원본 | Odaily Planet Daily ( @오데일리차이나 )

저자|난지( @어쌔신_말보 )

On August 15, MyShell announced its Binance Labs financing and announced that the creation of AIpp no longer requires a Creator Pass , and the interactive activity of the AIpp Store has increased significantly.

MyShell is a unique product in the AI track, with high financing and Binance endorsement, and has gone through a ten-month interactive cycle. From the perspective of interaction alone, is it popular now? How is the certainty? Which interactive method is the best? Odaily will dig deep into the data in this article to answer the questions.

(Note: Since a large amount of data is processed off-chain, MyShell cannot achieve the same accurate statistics on-chain as other projects. If there are omissions or better statistical and evaluation methods, readers are welcome to communicate.)

프로젝트의 기본 정보

프로젝트 소개

MyShell breaks the monopoly of technology giants on AI creation, provides AI developers with professional and easy-to-use creation tools, and introduces Cyrptos native incentive method to innovate the way AI is created and consumed.

Current status of the project

The current season is September 2024, which is also the third season of the AIpp version. Points distribution is mainly based on AIpp . Previously, it included:

The original Telegram version (Samantha, Sherlock, etc. AI);

The early version of the S season (the version that focuses on Genesis Pass interaction and sign-in interaction);

S Season end version (Sponsor badge system added).

공중 투하 기회

Determinism

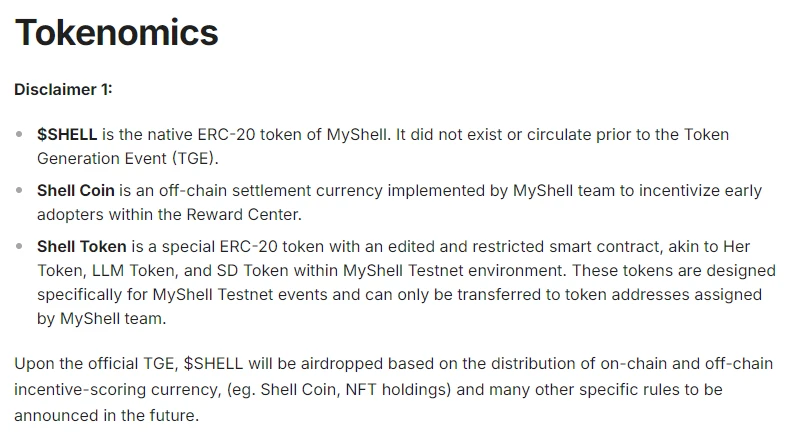

MyShell has made it clear in its official documents that there will be protocol tokens, and airdrops will be made based on the protocol chain currency Shell Coin and NFT holdings. The original text is as follows:

-

SHELL is the native ERC-20 token of MyShell . It does not exist and is not in circulation before TGE.

-

Shell Coin is an off-chain settlement currency implemented by the MyShell team to incentivize early adopters within the rewards center.

-

After the official TGE, SHELL will conduct airdrops based on the distribution of on-chain and off-chain incentive scoring currencies (such as Shell coins, NFT holdings) , as well as many other specific rules that will be announced in the future.

공중 투하 Quantity

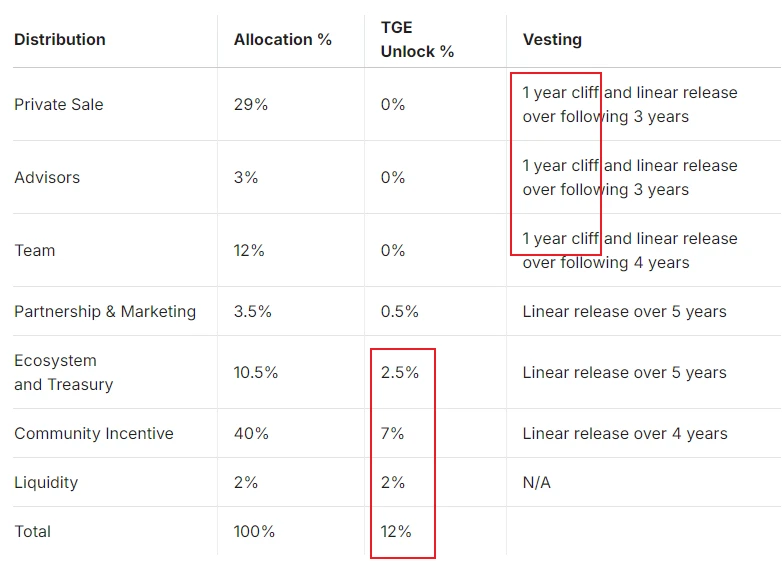

에 따르면 official documents , there are 1 billion SHELL protocol tokens in total. SHELL will unlock 12% of the tokens at TGE, including 7% for community incentives , 2% for liquidity, 2.5% for ecosystem, and 0.5% for marketing. Team and investor tokens will be released linearly after a 1-year Cliff period, and other tokens will begin to be released linearly after TGE.

Total number of people estimated

Since Dune does not support SQL queries on the opBNB network, a “naive” investigation method was adopted here.

The MyShell sign-in contract was created on October 19, 2023, and there are 327 days until the publication date of September 10, 2024. Each address can sign in once a day.

Odaily conducted two samplings and counted a total of 47,483,006 check-ins (9/9 17:00) and 47,844,299 (9/10 09:00). In total, 361,293 check-ins were made in 16 hours. It can be roughly estimated that the current total number of wallets is about 540,000 .

(Odaily Note: For reference, 6,670 check-ins occurred between 09:00 and 10:00, corresponding to a total of 160,000 wallets.)

There are two points worth noting here:

-

MyShell refreshes the sign-in data at 12:00 Beijing time. Theoretically, the sign-in rate should be higher between 12:00-17:00, so the 540,000 addresses should be underestimated to a certain extent .

-

It is impossible to fit the growth of 540,000 addresses in 327 days using conventional curves. It is speculated that the growth should be a step-by-step transition of addresses after each announcement of financing . Readers who wish to further explore can sample a large number of wallets and fit the life cycle statistics by using the Nonce number.

Estimated studio share

In MyShells sign-in, the difference in gas cost between using the AA wallet provided by MyShell (email login, etc.) and using a self-hosted wallet (such as MetaMask) is very large.

Here we make an extreme assumption that all those who use self-hosting are studios, and those who use AA wallets are Web2 users. Then what is the proportion of studios?

Odaily sampled 5,180 transactions, of which 6 were initiated by AA wallets, so the proportion of accounts that pump and dump transactions is estimated to be 99.88% .

Financing and valuation analysis

MyShell has completed three rounds of financing, namely:

-

In August 24, MyShell announced that it had received investment from Binance Labs ;

-

In March 24, MyShell announced the completion of a $11 million Pre-A financing round , led by Dragonfly, with participation from Delphi Ventures, Bankless Ventures, Maven 11 Capital, Nascent, Foresight Ventures, GSR, Animoca Ventures, Nomad Capital and OKX Ventures;

-

In October 2023, MyShell announced that it had completed a $5.6 million seed round of financing with a valuation of $57 million . This round of financing was led by INCE Capital, with participation from Hashkey Capital, Folius Ventures, SevenX Ventures and others.

MyShells core business scope has no direct competitor. The current ceiling of the circulating market value is Fetch.ais US$3 billion and Bittensors US$2 billion. Judging from the market value of Binances new coins and active AI projects, the bottom line is OCEANs US$176 million and Arkhams US$270 million.

Cost calculation

Daily Sign-in

As mentioned above, the cost varies greatly depending on the users login situation. Therefore, we need to discuss them separately:

-

AA wallet cost: 0.672 USDT per month . A single sign-in consumes 0.0000448 BNB on opBNB, which is equivalent to 0.0224 USDT based on the BNB unit price of 500 USDT.

-

Self-custody wallet cost: 0.0022899 USDT per month . A single sign-in consumes 0.00000015266 BNB on opBNB, which is equivalent to 0.00007633 USDT based on the BNB unit price of 500 USDT.

-

Points income: increasing in an arithmetic progression, about 465 points per month.

-

Exchange ratio: 1160:1 (significantly reduced, e.g. 46:1 at the end of April)

-

토큰 income: Myshell uses a rounded-down point calculation method. The token income for signing in August is 0.3-0.4 Shell Coin. The unit cost of signing in Shell Coin for AA wallet = 0.672/0.3 = 2.24 USD/coin, and the unit cost of signing in Shell Coin for self-hosted wallet = 0.0022899/0.3 = 0.007633 USD/coin.

-

Preliminary conclusion: Assuming that the project does not consider airdropping tokens based on daily sign-in activity, the sign-in of the AA wallet is already in deficit and there is no cost-effectiveness to participate. The studio can still brush it hard. MyShell estimates that a total of 54*0.3 = 162,000 Shell Coins will be distributed through sign-in in the August season.

Sponsor Points (AIpp Transactions)

MyShells sponsor points are settled and issued once a month, and the rules are not fully disclosed. This is used as a simple estimate for reference.

-

Cost: Excluding the bid-ask spread (arbitrage by other users during self-brush), according to the data disclosed by X platform user @scriptdotmoney, 20 points are distributed for every $1 consumed.

-

Exchange ratio: 1:1

-

Token income: 20 Shell Coins for every $1 spent. Shell Coin interaction unit cost = 1/20 = $0.05/minute .

-

Preliminary conclusion: From the perspective of unit cost, for ordinary users, the cost-effectiveness of sponsor points this season is far greater than sign-in.

-

Derived conclusion: In addition, Dune statistics show that in August, AIpp Store generated a total transaction volume of 1,354 BNB, which is equivalent to 745,000 US dollars at a BNB unit price of 550 USDT. According to the above data and 5% commission, MyShell distributed a total of 74.5 × 5% ÷ 0.05 = 745,000 Shell Coins through sponsor points in the August season . It should be noted that @scriptdotmoney is a professional user, and there may be situations where the interaction strategy and cost are better than those of regular users, and the September season is expected to be more volatile, so it is recommended to lower the expectations of this module here.

Robot Interaction

Cost: You need to purchase MyShell Creator Pass, the current floor price is 0.28 ETH (worth about 644 USDT). Without new financing, the price of the Pass is expected to continue to decline over time.

Exchange ratio: 38:1

Calculated backwards based on the number of conversations: 40 points can be obtained for every 10 interactions, which is equivalent to 40 ÷ 38 ÷ 10 = 0.105 ShellCoins per interaction. Here, we roughly calculate it based on the unit price of 1 U/coin, which corresponds to 6133 conversations. Of course, the project has not set a total limit on the total number of robot interactions. In theory, there can be unlimited interactions, but there is an unknown risk of witches.

Communicator Points

-

Cost: 1 Twitter account, set at $1 (regular cost of 6 U for a set of three)

-

Exchange ratio: 21:1

-

Token income: fixed at 60 cents per week, so theoretically 11.42 Shell Coins per month, which is very cost-effective.

결론적으로

In summary, the core conclusions include:

-

MyShell distributes about one to two million Shell Coins per month. After more than ten S seasons, if the Shell Coins are exchanged at a 1:1 ratio, there is still a long way to go to reach 70 million.

-

The total estimated number of wallets is about 540,000, 99.88% of which are studios;

-

The unit cost of signing in AA Wallet Shell Coin is 2.24 USD/coin. It is recommended to stop.

-

The unit cost of signing in the self-hosted wallet Shell Coin is 0.007633 USD/coin. It is recommended to continue;

-

Sponsor Points Shell Coin Interaction Unit Cost = 1/20 = $0.05/point, but it is recommended to adjust expectations downwards for the September season;

-

It takes 6133 interactions to get back the Creator Pass, and the risk of raising accounts and being a witch is relatively high;

-

Communicator points are very cost-effective and the interaction difficulty is low.

This article is sourced from the internet: MyShell interactive actuarial answer: Is it a roll or not? Which strategy has the best value for money?

Related: A deep dive into Sui鈥檚 core technology: What鈥檚 so unique about it?

Original author: David C, Bankless Original translation: Ismay, BlockBeats Editors Note: This article explores Suis core technologies such as object-oriented data model, Sui Move programming language, network structure, and dynamic NFT standards, and introduces its zkLogin that simplifies user experience and DeepBook that provides reliable transaction infrastructure. Although Sui still faces many challenges in the face of the mature EVM ecosystem and other competitors, its unique innovation may win it a place in the highly competitive crypto market. Few things generate more buzz in cryptocurrency than Layer 1 altcoins. While these new chains always promise to be bigger, faster, and better than Ethereum, few can actually deliver on these huge promises. In this round of cycles, a group of new competitors have emerged, among which venture-backed Sui has received a…