Summarizing the 35-year U.S. interest rate cycle, can the interest rate cut in 42 days trigger the second bull market fo

원본 | 외일체 포함ly Planet Daily ( @OdailyChina )

Author锝淣an Zhi ( @Assassin_Malvo )

Since Bitcoin broke through the high of $69,000 three years ago, it has been fluctuating widely between $50,000 and $70,000 for many consecutive months. After the Bitcoin halving, the only foreseeable grand narrative is the Feds interest rate cut .

The date of this event is set in stone. According to CME Federal Reserve observation data, the probability of the Federal Reserve cutting interest rates on September 24 has risen to 100% . The only difference is a 25 basis point or 50 basis point cut. Currently, the probability of the two is about 50-50.

So can the interest rate cut bring a big wave of market for Bitcoin and the entire crypto market? In this article, Odaily reviewed the five major interest rate cut cycles of the Federal Reserve from 1989 to 2019 to explore whether there is an objective law.

Carving Boat 2018-2020

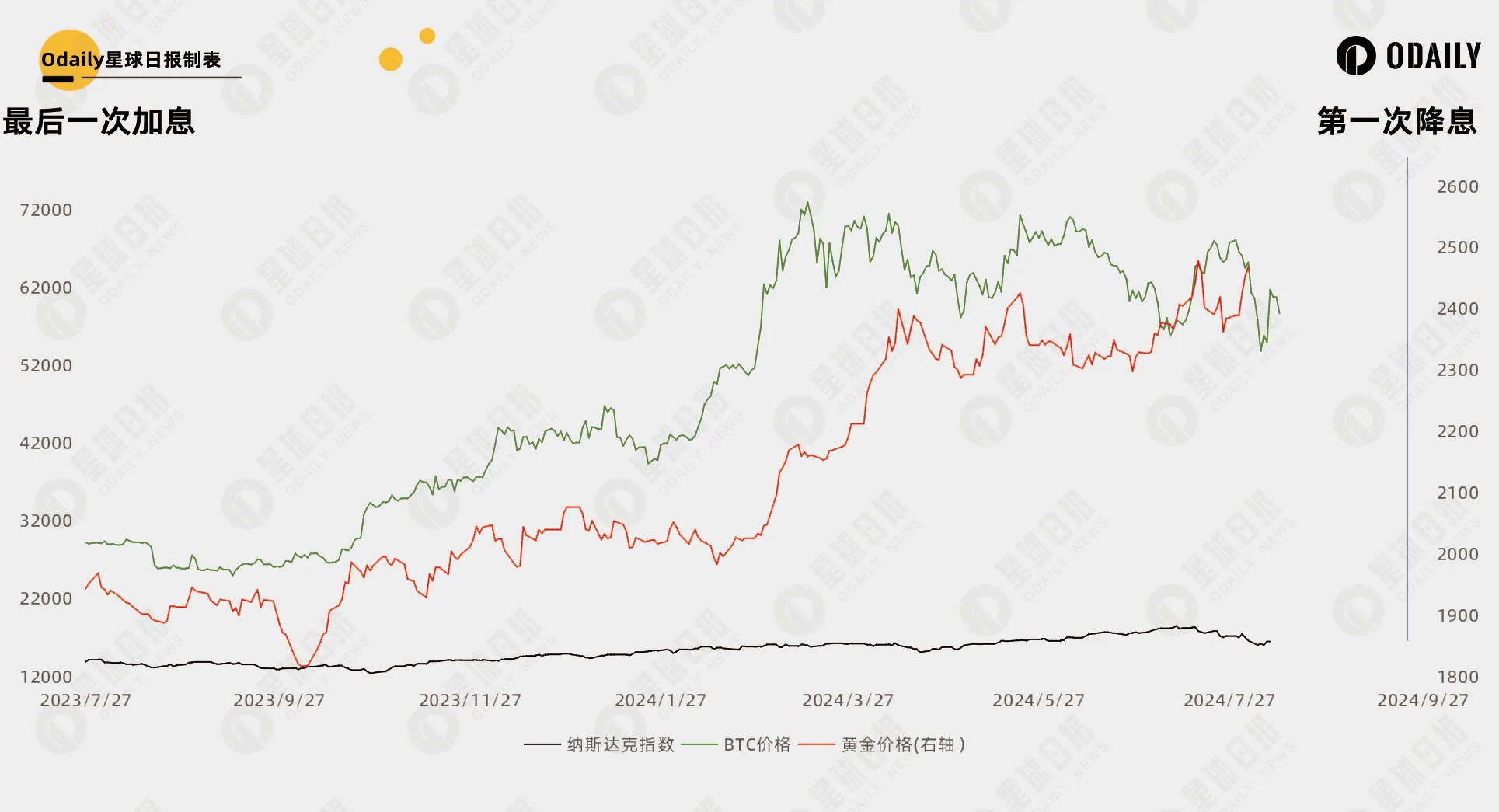

This round of Fed rate hikes ended on December 19, 2018, and the first rate cut began three quarters later on July 31, 2019. This round of rate cuts is also the first and only rate cut cycle experienced by the Bitcoin and crypto markets . The trends of Bitcoin pr얼음s, Nasdaq index and gold prices are shown in the following figure:

It can be clearly seen from the figure that the interest rate cut was already significantly priced in before it happened , especially Bitcoin, which had the largest advance amount. From the last interest rate hike to the first interest rate cut , Bitcoin rose by 161.7%, the Nasdaq rose by 23.2%, and gold rose by 13.7% . After the interest rate cut, only the Nasdaq and gold continued to rise, while Bitcoin continued to fluctuate widely.

Before the last rate cut (2020/3/15), Bitcoin had experienced the well-known 312 crash, and the global market was also in mourning. But at this time, the Federal Reserve had already lowered the interest rate to 0.00%-0.25%, so it adopted a super-large-scale quantitative easing policy, and eventually liquidity overflowed into the crypto market, triggering the big bull market in 2021.

The following is a comparison of the three major market trends after the last rate hike on July 27, 2023. At that time, just like now , from the last rate hike to August 2 (so the gold data was collected until this day), Bitcoin rose 122.6%, the Nasdaq rose 19.4%, and gold rose 27% . Bitcoin may have once again priced in the rate hike.

Looking back 1989-2008

The previous US interest rate cut cycle dates back to 2007, when Bitcoin was not yet born. However, it is generally believed that the crypto market is still strongly correlated with the US stock market , so we still use the Nasdaq and gold price trends as research objects and substitutes for Bitcoin prices to explore the relationship between interest rate cuts and price fluctuations.

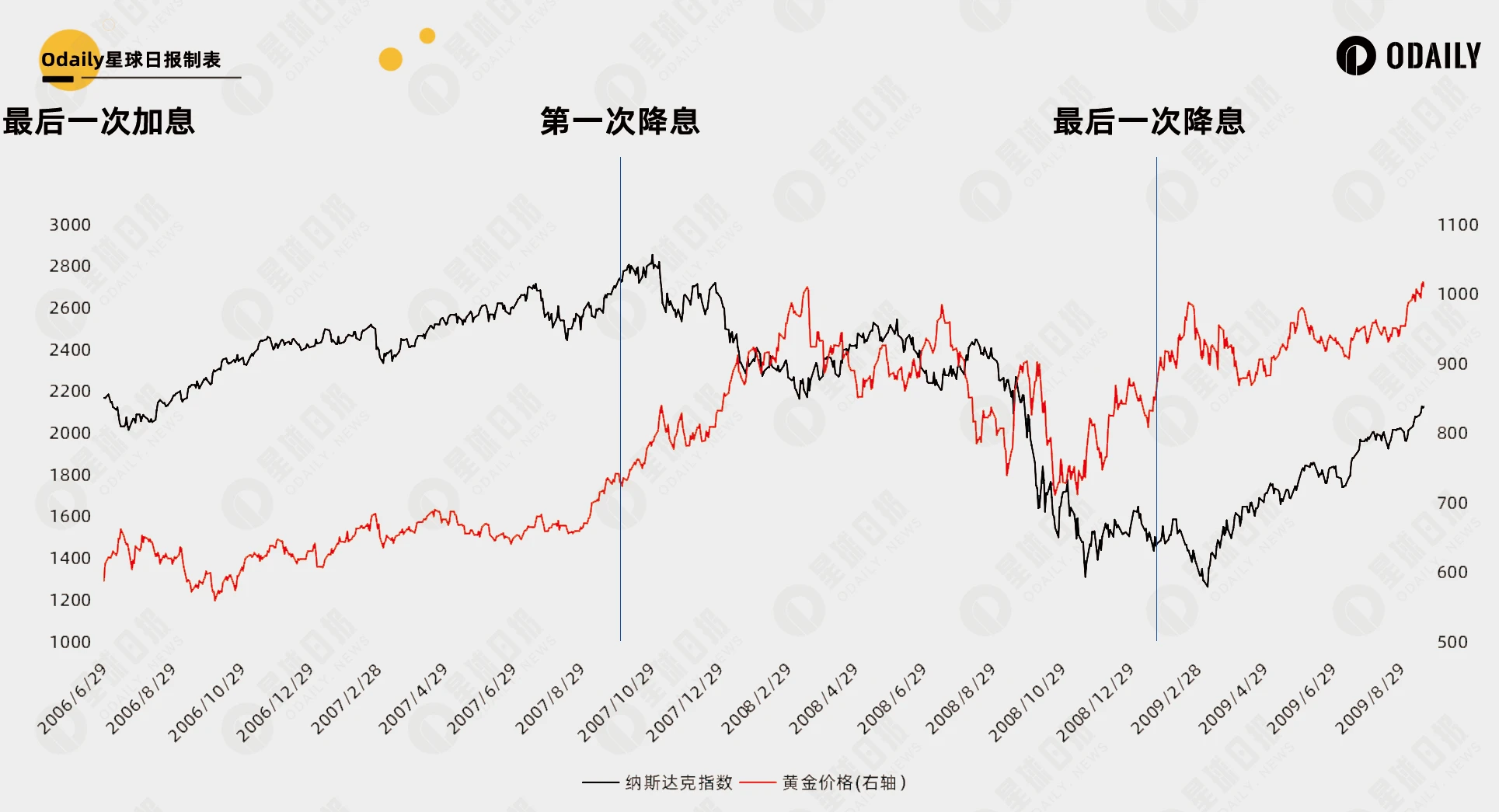

2006 – Hard Landing

In the cycle starting in 2006:

-

The last rate hike occurred on June 29, 2006, when the federal funds rate rose to 5.25%.

-

The first rate cut occurred on September 18, 2007, when the federal funds rate was lowered from 5.25% to 4.75%.

-

The last rate cut occurred on December 16, 2008, when the federal funds rate was reduced to 0% to 0.25%.

Trend:

-

The Nasdaq rose before the rate cut, fell after the rate cut, and rose around the end of the rate cut;

-

Gold rose before the interest rate cut and fluctuated upward after the cut.

In the context of the times:

The subprime mortgage crisis broke out in 2007, the financial system collapsed, and the Federal Reserve began to cut interest rates in September to respond to the deteriorating financial conditions and the threat of economic slowdown. BTC was then born .

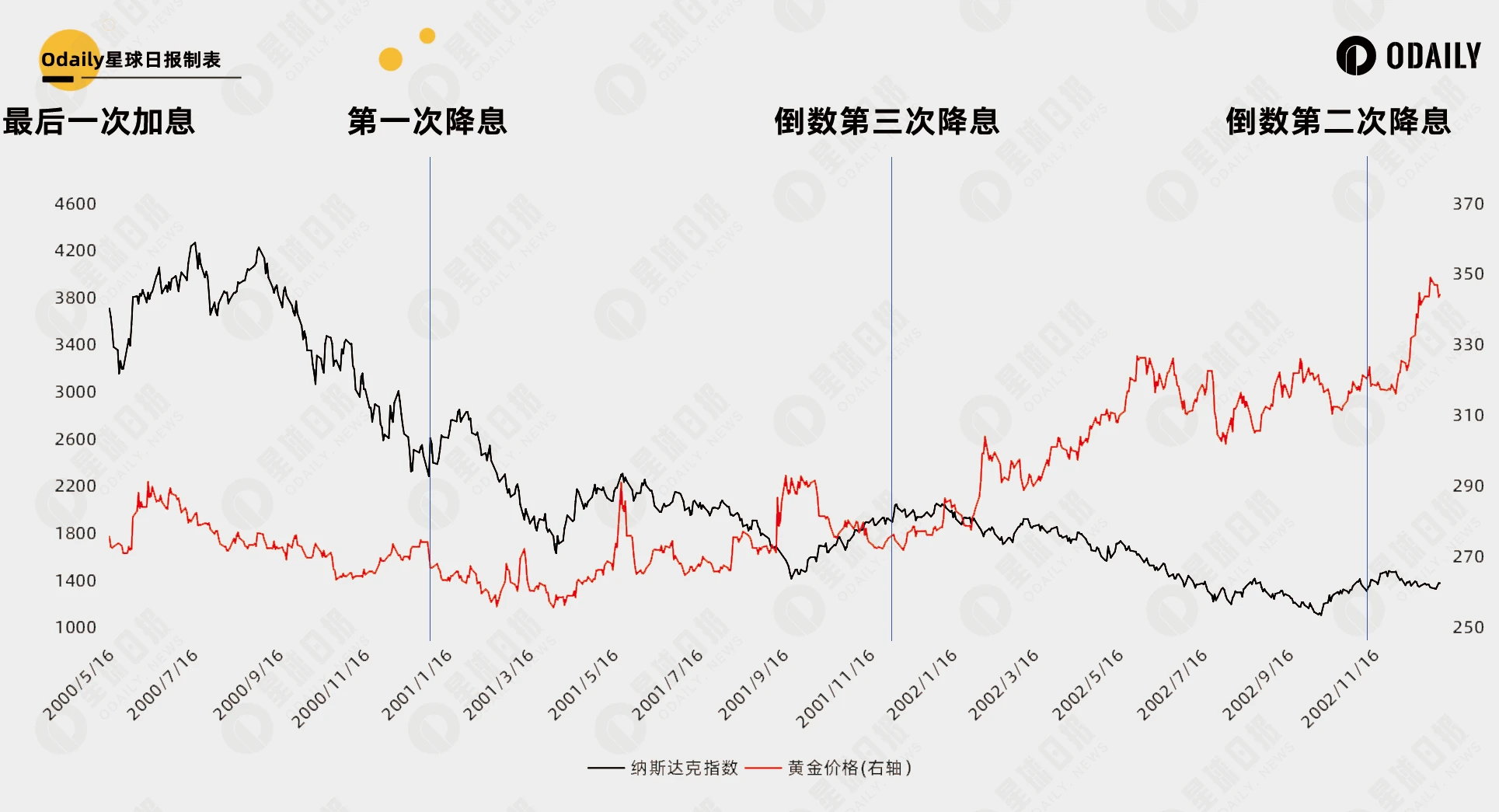

2000 – Hard Landing

In the cycle starting in 2000:

-

The last rate hike occurred on May 16, 2000, when the federal funds rate rose to 6.50%.

-

The first rate cut occurred on January 3, 2001, when the federal funds rate was lowered from 6.50% to 6.00%.

-

The last rate cut occurred on June 25, 2003, when the federal funds rate was lowered to 1.00%.

Trend:

-

The Nasdaq rose before the rate cut, fell after the rate cut, and rose around the end of the rate cut (it first peaked in June 2004, not shown in the figure);

-

Gold rose before the interest rate cut and fluctuated upward after the cut.

In the context of the times:

The dot-com bubble burst in 2000, and the valuations of technology stocks and internet companies fell sharply. The Federal Reserve began a series of interest rate cuts in early 2001 in an attempt to ease the pressure of the recession . However, due to the market collapse caused by the bursting of the bubble and the significant decline in corporate profits, market sentiment was extremely pessimistic.

1995 – Soft Landing

In the cycle starting in 1995:

The last rate hike was completed on February 1, 1995, and rate cuts began on July 6 of the same year, with the last rate cut on December 19. The entire cycle was very short compared to other years.

Trend:

-

The Nasdaq rose before the rate cut and rose after the rate cut;

-

Gold fluctuated before the rate cut and fell after the rate cut.

In the context of the times:

At the time, the U.S. economy was relatively strong and was in the early stages of technological innovation and the 개발 of the Internet. The 1995 rate cut was a precautionary measure intended to support continued economic expansion, and was therefore very short-lived.

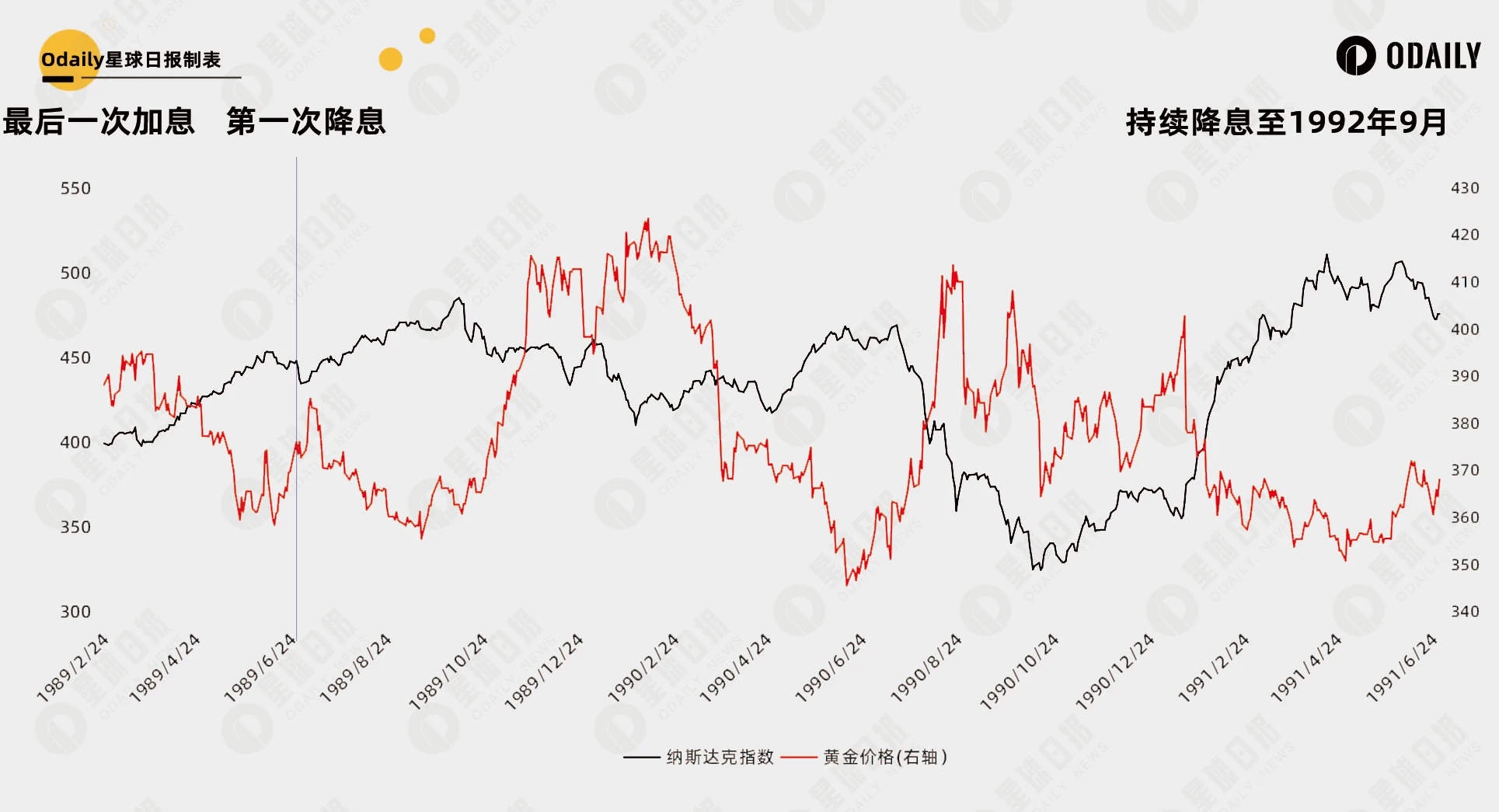

1989 – Soft Landing

In the cycle starting in 1989:

-

Last rate hike: On February 24, 1989, the federal funds rate rose to 9.75%.

-

First rate cut: On June 28, 1989, the federal funds rate was lowered from 9.75% to 9.5%.

-

Last rate cut: On September 4, 1992, the federal funds rate was lowered to 3.00%.

Trend:

-

The Nasdaq rose before the rate cut and fluctuated after the rate cut;

-

Gold fell before the rate cut and fluctuated after the rate cut.

In the context of the times:

The U.S. economy experienced a long period of expansion in the 1980s. By 1989, the economic expansion had lasted for 7 years, becoming one of the longest economic expansions in the post-war period. In the late 1980s, the United States faced high inflationary pressures, and the Federal Reserve responded to inflation by raising interest rates in 1988, but these interest rate hikes showed a suppressive effect on economic growth in 1989.

결론적으로

In summary, there are several notable conclusions:

-

Interest rate cuts do not directly trigger a bull market in the stock market and major asset classes. The related impacts are often already priced in.

-

The impact of interest rate cuts on the future market depends on the overall economic situation at that time. Is it a proactive interest rate cut to promote economic development, or is it forced to cut interest rates due to a black swan event? From the perspective of US stocks, it is a struggle between economic resilience and loose liquidity pricing.

-

Gold benefits from lower interest rates (and a falling dollar) and rises in most cases, and usually performs better in a hard landing mode.

Therefore, from a historical perspective, interest rate cuts are unlikely to be the fundamental driving force behind the rise of Bitcoin and the crypto market . Since 2024, we have experienced events such as Bitcoin spot ETFs and halvings, and the market needs the next grand narrative or fundamental change.

This article is sourced from the internet: Summarizing the 35-year U.S. interest rate cycle, can the interest rate cut in 42 days trigger the second bull market for Bitcoin?

Scam Sniffer released the 2024 Mid-Year Phishing Report, which showed that in the first half of 2024 alone, 260,000 victims lost $314 million on the EVM chain, of which 20 people lost more than $1 million per person. Sadly, another victim lost $11 million, becoming the second largest theft victim in history. According to the report, most ERC 20 token thefts are caused by signing phishing signatures, such as Permit, IncreaseAllowance, and Uniswap Permit 2. Most of the large thefts involve Staking, Restaking, Aave mortgage, and Pendle tokens. Most victims are directed to phishing websites through phishing comments from fake Twitter accounts. Phishing attacks are undoubtedly still the hardest hit area of on-chain security issues. As an entry-level product that meets the basic transaction needs of users, OKX Web3 Wallet…