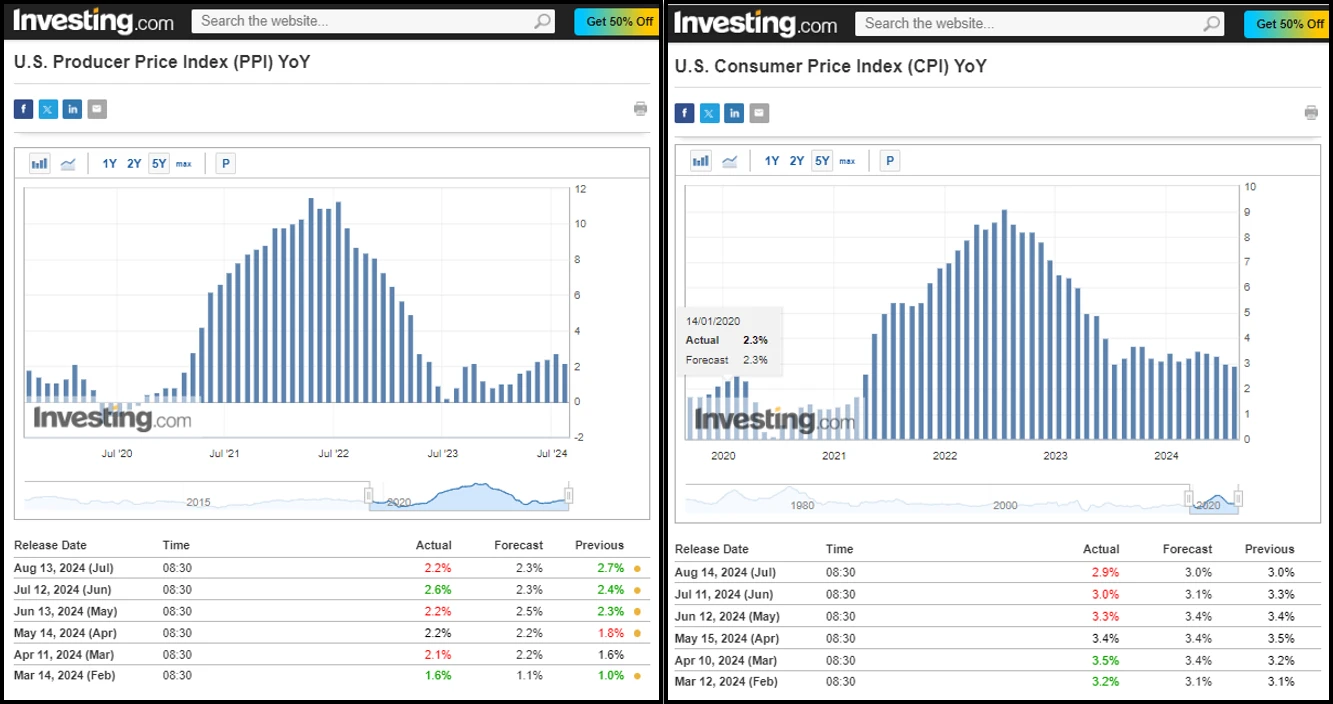

Mild inflation data, price range fluctuations

이미지 출처: https://hk.investing.com/

This week, two important inflation data, PPI and CPI, were released. CNBC said the data showed that the United States has passed the environment of ultra-high inflation. Moderate inflation data may mean that the Federal Reserve can turn its attention to other economic challenges, such as employment rate.

데이터: PPI data, an indicator of producer inflation, showed that prices rose by only 0.2% in July and were up about 2.2% year-on-year. This figure is now very close to the Feds 2% target, indicating that market expectations for the central bank to start cutting interest rates are basically on target.

CPI data, an indicator of consumer inflation, showed a year-on-year growth rate of 2.9% over the past 12 months, a figure that, while much lower than the high point in mid-2022, is still far from the Feds 2% target.

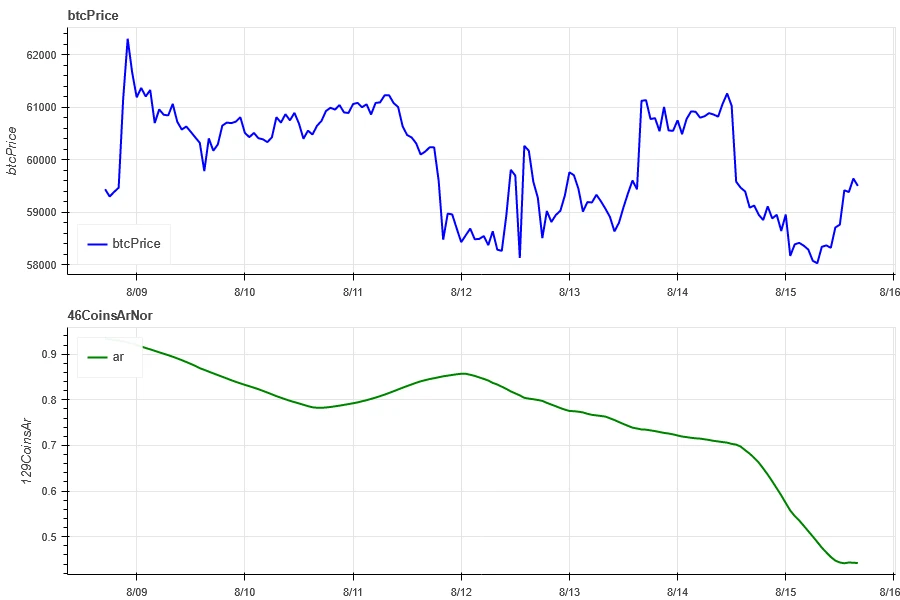

In terms of market conditions: After the release of the PPI data at 20:30 on the evening of the 13th, Hong Kong time, the market began to rise, and Bitcoin rose from 59,000 to around 61,500. It was not until the release of the CPI data at 20:30 on the 14th that the market began to fall, and Bitcoin fell from 61,500 to around 58,000.

Future events: The latest employment rate data will be released on September 6, the latest CPI and PPI data will be released on September 11 and 12, and the Federal Reserve will hold its interest rate decision at 02:00 Hong Kong time on September 19. September will be a critical node. If the Federal Reserve decides to cut interest rates, the market may bring a new round of surprises.

There are about 33 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

시장 기술 및 정서 환경 분석

감정 분석 구성 요소

기술 지표

Price Trends

BTC price fell -6.72% and ETH price fell -4.2% in the past week.

위 사진은 지난주 BTC 가격 차트입니다.

위 사진은 지난주 ETH 가격 차트입니다.

지난주 가격변동률을 보여주는 표입니다.

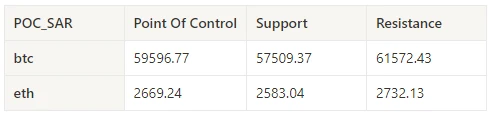

가격 분포 차트(지지 및 저항)

In the past week, both BTC and ETH have been fluctuating downward in a range of dense trading areas.

위 그림은 지난주 BTC의 밀집된 거래 지역 분포를 보여줍니다.

위 그림은 지난주 ETH 밀집 거래 지역의 분포를 보여줍니다.

표는 지난주 BTC와 ETH의 주간 집중 거래 범위를 보여줍니다.

거래량 및 미결제약정

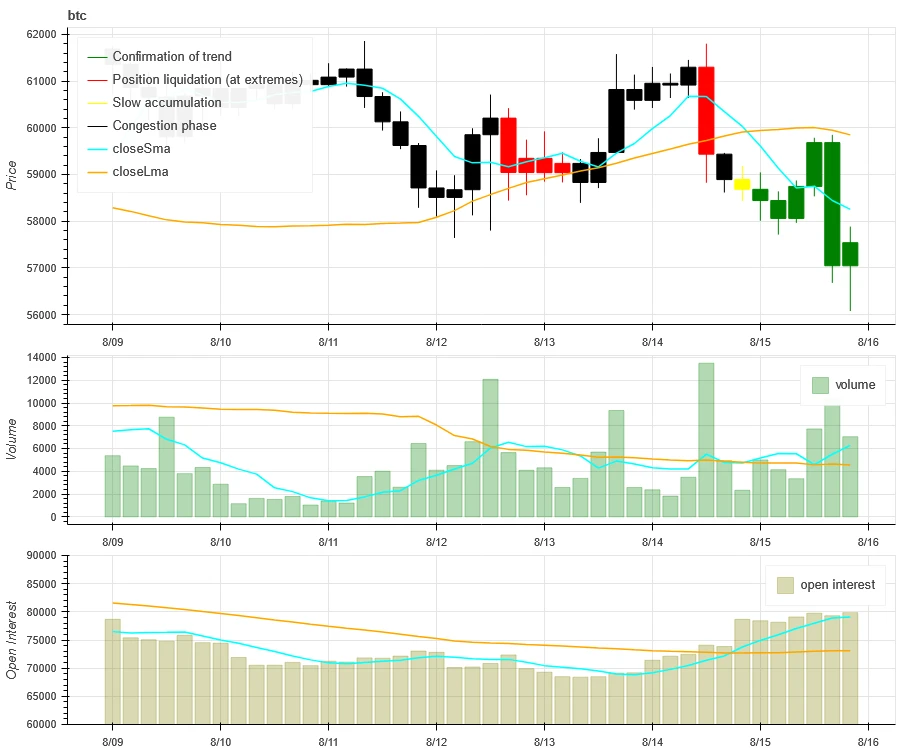

In the past week, both BTC and ETH had the largest trading volume when they rebounded sharply on August 12; the open interest of BTC increased while that of ETH decreased.

위 사진의 상단은 BTC의 가격동향, 가운데는 거래량, 하단은 미결제약정, 하늘색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산을 의미하며, 노란색은 포지션이 천천히 축적되는 상태, 검은색은 혼잡한 상태를 의미합니다.

위 그림의 상단은 ETH의 가격 추세를 나타내고, 가운데는 거래량, 하단은 미결제약정, 연한 파란색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산, 노란색은 포지션이 서서히 축적되고 있음, 검은색은 혼잡함을 의미합니다.

역사적 변동성과 내재된 변동성

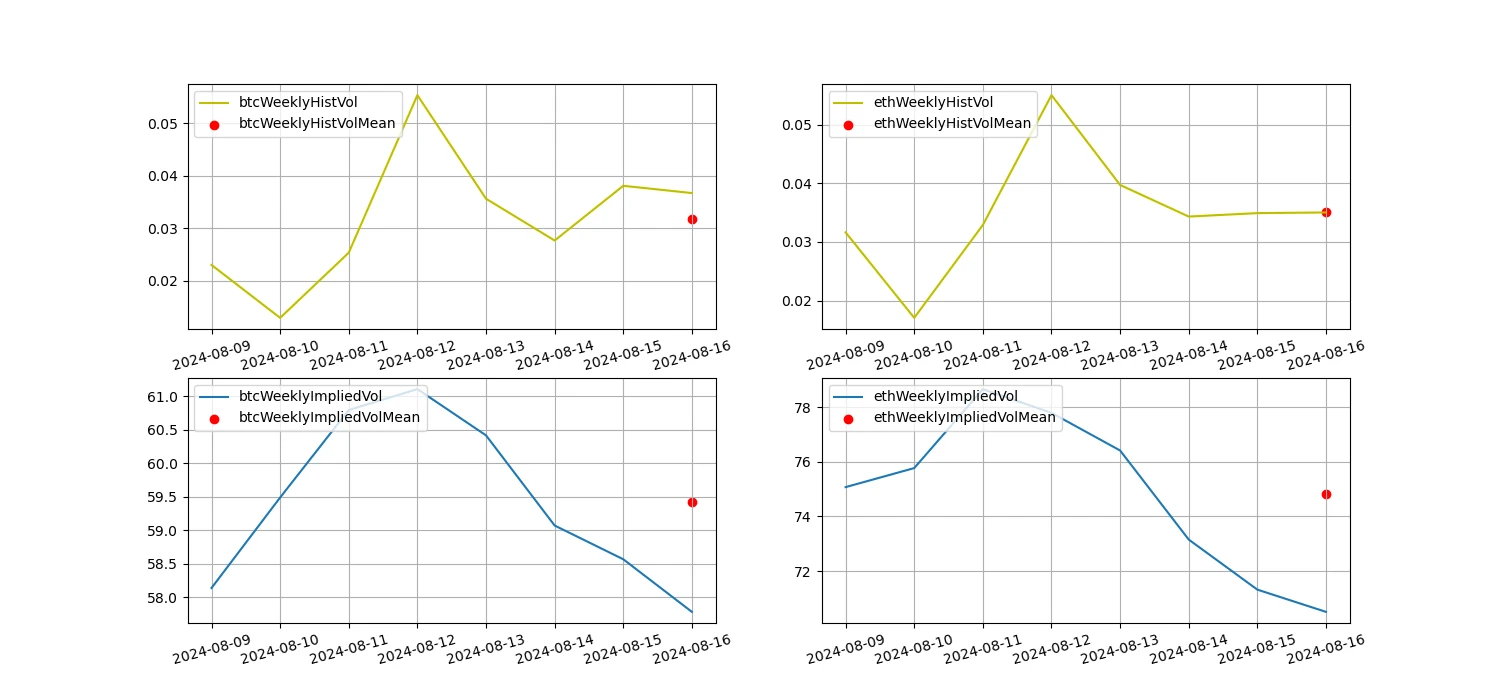

In the past week, the historical volatility of BTC and ETH was the highest when they rebounded sharply on August 12; the implied volatility of BTC and ETH both decreased.

노란색 선은 과거 변동성, 파란색 선은 내재 변동성, 빨간색 점은 7일 평균입니다.

이벤트 중심

The PPI and CPI inflation data were released this past week. After the PPI data was released at 20:30 on the evening of the 13th Hong Kong time, the market began to rise, and Bitcoin rose from 59,000 to around 61,500. It was not until 20:30 on the 14th when the CPI data was released that the market began to fall, and Bitcoin fell from 61,500 to around 58,000.

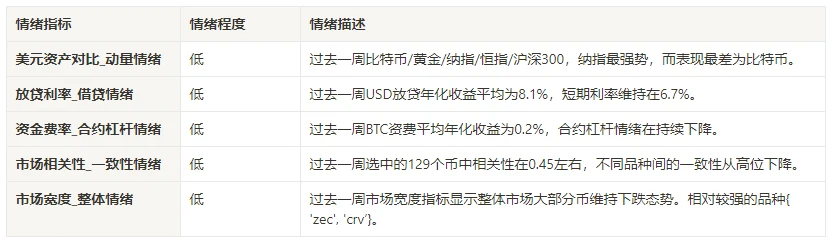

감정 지표

모멘텀 감정

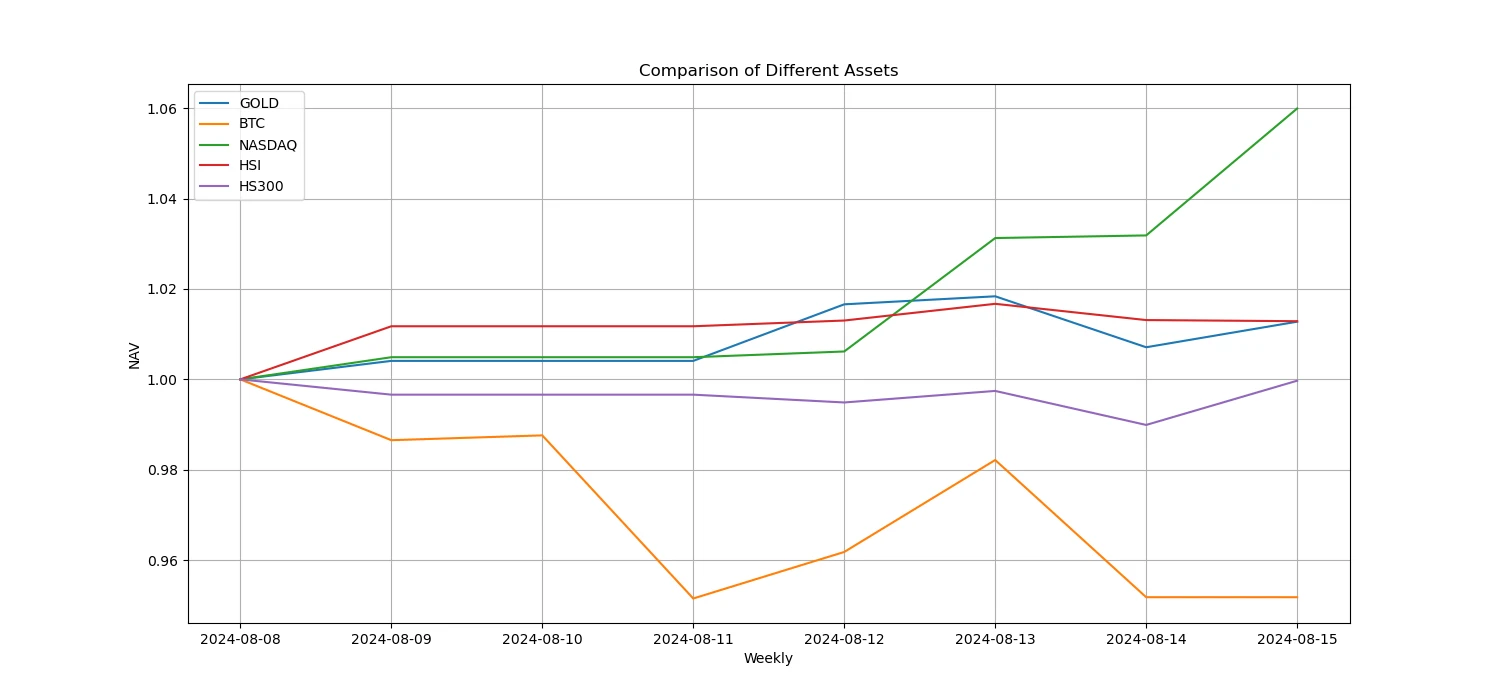

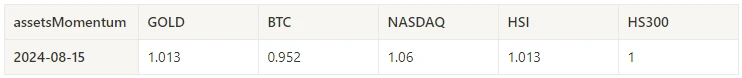

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, Nasdaq was the strongest, while Bitcoin performed the worst.

위 그림은 지난주 다양한 자산의 추세를 보여줍니다.

대출금리_대출심리

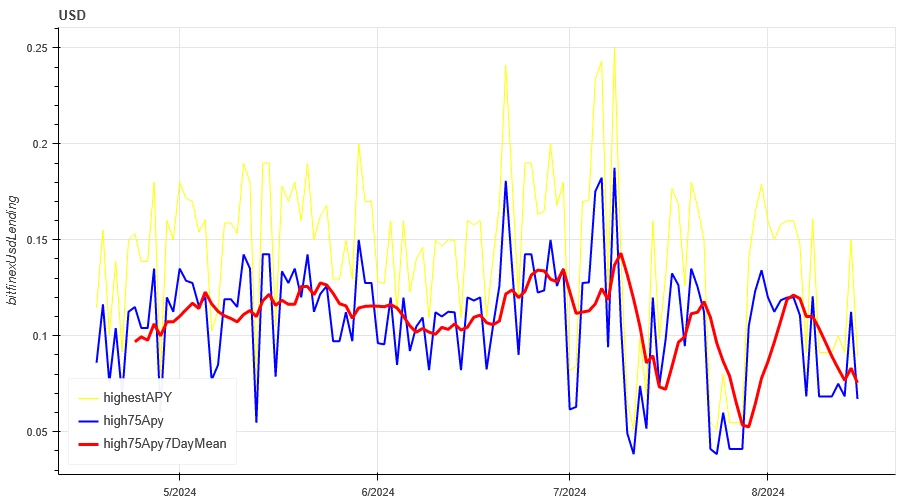

The average annualized return on USD lending over the past week was 8.1%, and short-term interest rates remained at 6.7%.

노란색 선은 USD 금리 최고가, 파란색 선은 최고가 75%, 빨간색 선은 최고가 75%의 7일 평균입니다.

표는 과거 보유일별 USD 이자율의 평균 수익률을 보여줍니다.

펀딩비율_계약 레버리지 감정

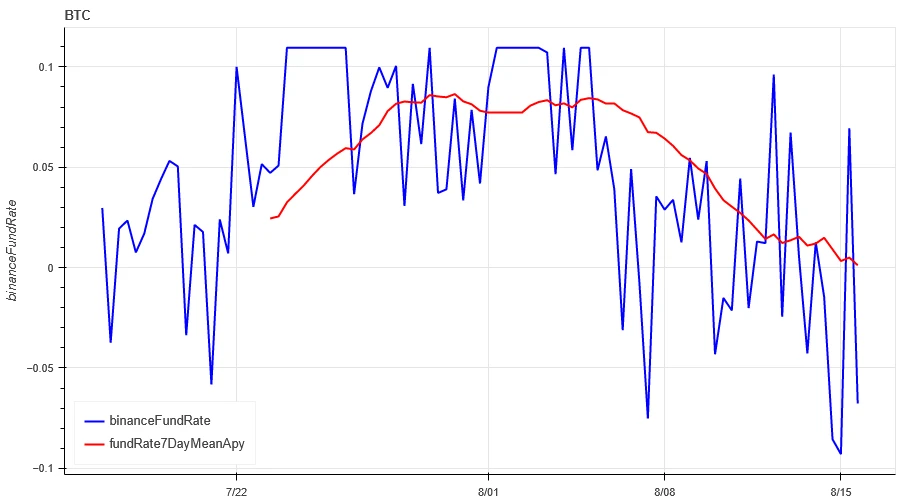

The average annualized return on BTC fees in the past week was 0.2%, and contract leverage sentiment continued to decline.

파란색 선은 바이낸스의 BTC 펀딩 비율이고, 빨간색 선은 7일 평균입니다.

표는 과거 보유일별 BTC 수수료의 평균 수익률을 보여줍니다.

시장 상관관계_합의적 감정

The correlation among the 129 coins selected in the past week was around 0.45, and the consistency between different varieties has dropped from a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

시장폭_전반적인 심리

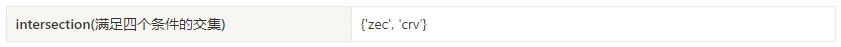

Among the 129 coins selected in the past week, 4% of them were priced above the 30-day moving average, 24% of them were priced above the 30-day moving average relative to BTC, 6% of them were more than 20% away from the lowest price in the past 30 days, and 7% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

요약하다

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) showed a volatile downward trend, especially when the historical volatility and trading volume reached a peak during the sharp drop and rebound on August 12. The open interest of BTC increased, while that of ETH decreased. The implied volatility decreased. Bitcoin performed the worst in comparison with gold, Nasdaq, Hang Seng Index and CSI 300, while Nasdaq performed the strongest. Bitcoins funding rate continued to decline, reflecting the continued decline in market participants interest in its leveraged trading. The correlation between the selected 129 currencies remained at around 0.45, showing that the consistency between different varieties has declined from a high level. The market breadth indicator shows that most cryptocurrencies in the overall market are still in a downward trend. The market began to rise after the PPI data was released on the 13th, and then the market began to fall after the CPI data was released on the 14th.

트위터 : @ https://x.com/CTA_ChannelCmt

웹사이트: 채널cmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.08.09-08.16): Mild Inflation Data Price Range Fluctuation

Related: When live streaming happens in Web3: Will Pump.fun create a “live streaming magic”?

Pump.fun is the most special product in this cycle. Since its launch more than 4 months ago, more than 1.17 million tokens have been issued on Pump.fun, and the cumulative revenue has exceeded 50 million US dollars. How to understand this number? Compared with Uniswap, the top traffic product in the previous bull market, it is estimated that Uniswap Labs annual revenue is about 25 million to 30 million US dollars. It can be said that Pump.fun is not a typical Web3 project. It does not have a complex token economics model or a DAO governance mechanism. However, with its precise market positioning, Pump.fun has created a business market that is sure to make money. Under the dominance of the attention economy, many people will interpret the continued prosperity of…