원본 | Odaily Planet Daily ( @오데일리차이나 )

The two hottest narrative directions of the Bitcoin ecosystem in 2024 are expanding Bitcoin’s programmability and staking to earn interest. Bitcoin’s scalability solutions are still in the stage of flourishing and exploring, but the “big king” and “small king” have already been distinguished in the narrative of staking to earn interest.

Babylon has become the mainstream in the Bitcoin staking interest narrative by virtue of its features such as self-custody of user assets, sharing Bitcoin security for PoS chains and obtaining staking income. In the first phase of staking on the mainnet launched by Babylon on August 22, the upper limit of 1,000 BTC was reached in just 7 blocks, and the network gas fee soared to thousands of satoshis/bytes.

The popularity of the Babylon ecosystem has also spawned many liquidity pledge protocols built around Babylon. Especially for retail investors, these liquidity pledge protocols not only provide convenience for them to participate in Babylon pledge, but also can further release BTC liquidity based on Babylon, providing users with more sources of income. 영형 Daily Planet Daily will review the liquidity pledge protocols of the Babylon ecosystem in this article. The summary information is shown in the figure below, and the detailed protocol introduction information is in the text.

Lombard (LBTC)

Lombard is a liquidity staking protocol in the Babylon ecosystem. It was founded in April 2024 and completed a $16 million seed round of financing on July 2, led by Polychain, with participation from Foresight Ventures, OKX Ventures, Robot Ventures, Babylon and others.

The BTC that users deposit into the Lombard platform will be pledged to Babylon to obtain pledge income. At the same time, users can mint LBTC on the Ethereum chain at a 1:1 ratio to participate in DeFi activities, and Babylons pledge income will be directly included in the LBTC token. In the future, LBTC also plans to expand to multiple blockchains such as Solana and Cosmos to expand the liquidity of LBTC.

Lombard uses a security alliance mechanism and non-custodial key management platform CubeSigner to ensure the security of users BTC.

On August 21, the day before Babylon launched the mainnet staking, Lombard launched a whitelist deposit test on the mainnet. Qualified users can deposit BTC into Lombard, and then when Babylon launches the mainnet, Lombard will help users deposit funds into Babylon. However, due to the fierce competition on the day of Babylon staking, Lombard decided not to stake BTC into Babylon for the time being, and invested the saved fees into ecological construction.

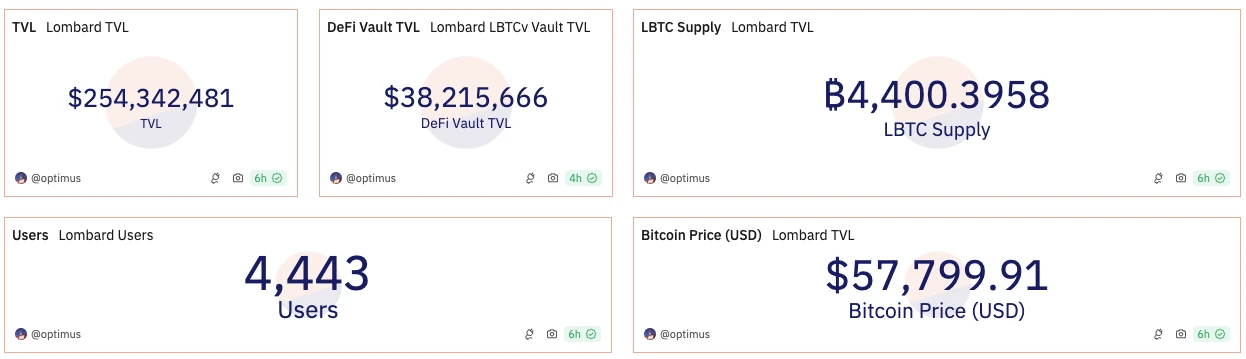

At the same time, Lombard launched a public beta version on September 3, and all users can deposit BTC and mint LBTC on the Lombard platform. According to 모래 언덕 data, the supply of LBTC has exceeded 4400.3958 pieces, and the number of addresses is 4443.

Bedrock (uniBTC)

근본적인 is a multi-asset liquidity staking protocol founded by PoS node service provider Rock X. On May 2, 2024, Bedrock completed a financing led by OKX Ventures, LongHash Ventures and Comma 3 Ventures, and the amount was not disclosed. Currently, Bedrock already supports liquidity staking services for Ethereum (uniETH), Bitcoin (uniBTC) and IOTeX (uniIOTX) chains.

Bedrock supports staking wBTC to Babylon, and users have two staking options: one is proxy staking, staking wBTC on the Ethereum network, and then a third party stakes the corresponding amount of BTC on Babylon; the other is conversion staking, exchanging wBTC for BTC with one click, and then staking it directly to Babylon. Staking income is calculated in uniBTC, and currently FBTC is also supported for staking.

Bedrock chose to cooperate with third-party BTC custodians and conduct external verification to separate the pledge right from the transfer right to ensure the security of user funds.

Bedrock is the largest delegator of the first phase of Babylon mainnet staking, delegating 297.8 BTC, accounting for nearly 30%. The minted amount of uniBTC is currently over 501, and the Cap 2 phase pre-staking is in progress. If the total staked amount reaches 800, a special reward pool will be unlocked.

PumpBTC (pumpBTC)

PumpBTC is a liquidity staking protocol in the Babylon ecosystem. The project was established in 2024 and there is no public financing information yet.

Currently, users can use WBTC, BTCB and FBTC to pledge on PumpBTC and obtain pumpBTC at a 1:1 ratio. Then third-party custodians such as Cobo and Coincover, which are partners of PumpBTC, will entrust the equivalent BTC to Babylon to earn income for users, and the income will be settled in pumpBTC. At the same time, PumpBTC has also launched a points incentive plan and a team mode. Users holding pumpBTC can earn points, and can pledge more than 0.0 2B TC to become the captain and invite people to form a team. There is no minimum pledge requirement for team members. Successful team formation can obtain corresponding pumpBTC points bonus.

PumpBTC successfully entrusted 118.4288 BTC in the first phase of the Babylon mainnet staking, accounting for 11.8% . According to 모래 언덕 data, the current total supply of PumpBTC is 349.31480504, and the number of participating staking addresses is 2333.

Lorenzo Protocol (stBTC)

Lorenzo is a Bitcoin liquidity financial layer based on Babylon. The project completed a round of financing on October 4, 2022, with Binance Labs participating in the investment, and the amount was not disclosed.

Lorenzo issues LST by separating principal from interest. Users who pledge BTC or BTCB to the Lorenzo platform will receive the liquidity principal token (LPT) stBTC at a 1:1 ratio, and the pledge reward will be settled by the yield accumulation token (YAT). At the same time, users can not only get the native income of Babylon pledge, but also get Lorenzos pledge points.

Lorenzo uses the Staking Agents mechanism to manage the issuance and settlement of LST. Staking Agents will be responsible for staking users BTC to Babylon, uploading the staking certificate to Lorenzo, and issuing stBTC and YAT to users. Although Staking Agents are designed to be composed of a group of trustworthy Bitcoin institutions and traditional financial giants, Lorenzo is currently the only Staking Agent.

Lorenzo successfully entrusted 129.36 BTC in the first phase of Babylon mainnet staking, accounting for 12.9%. Currently, Lorenzo has launched Babylon pre-staking activity Cap 2, and the total staked bitcoins in Cap 1 and Cap 2 have exceeded 507.

Solv Protocol (solvBTC.BBN)

Solv is a decentralized Bitcoin reserve protocol that can exchange pledges from other chains (such as Ethereum, BSC, Arbitrum, Bitcoin, etc.) for interest-bearing assets solvBTC, aiming to integrate Bitcoin liquidity in multiple chains. Solv Protocol has raised more than $11 million in total, with participating investors including IOSG Ventures, Binance Labs, and Blockchain Capital.

In July, Solv Protocol announced the launch of the liquidity staking token solvBTC.BBN in collaboration with Babylon, allowing users of Bitcoin assets on networks such as Ethereum, BSC, Arbitrum and Merlin to participate in Babylon staking by minting SolvBTC.BBN and obtain points rewards.

Solv Protocol chooses to cooperate with third-party crypto asset custody service provider Ceffu to ensure the security of users Bitcoin assets.

Solv Protocol successfully entrusted 250 BTC in the first phase of Babylon mainnet staking, accounting for 25%, and borne all gas fees for users. At the same time, according to the official platform TVL estimation, the total minting volume of solvBTC.BBN has exceeded 3,230.

pSTAKE Finance (yBTC)

pSTAKE is an older POS token liquidity staking protocol with a total project financing of over 20 million US dollars. Participating investors include Galaxy Digital, DeFiance Capital and Binance Labs.

On July 29, it announced the launch of a Bitcoin liquidity pledge program on Babylon, and provided a deposit limit of 50 BTC. Users who deposit BTC into pSTAKE will not immediately receive liquidity pledge tokens. According to official descriptions, yBTC is expected to be launched on Ethereum in September, and users who deposit BTC into pSTAKE Finance will receive an equivalent amount of yBTC. However, deposits can also earn points rewards.

On August 27, pSTAKE also launched the Babylon pre-staking activity Cap 2, and raised the deposit limit to 150 BTC. The minimum deposit amount of pSTAKE is 0.005 BTC. At the same time, pSTAKE uses the third-party custodian Cobo to ensure the safety of user funds.

pSTAKE successfully entrusted 10 BTC in the first phase of Babylon mainnet staking, accounting for 1%. Currently, the total pSTAKE bitcoin stake is about 101.

차크라

차크라 is a Bitcoin re-pledge protocol based on ZK proof and a modular BTC settlement network. The project completed a round of financing on April 26, 2024, with participation from ABCDE Capital, Bixin Ventures, StarkWare, etc. The specific amount was not disclosed.

Chakra has launched a Bitcoin staking pool for Babylon, which is synchronized with the Babylon mainnet. The pool allows users to stake BTC to Chakra and seamlessly transition to Babylon. Users can not only receive Babylon staking rewards, but also earn Chakra Prana and unlock multiple rewards in the near future.

The BTC pledged by users is kept in a multi-signature vault, which is jointly managed by Chakra and other entities such as Cobo to ensure the safety of user funds.

Chakra did not entrust users’ BTC to Babylon in the first phase of Babylon mainnet staking. 에 따르면 official data , the total amount of Chakra’s BTC staking is currently 25.75984.

SatLayer

SatLayer is a liquidity re-staking platform built on Babylon, which aims to use Bitcoin as a universal security layer to protect any type of dApp or protocol in the form of Bitcoin Verification Service (BVS). On August 22, SatLayer completed an $8 million Pre-seed round of financing, led by Hack VC and Castle Island Ventures, with participation from OKX Ventures, Mirana Ventures, Amber Group, etc.

SatLayer does not deposit BTC into Babylon, but provides additional profit opportunities for the LSD platform on Babylon. Users can deposit wBTC and liquid pledged BTC (LBTC, pumpBTC, SolvBTC) in the Babylon ecosystem into the SatLayer platform to enjoy the benefits. Currently, the rewards are issued in the form of Satlayer points.

SatLayer launched the first season deposit activity on August 23, with a cap of 100 BTC, which will last for 2 weeks. 현재, the pledged amount has exceeded the cap, reaching 132.54 BTC, of which more than 75% are uniBTC.

This article is sourced from the internet: Taking stock of the eight major Babylon ecosystem liquidity pledge protocols, which one is the TVL leader?

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money , including: The sectors with strong wealth creation effects are: real income sector (BANANA, AAVE), Bitget platform currency Hot searched tokens and topics: Ton Network, Bitgo Potential airdrop opportunities include: Solayer, Plume Network Data statistics time: August 15, 2024 4: 00 (UTC + 0) 1. Market environment Yesterday, the US released the July CPI, which exceeded expectations and reached 2.9. After the data was released, the market generally believed that the interest rate might be cut by 25 basis points in September. Since it did not reach 50 bp, the market went out of the shock and fell. In terms of ETFs, Bitcoin ETF had…