Bitget Research Institute: AAVE가 DeFi 부문을 선도하고 있으며 주요 통화의 변동성이 반등하고 시장이 성장하고 있습니다.

지난 24시간 동안 시장에는 많은 새로운 인기 통화와 주제가 등장했으며, 이는 돈을 벌 수 있는 다음 기회가 될 수 있습니다. , 포함:

-

Sectors with strong wealth-creating effects are: DeFi (AAVE, UNI), BGB;

-

The most searched tokens and topics by users are: DOGS, Story Protocol, Matic;

-

Potential airdrop opportunities include: Solayer, Symbolic;

Data statistics time: August 22, 2024 4: 00 (UTC + 0)

1. 시장환경

Yesterday, the U.S. Department of Labor announced that the labor market had revised down the number of new jobs by 818,000, indicating that the U.S. job market was clearly not as strong as previous data had shown. After the data was released, the market briefly surged and then fell back.

In terms of ETFs, Bitcoin ETF had a net inflow of US$39.5 million yesterday, and has continued net inflows for five consecutive trading days; Ethereum ETF had a net outflow of US$18 million, and has continued net outflows for five consecutive trading days.

In terms of the track, the old DeFi sector of the crypto market exploded collectively yesterday, with AAVE, UNI and others leading the rise. The main reason is that AAVE has set new highs in all fundamental data, continues to be profitable, and is already proposing to reform the AAVE token economics, hoping to introduce a revenue sharing mechanism to enhance the practicality of the token.

2. 부의 창출 부문

1) Sector changes: DeFi (AAVE, UNI)

주된 이유:

-

AAVE protocol indicators continue to grow, exceeding the previous cycle high. Strong profit performance reflects the high fit between the product and the market, but the price of the currency is still undervalued, and the market discovers and repairs the valuation. The Aave Chan Initiative (ACI) has just launched a proposal to reform the AAVE token economics, hoping to introduce a revenue sharing mechanism to enhance the utility of the token. UNI is also exploring a revenue sharing mechanism.

Rising situation: AAVE rose 39.3% in the past 7 days, and UNI rose 12.0% in the past 7 days;

시장 전망에 영향을 미치는 요인:

-

프로토콜 지표: 프로토콜 지표는 일일 활동, 거래량, 수익성 등을 포함한 프로토콜 활동을 판단하는 데 중요합니다. 예를 들어, AAVE는 현재 시장 환경에서 프로토콜 지표 측면에서 역사적 최고치에 도달할 수 있으며, 시장은 자연스럽게 수리를 위해 해당 시장 가치 평가를 제공할 것입니다. 반대로 프로토콜 지표가 성장할 수 없다면 시장은 프로토콜 개발에 대해 낙관할 이유가 없습니다.

-

수익 분배: 점점 더 많은 DeFi 프로토콜이 자체 토큰을 프로토콜 수익에 연결합니다. 이 사업 모델은 토큰 거래에 대한 열정을 반복적으로 활성화합니다. 투자자들은 토큰을 보유할 만한 충분한 이유가 있습니다. 따라서 프로토콜 수익 분배의 홍보는 토큰 가격에 큰 영향을 미칠 것입니다.

2) Sectors that need to be focused on in the future: BGB

주된 이유:

-

Bitget Exchange has recently started in-depth cooperation with the popular Telegram Bot project DOGS. Influenced by the cooperation, Bitget application has entered the top ten in the download volume of App Store Finance in 11 countries. Under the premise of steady development and cooperation with many projects, users have more reasons to hold BGB and look forward to the subsequent relevant actions of the exchange;

시장 전망에 영향을 미치는 요인:

-

Activities such as LaunchPad/LaunchPool: As an exchange token, one of the important uses of BGB is to participate in the exchange LaunchPad/LaunchPool and other activities. Bitget has recently cooperated with many major projects and has a deeper cooperation with popular projects. If LaunchPad/LaunchPool has a good benefit effect, the demand for BGB will increase significantly, and the price will also rise.

3. 사용자 핫 검색

1) 인기 Dapp

DOGS

The market focuses on DOGS, a high-traffic Telegram Mini Bot project in the TON ecosystem. The DOGS airdrop will end on August 22, and TGE will be held on August 26. DOGS already supports pre-charging the airdrop directly to Bitget. In addition, Bitget has also launched the BitgetLuckyDogs event, where users who deposit 1,000 DOGS can automatically participate in the lucky draw (up to 1 BTC grand prize).

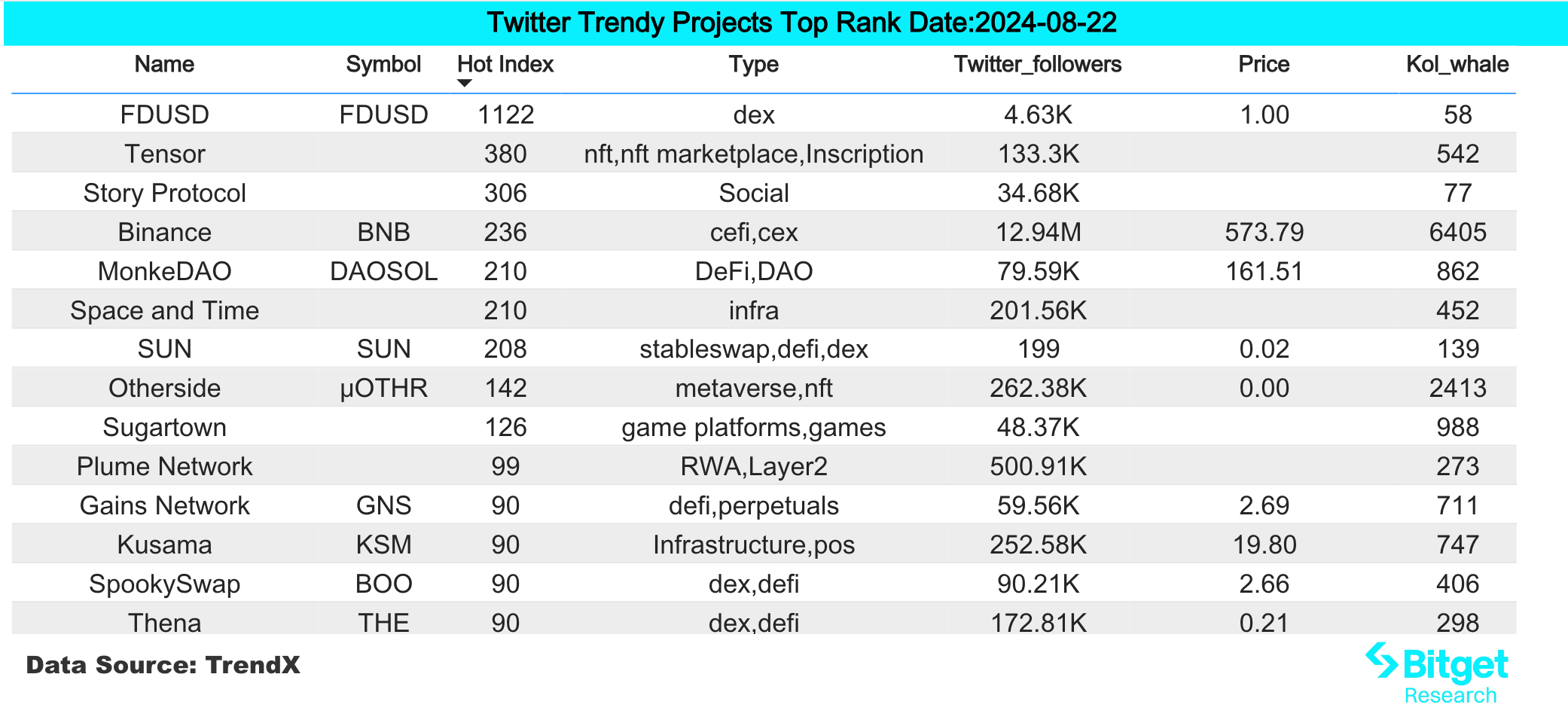

2) 트위터

Story Protocol

Story Protocol is an IP management protocol that uses blockchain technology to change the way humans record history. The project recently completed a $80 million Series B financing, led by a16z Crypto, and other participating institutions include Foresight Ventures, Hashed, etc. As of now, PIP Labs, the open team behind Story Protocol, has raised $140 million and is valued at $2.25 billion. The market attention is very high, and it may become a leading project in the new track of blockchain. It is recommended to pay attention.

3) 구글 검색 지역

글로벌 관점에서 보면:

Matic

Polygon will complete the upgrade of the token MATIC on September 4 and update the new token economy. POL will become an asset with an annual issuance rate of 2%, mainly distributed to validators + community treasury, increasing the communitys influence on Polygons future planning; Coinbase will include POL in the coin listing roadmap, and POL will become a hot search term on Google in the English and European regions. So far, MATIC has risen 15% in 24 hours, and the trading heat and community attention are relatively high.

각 지역의 인기 검색어 중:

(1) 아시아: 아시아는 BTC, ETH, DOGE 등을 포함한 가중 자산에 초점을 맞추고 있습니다. 아시아 국가마다 초점이 다릅니다. 예를 들어, 파키스탄은 TON 게임 BLUM에 초점을 맞추고, 인도네시아는 ETHFI에 초점을 맞추고, 싱가포르는 AI 프로젝트 FET에 초점을 맞춥니다.

(2) CIS 지역: CIS 지역은 여전히 톤 앱 게임에 대한 열정이 높습니다. 예를 들어, Blum 프로젝트는 우즈베키스탄, 우크라이나, 벨로루시에 등장했습니다.

(3) 라틴 아메리카: 라틴 아메리카는 개 관련 토큰에 비교적 집중적으로 초점을 맞추고 있으며, 플로키, 봉크, 시바 이누가 인기 검색어에 등장합니다. 최근에는 SAND, MANA 등 게임 프로젝트에 대한 관심도 증가했습니다.

잠재적인 공중 투하 기회

솔레이어

Solayer is building a restaking network on Solana. Solayer leverages its economic security and quality execution as a decentralized cloud infrastructure to enable higher degrees of consensus and blockspace customization for application developers.

In July 2024, Solayer announced the completion of the builder round of financing, and the specific investment amount was not disclosed. Investors include Binance labs, Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-founder Richard Wu, etc.

Specific participation method: You can stake SOL and SOL LST (jitoSOL, mSOL, bSOL, INF) supported by some projects to obtain points for each Epoch. Currently, the main network is open, and staking SOL can obtain sSOL and platform points.

공생

Symbiotic은 분산형 네트워크가 강력하고 완전한 주권 생태계를 부트스트랩할 수 있도록 하는 범용 재스테이킹 프로젝트입니다. Active Validation Services 또는 AVS라고 하는 분산형 애플리케이션이 서로의 보안을 공동으로 보장할 수 있는 방법을 제공합니다.

Symbiotic은 최근 Paradigm과 Cyber Fund가 투자에 참여하여 10조 580만 달러 규모의 시드 라운드 자금 조달을 완료했습니다.

참여 방법: 프로젝트 공식 웹사이트로 가서 지갑을 연결하고 ETH와 ETH LSD 자산을 입금하세요.

원래 링크: https://www.bitget.fit/zh-CN/research/articles/12560603814747

면책조항: 시장은 위험하므로 투자할 때 주의하세요. 이 기사는 투자 조언을 구성하지 않으며, 사용자는 이 기사의 의견, 견해 또는 결론이 자신의 특정 상황에 적합한지 여부를 고려해야 합니다. 이 정보를 바탕으로 투자하는 것은 귀하의 책임입니다.

This article is sourced from the internet: Bitget Research Institute: AAVE leads the DeFi sector, the volatility of mainstream currencies rebounds and the market may soon usher in a change

Related: Attendees Guide: TOKEN2049 Singapore Surrounding Activities

The Web3 cryptocurrency conference TOKEN 2049 Singapore will be held at the Marina Bay Sands Hotel in Singapore from September 18 to 19. During the two-day event, hundreds of gatherings, seminars and peripheral activities will be held in rotation, and it is expected to attract more than 20,000 attendees from more than 7,000 companies and more than 100 countries. The event aims to provide a platform for interaction and communication for Web3 entrepreneurs, institutions, industry insiders, investors, builders and people with a strong interest in the cryptocurrency and blockchain industry. For more information, please visit the official website of the event: https://www.asia.token2049.com/ Odaily Planet Daily has compiled surrounding activities for readers and participants (continuously updated). The times marked below are all Singapore time (GMT+ 8): Token 2049 Main Conference Agenda…