Weekly Editors Picks는 Odaily Planet Daily의 기능적 칼럼입니다. Planet Daily는 매주 방대한 양의 실시간 정보를 다루는 것 외에도 많은 고품질 심층 분석 콘텐츠를 게시하지만 정보 흐름과 핫 뉴스에 숨겨져 있어 지나칠 수 있습니다.

따라서 저희 편집부는 매주 토요일마다 지난 7일간 게재된 콘텐츠 중에서 시간을 들여 읽고 수집할 만한 고품질 기사를 선정하여 데이터 분석, 업계 판단, 의견 산출의 관점에서 암호화폐 세계에 대한 새로운 영감을 제공해 드립니다.

이제 와서 우리와 함께 읽어보세요.

투자하다

In the cryptocurrency space, carry trades are often expressed as borrowing stablecoins to invest in DeFi. Although the returns are high, they also come with significant risks due to volatility. Carry trades can enhance market liquidity, but they can lead to sharp fluctuations and exacerbate market instability during crises. In the crypto market, this can trigger speculative bubbles. Therefore, risk management is critical for investors and businesses using this strategy.

Innovations such as yield tokenization and decentralized liquidity are shaping the future of arbitrage trading in cryptocurrencies. However, the potential rise of anti-arbitrage mechanisms poses challenges that require the development of more resilient financial products to address.

From the users perspective, the endless Meme and Ton mini-game projects have almost swallowed up the market. This is not just a problem for any CEX, but the entire market is going through a painful period of adjustment. Meme and Ton mini-games are like lighting a box of gorgeous fireworks. User flow, incremental funds, and attention are all immediate. The accounts look good for a while, but they are also accelerating the draining of market liquidity and overdrawing users trust in exchanges and Crypto.

The exchange is not a referee; it looks at the emotional value of the community and retail investors.

시장이 회복됨에 따라 어떤 분야가 새로운 밝은 별이 될 것인가?

Sui ecology, CZ released from prison, AI sector, modularization.

바이낸스가 기존 코인 계약을 집중적으로 출시하면, 일반 사용자는 어떻게 가장 많은 혜택을 얻을 수 있을까요?

The first minute after the announcement is the highest point within 24 hours. The most stable strategy is to hold short positions for a long time after the contract goes online.

창업가정신

DeFi의 진화: 디지털 성장보다 인간화가 더 중요한 이유는 무엇일까?

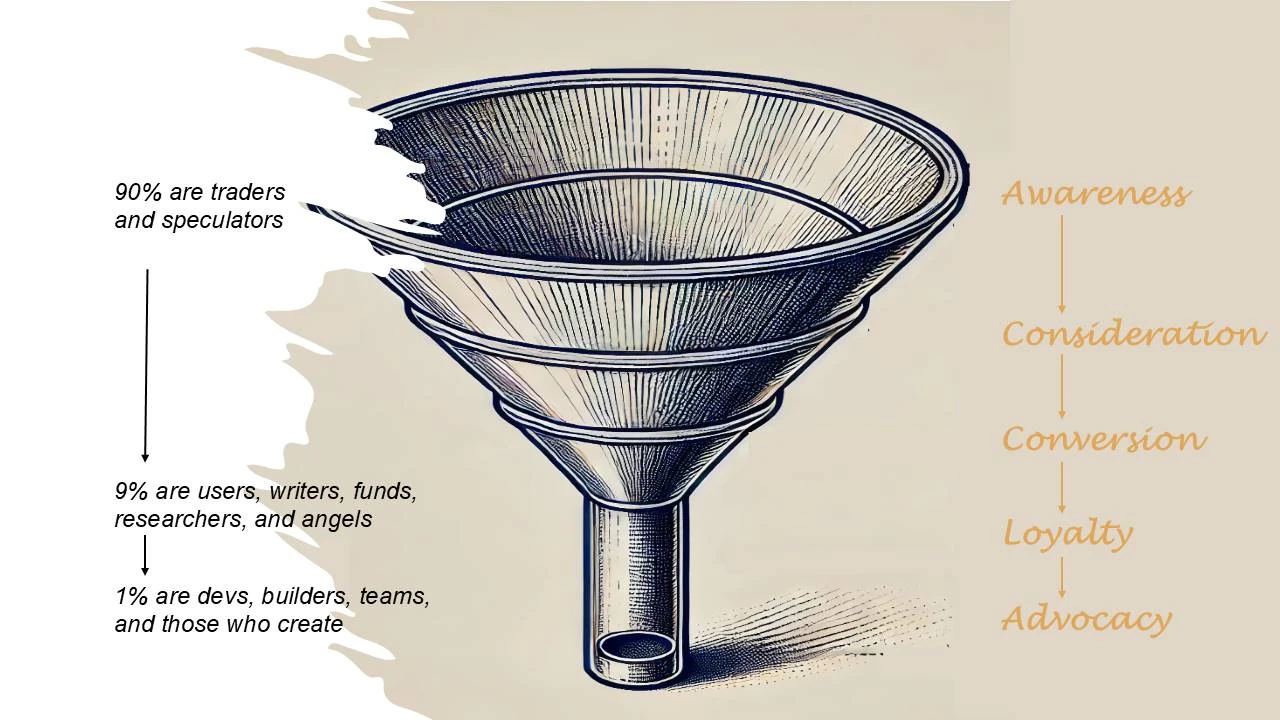

The community can be divided into three levels:

-

1%는 창작자이자 개발자, 건설자, 팀입니다.

-

9% are users, authors, funds, researchers and angel investors who are keen to observe this field and make some comments. Although they are not part of the team, they are not novices who are just passing by.

-

90%는 보통 문서를 읽지 않는 무작위 거래자이자 투기자입니다. 그들은 헤드라인을 따라가고, 암호화폐를 사고 팔지만, 심층적인 조사를 하는 데는 관심이 없습니다. 그들은 멍청하지 않고, 그저 어떤 투자에도 집착하지 않습니다. 그들에게는 기본은 보통 중요하지 않고, 가격 움직임에만 집중합니다.

A small number of high-level contributors are often more valuable than thousands of fans or critics. These core members, who are closely connected by common intrinsic values (preferably on-chain), often have a more lasting impact despite the higher upfront investment required.

커뮤니티를 직접 개인적으로 참여시키세요. 20개의 적절한 개인 메시지는 20,000명의 팔로워에게 트윗하는 것보다 더 즉각적인 결과를 낼 수 있습니다. 이 접근 방식은 쉽게 확장되지 않지만 활기차고 건강한 커뮤니티를 구축하는 초기 단계에서는 필수적입니다.

강력한 커뮤니티는 채용의 풍부한 원천일 뿐만 아니라, 특히 비엔지니어링 인재를 유치하는 데 적합합니다. 프로젝트가 커뮤니티의 인재를 유치하지 못한다면, 커뮤니티 구축과 채용 노력을 더 잘 결합하는 방법을 재고해야 할 수도 있습니다.

관점: 암호화 애플리케이션은 기술보다는 수요에 더 중점을 두어야 합니다.

Most consumer apps can be divided into three categories: enrichment, social, and entertainment, as well as their intersections. User onboarding and retention are two key moments for a good app, especially retention. Therefore, design for the right community from the beginning. Innovation should be reflected in the user experience, not the technology itself. Make good use of existing modules.

나 나

2천개의 스마트 주소 데이터는 이더리움 밈 빅 위너의 특성을 요약합니다: 다이아몬드 핸드 또는 PvP | Nanzhi 제작

Characteristics of top players: super diamond hands, 40% -45% winning rate, profit and loss ratio of more than 1:5.

PEPE가 주요 지지 수준을 잃었는데, 하단에서 매수 기회는 어디에 있을까요?

Prices may fall further in the short term, but as the fourth quarter approaches, PEPE is expected to have a rebound opportunity.

For investors who are optimistic about the token in the long term, the current price trend may be a good opportunity to increase holdings, and emerging Pepe products such as Pepe Unchained will also become the focus of the market. Short-term investors should remain cautious and avoid high-risk operations under the pressure of the bear market.

비트코인 생태계

비트코인 L2 생태계에 대한 통찰력: 사이드체인과 롤업이 주류가 되고, 최고 프로젝트가 수백만 달러를 모금

There are many Bitcoin Layer 2 projects, and even a phenomenon of inflation has appeared. The technical routes adopted by various projects are different. Well-known Bitcoin Layer 2 projects such as Stacks and Rootstock were established relatively early and have been exploring related technologies for a long time, but the projects currently lack more highlights.

As the Bitcoin basic protocol matures, projects such as Merlin, RGB++, and Babylon are making the Bitcoin ecosystem more capable of doing more, which also brings more possibilities for the development of Layer 2.

The narrowing of Layer 2 technical standards may be a trend of future development.

이더리움과 스케일링

Ethereum’s 10-year power transition: 3 reshuffles, “midlife crisis” and de-Vitalikization

An introduction to all the high-ranking officials in Ethereum history.

There are three catalysts for ETHs potential rebound: EigenLayers $EIGEN token is about to start trading; gas has reached its highest level in 6 months; Vitalik Buterin is active again.

Puffer UniFi AVS 이해하기: 사전 설명부터 이더리움의 다음 10년까지?

Puffer UniFi AVS, as a pre-confirmation technology solution with innovative mechanism design, is the most critical step of Based Rollup+Preconfs at present:

-

사용자에게 Puffer UniFi AVS는 거의 즉각적인 거래 확인 경험을 제공하여 사용자 경험을 크게 개선하고 기반 롤업의 대중화와 광범위한 채택을 위한 견고한 기반을 마련합니다.

-

사전 확인 서비스 제공자의 경우, 온체인 등록 및 페널티 메커니즘을 통해 보상 및 처벌 메커니즘을 강화하여 생태계 내 효율성과 신뢰성을 향상시킵니다.

-

For L1 verification nodes, it opens up additional income channels, increases the attractiveness of participating in node verification, and further strengthens the economic incentives and legitimacy of the Ethereum mainnet.

다중 생태 및 크로스 체인

Recommended: Singapore Breakpoint Review: 43 Solana Key Project Updates .

Sui is gaining popularity. Will it become the next Solana?

On-chain data: Sui is better than Solana in 2021; Social media influence: Sui lacks a celebrity spokesperson; Grasping the trend: Solana still occupies the main market of MEME; Capital boost: The two come from the same school; 시장 performance: The market trends do have similar experiences.

또한 추천: Sui sets off a meme trend, a quick article to introduce trading tools and popular tokens .

TON 아시아 개발 관계 이사: 개발자들은 TON을 기반으로 무엇을 구축해야 할까요?

The core of TON and Telegram should always revolve around three pillars: social, payment, and finance (huge user base + seamless cross-platform functionality + powerful value transfer).

Areas to watch Promising areas include credit card cashback and gift card businesses, RWAs, Earn products, Launchpool type initiatives, or companies focused on offline QR code payment solutions.

디파이

DeFi Renaissance in Progress: What changes have taken place in the fundamentals of the track?

There are multiple factors that point toward a DeFi resurgence.

On one hand, we are witnessing the emergence of multiple new DeFi primitives that are more secure, scalable, and mature than they were a few years ago. DeFi has proven its resilience and established itself as one of the few sectors in crypto with real-world use cases and real adoption.

On the other hand, the current monetary environment is also supporting the revival of DeFi. This is similar to the background of the last DeFi summer, and the current DeFi indicators suggest that we may be at the starting point of a larger upward trend.

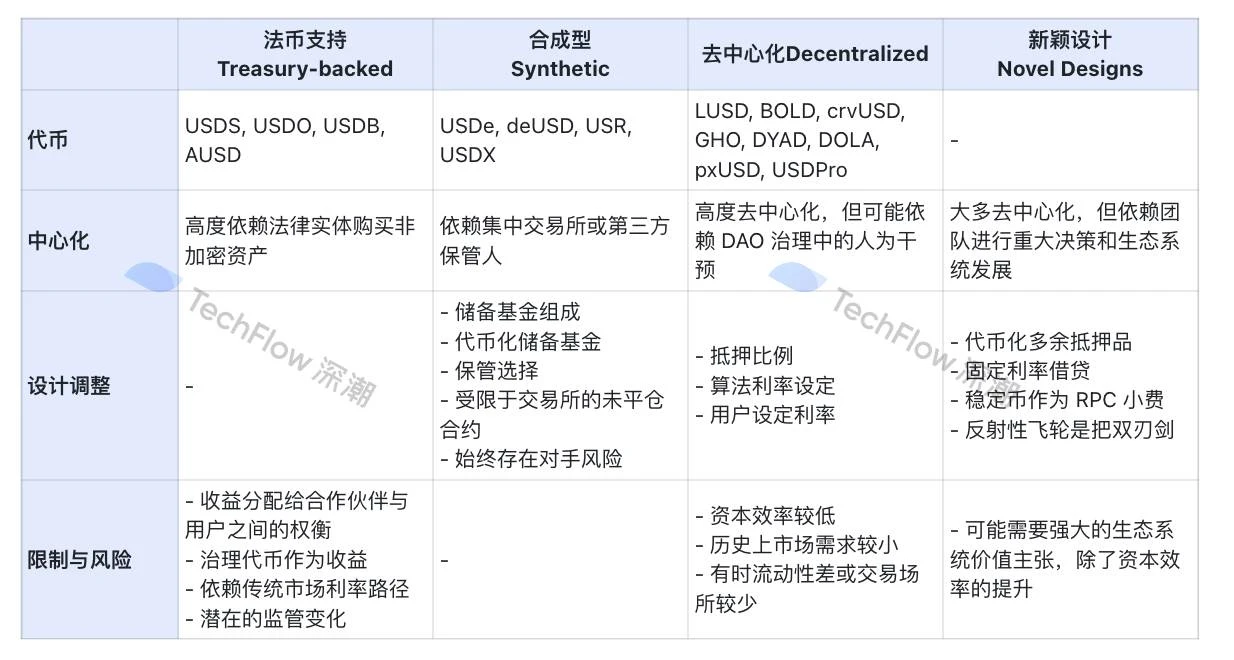

Messari Researcher: 스테이블코인 시장의 다양한 제품 및 기능 개요

Key catalysts for AAVE to outperform other altcoins include stakers sharing protocol revenue, partnership with BlackRock, entry into Solana, leading position, and brand credibility.

Although AAVE has seen significant gains recently, its price remains undervalued.

GameFi, SocialFi

Delphi Digital Report: Web3 Game Funding Declines, But Activity Remains Strong

More than 50 games were launched in 2024, including notable profitable projects such as Xai, Pixels, and Notcoin.

Shooting games are still the mainstream genre in Web3.

Among MMORPGs, the most anticipated game is MapleStory Universe.

Mobile games such as King of Destiny and Matr1x Fire have grown rapidly, attracting hundreds of thousands of users. Matr1x Fire has exceeded 3.5 million downloads.

Ronin and the TON ecosystem are at the forefront of the Web3 game.

Farcaster Top 100 Celebrities: 고품질 피드 구축

Initially, Warpcast adopted an invitation system. Dan Romero checked Twitter private messages one by one and invited users to join. The founder manually onboarded the first 10,000 users, who were roughly divided into three categories: Coinbase, VCs such as a16z, and the Ethereum ecosystem. The freeloaders came and went, but Warpcast remained the same.

In contrast, Twitter is like public media, and Farcaster is like a circle of friends – Twitter influencers are generally encouraged to output Alpha information, project research, and industry insights, while Farcaster influencers prefer to talk about new products or ideas, life insights, and life thoughts.

이번 주의 핫 토픽

In the past week, Fortune: CZ was released early , and his lawyer said he was unwilling to be interviewed immediately; Ethereum Meme reappeared a hundred dogs barking, Hippo single-handedly rescued Solana, and the zoo market hit after three years;

In addition, in terms of policies and macro markets, Biden: The Fed is expected to continue to cut interest rates ; 해리스 promised to make the United States dominant in the blockchain field and reiterated support for digital assets; the U.S. SEC approved BlackRocks Bitcoin spot ETF option trading ; on September 21, the RMB exchange rate against the U.S. dollar approached the 7.0 mark , and the USDT over-the-counter exchange rate fell to 6.94; the Governor of the Bank of Japan: If trend inflation rises as predicted, it is appropriate to raise interest rates ; the Japanese Financial Services Agency plans to reform crypto game regulations, which may make it easier for companies to handle in-game crypto assets; foreign media: Former Apple design director confirmed that he is developing new equipment with OpenAI , and iPhone veterans have joined;

In terms of opinions and opinions, VanEck analysts: Harris presidency may be more beneficial to Bitcoin ; Bank of America: The current market reaction to the Feds 50 bp rate cut seems to be following the script of soft rate cut or panic rate cut; US congressmen criticized 게리 겐슬러 as the most destructive and lawless chairman in the history of the SEC; Arthur Hayes : The accuracy rate of macroeconomic forecasts in recent years is only 25%, but crypto investments are still profitable; Vitalik: Reducing L1 slot time is worth discussing, but it needs to be done with caution to avoid damaging independent pledgers; Vitalik: The realization of the concepts of popup city and network states still requires solving governance and membership issues; Aave co-founder: There is no proposal to divest wBTC , and Sky may bear legal responsibility for forced divestiture;

Regarding institutions, large companies and leading projects, Circle CEO: IPO is being promoted and plans to move the headquarters to Wall Street next year; Binance launched pre-market trading services ; Blast launched the global deposit layer GDL, which supports deposits to any Blast address or DApp through multiple CEX and fiat currency deposit channels; 에테나 plans to cooperate with Securitize to launch a new stablecoin UStb, supported by BlackRock BUIDL; Jupiter is promoting the second major vote ( J4J#2 ) on the disposal of its token JUP to determine the disposal results of approximately 215 million JUP (approximately US$190 million); ether.fi Foundation: ETHFI airdrop in the third quarter is open for application; Pencils Protocol is open for airdrop application; LayerZero: The ZRO airdrop claim period has ended , and unclaimed tokens will be redistributed; Magic Eden will launch the ME token on Solana ; Stacks Foundation: Nakamoto activation is expected to take place on October 9; 햄스터 컴뱃 : 88.75% of HMSTR can be claimed on the first day, 2.3 million users were banned for cheating, and token distribution caused controversy; TERMINUS led the Mars Tide Meme coin outbreak ;

In terms of data, IntoTheBlock: USDT market value is nearly 120 billion US dollars, a record high ; Three Arrows Capital and Alameda Research need 3 years to sell all their unlocked WLD … 글쎄요, 이번 주도 기복이 심한 한 주였습니다.

첨부된 포털이다 "주간 편집자 추천" 시리즈로

다음에 또 만나요~

This article is sourced from the internet: Weekly Editors Picks (0921-0927)

The crypto markets 85% plunge on Monday caught most people off guard. Compared with the Mentougou incident and the US and German governments selling of coins some time ago, this plunge was more sudden. There was no obvious warning signal from the news, and the market sentiment became extremely panic. The panic greed index once fell to the freezing point of 17. Fortunately, the US stock market opened on Monday night and the trend was still stable. The expected decline did not occur. The BTC daily line closed steadily above 54,000 and slowly recovered throughout Tuesday, stabilizing at 56,000. Another day has passed. As various events and clues surface more clearly, we can better review the entire decline event. This article will also sort out and interpret this market crash.…