원본 | Odaily Planet Daily ( @오데일리차이나 )

저자|난지( @어쌔신_말보 )

Ethereum and Layer 2 based on Ethereum have been declining in recent two years, both in terms of token prices and core projects. Among them, ARB has become the token with the worst price performance in the past year , and STRK has fallen by 90% in just half a year since its launch.

The fundamental reason is that, on the one hand, the Layer 2 ecosystem is limited in activity and income, and on the other hand, the tokens of each Layer 2 only have governance functions and cannot generate income, so the demand is weak. In response to the latter, PlutusDAO, a governance aggregation protocol on Arbitrum, launched a proposal to stake ARB for interest last year and passed the off-chain vote. Although it ultimately failed in the on-chain voting link, it did successfully boost the coin price for a period of time (an increase of about 40% in 30 days) .

On August 16, the Arbitrum community preliminarily passed the proposal to enable ARB staking to unlock token utility in order to empower the ARB token. What are the specific contents of the proposal and can it reverse the fundamentals of the ARB token? Odaily will explain it in this article.

Proposal Interpretation

Governance and Token Pain Points

The proposal was put forward by Tallys head of market operations, Frisson, who said that ARB has the following main problems :

-

Governance power is the only source of demand for ARB, but there is a large amount of new supply of tokens, including unlocking, treasury expenditures, etc.

-

ARB re-staking or use in DeFi is incompatible with governance functions. When ARB is deposited into a smart contract, it loses voting rights, and less than 1% of ARB tokens are actively used in on-chain governance .

-

The number of DAO members participating in governance has continued to decline since the launch of the Arbitrum token.

Solution

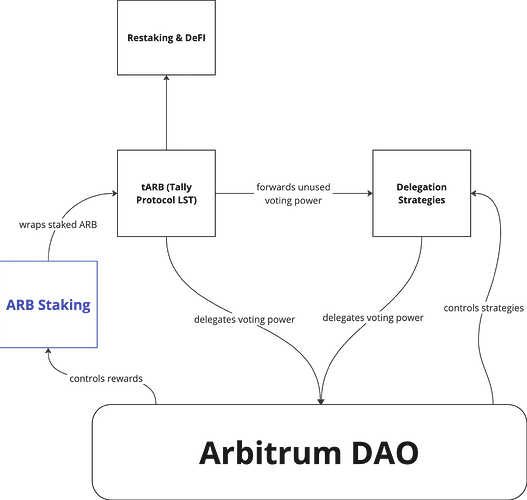

Therefore, the proposal hopes to create a mechanism to distribute the income from Arbitrum to token holders, including sequencer fees, MEV fees, validator fees, token inflation, and treasury, but the specific sources of which income will be introduced still need to be decided by subsequent governance votes.

Furthermore, the proposal requires token holders to entrust their tokens to “active governance” before they can earn returns. At the same time, the proposal introduces the ARB liquidity staking token stARB through Tally , allowing holders to retain the ability to combine with DeFi protocols and automatically compound interest while staking tokens.

Through the combination of the above two modules, ARB holders are expected to gain income through network activities, and the introduction of stARB makes the governance of tokens no longer restricted, and the combination with income can enhance the activeness of governance.

From a fundamental logic point of view, the passage of this proposal is obviously good for ARB, but in practice, we still need to consider one question: how much is the income from network activities ? Even if all network income is distributed to token holders, how much benefit can it bring to them?

Network activity income

Increased network activity

Judging from conventional indicators, Layer 2s market share is actually still trading sideways at a high level or even rising slightly. The following figures show the active addresses, daily trading volume, TVL and DEX trading volume of several major Layer 2s.

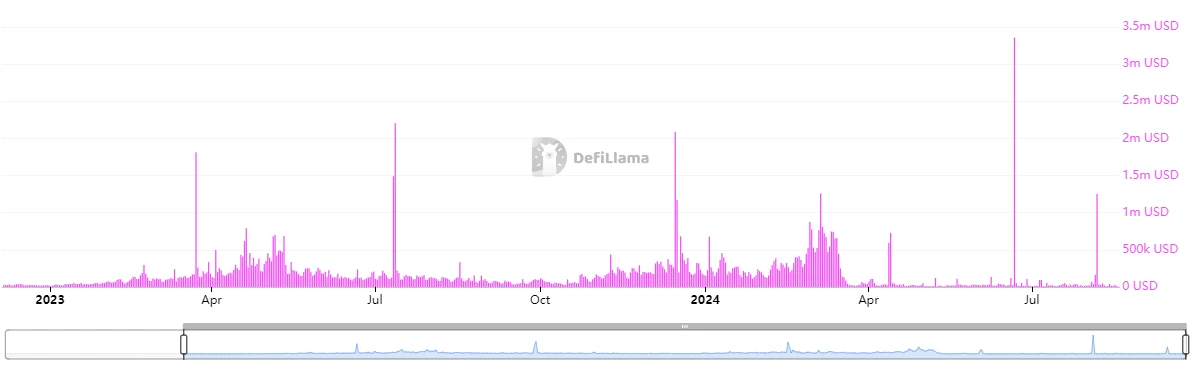

Network income has dropped to negligible

However, DefiLlama data shows that the Arbitrum network has only earned $6,000 in the past 24 hours . Since the Cancun upgrade in March, except for a few occasional outbreaks, the daily revenue has fluctuated between $10,000 and $40,000. Calculated at $30,000 per day, the network revenue for a year is only about $10 million, which is a drop in the bucket compared to ARBs $1.8 billion market capitalization and the recent $60 million in token unlocking per month.

The main reason for the sharp drop in revenue is that before the Cancun upgrade, the revenue of Arbitrum and other Layer 2 networks mainly came from the difference between Gas fees paid by users on Layer 2 and fees for Layer 2 to submit transactions to the Ethereum mainnet. For example, Starknet requires at least $1-2 per transaction, but the cost is basically negligible, and the profit margin exceeds 99% . After the Cancun upgrade, this core revenue is no longer expected to return to the same level .

Therefore, the only way to provide reasonable returns is to issue more ARB. In November last year, PlutusDAO proposed to issue 100 million ARB as staking rewards. Although it passed the Snapshot off-chain vote, it was not passed on the Tally chain. The reason may be that the inflation rate is too high. In November last year, 100 million ARB accounted for 7% of the circulation and 1% of the total.

The current circulation of ARB is 3.26 billion. If 100 million more are issued, the yield will be 3%. It will take one year to distribute them all to reach the minimum level of DeFi income. Once the inflation rate is too high, it will become a major threat to the token price.

결론적으로

In summary, although this staking empowerment proposal is logically tenable and obviously beneficial to ARB, considering the actual profitability of the network , the degree of benefit is currently limited . The Tally voting plan will be held in October, and it is recommended that relevant holders of ARB tokens pay attention to the specific plan in the next two months.

This article is sourced from the internet: Arbitrum has preliminarily passed the staking empowerment proposal. Can it revitalize the ARB token?

Related: The rise of Bitcoin: new opportunities to increase liquidity

I. Introduction Since Satoshi Nakamoto published the Bitcoin white paper in 2009, Bitcoin has been hailed as digital gold and has occupied an unshakable position in the field of cryptocurrency. Its decentralization, scarcity and security have enhanced its appeal as a long-term value storage tool. In contrast, Ethereum has quickly become another important pillar of the blockchain industry with its powerful smart contract platform and flexible development environment since its launch in 2015. Ethereums smart contract function provides unlimited possibilities for the development of decentralized applications (dApps), enabling it to achieve remarkable achievements in the fields of decentralized finance (DeFi) and non-fungible tokens (NFTs). Despite its importance in the crypto world, the Bitcoin ecosystem faces some unique challenges compared to Ethereum: Lack of smart contract platform: The lack of a…