원작자: Sleeping in the rain

GM September Outlook is here.

September is still a dangerous month for me and I would not consider making too many trades (currently short).

wait.

This article aims to describe the tracks and targets that I will focus on in September from my personal perspective in simpler and more precise language.

요약

1. Optimistic about the $BTC ecosystem, BTC staking, wBTC competitors ($T), inscriptions/runes ($SATS $ORDI), and $RUNE;

2. Uniswap v4 $UNI, which is optimistic about DeFi, is the most important catalyst for the current DeFi ecosystem. ($COW is also making some small moves);

3. The cold reception of Solana ecosystem may give us an opportunity to buy at the bottom. I think $JTO $CLOUD $DRIFT $KMNO are good targets. Let’s see which one can attract market attention.

4. Be cautious when considering RWA targets. $MPL and $CPOOL are two projects worth paying attention to;

5. MakerDAO’s name change provides an opportunity for market speculation, which may also be beneficial to $LQTY;

6. CZ’s release from prison is a good prediction for $BNB;

7. Pendle is moving closer to BTCFi;

1/ BTC Ecosystem

The three main things related to the BTC ecosystem are:

-

The market interest in $BTC staking triggered by Bayblon is, to put it bluntly, a nesting doll;

-

While wBTC is widely questioned, other younger brothers have opportunities: 1) Coinbase launches $cbBTC; 2) former younger brother Threshold $tBTC has gained huge room for growth; 3) Stack sBTC’s cross-chain adoption after Satoshi Nakamoto’s upgrade, etc.

PS In the future, the competition among various types of packaged BTC will become more and more fierce, and the market may pay attention to cross-chain protocols that support native BTC, such as Thorchain $RUNE. Also, tBTC operator Threshold proposed to merge with wBTC, but I think it is not realistic.

-

Fractal Bitcoin, the Bitcoin extension network, is scheduled to launch the mainnet on September 9. This is expected to be a buy-in for the market, which is good for the BRC 20 ecosystem, and runes will also receive attention (not directly good).

(If there is anything I havent mentioned, please feel free to add it)

2/ DeFi

Recently, many people have been supporting old DeFi projects, such as $AAVE (Aave’s recent fundamentals are very good).

It should be pointed out that although Aave has made a lot of plans for future token economics some time ago, I think it will take a long time for these plans to be realized. In addition, Aave hopes to maintain the peg between GHO and the US dollar by integrating BlackRock BUIDL.

I will pay special attention to $UNI recently. On August 15, Uniswap Labs announced a V4 security competition with a prize pool of $2.35 million in cooperation with the Uniswap Foundation and Cantina. Uniswap v4 is about to be launched (previously expected to be launched in Q3).

The importance of Uniswap v4 has been analyzed by many people, so I will not repeat it. I will find an article for you to read: 링크 .

I think the launch of Uniswap v4 is of great significance and is the most important catalyst for the DeFi ecosystem at present (and it seems that no one is talking about it in the Chinese area now).

It is also worth mentioning that Cow Protocol may also be aware of the threat of Uniswap v4 and is working with Wintermute to seek CEX Listings and better liquidity on the chain.

3/ Solana

The most interesting thing about Solana ecosystem is memecoin. You can check out which memecoins English KOLs are Shilling. You can follow my 목록 .

The second is the most profitable protocols in the Solana ecosystem, such as Jito $JTO / Raydium $RAY / Jupiter $JUP / Banana $BANANA

And some other applications that have captured market attention/liquidity: Drift $DRIFT / Kamino $KMNO / Sanctum $CLOUD

Here are some of the coins I’ve put on my watchlist ⬇️

-

Jito — closely related to the prosperity of the Solana ecosystem;

-

Sanctum — LST liquidity layer. Recently, CEX has entered the $SOL staking market, which is a positive for it.

Here is a more detailed description: 링크 .

-

Kamino — Solana liquidity layer, accounting for 28% of Solana’s total TVL.

-

Banana——The only TG Bot listed on Binance (except Bonk).

Here is another idea of mine: With the markets aversion to VC infrastructure tokens last time, memecoin has become the new darling of the market. When the market gradually returns to rationality, fully circulated application tokens and application tokens with a large amount of real cash income may become the next hype concept in the market (I dont mean to say that meme is bad). I hope its not my wishful thinking.

4/ RWA (Please consider RWA related targets carefully)

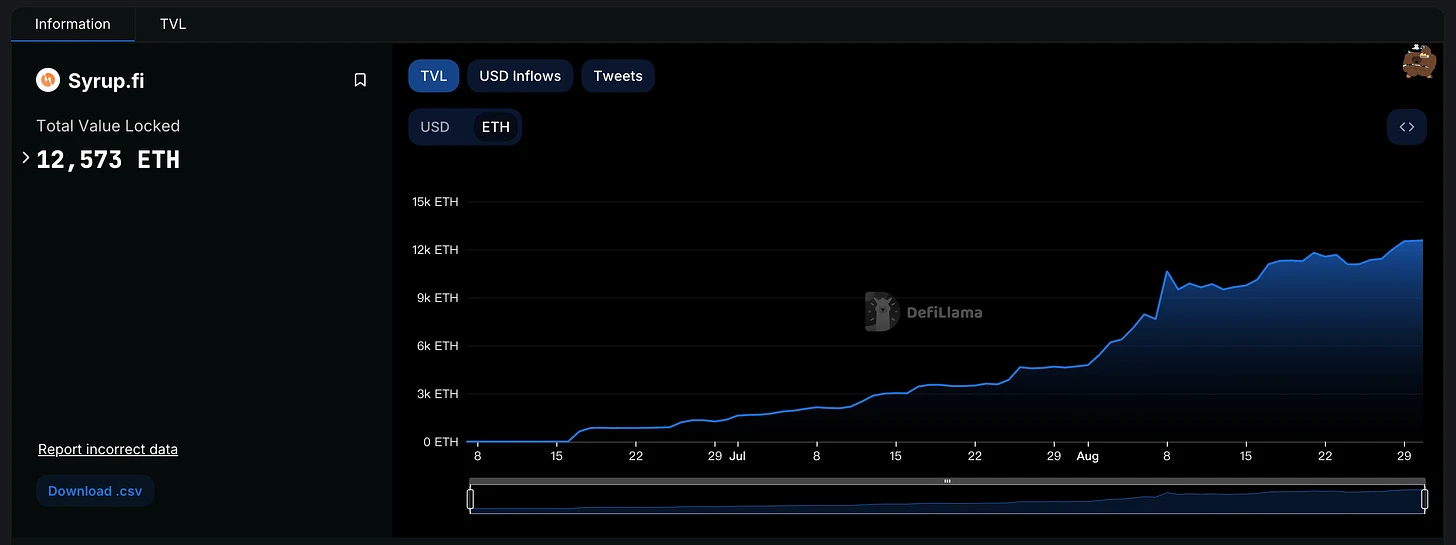

As I mentioned in my August Outlook, I really like Maple. I will update you on the latest developments of Maple.

1) Maples fundamentals are growing well;

2) Coming in Q4, $MPL will be split 1:100 and renamed SYRUP. The income from the lending business will be used to repurchase SYRUP.

https://x.com/maplefinance/status/1828089885657534644

Another project worth watching is Clearpool — a protocol for institutional lending.

Clearpool launched a Layer 2 Ozean based on RWA income/OP Stack: 1) The Gas medium is a stable currency called USDX; 2) The chain also does account abstraction; 3) $CPOOL will manage Ozean and Clearpool, and $CPOOL can obtain Ozeans sorter income.

However, judging from the price behavior, the market is not buying it.

https://x.com/ClearpoolFin/status/1825880491196821806

However, investing in the RWA track right now feels a bit like joining the National Army in 1949, so please be cautious before pressing the buy button.

5/ Stablecoins

When talking about stablecoins, we can’t avoid the name change of MakerDAO. This name change has both advantages and disadvantages. The name Sky is simple and easy to remember, and USDS is more direct than DAI, which is good for expanding new increments. At the same time, Sky has also created more adoption scenarios for USDS, such as mining Subdao tokens. The bad points @tme l0 211 also mentioned, such as USDS has added a blacklist freezing function. This has also triggered a series of controversies in the community.

It is also worth mentioning that in order to encourage migration, MakerDAO has set additional rewards.

Join early and get boosted Sky Token Rewards.

Looking at it from another angle, if DAI is no longer decentralized, it will be good for other decentralized stablecoins, such as $LQTY.

6/ Others

-

9.4 $MATIC – $POL renamed;

-

Fantom new Layer 1 Sonic testnet;

-

Arbitrum Stylus upgrade;

-

9.28 CZ or released after serving his sentence;

-

Eigenlayer Q3 should also see some major project progress and EIGEN token transfer;

-

Eigenpie IDO (if you have accumulated points before, remember to participate. There is a high probability that you can make money with 3M FDV);

-

Berachain may be launched on the mainnet in Q3;

-

There are some projects that may hold TGE (but considering the sluggish market, their TGE time may be postponed): Solv, Grass, DappOS, StakeStone, KelpDAO;

-

Singapore 토큰 2049 (Does it always fall at every meeting?)

This article is sourced from the internet: September Crypto Market Outlook: Optimistic about BTC Ecosystem, Cautiously Consider RWA-Related Targets

Original author: flowie , ChainCatcher Original editor: Marco, ChainCatcher Last week, Tether released its Q2 2024 financial report. Tethers Q2 net operating profit reached US$1.3 billion, and its profit in the first half of 2024 was as high as US$5.2 billion, a record high. The profit of half a year is 5.2 billion US dollars, which is equivalent to nearly 30 million US dollars a day, which is beyond the reach of many listed companies. However, Tether, which has made a lot of money, may not be as glorious as the financial report shows. On June 31, the EUs new MiCA law came into effect, which means that Tethers stablecoins are officially facing mass delisting in Europe. Crypto exchanges such as Binance, OKX, Uphold, and Bitstamp have announced the delisting…