원본 | 오데일리 플래닛데일리(Odaily Planet Daily) @오데일리차이나 )

저자: Wenser ( @웬서 2010 )

Recently, an industry report on the U.S. SECs enforcement fines in the crypto industry has attracted a lot of attention. It mentioned that the U.S. SECs cryptocurrency enforcement fines in 2024 will reach 4.7 billion U.S. dollars. It is worth mentioning that this figure was only 150.3 million U.S. dollars in fiscal year 2023, an increase of more than 30 times year-on-year.

Today, after the Bitcoin spot ETF and Ethereum spot ETF were approved, as the dividing line between the traditional financial industry and the cryptocurrency industry becomes increasingly blurred, the influence of the US SEC on the cryptocurrency industry continues to increase. Odaily Planet Daily will use this report to briefly analyze the hidden information behind the US SECs enforcement fines for reference by industry professionals.

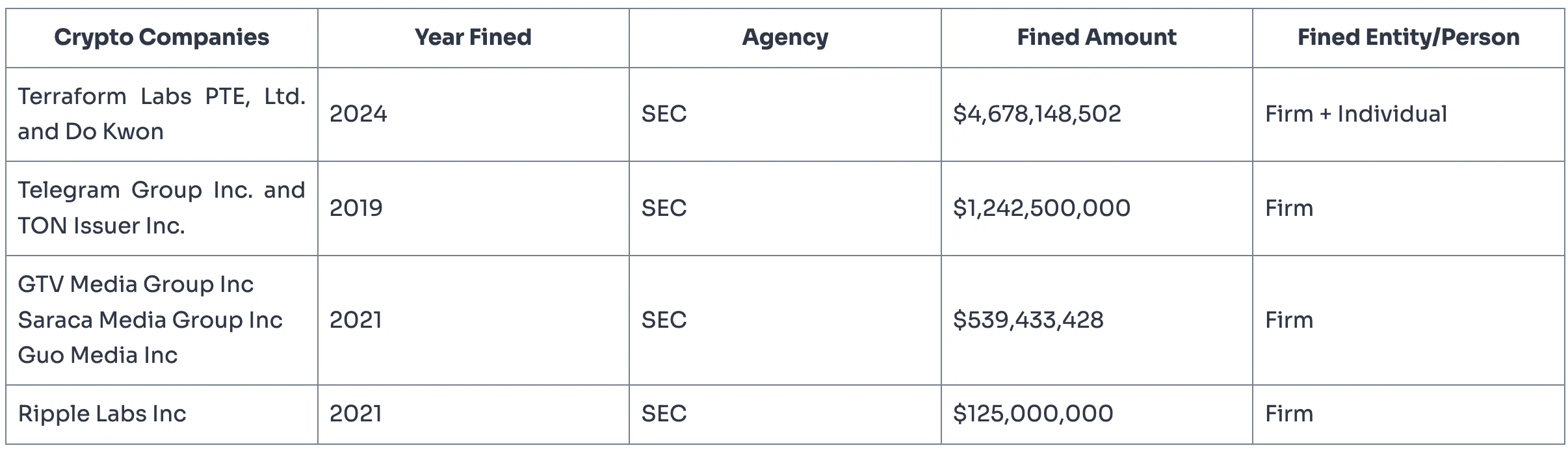

Sky-high fines: 4 cryptocurrency projects have been fined a total of $6.58 billion

4 sky-high fines

In terms of the amount, the SEC’s four “sky-high fines” include the following events:

The originator of USTLUNA: Terraform Labs and founder Do Kwon

The U.S. SEC fined Terraform Labs and its founder Do Kwon up to $4.68 billion for misleading investors and providing unregistered securities. The details of the fine are: As part of the settlement, Terraform agreed to pay $3,586,875,883 in illegal gains, $466,952,423 in prejudgment interest, and $420 million in civil penalties. Terraform also agreed to stop selling its crypto asset securities, end operations, replace two directors, and distribute the remaining assets to investor victims and creditors through a liquidation plan, which requires approval from the court in Terraforms ongoing bankruptcy case. Do Kwon agreed to share with Terraform $110 million in illegal gains and $14,321,960 in prejudgment interest, as well as $80 million in civil penalties.

Although after the news broke, Fortune magazine claimed that Terraform Labs has gone bankrupt and is unable to pay the huge fine of $4.47 billion to the US SEC, and at the end of July, the SEC also issued a statement saying that the SEC will not receive any compensation until investors and creditors receive full compensation in the corresponding bankruptcy case.

At present, the latest progress of the ticket is that the Terra project party issued an announcement in August stating that the Chapter 11 bankruptcy case hearing of Terraform Labs Pte Ltd (TFL) and Terraform Labs Limited (TLL) will be held at 10 pm Beijing time on September 19, 2024 (10 am Eastern Time).

Social giants with nearly 1 billion users: Telegram Group Inc. and TON Issuer Inc.

Telegram was fined $1.24 billion by the SEC after it was found to have illegally sold unregistered digital tokens in its TON (Telegram Open Network) initial coin offering (ICO). The SEC intervened, halted the project, and stressed the importance of registration and compliance when raising funds through token sales.

에 따르면 relevant information from the U.S. SEC: The defendant (referring to Telegram and the former TON) sold approximately 2.9 billion digital tokens called Grams at a discount to 171 initial purchasers worldwide, including more than 1 billion Grams to 39 U.S. purchasers. Telegram promised to deliver Grams to initial purchasers no later than October 31, 2019 after the launch of its blockchain, at which time the purchasers and Telegram will be able to sell billions of Grams to the U.S. market. The complaint alleges that the defendant failed to register its offer and sale of Grams (securities), in violation of the registration provisions of the Securities Act of 1933.

Everyone knows what happened next. Telegram handed TON over to the community, returned part of the IC0 funds (US$1.2 billion), and accepted the corresponding punishment (US$18.5 million). For details, see Telegram founder Pavel Durov was arrested, and a 10,000-word review of his legendary history of success 그리고 Telegram founder was arrested, more than half of the funds were withdrawn, will the TON ecosystem suffer a devastating blow? and other articles.

The episode with the most “traditional financial attributes”: GTV Media Group Inc., Saraca Media Group Inc. and Voice of Guo Media Inc.

The entities were fined $539.43 million for their unlawful and unregistered offering of GTV common stock and digital asset securities. The SEC’s action is intended to address the lack of transparency and regulatory compliance in its offering and protect investors from fraud and misinformation.

It can be seen that digital asset securities related to media groups are also within the “range” of the US SEC.

Unresolved “Securities” Case: Ripple Labs Inc.

Ripple Labs faces a $125 million fine for selling XRP as an unregistered security. The case is one of the most closely watched in the cryptocurrency space and involves a debate over whether XRP should be classified as a security under U.S. law. The SEC brought the case to protect investors from fraud and highlight the need for stricter regulation of ICOs and token sales.

The incident came to a temporary end in early August this year, when a U.S. judge ruled that Ripple’s sale of XRP to retail investors did not violate federal securities laws ( see: “XRP once soared more than 20%, another phased victory for Ripple in its lawsuit against the SEC” for details), but Ripple still had to pay a $125 million fine. Just a few days ago, Ripple asked the judge to suspend the execution of the SEC’s $125 million fine.

To sum up, the main reasons for the huge fines are the IC0 token sales, unregistered securities identification and other links, and the related projects are the face of the crypto industry, which is in line with the US SECs purpose of making a show of force.

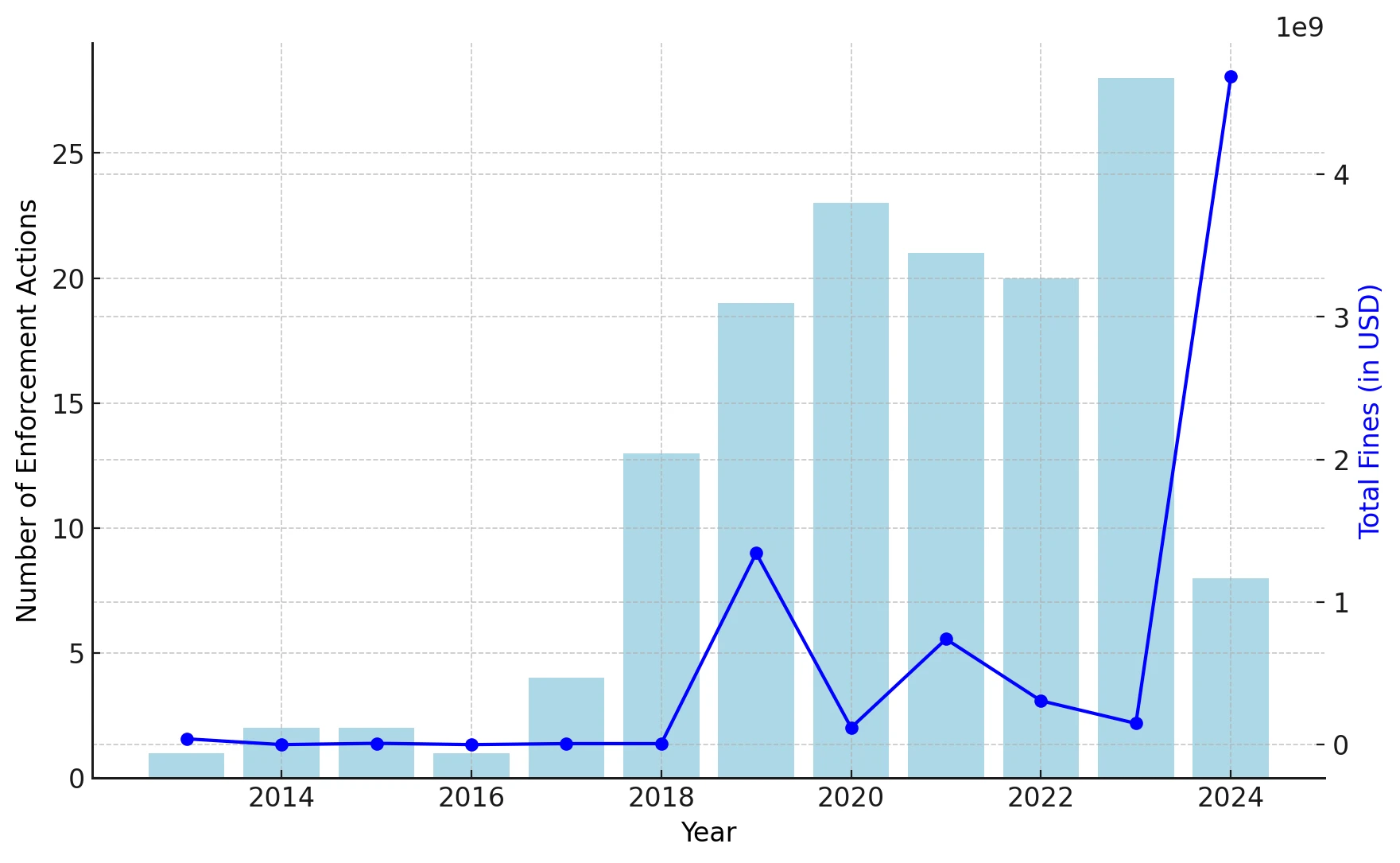

Fines trends: Fewer incidents, bigger amounts

Looking back at the fine trends from 2014 to 2024, before 2018, the number of enforcement actions was only in the single digits, indicating that the U.S. SEC paid limited attention to the cryptocurrency industry at that time, and also indirectly indicated that the crypto industry was in a wild period and had a limited scale.

From 2018 to 2023, as the market cycle switched from bull to bear, the cryptocurrency industry also matured, and the US SEC enforcement actions gradually increased from 14 to 30; until 2024, the 15th anniversary of the birth of Bitcoin and the 10th anniversary of the birth of Ethereum, combined with the successive approval of Bitcoin spot ETF and Ethereum spot ETF, the number of participants in the US cryptocurrency industry exceeded 50 million. The scale of the cryptocurrency industry and the scope of the momentum it has brought cannot be underestimated, so the SECs enforcement actions dropped sharply to 11, but the amount of fines has reached a new high.

According to statistics, in 2018, the average fine amount was only 3.39 million US dollars, but by 2024 this figure had risen to an average of 426 million US dollars, an increase of 12,466.37%.

US SEC fines by year

Landmark years: 2019, 2021, 2024

In 2019, the average amount of fines imposed by the U.S. SEC jumped sharply from $3.39 million to $70.68 million. The $1.24 billion fine imposed on Telegram Group Inc. and the TON blockchain project for selling unregistered digital tokens became a regulatory turning point. This figure increased by 1979.05% compared to 2018, indicating a major shift in the SECs approach to dealing with regulatory violations in the cryptocurrency field.

It is worth mentioning that the chairman of the SEC at that time was Jay Clayton, who was appointed by Trump during his tenure and was known as the Wall Street Plague God . During his tenure, the SEC accused Tesla founder Musk of posting false and misleading privatization news on social media in 2018. In the end, Musk settled with the SEC, resigned as chairman of Tesla and paid a fine of 20 million US dollars. In addition, the US SECs tough attitude towards the cryptocurrency industry also began with him. Jay Clayton not only included the relevant transactions in the securities law supervision, but also restricted cryptocurrency fundraising activities and Bitcoin trading funds: In 2018, the SEC urged cryptocurrency trading platforms to register and accept further supervision, and believed that except for Bitcoin and Ethereum, other digital cryptocurrencies are securities and should be regulated by US securities laws. The initial token issuance IC0 is basically a securities issuance that needs to comply with specific regulatory requirements. At the same time, since 2018, the SEC has postponed and rejected the Bitcoin ETF applications of many asset management companies due to reasons such as freedom from market manipulation and unclear regulatory rules, which once caused market dissatisfaction.

At the end of 2020, when he resigned, the SEC had completed the development of 65 final rules, levied $14 billion in fines, and paid about $565 million to whistleblowers, including a record $114 million in bonuses, the largest reward in the programs history. According to Politico, the total number of enforcement cases during Claytons tenure of 3,152 was far higher than that of the previous SEC chairman. Subsequently, Allison Herren Lee temporarily served as the chairman of the US SEC.

In April 2021, the current SEC Chairman Gary Gensler took office. As the Chairman of the Commodity Futures Trading Commission (CFTC) during Obamas administration, a former Goldman Sachs investment banker, and a professor at MIT, Gary Gensler inherited Jay Claytons tough attitude towards the crypto industry. At the same time, he also began his own unfriendly crypto regulatory journey because of his familiarity with cryptocurrencies. In 2021, the average fine amount of the SEC rebounded rapidly to US$35.2 million, an increase of 579.35% from 2020. It was this year that the SEC launched an investigation and fined Ripple. Gary Gensler, with his familiarity with the crypto industry, began to refocus the SEC on the main players in the cryptocurrency industry. For more information about Gary Gensler, see A New Perspective on the Misunderstood SEC Chairman Gary Gensler .

The huge fine in 2024 is more like putting an end to the UST and LUNA bankruptcy incident in 2022. As we mentioned earlier, the specific implementation still needs to be tested by time.

Fine amount: There were few high-level fines, with 76 fines of less than $10 million.

Looking back at past fines, from 2020 to 2024, there were only two high fines of US$1 billion, while there were as many as 76 fines of less than US$10 million. This shows that, on the one hand, small and medium-sized enterprises facing compliance issues are often punished; on the other hand, it also shows that the US SEC is also ruthless towards small projects and its regulatory supervision is quite extensive.

Of course, from a trend perspective, the current attitude of the U.S. SEC is to take more influential enforcement actions (such as higher fines, more vigorous publicity, etc.) against representative cases to establish industry cases.

Statistics of fines in 2020-2024

Summary: Supervision is becoming more mature with the development of the industry, and the US SEC is still the Sword of Damocles

In 2013, when cryptocurrencies were in their infancy, the U.S. SEC fined $40.7 million;

In 2020, the U.S. SEC fined Robinhood Financial LLC $65 million;

In 2022, the US SEC prosecuted the fraudulent ICO of the individual actor Barksdales;

In 2023, the US SEC filed charges against US-listed exchanges such as Coinbase;

In 2024, the US SEC imposed a record fine of $4.68 billion on Terraform Labs and Do Kwon.

It can be said that as the crypto industry becomes increasingly mature, regulatory forces represented by the U.S. SEC are also gradually infiltrating. To some extent, it has a certain warning effect on participants in the dark forest of cryptocurrency, especially project parties and individuals and organizations that commit fraud, just like the Sword of Damocles hanging over their heads.

The development of the encryption industry may also need to forge its own path through blood and fire, swords and frost.

This article is sourced from the internet: The US SEC will generate $4.7 billion in revenue in 2024. Will the cryptocurrency industry become a cash machine?

Original text arrangement translation: TechFlow Guests : Vitalik Buterin , Founder of Ethereum; Christopher Goes , Co-founder of Anoma Moderator : Michael Ippolito Podcast source : Bell Curve Original title : EthCC Campside Chat: Protocols, Ecosystems, Community 토큰s | Vitalik Buterin Christopher Goes Air Date : July 17, 2024 Summary of key points In this special episode, Vitalik Buterin and Christopher Goes join us live during the intention discussion session during EthCC 2024! Key highlights from this sideline talk include: Vitalik’s reflections on the cryptocurrency journey so far, and his insights on the birth of Ethereum, unbundling blockchain components, and competing with centralized protocols. The interview ends with thoughts on social consensus and the importance of learning from past failures to better navigate future developments. Reflections on the past 15…