Key Metrics (August 19 4pm -> August 26 4pm Hong Kong time):

-

BTC/USD +8.5% ($58,600 -> $63,600), ETH/USD +4.4% ($2,620 -> $2,735)

-

BTC/USD December (end of year) ATM volatility unchanged (62.2 -> 62.2), December 25 day risk reversal volatility -2.0 v (4.1 -> 2.1)

-

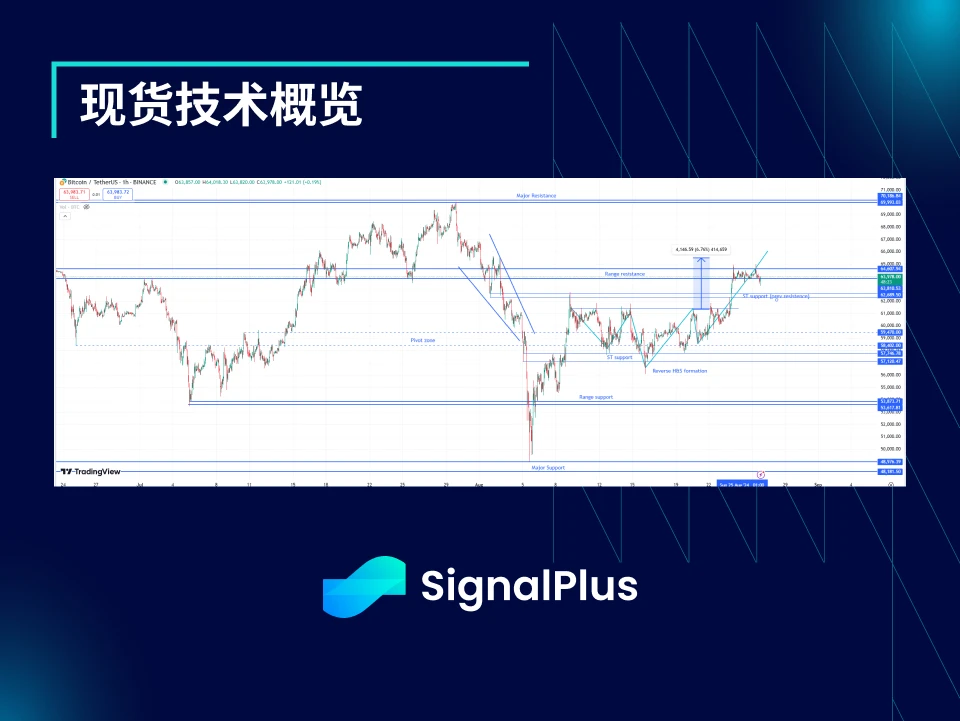

The spot price has finally managed to break through 54-63k and is testing the price range resistance of 64-65k. If it can break through this range, the BTC price may challenge the highs again (initial target is 70k, then above 74k). The initial support level is below 62.5k.

-

Combined with Fridays price breakout, the past few weeks volatile action has formed a (slightly confusing) inverse head and shoulders pattern, suggesting a more intentional move toward range lows could be in the cards if prices pull back again and fail to successfully break through overhead resistance.

시장 이벤트:

-

The market was generally in a quiet consolidation phase at the beginning of this week, but as Powells speech at the Jackson Hole conference approached on Friday night, market expectations gradually heated up. Powell did not respond strongly to the markets expectations of a quick adjustment to faster and earlier rate cuts, but admitted that now is the time to start the Feds rate cut cycle.

-

The cryptocurrency market was relatively slow to react initially (compared to the rapid rise in US stocks/weakening of the USD versus the G10 currencies), but eventually BTCUSD broke through the recent 58-62k price range and stabilized at 64k, driving ETHUSD to the high of the recent range in tandem.

-

Geopolitical noise is now fading into the background, with no signs of an imminent escalation of tensions in the Middle East, while peace talks are struggling to make any substantial progress.

ATM 암시적 변동성:

-

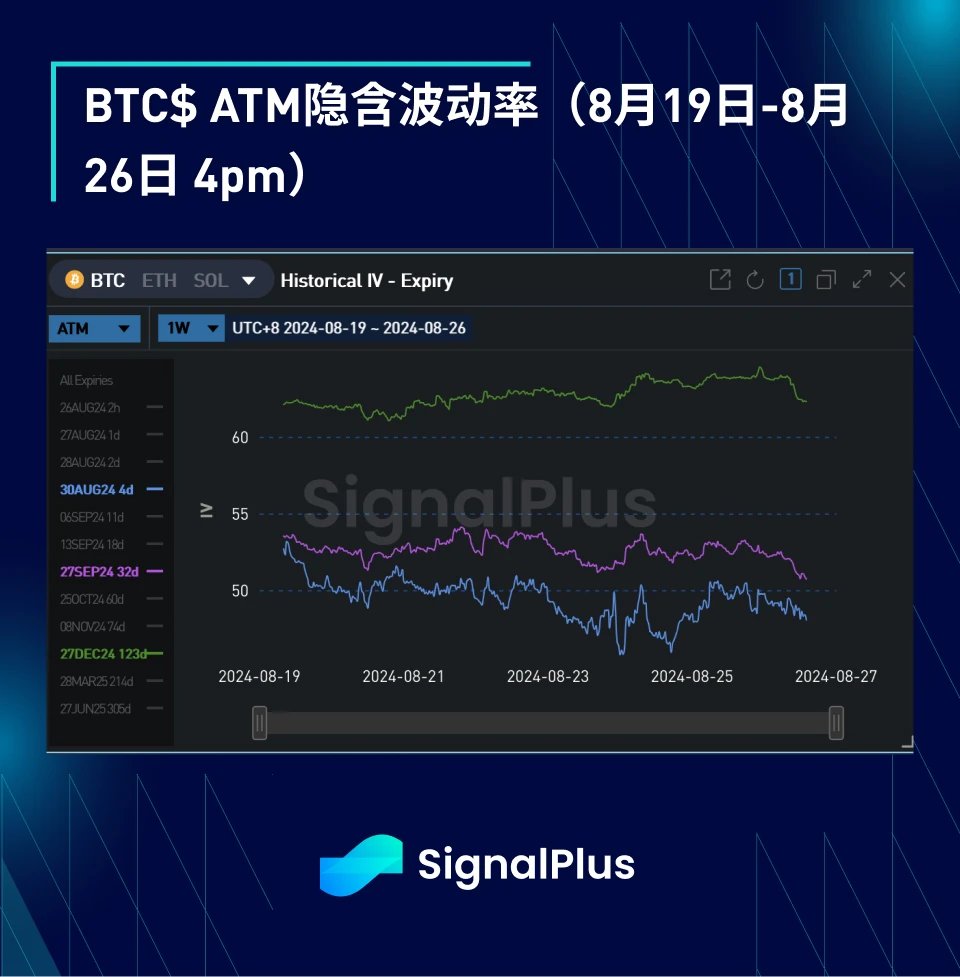

Implied volatility has been mostly sideways this week, with spot prices range-bound ahead of the Jackson Hole meeting, which has pushed implied volatility up to the overnight breakeven of 2.5% (with an implied volatility of 60). This level is roughly reasonable based on high-frequency data, but low based on fixed-time data.

-

After the Jackson Hole meeting, the spot price broke out of the 58-62k range and the implied volatility initially rose. But by Monday, the implied volatility quickly fell back, and the spot/realized volatility stagnated around 64k.

-

There was continued demand for US election-related options, mostly through rolling September/October call options to November/December. However, a large supply of long-dated call options after the weekend also caused forward prices to fall, reducing the impact of the US election.

비대칭성/볼록성:

-

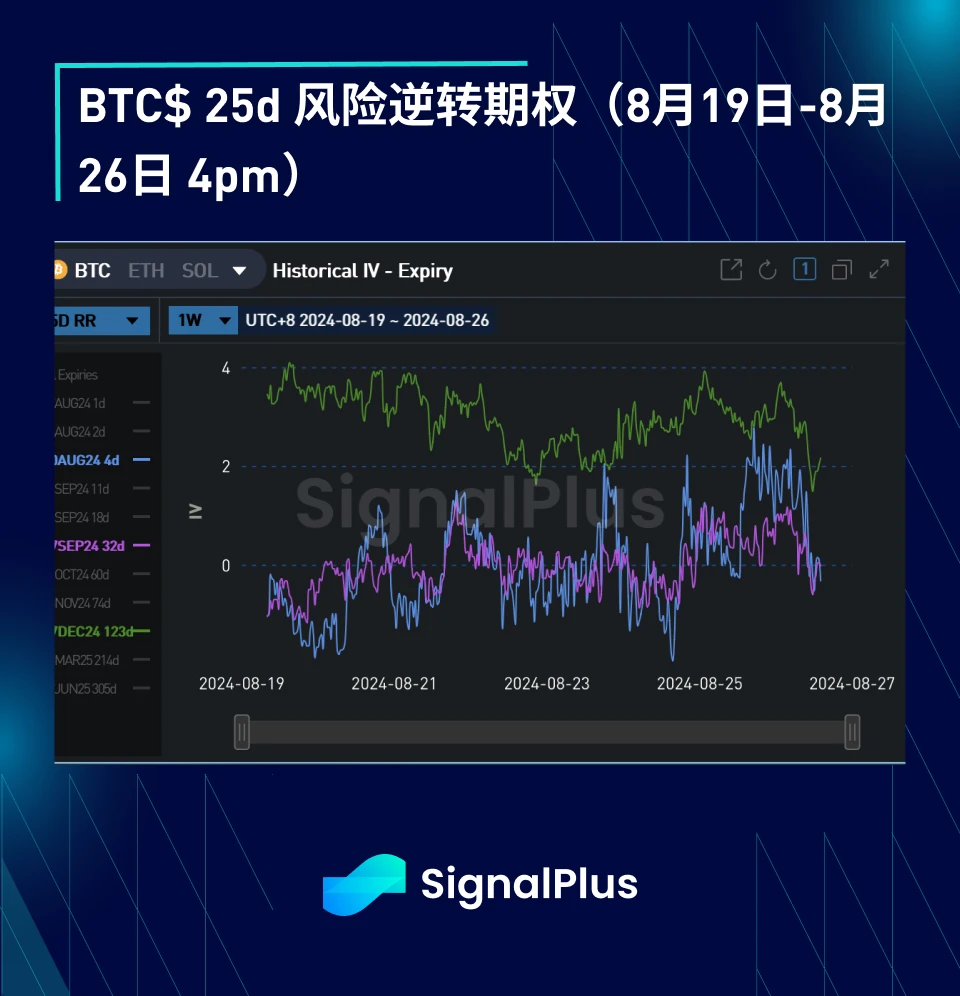

The skew pricing has moved significantly lower (less demand for options on the upside), which is interestingly the opposite of the spot price movement. This could indicate that the market is still concerned about an accelerated decline in prices, as the previous two declines in this range were very volatile.

-

In addition, some traders are taking advantage of the rise in spot prices to sell covered calls, especially at longer maturities, which puts downward pressure on the tilt of the term structure.

-

Convexity has weakened this week, with both realized volatility and realized spot risk reversals showing low correlations, which has exerted some downward pressure on convexity.

이번 주 거래에서 행운을 빌어요!

t.signalplus.com에서 SignalPlus 트레이딩 베인 기능을 사용하면 더 많은 실시간 암호화폐 정보를 얻을 수 있습니다. 업데이트를 즉시 받으려면 Twitter 계정 @SignalPlusCN을 팔로우하거나 WeChat 그룹(WeChat 보조원 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구와 소통하고 상호 작용하세요. SignalPlus 공식 웹사이트: https://www.signalplus.com

Welcome to join the Odaily official community

Telegram subscription group: https://t.me/Odaily_News

Telegram chat group: https://t.me/Odaily_CryptoPunk

Official Twitter account: https://twitter.com/OdailyChina

This article is sourced from the internet: BTC Volatility: Week in Review August 19–26, 2024

Related: How crypto hedge funds generate excess returns: Actively manage risks and invest in BTC

Original author: Crypto, Distilled Original translation: TechFlow Coinbase just released a report on how crypto hedge funds generate excess returns. Here are the most valuable insights. Report Overview The report reveals the main strategies used by active crypto hedge funds. It provides valuable insights for any investor looking to: Better manage risk Capturing excess returns Deepen your understanding of encryption Provided valuable insights. Passive or active strategy? Regardless of your experience level, always compare your performance to $BTC. If you can’t outperform $BTC for a year or more, consider a passive strategy. For most investors, DCAing $BTC on a regular basis is usually the best option during a bear market. Bitcoin – Benchmark $BTC is the preferred benchmark for crypto market beta. Since 2013, $BTC has had an annualized return…