Original author: shaofaye 123, Foresight news

What is the investment with the highest return rate in 2024? Without a doubt, it is Memecoin. From Bases Degen to Solanas Bome, tens of millions of times myths have been born one after another on Memecoin. The dispute between uppercase and lowercase Neiro, the zoo craze caused by hippos, Memecoin seems to never lack hype angles, constantly bringing new wealth effects, attracting various chains to join in. Sunpump pulled up TRXs previous high, Vista led ETH Gas to recover, and Memecoin accounted for as many as 15 of the only 42 projects that outperformed BTC this year. Nowadays, the Pump.fun imitations of various chains are in full bloom. As the real gold of cryptocurrency, what kind of sparks will the combination of Bitcoin ecology and Pump.fun bring?

This article will take you through the Pump.fun in the Bitcoin ecosystem.

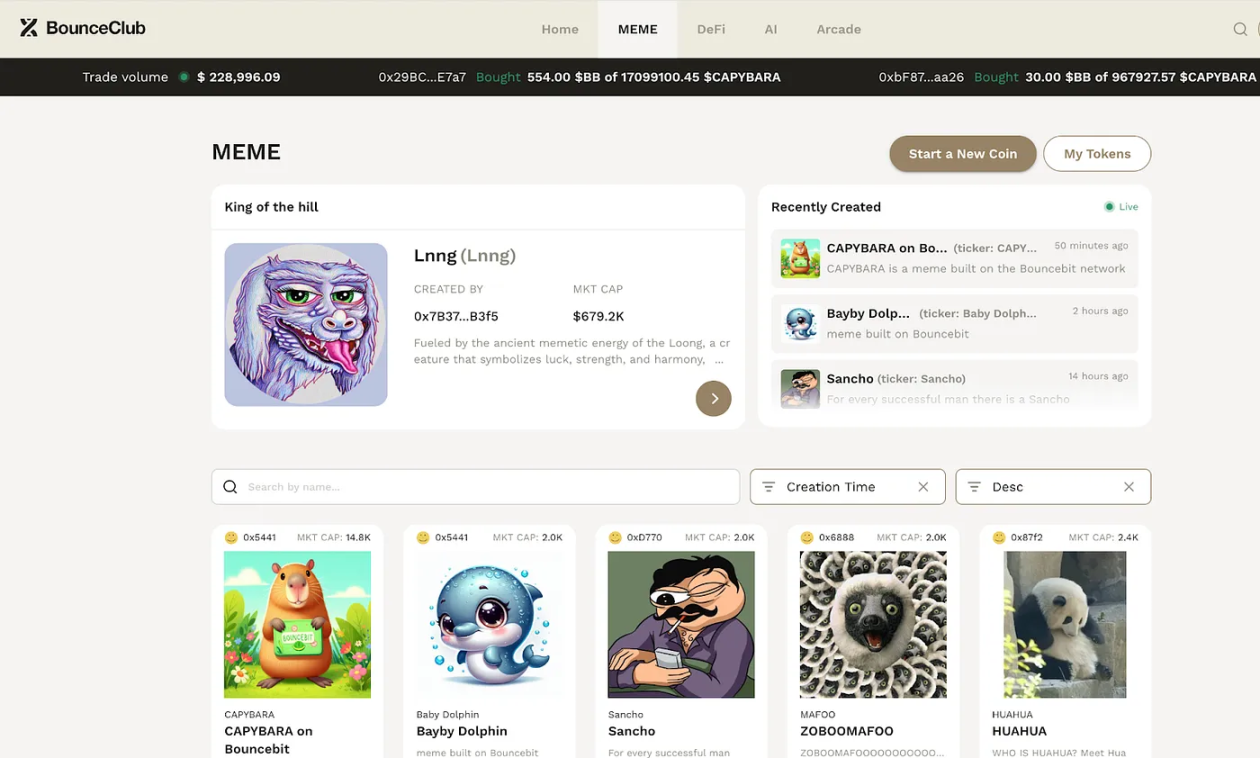

바운스비트

BounceBit Club

BounceBit is a BTC native re-staking chain that mainly provides a base layer for different re-staking products. BounceBit Club is an ecosystem on the BounceBit Chain. It integrates elements such as trading, AI, GameFi, and DeFi Farm. It also provides the creation and issuance of Memecoin. Compared with other issuance platforms, the Memecoin issuance platform on BounceBit Club is more systematic and concise. At the same time, BounceClub also announced that it will join the existing Memecoin community to promote the development of BounceBits native Memecoin. Its launch phase adopts a Bonding curve similar to Pump.fun. After the market value reaches 72,000 BBs, it will add a pool and destroy all LP pools.

Fractal Bitcoin

Satspump.fun

Satspump.fun is a Memecoin issuance platform on the Bitcoin extension network Fractal Bitcoin. Currently, the platform has reached cooperation with Bitcoin ecological chain game infrastructure UniWorlds, Nodino BTC and other platforms. The official announced a BRC-20 airdrop on August 9. Anyone who holds $300 worth of whitelisted BRC-20 tokens (ORDI, SATS, PIZZA, SHNT, WZRD, HONK, RATS) or 3 bitmaps in their wallet is eligible for this airdrop. Satspump.fun claims to use CAT_20 technology, and will migrate liquidity to DotSwap V3 AMM Swap for trading after the token market value reaches the joint curve target.

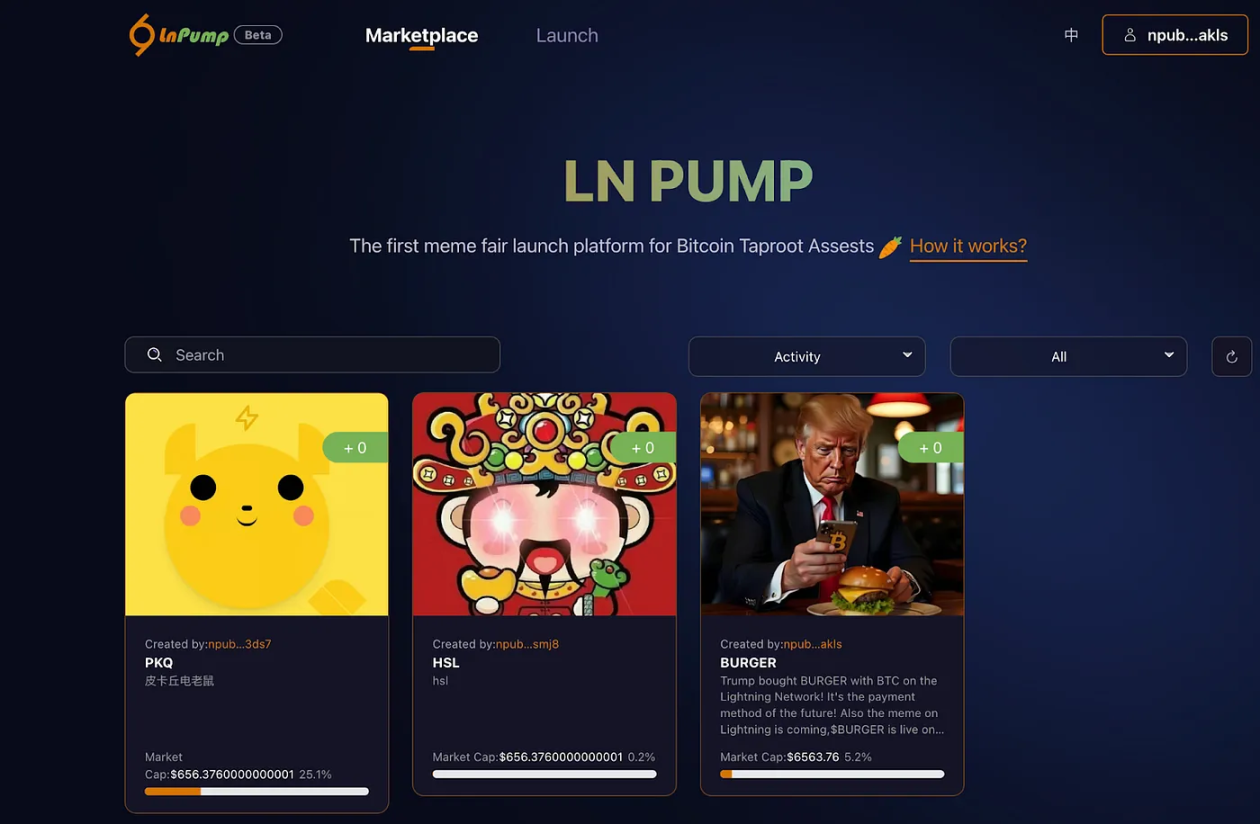

Lightning Network

Lnpump.fun

In October 2023, Lightning Labs released the Taproot Assets protocol. Taproot Assets supports the issuance of stablecoins and other assets on Bitcoin and the Lightning Network. Such assets are based on the programmable nature of Bitcoin Script to control issuance, are completely decentralized, and are ultimately implemented through the Lightning Network. Lnpump.meme is a Meme issuance platform on the Lightning Network. Compared to pump.fun, Lnpump distributes tokens by fairly launching and casting at the same price to avoid inner pool PVP. After the launch, all casting fees enter the pot, and the minted tokens are repurchased by an increasing price auction. When the pot price is equal to the auction price, the auction ends and public trading begins. (The project is in an extremely early stage and there is always a risk of RUG.)

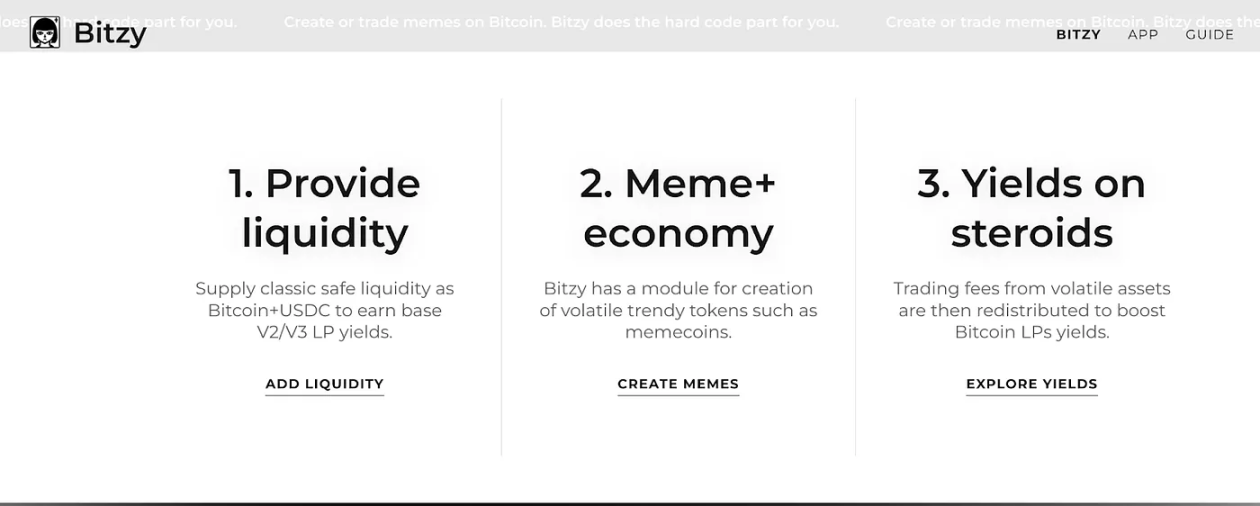

보타닉스

Bitzy.app

Botanix is a decentralized 2-layer EVM on Bitcoin, combining the security and decentralization of Bitcoin with the ease of use and versatility of EVM. It is now available on the testnet. The Meme distribution platform of this ecosystem is Bitzy.app, which claims to create tokens with two clicks and zero code and has certain airdrop expectations.

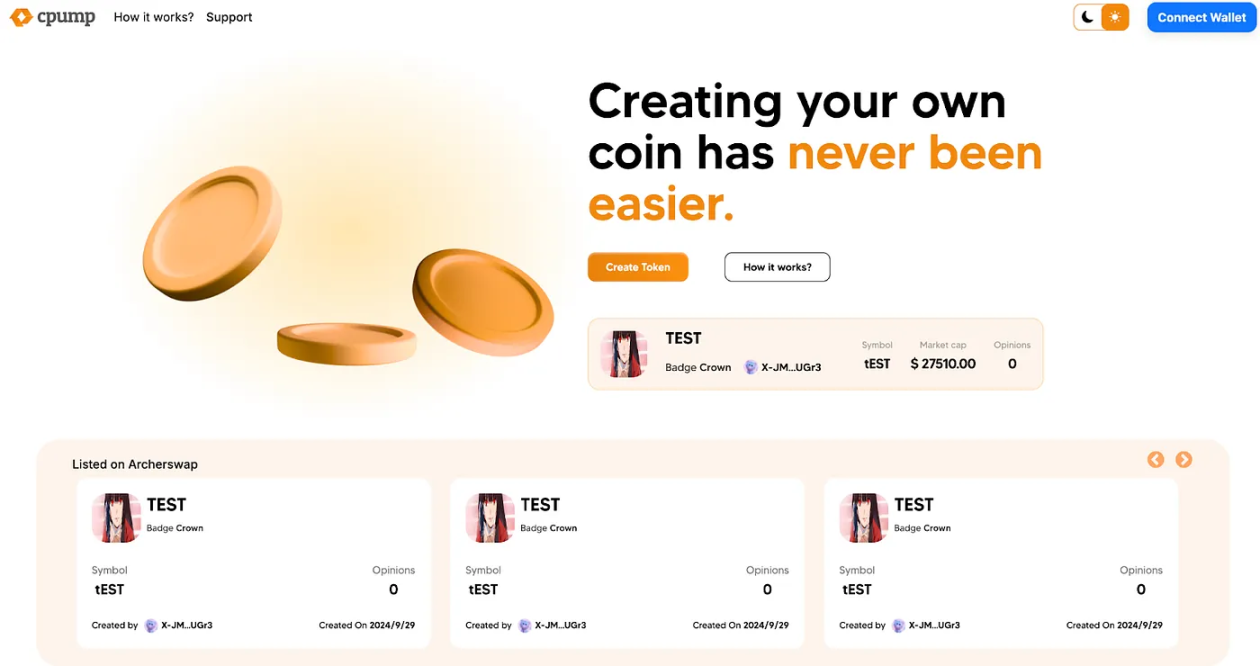

핵심

Cpump.fun

After CORE announced its entry into the Bitcoin ecosystem, the main chain token increased by 6 times within a month, and its ecosystem is relatively rich. Cpump.fun is a Meme launch platform based on the CORE chain. Its basic gameplay is similar to Pump.fun. In the initial stage, it trades according to the Bonding curve. Compared with Pump.fun, Cpump.fun can add a pool for liquidity migration when the market value reaches 23K, and will migrate to Archerswap for trading.

스택

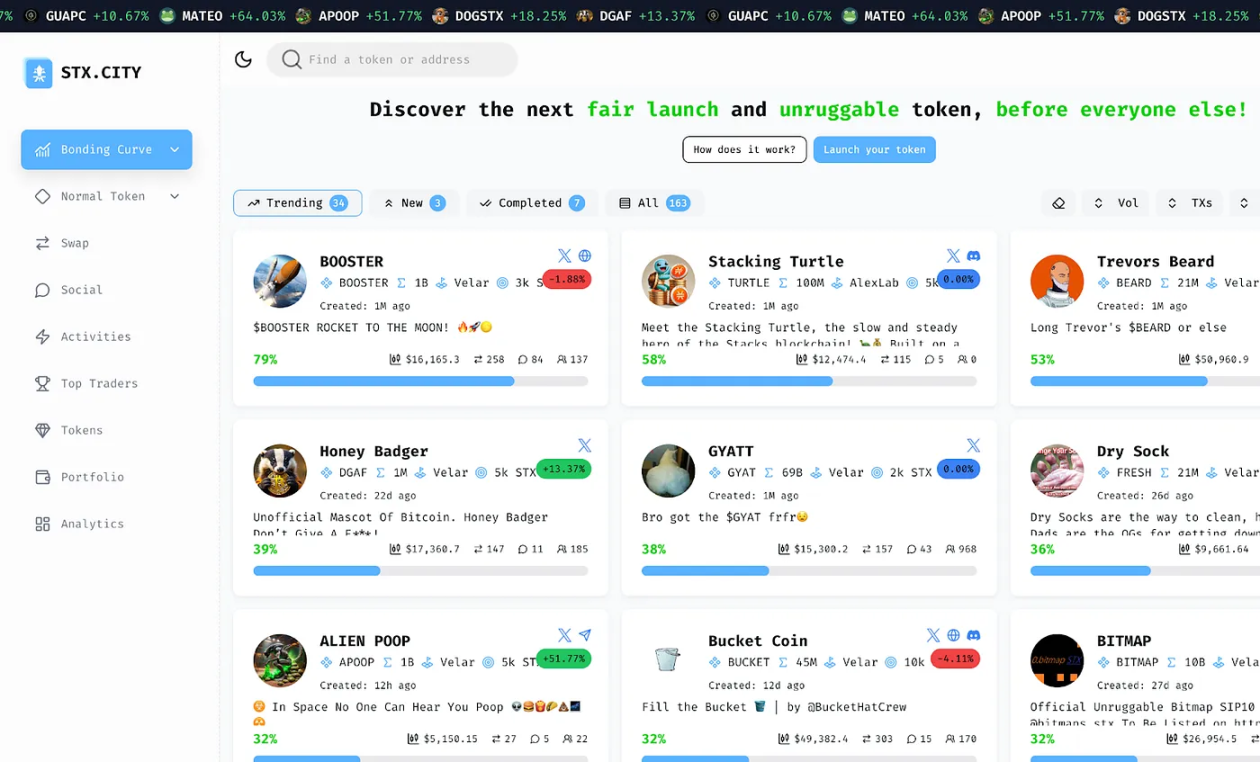

Stx.city

Stacks is Bitcoin L2, which adopts a pyramid approach, with a basic settlement layer at the bottom, and can add smart contracts and programmability layers. Stx.city is the Meme launch platform of the chain. After the original Bonding curve transaction is completed, the contract will burn 20% of the remaining tokens and pair them with the received STX to add initial liquidity, and all the LPs in the pool will be destroyed. With the dual benefits of destroying tokens and LPs, it is easier to push up the token price in the early stage.

결론

As crypto users call for fair launches and the community is tired of VC coins, the Meme issuance platform has become the fifth set added after the traditional four-piece set (stablecoin, cross-chain bridge, Swap, lending) of each public chain. Judging from the inscriptions and runes, the Bitcoin ecosystem exists and needs Memecoin, but it does not seem to be necessarily built on Pump.fun. The Bitcoin ecosystem needs its own unique way of issuing Memecoin.

Special thanks to: 1783 DAO.eth

This article is sourced from the internet: An article reviewing the Bitcoin ecosystem Pump.fun

Related: In-depth comparison of cross-chain protocols LayerZero and deBridge

introduce LayerZero is a full-chain interoperability protocol designed for lightweight messaging across chains. Stargate is the official bridge launched by the LayerZero team. deBridge is the liquidity internet of DeFi, focusing on speed, security, and user experience, driving real-time value and information delivery across the entire DeFi space. By enabling unified liquidity, free information exchange, and open access, deBridge transforms DeFi into a unified open market. This article will conduct an in-depth analysis of layerzero and its cross-chain products Stargate and debridge, including a comparison of technical models, TVL models, protocol activity, revenue, protocol activity, etc. About Trading Volume and TVL First, we understand that TVL and transaction volume are not the most accurate indicators of value capture for the following reasons: Bridges must continually distribute incentives to maintain TVL…