

As LBank expands its services globally, its innovative solutions, strong regulatory foresight, and growing international presence will solidify its position as a leader in the cryptocurrency industry. Looking ahead, LBank is confident in its global compliance strategy, anticipating a future filled with innovation, breakthroughs, and deeper market integration.

Related: Aptos Labs acquires HashPalette to expand into the Japanese blockchain market

On October 3, 2024, Aptos Labs announced the official acquisition of HashPalette Inc., a subsidiary of HashPort Inc., which developed the Palette Chain. Under the agreement, HashPort will migrate Palette Chain and HashPalettes applications to the Aptos network, including the EXPO 2025 digital wallet for the Osaka Kansai Expo 2025. The acquisition will help Aptos Labs expand its influence in Asia and introduce the high-performance Aptos Network to one of the worlds important digital economies. Why Japan? Aptos Labs’ agreement to acquire HashPalette is a strategic move into the Japanese blockchain market. HashPalette has established strong relationships with several Japanese businesses, including KDDI, making this acquisition a connection to some of the most influential companies in Japan. Leveraging these relationships, coupled with the Aptos Network’s robust technology, Aptos Labs is…