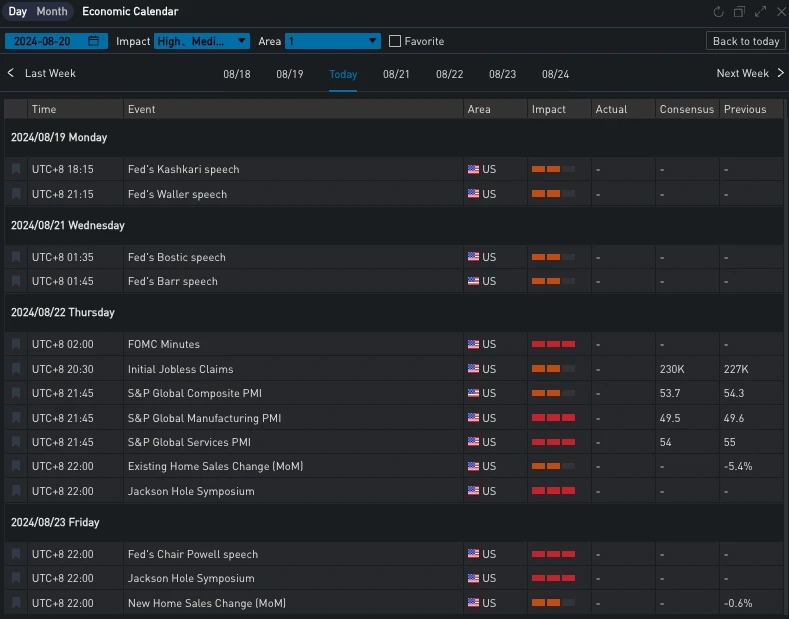

According to the New York Feds July survey on labor market expectations, the proportion of respondents who are worried about losing their jobs in the next four months has increased from 3.9% last year to 4.4%, the proportion of people who expect to change jobs has increased to 11.6%, and the proportion of workers who have been looking for jobs in the past four weeks has increased to 28.4%… A series of indicators in the report have shown cracks in the labor market! This is undoubtedly a worrying phenomenon. Although the number of people applying for unemployment benefits is still relatively low and last weeks retail data performed well, economists continue to issue warnings, pointing out that when the economy is at a turning point, the slowdown in the labor market tends to be relatively early, and the economic growth data cools down later. The focus of the market this week is on Federal Reserve Chairman Powell, who will face a completely different dilemma at the Jackson Hole meeting than the previous year. Considering the recent reassuring inflation data, Powell may remind everyone to pay more attention to employment issues than predicting how much interest rates will be cut in September. The Federal Reserve will receive a revised job growth data on Wednesday, which may show that job growth from last year to the beginning of this year is weaker than before. In addition, the non-farm data at the beginning of next month will inevitably be the focus of attention in determining market sentiment and trends.

Source: Economic Calendar

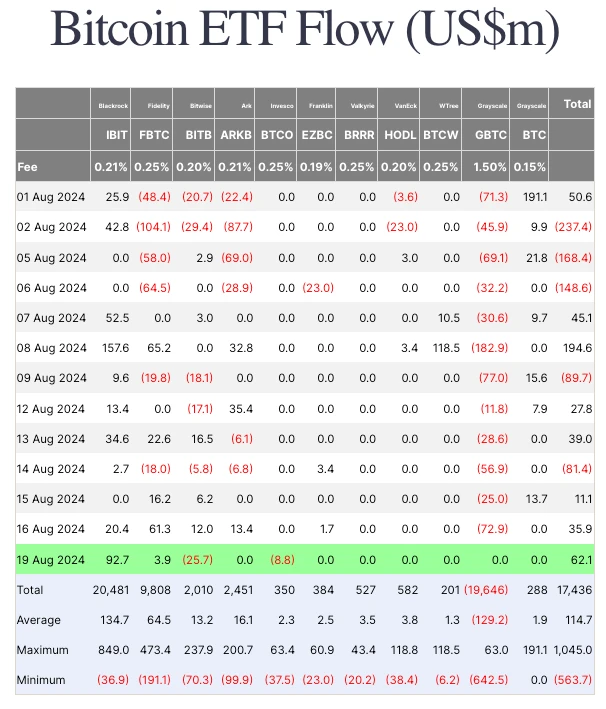

Back to the digital currency, the price of the currency has been rising from the bottom in the past 24 hours. ETH completed delivery at 2674.87 (+ 2.2%), recovering all the lost ground yesterday. BTC is more favored by the market, breaking through the pivot point of 60,000 US dollars and challenging the 61,000 mark, closing at 60901.71, with a daily increase of up to + 3.95%. In addition to the comparison of currency prices, we can see that in the past few days, BTC ETF has continued to have positive capital inflows, while ETH is still losing funds under the shadow of Grayscale ETHEs selling pressure.

출처: 파사이드 투자자

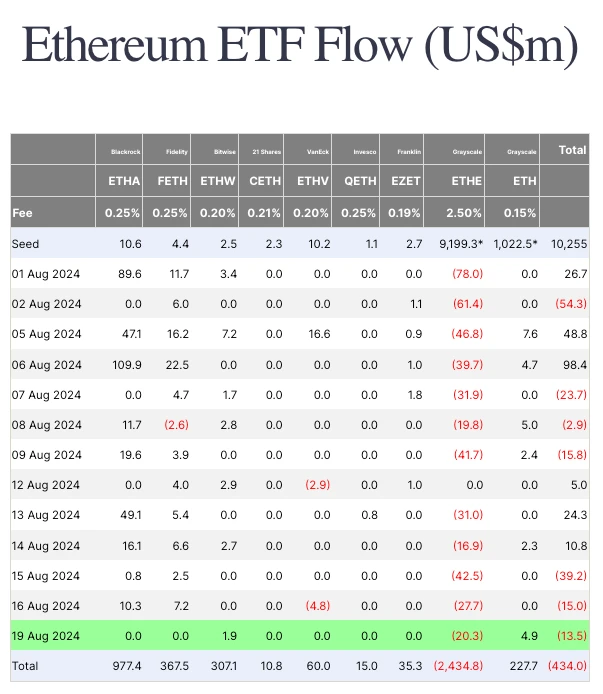

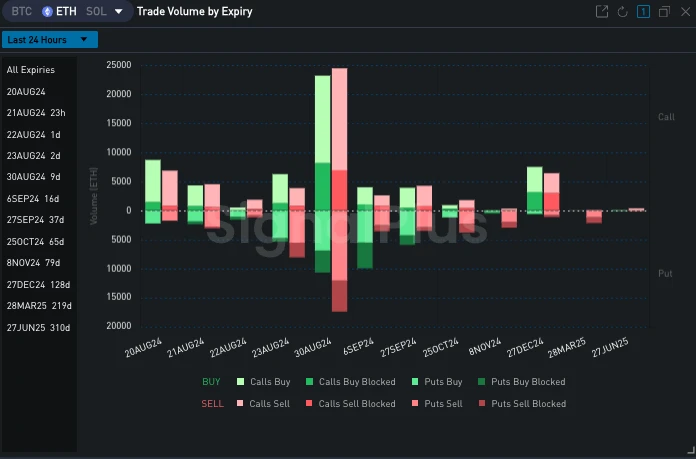

Such market sentiment is also reflected in the options market. From the changes in Vol Skew, we can see that the RR at the front end of BTC has risen sharply back to the positive range, while the curve at the front end of ETH is still tilted towards put options.

Source: SignalPlus, Vol Skew

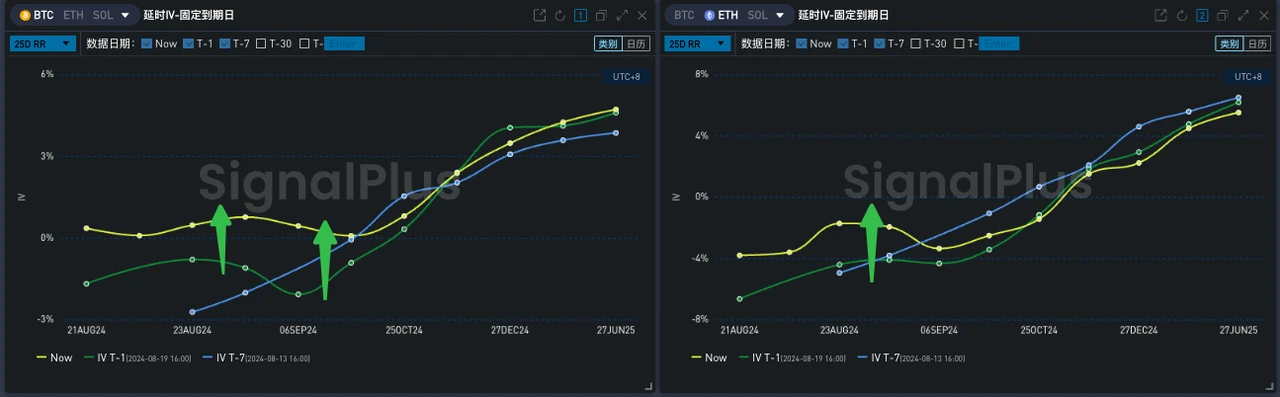

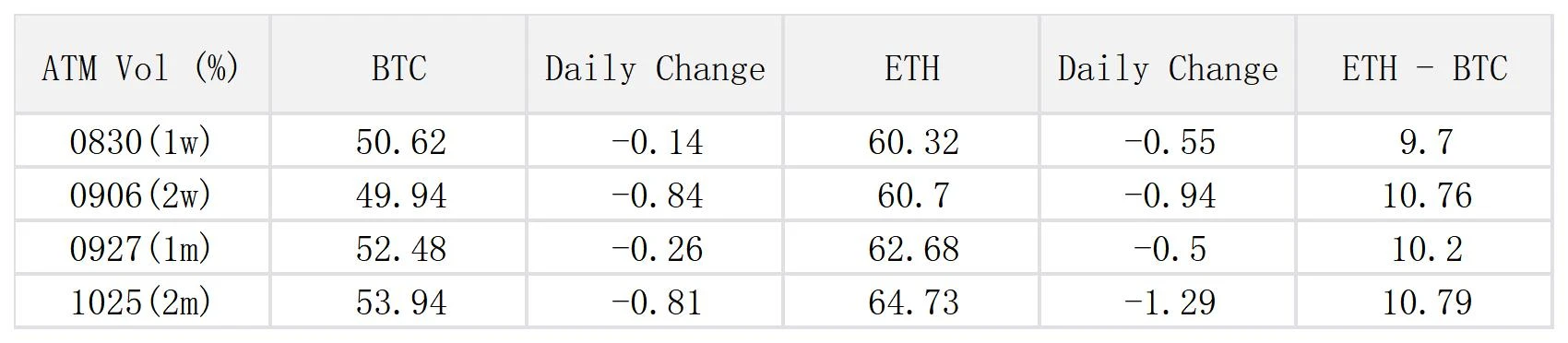

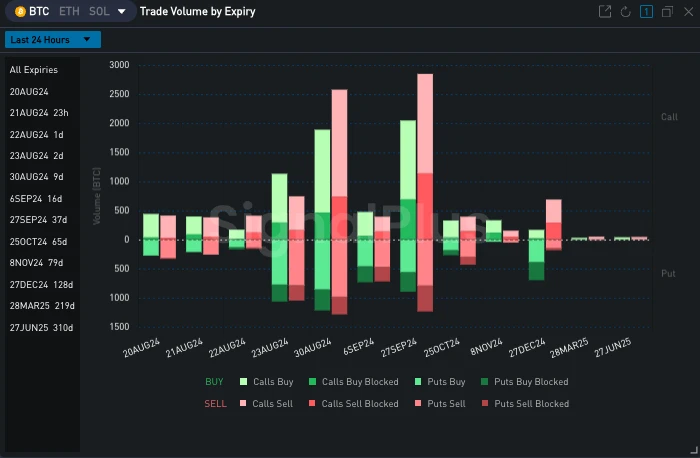

From the overall level of implied volatility, the price increase has led to a slight decline in IV over the past day. BTCs intraday Realized Vol of ~48% is basically the same as the front-end IV, and ETHs RV is about 49%, which is slightly lower than the front-end IV by about 5%-7%. From the transaction, we can see that the sharp rise in BTC price and the return of Skew have attracted traders to sell call options, represented by 29 SEP-70000-C. In the past 24 hours, Deribit sold 800 contracts in bulk, and 938.8 contracts were sold on the option chain, making 25 dRR form a local low on this expiration date; at the same time, 30 aug also showed obvious Sell Risky Flow, with most transactions concentrated on selling 64,000 67,000 Calls vs buying 55,000 Puts.

Source: Deribit (as of 20 AUG 16: 00 UTC+ 8)

출처: 시그널플러스

Data Source: SignalPlus, Deribit, BTC ETH overall transaction distribution

t.signalplus.com에서 SignalPlus 트레이딩 베인 기능을 사용하면 더 많은 실시간 암호화폐 정보를 얻을 수 있습니다. 업데이트를 즉시 받으려면 Twitter 계정 @SignalPlusCN을 팔로우하거나 WeChat 그룹(WeChat 보조원 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구와 소통하고 상호 작용하세요. SignalPlus 공식 웹사이트: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240820): BTC! BTC!

관련: Planet Daily | 연방준비제도가 9월에 금리를 인하할 확률은 89.6%입니다. Ethereum 현물 ETF tr

헤드라인 9월에 연준이 금리를 25bp 인하할 확률은 89.6%입니다. CME Fed Watch 데이터는 다음과 같습니다. 연준이 8월에 금리를 유지할 확률은 93.3%이고, 25bp 인하할 확률은 6.7%입니다. 연준이 9월까지 금리를 유지할 확률은 0%이고, 25bp의 누적 금리 인하 확률은 89.6%이고, 50bp의 누적 금리 인하 확률은 10.2%이고, 75bp의 누적 금리 인하 확률은 0.3%입니다. 이더리움 현물 ETF 거래량이 이틀째 $9억5천1백만에 도달 미국 시장에서 거래 둘째 날, 이더리움 ETF 누적 거래…