Bitget Research Institute: 시장은 마지막 하락을 예고할 수 있으며 BTC는 일괄적으로 바닥을 매수할 것을 고려할 수 있습니다.

지난 24시간 동안 시장에는 많은 새로운 인기 통화와 주제가 등장했으며, 이는 돈을 벌 수 있는 다음 기회가 될 수 있습니다. 포함:

-

The sectors with strong wealth creation effect are: SOL Meme coin, RWA sector (ONDO, Pendle)

-

Hot search tokens and topics by users: Solayer, Fractal

-

Potential airdrop opportunities include: Plume Network, Fuel

Data statistics time: August 28, 2024 4: 00 (UTC + 0)

1. 시장환경

In the past 24 hours, BTC briefly fell to $58,000, and ETH briefly fell below $2,400. BTC ended its rebound and plummeted yesterday. The gas on the ETH chain dropped to 1 gwei. The market is extremely lacking in hot spots. The number of bitcoins in the exchange has dropped to the lowest level since November 2018. In the short term, the market may usher in a major uptrend after a second drop, and the long-term outlook remains bullish.

From a macro perspective, the US Ethereum spot ETF had a net outflow of $3.44 million yesterday, and the spot Bitcoin ETF had a net outflow of $127 million yesterday. The FOMC meeting minutes and Powells dovish stance have driven the rise of Bitcoin. Short squeezes may push up the price of Bitcoin. At present, it has bottomed out again after the rebound, preparing for the next main uptrend. At the same time, Nasdaq is seeking approval from the US SEC to launch Bitcoin index options. The situation of traditional funds entering the circle is very obvious. The crypto market is expected to have improved liquidity in the future, which may trigger a wave of altcoins. It is recommended to pay attention to the recent trend of altcoins.

2. 부의 창출 부문

1) Sector changes: SOL Meme Coin (WIF, BONK, POPCAT)

Main reasons: SOL price is relatively stable, standing firm at the integer mark of 17 US dollars; the DEX trading volume on Solana has reached a new high recently, and funds are relatively active, driving the rise of ecological projects

Rising situation: POPCAT rose 62.5% in the past 7 days;

시장 전망에 영향을 미치는 요인:

-

SOL token trend: In the Solana ecosystem, the trend of SOL tokens will affect the price of the entire ecosystem token, because many tokens on DEX are priced in SOL. Keep an eye on the price trend of SOL. If SOL maintains an upward trend, you can continue to hold SOL ecosystem assets;

-

Dynamic performance of top memes: Solana ecosystem鈥檚 Meme coin, which was previously listed on Robinhood, has seen an increase in SOL tokens. Generally, Solana鈥檚 top MEME coins have seen a faster increase in value. The trading volume of Solana鈥檚 core Meme coins has increased recently, and the trading demand is relatively high, so there is room for token layout.

2) Sectors that need to be focused on in the future: RWA sector (ONDO, Pendle)

주된 이유:

-

The RWA sector is still the most popular sector in the current cryptocurrency industry, and is considered to have a large market size. ONDO and Pendle occupy the RWA treasury tokenization track and the crypto asset interest rate swap market track respectively. The asset volume ceiling of these two tracks is extremely high, and the protocol income that the protocol can generate increases with the growth of asset volume. Investors should pay special attention to each round of market rebound.

시장 전망에 영향을 미치는 요인:

-

Total asset size of the protocol: The cash flow output of this type of protocol mainly depends on the asset size of the protocol. As the asset size accommodated by the protocol gradually increases, the income that the protocol can generate will also gradually increase, and the corresponding currency price will also have a strong performance.

-

Policy impact: As the cryptocurrency industry gradually passes various legislations and social recognition gradually increases, policies that are favorable to this track will also be one of the main factors for the rise of tokens in this track. As more asset management giants enter this field, I believe that the subsequent development of this field will steadily improve.

3. 사용자 핫 검색

1) 인기 Dapp

Solayer:

Solayer is the Solana ecosystem re-staking protocol. Yesterday, it announced the completion of a $12 million seed round of financing, led by Polychain Capital, with participation from Big Brain Holdings, Hack VC, Nomad Capital, Race Capital, ABCDE, and Arthur Hayes family office Maelstrom. Currently, Solayers TVL exceeds $178 million, and users are enthusiastic about participating.

2) 트위터

Fractal:

Fractal Bitcoin, a Bitcoin extension network, posted on social media that it is expected to launch the mainnet on September 9. It also announced the token economics, with 80% allocated to the community and 20% to the team and contributors (with a lock-up period). Among them, POW mining accounts for 50%, the ecosystem treasury accounts for 15%, pre-sales account for 5%, consultants account for 5%, community grants account for 10%, and core contributors account for 15%. Due to the high popularity of the project, users can consider participating in potential airdrop opportunities.

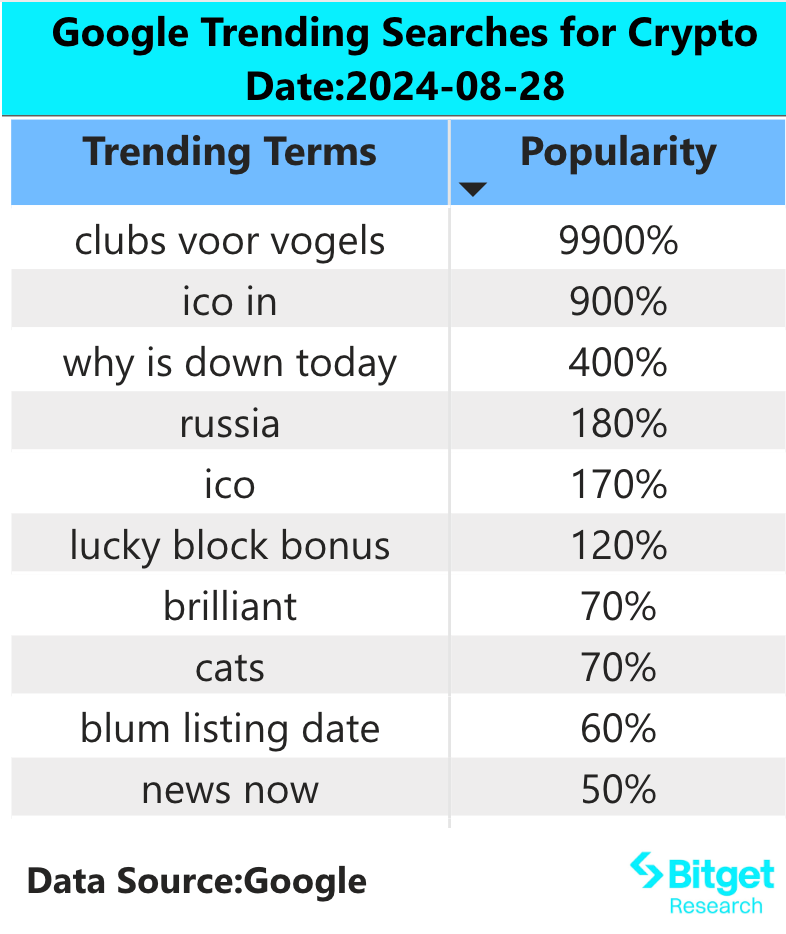

3) 구글 검색 지역

글로벌 관점에서 보면:

Blum Listing Date:

Blum is a decentralized exchange that offers token trading from centralized and decentralized platforms, as well as simplified derivatives trading. A mobile app and a mini-app were launched within Telegram. Blum will offer futures trading and the ability to buy tokens from various networks. Blums trading function has not yet been launched, but it has gained 10 million users through the model of earning points through mini-game mining. According to the official TG channel information, it is currently in the stage where users collect Blum points, which will be exchangeable for tokens. Due to the high popularity of the project, users can consider participating in the TG BOT mini-game to win future airdrops.

각 지역의 인기 검색어 중:

(1) Asia: Hot searches in Asia are very scattered, and there are basically no concentrated hot words.

(2) CIS region: The CIS region still maintains a high enthusiasm for ton app games. For example, the blum project appears frequently, and sunpump also appears in the hot searches, indicating that the CIS region is more enthusiastic about meme tokens on the tron chain.

(3) Latin America: Latin America pays more attention to the dog series tokens. At the same time, there are also depin projects such as grass and meme coin launch platforms such as sunpump. Overall, due to market reasons, Latin Americas attention to specific tokens has decreased.

잠재적인 공중 투하 기회

Plume Network

Plume Network is a modular L2 network dedicated to the RWA track. Its product form is to integrate asset tokenization and directly supply suppliers products on the chain. The project recently completed a seed round of financing with a financing amount of US$10 million. The participating institutions include Haun Ventures, Superscrypt, Galaxy, and SV Angel.

The project recently launched a test network and launched activities such as Earn Mile, Check In, and Passport.

Specific participation methods: 1) Visit the project official website, click Connet Wallet, and then enter the App; 2) Earn mileage through Swap, Stake, Speculate, completing tasks on the platform, Check-in, etc.

연료

Fuel은 UTXO 기반 모듈식 실행 계층으로, Ethereum에 글로벌하게 접근 가능한 규모를 제공합니다. 모듈식 실행 계층인 Fuel은 모놀리식 체인이 할 수 없는 방식으로 글로벌 처리량을 달성할 수 있으며, Ethereum의 보안을 계승합니다.

2022년 9월, Fuel Labs는 Blockchain Capital과 Stratos Technologies가 주도한 자금 조달 라운드에서 $80 million을 성공적으로 모금했습니다. CoinFund, Bain Capital Crypto, TRGC 등 여러 주요 투자 기관이 투자했습니다.

참여 방법: Fuel에서 수락한 토큰을 획득한 포인트에 직접 입금할 수 있습니다. 참가자는 다음 자산에 입금한 $1당 하루에 1.5포인트를 획득할 수 있습니다.

포인트: ETH, WET, eETH, rsETH, rETH, wbETH, USDT, USDC, USDe, sUSDe 및 stETH; 7월 8일부터 22일까지 ezETH를 입금하면 하루에 3포인트를 적립합니다.

원래 링크: https://www.bitget.fit/zh-CN/research/articles/12560603814976

면책조항: 시장은 위험하므로 투자할 때 주의하세요. 이 기사는 투자 조언을 구성하지 않으며, 사용자는 이 기사의 의견, 견해 또는 결론이 자신의 특정 상황에 적합한지 여부를 고려해야 합니다. 이 정보를 바탕으로 투자하는 것은 귀하의 책임입니다.

This article is sourced from the internet: Bitget Research Institute: The market may usher in the last drop, and BTC may consider buying the bottom in batches when it drops for the second time

Original author: @QwQiao @xyczzcyx Compiled by: TechFlow At @alliancedao , we receive around 3,000 applications per year to join our crypto startup accelerator. We collect data such as the blockchain they use, product type, and geographic location. Because of the large sample size and our neutrality to these factors, we are able to gain unique insights into how the industry is trending. Blockchain Layer 1 Ethereum remains the dominant ecosystem. However, Solana is recovering after bottoming out in the second half of 2022, which may be related to the collapse of FTX in the same period. Bitcoin is experiencing a resurgence amid the craze for ordinarys, runes, and Bitcoin L2 technology. Changes in L1 share over time L1 share in the first half of 2024 Ethereum Layer 2 Focus on…