Bitcoin rises as dovish stance turns to imminent rate cut

At 10 a.m. Eastern Time on Friday, August 23, Federal Reserve Chairman Powell made an important speech at the Jackson Hole Global Central Bank Annual Meeting.

**It is worth noting that Powell stated quite clearly: The time for policy adjustment has come. The policy direction is clear, and the timing and pace of interest rate cuts will depend on subsequent data, changes in the outlook and the balance of risks.

Some analysts said that although Powell confirmed the markets widespread expectation of starting interest rate cuts in September, this speech was also dovish, providing a certain clarity to the financial market in the short term, but did not provide many clues about how the Fed will act after the September meeting.

For example, if there is another negative employment report, whether there will be a sharp 50 basis point rate cut, and whether rate cuts will continue in the coming months. However, Powells speech at least confirmed that the Feds fight against inflation over the past two years is about to reach a critical turning point.

After the annual meeting, Bitcoin rose from US$61,000 to a high of US$65,000, an increase of 6.5%.

There are about 26 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

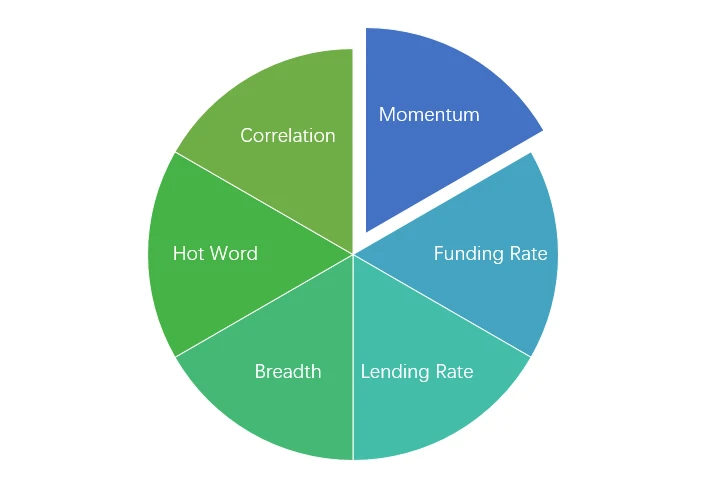

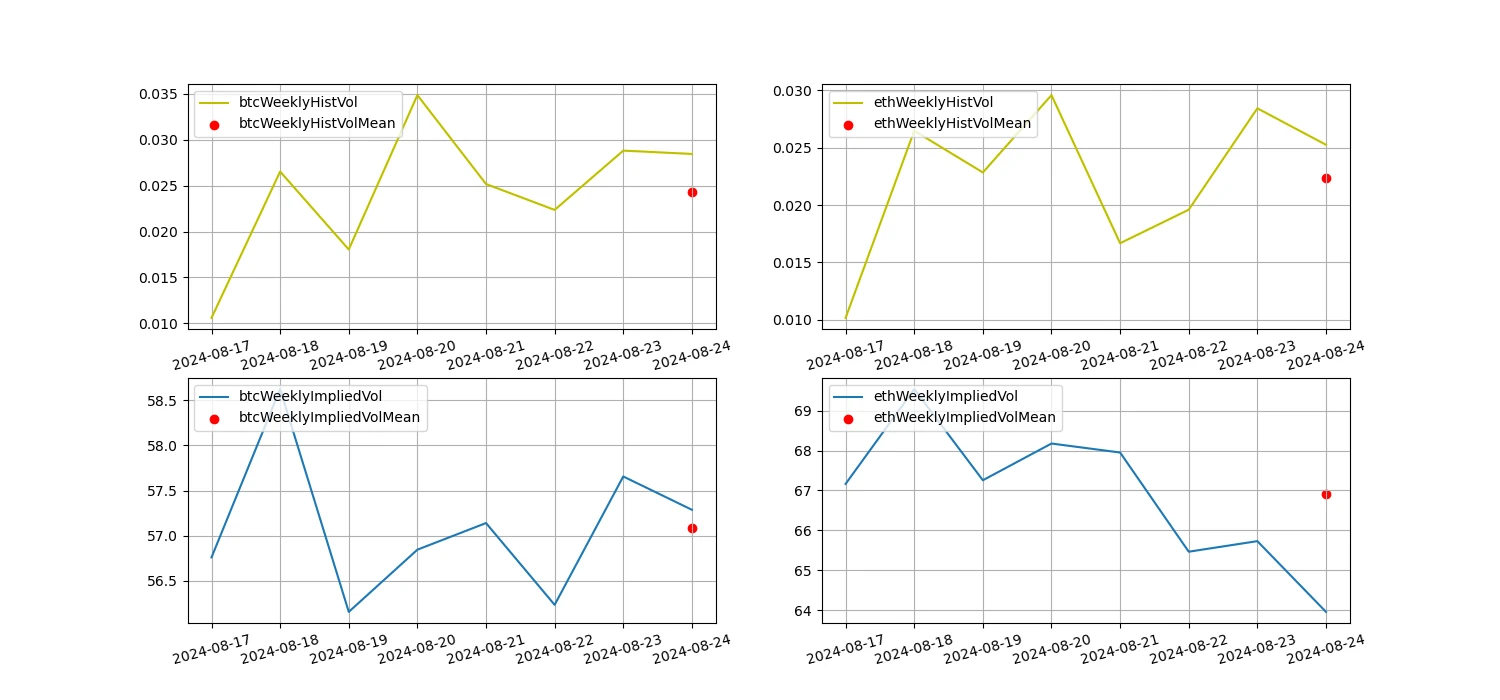

시장 기술 및 정서 환경 분석

감정 분석 구성 요소

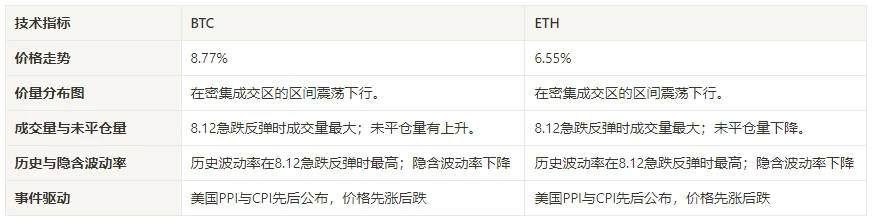

기술 지표

Price Trends

In the past week, BTC prices rose 8.77% and ETH prices rose 6.55%.

위 사진은 지난주 BTC 가격 차트입니다.

위 사진은 지난주 ETH 가격 차트입니다.

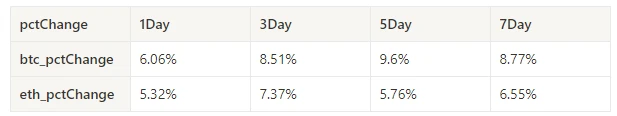

지난주 가격변동률을 보여주는 표입니다.

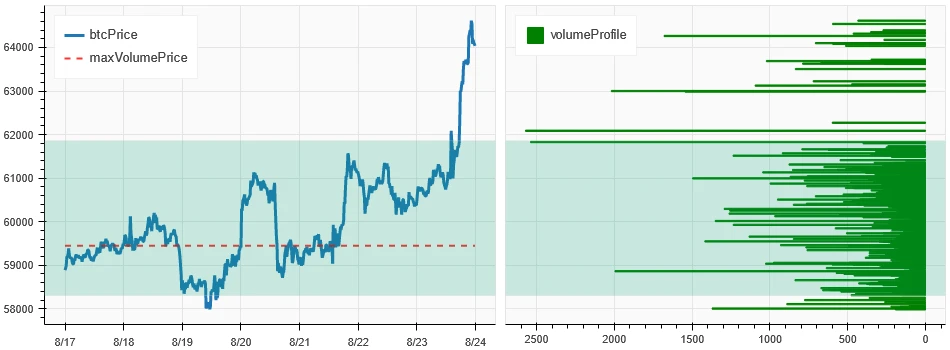

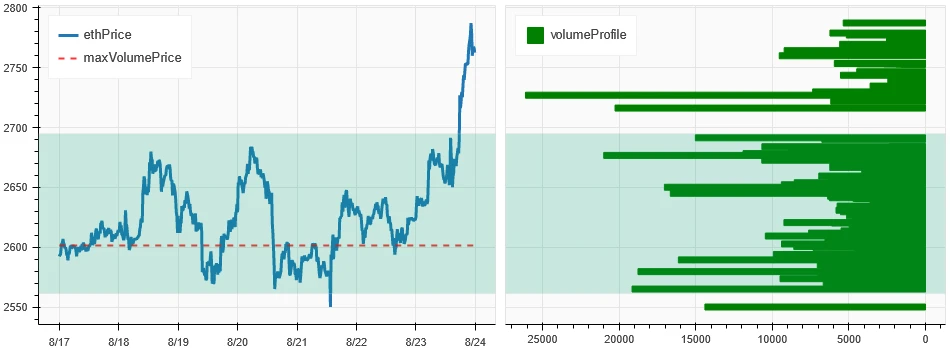

가격 분포 차트(지지 및 저항)

In the past week, both BTC and ETH broke through the concentrated trading area and formed an upward trend.

위 그림은 지난주 BTC의 밀집된 거래 지역 분포를 보여줍니다.

위 그림은 지난주 ETH 밀집 거래 지역의 분포를 보여줍니다.

표는 지난주 BTC와 ETH의 주간 집중 거래 범위를 보여줍니다.

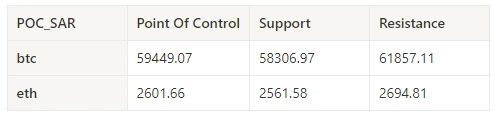

거래량 및 미결제약정

In the past week, the trading volume of BTC and ETH was the largest when they rose to 8.23; the open interest of BTC and ETH both increased slightly.

위 사진의 상단은 BTC의 가격동향, 가운데는 거래량, 하단은 미결제약정, 하늘색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산을 의미하며, 노란색은 포지션이 천천히 축적되는 상태, 검은색은 혼잡한 상태를 의미합니다.

위 그림의 상단은 ETH의 가격 추세를 나타내고, 가운데는 거래량, 하단은 미결제약정, 연한 파란색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산, 노란색은 포지션이 서서히 축적되고 있음, 검은색은 혼잡함을 의미합니다.

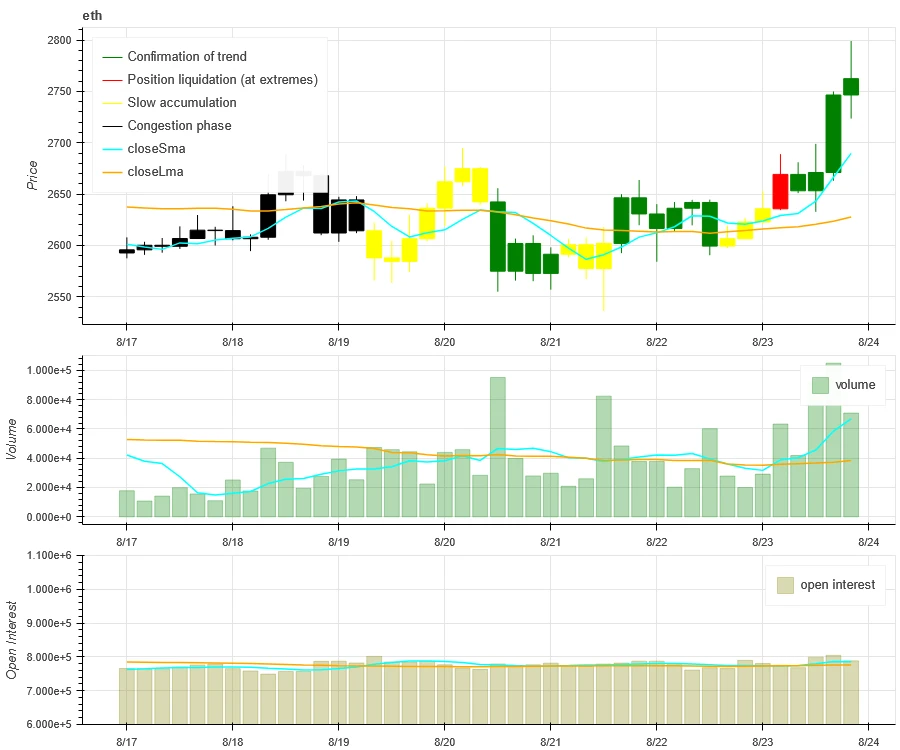

역사적 변동성과 내재된 변동성

In the past week, the historical volatility of BTC and ETH was highest when they fluctuated in a wide range of 8.20; the implied volatility of BTC increased while that of ETH decreased.

노란색 선은 과거 변동성, 파란색 선은 내재 변동성, 빨간색 점은 7일 평균입니다.

이벤트 중심

This past week, the Federal Reserve’s annual meeting hinted at an upcoming rate cut, and Bitcoin rose 6.5% in response.

감정 지표

모멘텀 감정

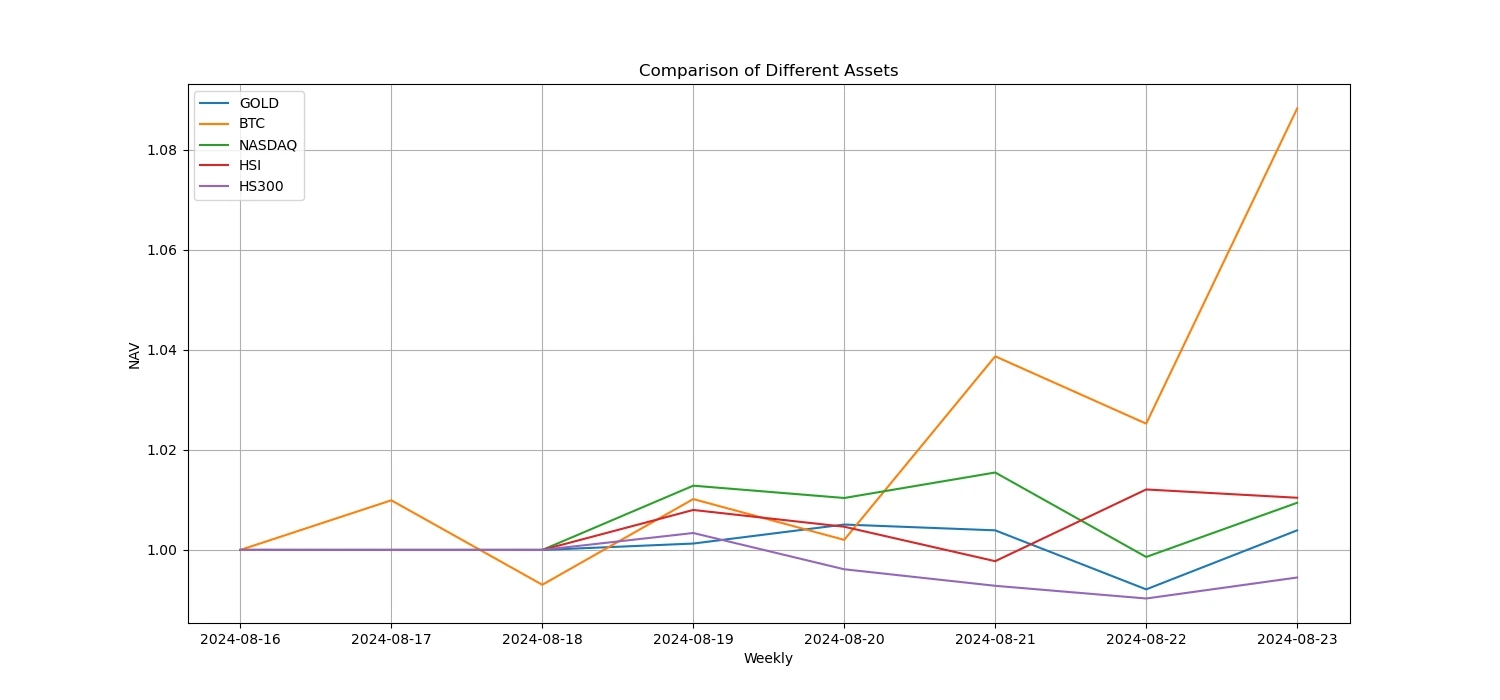

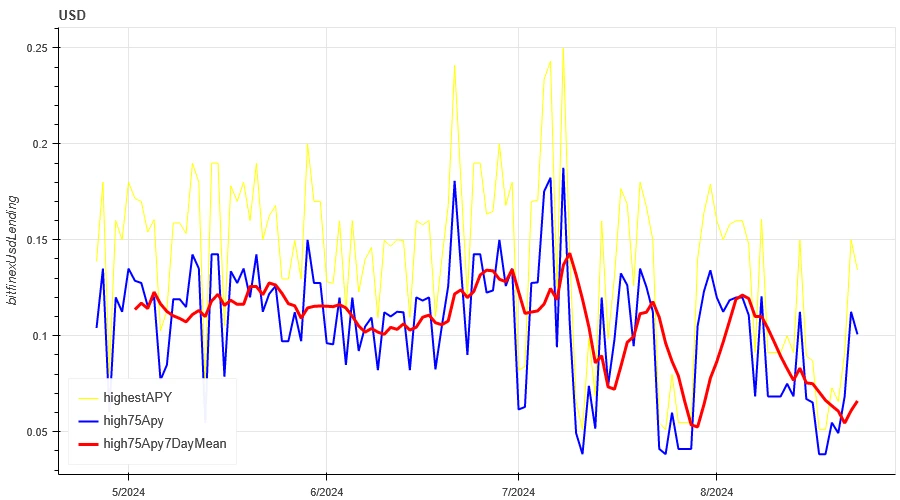

지난주 비트코인/금/나스닥/항셍지수/CSI 300 중에서 비트코인이 가장 강세를 보였고, CSI 300은 가장 부진한 성과를 보였습니다.

위 그림은 지난주 다양한 자산의 추세를 보여줍니다.

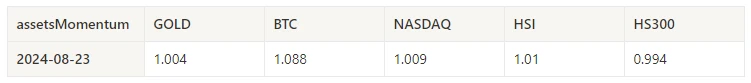

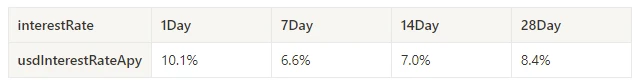

대출금리_대출심리

The average annualized return on USD lending over the past week was 6.6%, and short-term interest rates rose to 10.1%.

노란색 선은 USD 금리 최고가, 파란색 선은 최고가 75%, 빨간색 선은 최고가 75%의 7일 평균입니다.

표는 과거 보유일별 USD 이자율의 평균 수익률을 보여줍니다.

펀딩비율_계약 레버리지 감정

The average annualized return on BTC fees in the past week was -1.4%, and contract leverage sentiment is turning pessimistic.

파란색 선은 바이낸스의 BTC 펀딩 비율이고, 빨간색 선은 7일 평균입니다.

표는 과거 보유일별 BTC 수수료의 평균 수익률을 보여줍니다.

시장 상관관계_합의적 감정

The correlation among the 129 coins selected in the past week was around 0.85, and the consistency between different varieties has increased from a low level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

시장폭_전반적인 심리

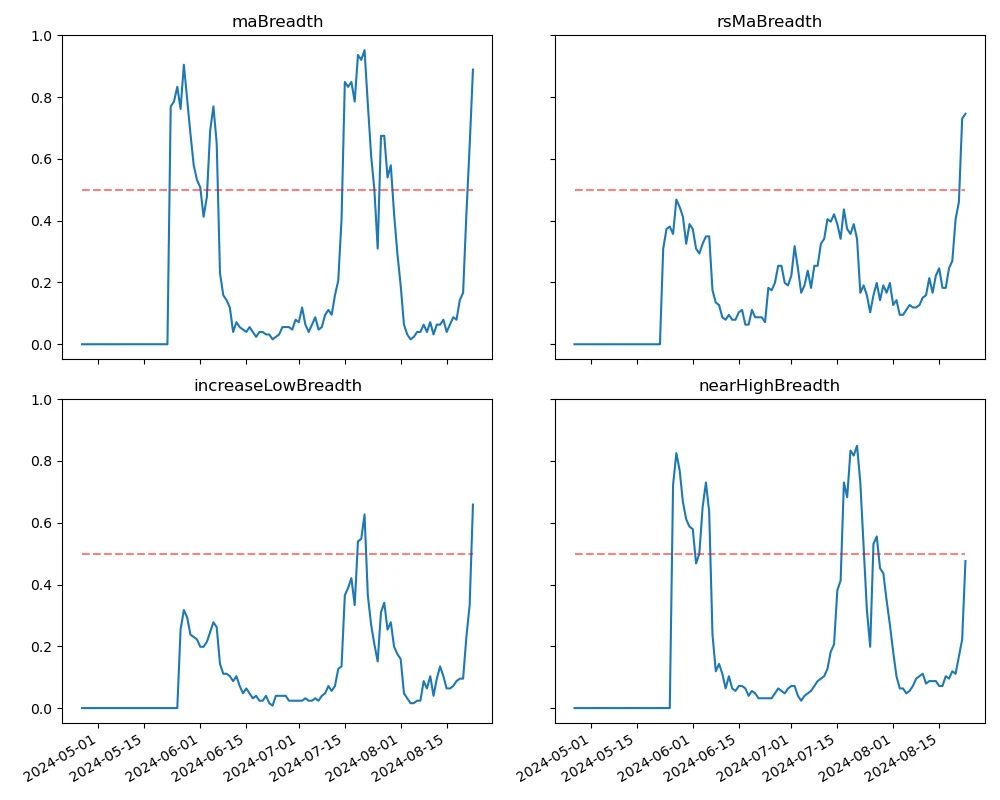

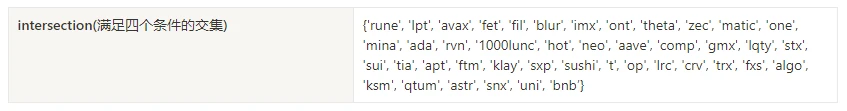

Among the 129 coins selected in the past week, 89% of them were priced above the 30-day moving average, 75% of them were above the 30-day moving average relative to BTC, 66% of them were more than 20% away from the lowest price in the past 30 days, and 48% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market returned to an upward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

요약하다

In the past week, the price of Bitcoin (BTC) and Ethereum (ETH) fluctuated and then rose. The historical volatility peaked on August 20 when the market fluctuated widely, and the trading volume peaked on August 23 when the market rose. The open interest of both BTC and ETH increased. The implied volatility of BTC increased while that of ETH decreased. Bitcoin performed the best in comparison with gold, Nasdaq, Hang Seng Index and CSI 300, while CSI 300 performed the weakest. Bitcoins funding rate fell to negative, reflecting the pessimistic sentiment of market participants. The correlation between the selected 129 currencies remained at around 0.85, showing that the consistency between different varieties has risen from a low level. The market breadth indicator shows that most cryptocurrencies in the overall market are still back to an upward trend. The Federal Reserves annual meeting hinted at an upcoming rate cut, and Bitcoin rose 6.5% in response.

트위터 : @ https://x.com/CTA_ChannelCmt

웹사이트: 채널cmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.08.16–08.23): Bitcoin rises as dovish turn to impending rate cut

Related: How crypto hedge funds generate excess returns: Actively manage risks and invest in BTC

Original author: Crypto, Distilled Original translation: TechFlow Coinbase just released a report on how crypto hedge funds generate excess returns. Here are the most valuable insights. Report Overview The report reveals the main strategies used by active crypto hedge funds. It provides valuable insights for any investor looking to: Better manage risk Capturing excess returns Deepen your understanding of encryption Provided valuable insights. Passive or active strategy? Regardless of your experience level, always compare your performance to $BTC. If you can’t outperform $BTC for a year or more, consider a passive strategy. For most investors, DCAing $BTC on a regular basis is usually the best option during a bear market. Bitcoin – Benchmark $BTC is the preferred benchmark for crypto market beta. Since 2013, $BTC has had an annualized return…