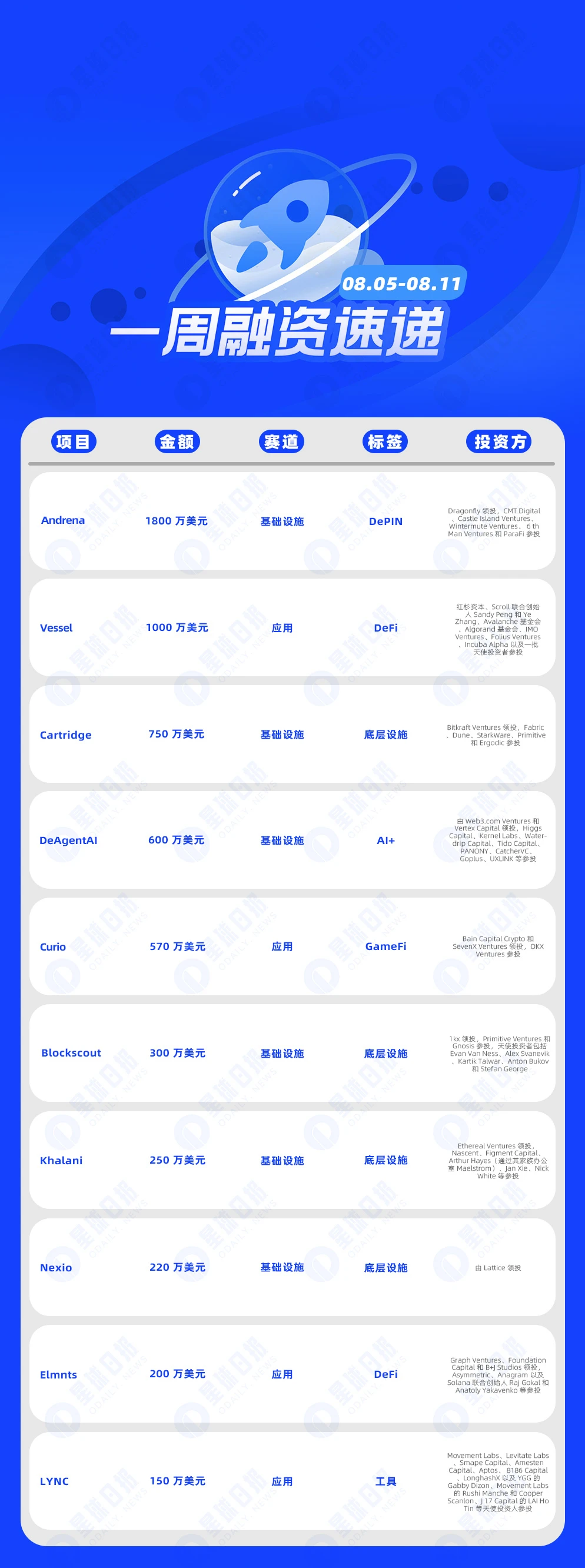

According to incomplete statistics from Odaily Planet Daily, there were 14 blockchain financing events announced at home and abroad from August 5 to August 11, which was a decrease from last weeks data (15). The total amount of financing disclosed was approximately US$61.9 million, which was a decrease from last weeks data (US$102 million).

Last week, the project that received the most investment was the Solana ecosystem DePIN project Andrena (US$18 million); followed closely by the ZK order book trading platform Vessel (US$10 million).

다음은 구체적인 자금 조달 이벤트입니다(참고: 1. 발표된 금액 순으로 정렬, 2. 자금 조달 및 MA 이벤트 제외, 3. *는 블록체인과 관련된 사업을 하는 기존 기업을 나타냄):

Solana Ecosystem DePIN Project Andrena Completes $18 Million in Financing, Led by Dragonfly

On August 7, Andrena, a DePIN project of the Solana ecosystem, completed a financing of US$18 million, led by Dragonfly, with participation from CMT Digital, Castle Island Ventures, Wintermute Ventures, 6th Man Ventures and ParaFi. According to its co-founder Neil Chatterjee, this round of financing is an extension of the Series A financing, and the structure is a simple agreement for future equity (SAFE) with token warrants.

Vessel Completes $10 Million Seed Round, Sequoia Capital and Others Participate

On August 8, ZK order book trading platform Vessel completed a $10 million seed round of financing, with participation from Sequoia Capital, Scroll co-founders Sandy Peng and Ye Zhang, Avalanche Foundation, Algorand Foundation, IMO Ventures, Folius Ventures, Incuba Alpha and a group of angel investors.

블록체인 게임 인프라 제공업체 Cartridge, Bitkraft Ventures 주도로 $750만 달러 규모의 시리즈 A 펀딩 라운드 완료

On August 8, blockchain gaming infrastructure provider Cartridge completed a $7.5 million Series A financing round led by Bitkraft Ventures, with participation from Fabric, Dune, StarkWare, Primitive, and Ergodic. After the completion of this round of financing, Cartridge also announced the launch of Dojo 1.0, an open source development toolset and framework for building verifiable games.

On August 8, Web3 AI network DeAgentAI announced on the X platform that it had completed a $6 million seed round of financing. This round of financing was led by Web3.com Ventures and Vertex Capital, with participation from Higgs Capital, Kernel Labs, Waterdrip Capital, Tido Capital, PANONY, CatcherVC, Goplus, UXLINK and others.

On August 6, Web3 game studio Curio completed a $5.7 million seed round of financing, led by Bain Capital Crypto and SevenX Ventures, with participation from OKX Ventures. As of now, its total financing amount has reached $8.7 million. Curio aims to build a composable infrastructure for on-chain games, and the new funds are intended to be used to expand its team size.

Open-source block browser Blockscout completes $3 million seed round of financing, led by 1kx

On August 7, the open source block browser Blockscout announced the completion of a $3 million seed round of financing, led by 1kx, with participation from Primitive Ventures and Gnosis. Angel investors include Evan Van Ness, Alex Svanevik, Kartik Talwar, Anton Bukov and Stefan George.

Intent-driven solver platform Khalani completes $2.5 million seed round led by Ethereal Ventures

On August 7, according to official news, the intention-driven decentralized solver platform Khalani announced the completion of a $2.5 million seed round of financing, led by Ethereal Ventures, with participation from Nascent, Figment Capital, Arthur Hayes (through his family office Maelstrom), Jan Xie, Nick White and others.

BTC ecosystem project Nexio completes $2.2 million in financing, led by Lattice

On August 9, BTC ecosystem project Nexio announced on the X platform that it had completed a $2.2 million financing led by Lattice. The funds will be used to introduce Facebooks Move Virtual Machine into the Bitcoin ecosystem, solve smart contract vulnerabilities in EVM-based expansion solutions and multi-signature bridge designs, and reduce transaction costs and increase transaction throughput.

On August 6, Solana ecosystem RWA tokenization project Elmnts announced on X that it had completed a $2 million Pre-Seed round of financing, led by Graph Ventures, Foundation Capital and B+J Studios, with participation from Asymmetric, Anagram and Solana co-founders Raj Gokal and Anatoly Yakavenko.

On August 8, LYNC, a Rollup project focusing on mobile phone business, completed a US$1.5 million Pre-Seed round of financing. Movement Labs, Levitate Labs, Smape Capital, Amesten Capital, Aptos, 8186 Capital, LonghashX, as well as angel investors such as Gabby Dizon of YGG, Rushi Manche and Cooper Scanlon of Movement Labs, and LAI Ho Tin of J 17 Capital participated in the investment.

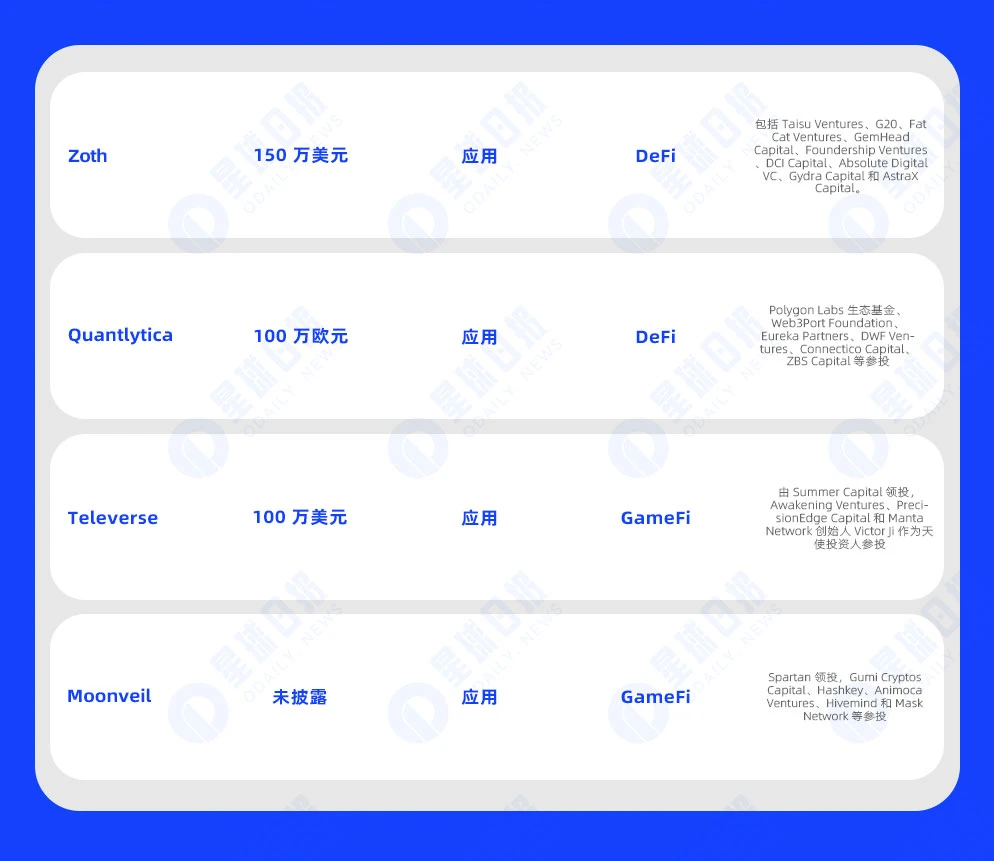

RWA Project Zoth Completes $1.5M Funding, Launches $100M RWA-Backed ZTLN Token

On August 6, according to official news, the RWA project Zoth completed US$1.5 million in financing. The new funds will be used to launch the US$100 million RWA-supported Tokenized Liquid Notes (ZTLN).

This round of financing attracted well-known investors, including Taisu Ventures, G20, Fat Cat Ventures, GemHead Capital, Foundership Ventures, DCI Capital, Absolute Digital VC, Gydra Capital and AstraX Capital. Zoth also received support from Coinbase, Hedera and Ripples XRPL Foundation, in addition to funding from a number of crypto angel investors.

On August 8, according to official news, AI-driven liquidity distribution protocol Quantlytica announced the completion of 1 million euros in financing, with participation from Polygon Labs Ecological Fund, Web3Port Foundation, Eureka Partners, DWF Ventures, Connectico Capital, ZBS Capital, etc. It is reported that the funds raised will be used to support protocol development, strengthen AI assistance within the ecosystem, and break down liquidity barriers between users and project parties.

Televerse Completes $1 Million Seed Round Led by Summer Capital

On August 9, Televerse, an innovative mini-game network based on the TON blockchain, announced the completion of a $1 million seed round of financing. The financing was led by Summer Capital, with Awakening Ventures, PrecisionEdge Capital and Manta Network founder Victor Ji participating as angel investors.

Moonveil Completes Pre-A Round of Financing, Spartan Leads Investment

On August 6, Moonveil announced the completion of its Pre-A round of financing, with a total financing amount of US$9 million. Spartan led the investment, and Gumi Cryptos Capital, Hashkey, Animoca Ventures, Hivemind and Mask Network participated in the investment.

This article is sourced from the internet: Financing Express of the Week | 14 projects received investment, with a total disclosed financing amount of approximately US$61.9 million (8.5-8.11)

관련 기사: 비트코인의 전통적인 4년 주기가 끝나가고 있을까?

원문: Bitcoin Magazine Pro 원문 번역: Vernacular Blockchain 비트코인의 4년 주기는 투자자와 암호화폐 애호가들에게 오랫동안 큰 관심을 받아왔습니다. 이들은 이러한 반복적인 가격 움직임 패턴을 주의 깊게 추적하여 다가올 시장 움직임을 예측합니다. 그러나 비트코인 시장과 경제 환경의 변화하는 역학을 감안할 때, 전통적인 4년 자본 흐름 주기가 끝나가고 있다는 것을 인정해야 합니다. 여기서는 비트코인의 4년 주기가 끝날 가능성을 고려해야 하는지, 그리고 이 이론이 증거에 의해 충분히 뒷받침되는지 또는 단지 추측인지 살펴보겠습니다. 1. 비트코인의 4년 주기 해석 비트코인의 4년 주기는 주로 약 4년마다 발생하는 비트코인 반감기 이벤트에 의해 주도됩니다. 반감기 이벤트 동안 비트코인 거래에 대한 채굴 보상이 반으로 줄어들어…