원저자: BitpushNews

The day before the Federal Reserve’s interest rate decision, the crypto market generally rose.

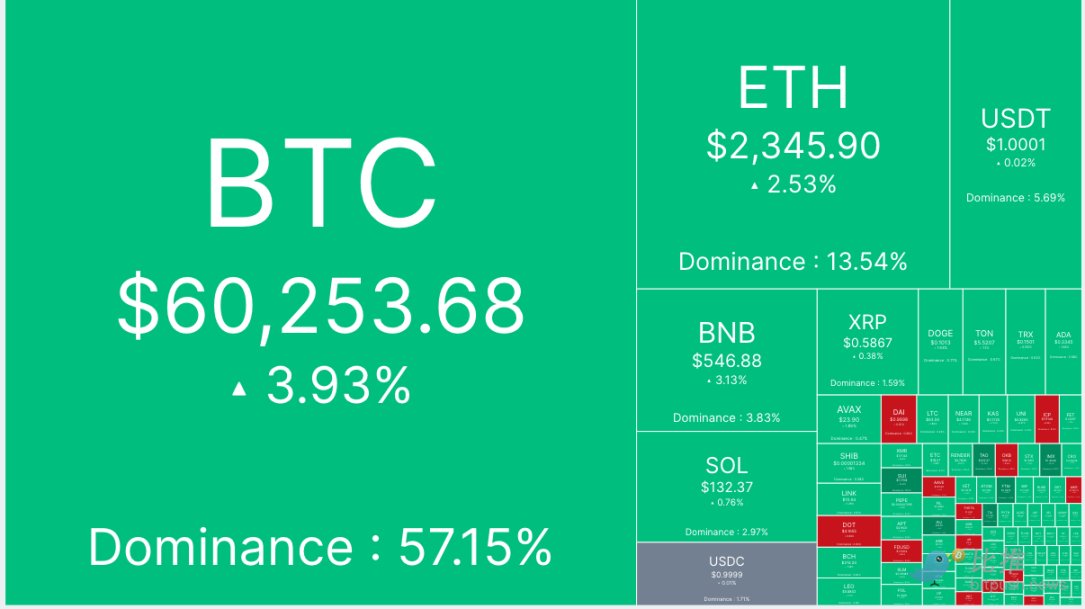

According to Bitpush data, Bitcoin soared to $61,000 during trading on Tuesday, the largest intraday gain since August 8. Mainstream currencies such as Ethereum, Dogecoin and Solana also rose, with gains ranging from 2% to 4%. As of press time, the trading price fell back to around $60,253, a 24-hour increase of nearly 4%.

In terms of altcoins, most of the top 200 tokens by market capitalization rose. Dymension (DYM) had the largest increase, up 24.1%, followed by Immutable (IMX) and Celestia (TIA), up 15.6%. Trust Wallet 토큰 (TWT) fell the most, down 12.5%, Helium (HNT) fell 5.3%, and Theta Network (THETA) fell 1.7%.

The current overall market value of cryptocurrencies is $2.08 trillion, and Bitcoin’s market share is 57.1%.

The three major U.S. stock indices were mixed, with the Nasdaq closing up 0.2%, the Dow Jones closing down 0.12%, and the SP flat.

Focus on rate cuts

The strong performance of cryptocurrencies comes as market watchers are closely watching tomorrows Federal Open 시장 Committee (FOMC) meeting, where the Federal Reserve is expected to announce its first interest rate cut since 2020.

Steven Lubka, director of Swan Private at Swan Bitcoin, said the fourth quarter will be positive for the cryptocurrency asset class, regardless of the magnitude of the rate cut.

He said in a report: If the Fed cuts rates by 50 basis points, the price of Bitcoin may rise, but if the market views it as an emergency move, this may offset this gain. A 25 basis point rate cut will bring more uncertain results, and no rate cut may lead to a short-term sell-off. Looking ahead to the fourth quarter of 2024, we expect Bitcoin to perform strongly, thanks to improved liquidity conditions. In addition, the FTX bankruptcy is expected to return $16 billion to investors, providing them with liquidity that can be used to repurchase assets.

According to CMEs Fed Watch, the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 37.0%, and the probability of cutting interest rates by 50 basis points is 63.0%.

Bitcoin is expected to reach $90,000 in the next year

TradingView analyst TradingShot said: Bitcoin broke through the 1D MA 50 (blue trendline in the figure below) today and slightly broke through the top of the triangle pattern since July (lower high trendline). Buying pressure is strong after the second rebound from the 1W MA 50 (red trendline) in just 1 month. If the 1D candle closes above the lower high, we will receive a strong breakout buy signal for at least the rest of the year.

TradingShot said, “In this case, we see an ascending channel similar to the one before March 2024, which does have the potential to test the 6-month resistance zone before the US election, followed by a technical pullback before the election, and then resume the uptrend for the rest of the year, with the target being at least the 2.0 Fibonacci extension level, which is $90,000.”

“Bitcoin local structure turned bullish again here, closing above the previous September high and locking in a higher low,” independent analyst Jelle said in a Sept. 17 X post.

Jelle mentioned Bitcoin’s recent high of $60,670, which was reached on September 13, up from the high of $59,830 reached on September 3. According to the analyst, this move shows that the market is strong enough to overcome the $65,000 resistance level, saying: “Looking at the BTC/USD 12-hour chart, it looks like a breakout above $65,000 is on the cards — and then a new all-time high.”

This article is sourced from the internet: Bitcoin breaks through $61,000, posting its biggest intraday gain since early August

관련: Matrixport Investment Research: 일일 코인 주조 데이터가 회복되고 암호화폐 시장의 전반적인 추세는 긍정적입니다.

Matrixport Research Institute의 최신 연구에 따르면 암호화폐 시장의 전반적인 추세는 긍정적입니다. 주요 요인은 다음과 같습니다. 스테이블코인 일일 채굴 데이터 증가 BTC 채굴 해시율 증가, BTC 가격 상승 예상 트럼프가 BTC를 미국 전략적 비축 자산에 포함할 것이라고 발표할 수 있으며, 선거로 인해 BTC가 상승할 것으로 예상됨 ETH ETF가 마침내 승인, 첫날 거래량은 BTC ETF 거래량의 20-25% BTC는 지난주 동안 상승세를 유지했으며, 이는 스테이블코인 채굴 증가, BTC 채굴 해시율 증가, 트럼프가 선거에서 이길 경우 BTC를 전략적 비축 자산에 포함할 것이라는 추측, ETH ETF의 성공적인 출시 등의 요인에 의해 주도되었습니다. 스테이블코인 일일 채굴…