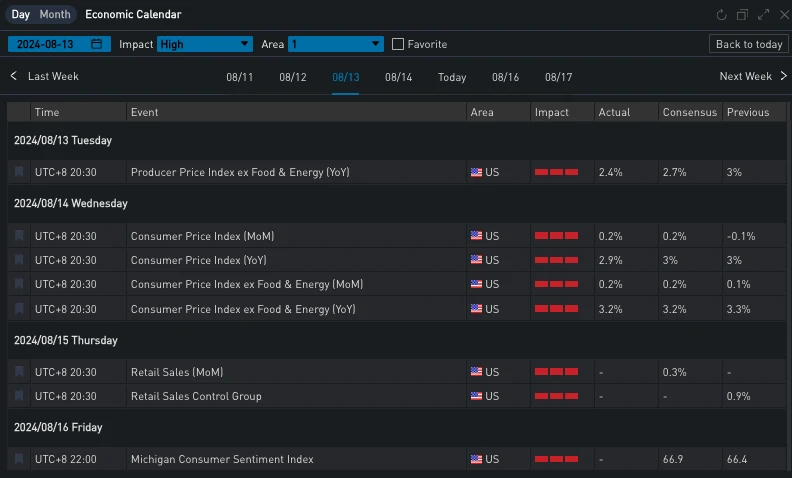

Yesterday (14 AUG), the highlight of this week, the release of US CPI data, was released. The data showed that the US seasonally adjusted CPI annual rate at the end of July was 2.9%, falling for the fourth consecutive month, the first time since March 2021 to return to the 2-digit level, slightly lower than the markets expectation of 3%; the core CPI annual rate was 3.2%, in line with market expectations. However, digital currencies suffered a sharp decline after the release of the data. BTC fell from 61,000 to 58,000, a drop of more than 5%. The price of Ethereum initially showed strong resilience, and the price stabilized after a short-term decline to 2,650, but fell again to above 2,600 a few hours before the close, and the intraday decline was also close to 5%. Some traders questioned this, believing that this was not a proper response to the CPI that was “in line with expectations.” Stepping back, as a highly correlated currency pair, ETH is usually more volatile than BTC, so they were a little surprised by yesterday’s market. Let’s expand on this.

Source: SignalPlus Economic Calendar; TradingView

After the release of CPI, the yield on the 10-year U.S. Treasury bond rose first and then fell, and gradually rose during the day. It can be seen that after the release of the U.S. PPI the day before, the markets expectations for CPI should be lower than expected overall, so this result is disappointing for the dovish market. Looking closely at this report, the most disappointing thing in the market may be the accelerated rise in rents: In June, owner equivalent rent just hit the lowest level since 2021, and in July this indicator accelerated to 0.36%, while housing prices rose by 0.4%, compared with only 0.2% in June, which aroused market doubts. However, since this indicator has a slightly lower weight in the PCE indicator favored by the Federal Reserve, this indicator will be slightly lower than CPI. Rusty Vanneman, chief investment officer of Orion, said that he believes that there is still a high possibility of a rate cut in September, but the current inflation problem is more difficult than the Federal Reserve expected, because the possibility of a 50 basis point rate cut in September needs to be reassessed.

With inflation data successfully falling below 3%, investors can shift their focus from inflation to economic growth and employment. Jack Mcintyre, investment manager at Brandywine Global, said: The U.S. CPI data is important, but in terms of its impact on the market, it may rank third in the hierarchy of economic data – namely employment, retail sales and inflation, so it is not so important. Retail data will be released tonight, and volatility on the front end of options is still flat, implying this part of uncertainty.

출처 : 투자

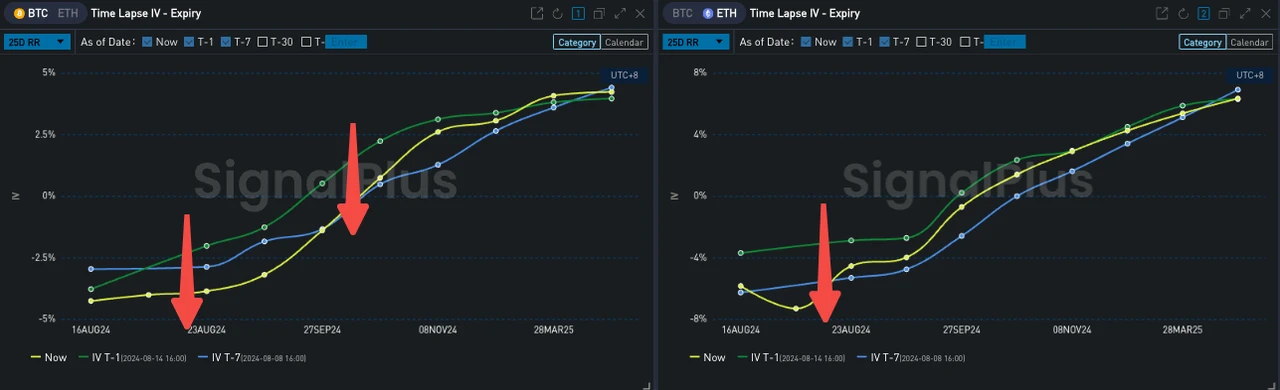

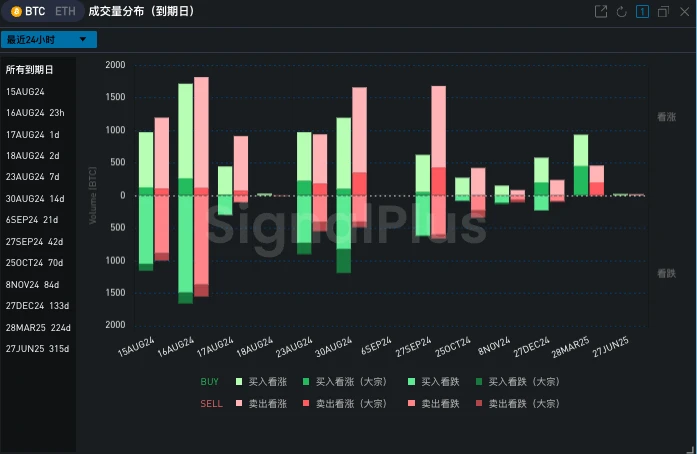

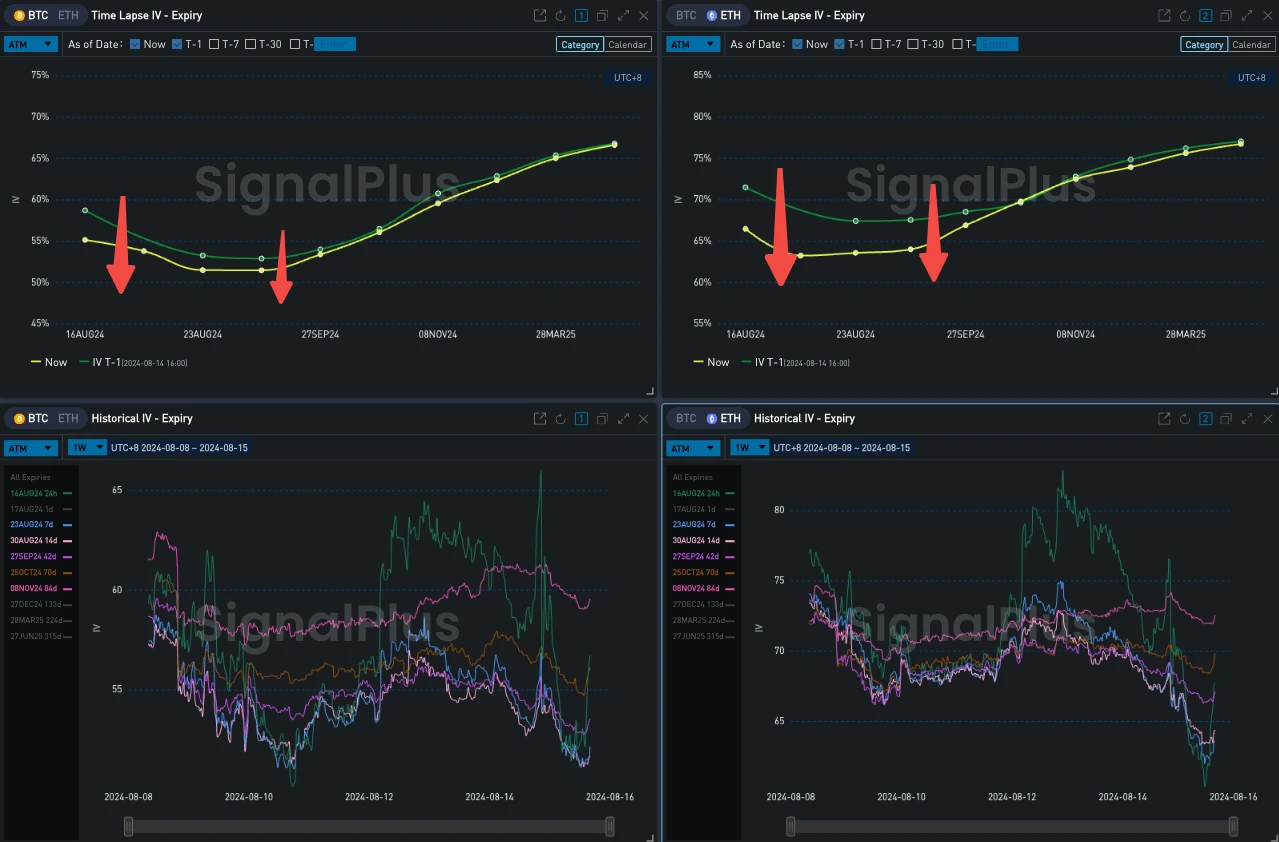

In another piece of news, the US government transferred 10,000 bitcoins to CoinBase Prime, which triggered market concerns about potential sell-offs and led to a drop in bitcoin prices. From the perspective of option transactions, there is a large demand for put option protection in the short and medium term for BTC, which has led to an overall decline in the mid- and front-end Risky. From the perspective of overall volatility, ETHs front-end IV ended its obvious decline after the release of CPI, while BTC maintained an upward trend under the uncertainty brought about by higher actual volatility and potential selling pressure. Tonights US retail data will once again test the digital currency market.

Source: SignalPlus, BTC RR is reduced overall

Source: SignalPlus, BTC transaction distribution

Source: Deribit (as of 16 AUG 16: 00 UTC+ 8)

출처: 시그널플러스

t.signalplus.com에서 SignalPlus 트레이딩 베인 기능을 사용하면 더 많은 실시간 암호화폐 정보를 얻을 수 있습니다. 업데이트를 즉시 받으려면 Twitter 계정 @SignalPlusCN을 팔로우하거나 WeChat 그룹(WeChat 보조원 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구와 소통하고 상호 작용하세요. SignalPlus 공식 웹사이트: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240815): CPI Hidden Surprises

관련: SignalPlus Volatility Column (20240715): 총소리가 울렸을 때

7월 13일 미국 현지 시각 오후 6시, 트럼프는 펜실베이니아주 버틀로브에서 새로운 대선 캠페인 연설을 했습니다. 오후 6시 11분, 한 총잡이가 행사장 밖의 높은 위치에서 그에게 총을 여러 발 쏘아 트럼프의 오른쪽 귀를 다쳤고, 트럼프에 대한 미국 국민의 지지를 표명하면서 그의 선거 승리율이 70% 이상으로 치솟았습니다. 그가 디지털 통화를 사용하고 지지한 것을 고려하면(적어도 이번 선거 기간 동안), 이 암살 사건은 또한 주말 바닥에서 BTC 가격의 지속적인 상승과 전반적인 변동성 수준의 급격한 상승을 간접적으로 뒷받침했습니다. 출처: TradingView; SignalPlus 하지만 비트코인 회복의 공로는 전적으로 그에게 있는 것은 아닙니다. Farside Investors에서 제공한 데이터에 따르면, 전통적인 펀드가…