At 9:00 am Beijing time, Trump and Harris held their first presidential debate as scheduled. Neither mentioned cryptocurrencies, but mainly discussed traditional topics such as foreign policy and immigration. According to data from Polymarket, as the debate progressed, the balance of victory slowly shifted to Harris, and the market reaction also highlighted traders attention to the election results. Although cryptocurrencies were not directly mentioned, the expectation of Trumps declining chance of winning was undoubtedly transmitted to the price of digital currencies. The political uncertainty brought about by the draw made traders more cautious, and short-term negative risk aversion reappeared, causing BTC to fall by -1.6% in one hour and then tested the $56,000 support.

Source: Polymarket

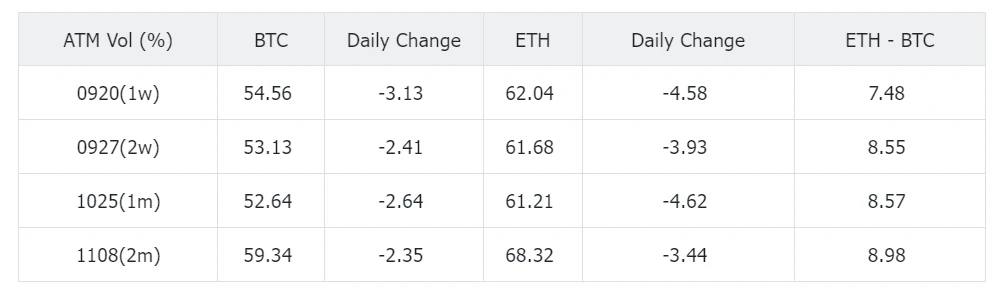

After the debate, the price completed the correction from the high point and consolidated around 56500. The actual intraday volatility of BTC is about 43%, which is much lower than the pricing in the options market yesterday. The implied volatility curve has also been significantly revised down on this basis, and the front end still prices a 60% volatility for tonights CPI data.

출처: 시그널플러스

Source: Deribit (as of 11 SEP 16: 00 UTC+ 8)

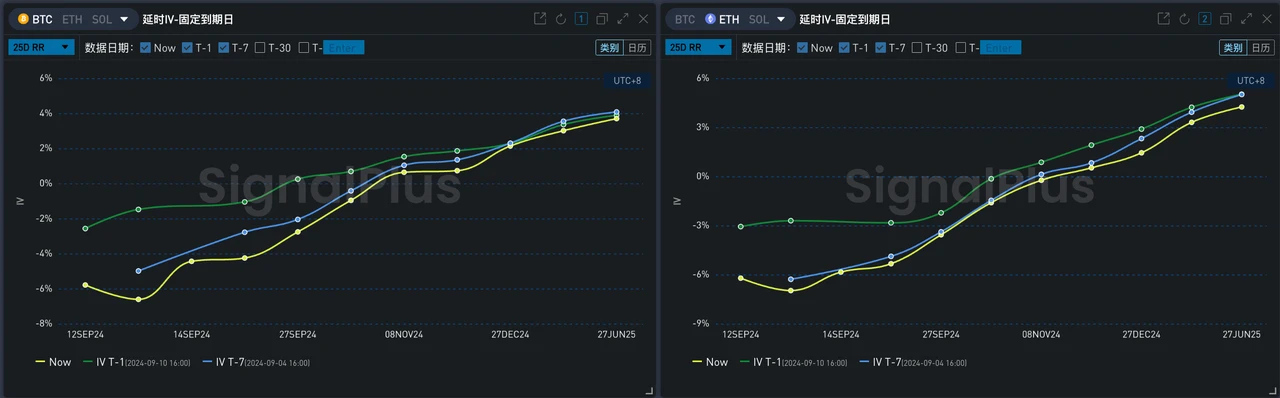

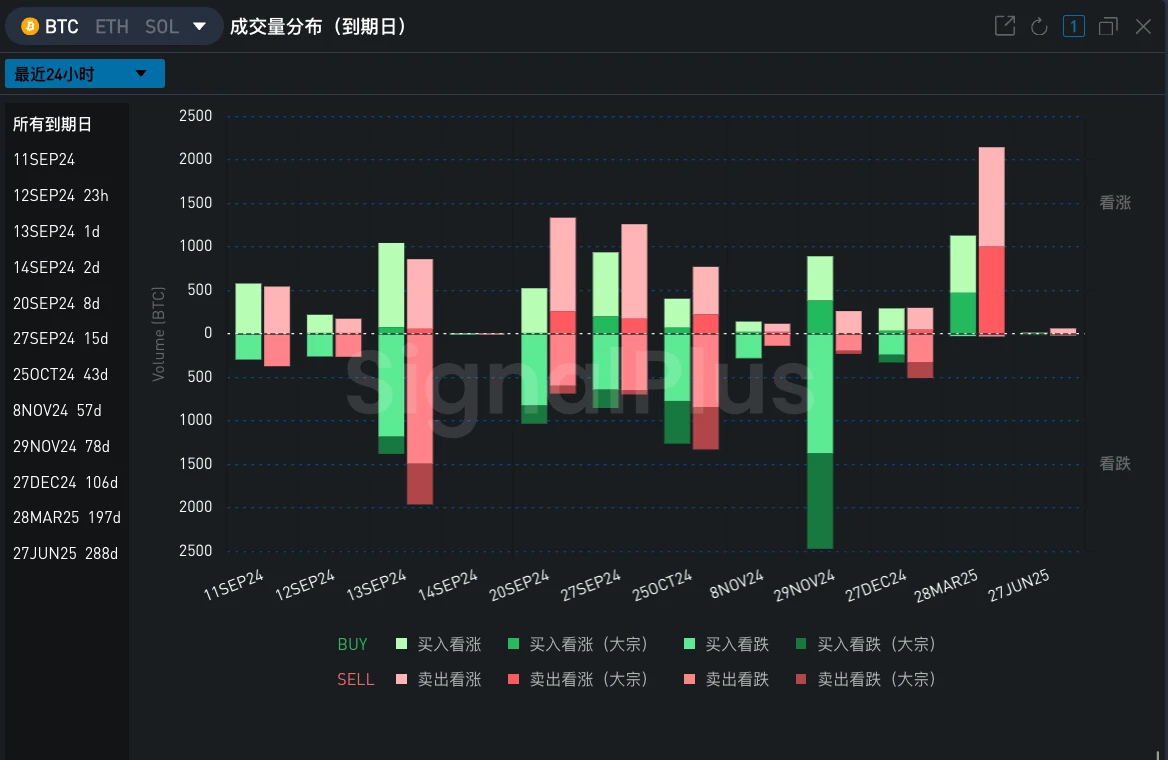

On the other hand, the change of Vol Skew reflects the recent ups and downs of the market sentiment. Yesterday, the performance of BTC spot ETF ending negative inflow was regarded by investors as a shift in market sentiment. The price challenged 58,000 and led to the return of Vol Skew. Today, although Ethereums ETF also ended the outflow of funds and BTC continued to inflow, the negative risk aversion caused by political uncertainty still poured cold water on the enthusiasm that had just been ignited in the market. Correspondingly, from the perspective of trading, the price rebound and the return of Vol Skew created cheap opportunities to buy Put on BTC, and a lot of put options were bought in various terms, especially at the end of November. On ETH, the flow brought by this market is a large number of selling Calls. The more representative one is the 20 SEP multiple custom strategies from bulk, which sold 2350 and 2400 call options at the same time and obtained high Premium income.

Source: SignalPlus, 25 D RR changes

Source: SignalPlus, transaction data

Source: SignalPlus, ETH block trade data

t.signalplus.com에서 SignalPlus 트레이딩 베인 기능을 사용하면 더 많은 실시간 암호화폐 정보를 얻을 수 있습니다. 업데이트를 즉시 받으려면 Twitter 계정 @SignalPlusCN을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 상호 작용하세요.

SignalPlus 공식 웹사이트: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240911): Draw

원저자: Biteye 핵심 기여자 Viee 원번역: Biteye 핵심 기여자 Crush Black Myth: Wukong은 하룻밤 사이에 최고 수준의 게임이 되었고, 출시 첫날 Steam 온라인 랭킹에서 1위를 차지하며 단독 게임으로는 온라인 사용자 수 기록을 세웠습니다. TON 생태계 Meme 코인 DOGS는 Binance의 57번째 신규 코인 채굴 단계에서 처음으로 출시되었으며, Binance, OKX, Gate.io와 같은 주요 거래소에서 이틀 만에 오픈될 예정입니다. 이 두 가지는 관련이 없어 보이지만, 하나는 개발에 7년이 걸렸고 4억 위안이 들어간 AAA 걸작입니다. 1시간 플레이하면 2천만 위안을 지출합니다. 다른 하나는 저렴하고 FOMO를 통해 전 세계에 퍼뜨리기 위해 에어드랍되는 토큰입니다.